da-kuk

This article was first released to Systematic Income subscribers and free trials on July 2.

Welcome to another installment of our CEF Market Weekly Review where we discuss CEF market activity from both the bottom-up – highlighting individual fund news and events – as well as top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the last week of June. Be sure to check out our other weekly updates covering the BDC as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

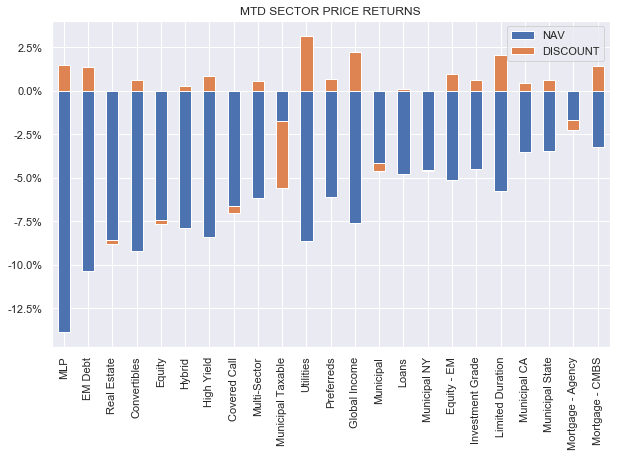

CEFs had a good week. Despite many CEF sectors featuring a drop in the NAV due to the fall in stocks and a rise in credit spreads, the fall in Treasury yields supported the performance of higher-quality fixed-income sectors. All but one sector saw tighter discounts which further supported fund prices. Munis, Agency and Investment-grade bonds outperformed during the month.

Systematic Income

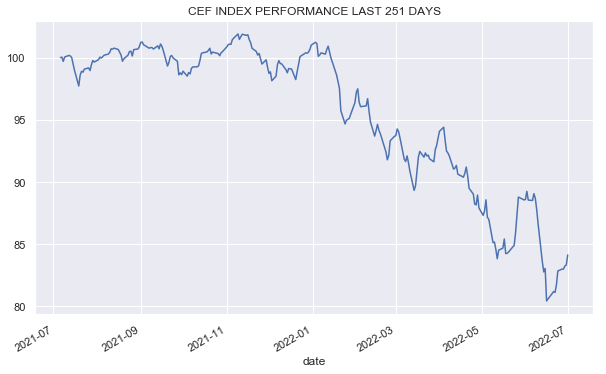

The overall CEF index is roughly back to where it was in May before the recent performance zig-zag. The space remains down around 16% over the past year in total price terms.

Systematic Income

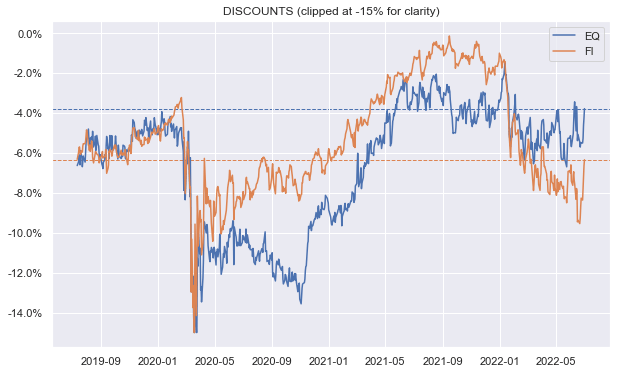

Much of the recent rally is due to discounts which tightened sharply across both equity and fixed-income CEF sectors.

Systematic Income

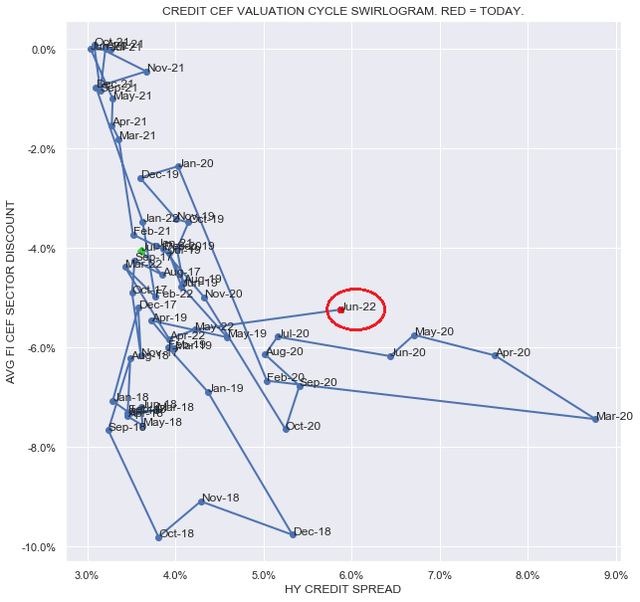

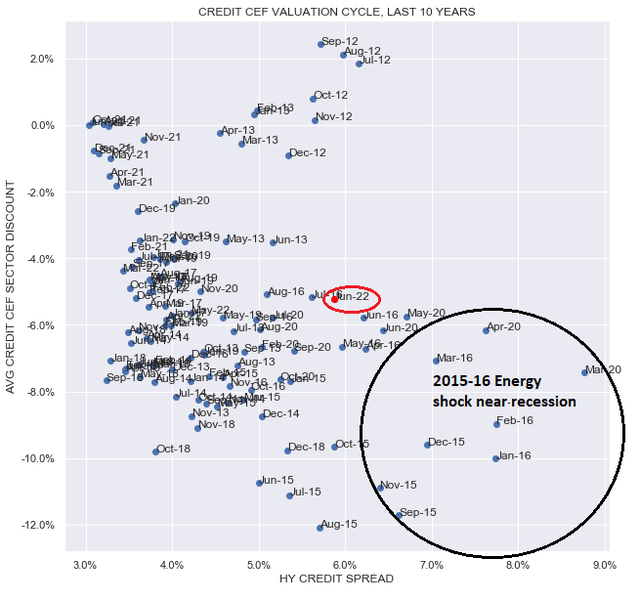

What is very interesting is that the current position of the credit CEF space is not a million miles away from where it was two years ago. Credit spreads were about the same as today while discounts were a bit wider of current levels by around 1%. This is a truly odd outcome, particularly given we only learned of a high level of vaccine effectiveness towards the end of 2020. A key difference between then and now is that the Fed had already backstopped credit markets by the middle of 2020 but is very unlikely to do so again this time around.

Overall, it’s clear that the market remains in the “right” part of the chart – in the center to bottom-right – where valuations are very attractive which is why we have continued to slowly add to our CEF allocation across our Income Portfolios.

A full-blown recession will likely take us further to the right of the chart. If we take a longer-term view we can see that the market could easily end up around its 2015-2016 levels when we had a near-recession due to the Energy shock of 2015.

Market Themes

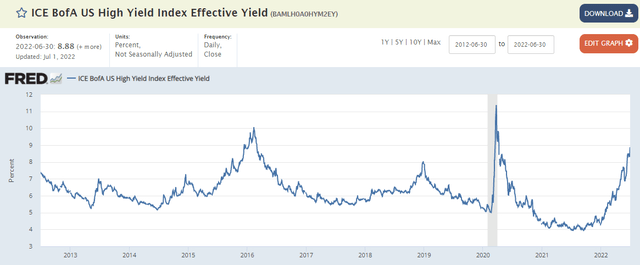

A key theme in the current fixed-income market is that underlying asset yields are unusually high. For example, the High-Yield corporate bond yield is trading close to 9% – a level that it has breached only briefly over the last decade.

This kind of environment has a knock-on impact on various CEF features. For instance, when underlying yields are high, discounts are more important in CEF allocation decisions because they act as a magnifier on underlying yields.

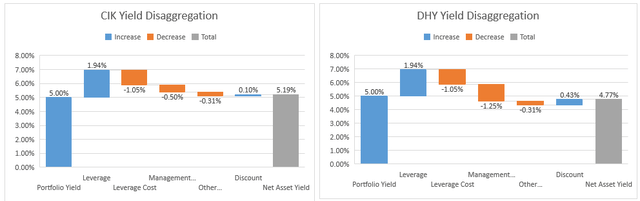

To illustrate this, let’s consider two very similar High-Yield corporate bond CEFs CIK and DHY. We should say both funds have pockets of bank loans but they are primarily bond funds. The key difference between these two funds is that CIK has a much lower management fee than DHY. We use the funds’ current discounts of around 2% for CIK and 9% for DHY.

Starting from a portfolio yield of 5% (roughly where high-yield corporate bond yields were at the start of the year) we end up with a net yield of 5.19% for CIK and a net yield of 4.77% for DHY. In other words, when underlying yields are low, the fact that DHY has a much wider discount doesn’t actually allow it to generate a higher net yield for investors. At low level of underlying asset yields a lower management fee can be the decisive factor in how much yield a given fund generates.

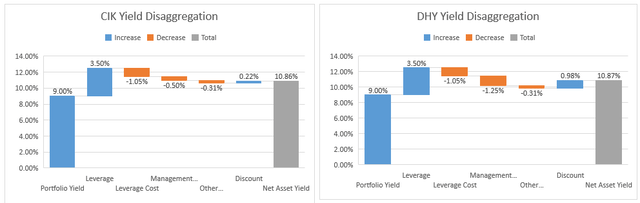

Now if we look at both funds in an environment where underlying yields are closer to 9% what we see is that DHY now boasts a slightly higher net yield.

When underlying yields were 5%, the much wider DHY discount only added an additional net yield of 0.33% relative to CIK (i.e. 0.43% – 0.10). With yields at 9%, DHY can now add an additional net yield of 0.76% relative to CIK which allows it to generate a higher net yield despite a much lower management fee of CIK.

In short, the same discount differential allows DHY to come out ahead of CIK when asset yields are high despite its higher management fee. Of course, this doesn’t mean that investors should go and seek out funds with the widest discounts. Clearly, funds with wider discounts can just be value traps. But, all else equal, as underlying asset yields increase, wider discounts can drive a higher level of net income for fund holders.

Market Commentary

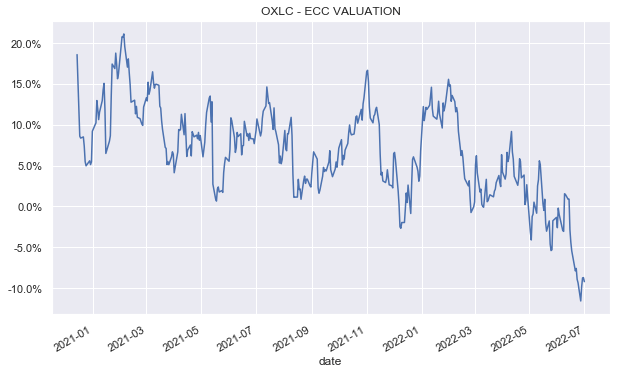

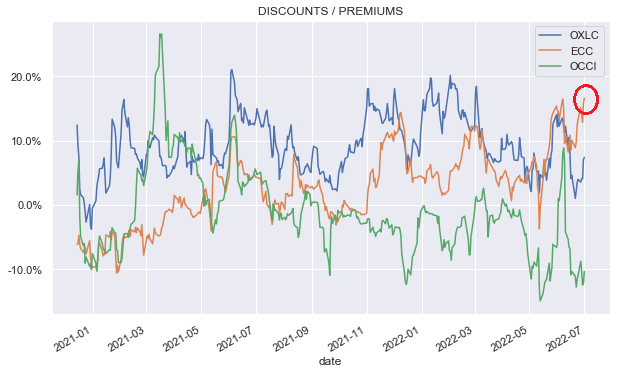

The CLO Equity / loan CEF XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) is doing another common share offering which has pushed the stock lower. Likely related to this is a new issuance of institutional 6% convertible preferreds. This is because the fund would otherwise organically deleverage slightly as its borrowings / total assets ratio would mechanically fall as its assets increase from the offering. The preferreds can be converted by holders to common shares at the max of price or NAV. This could lead to a small potential NAV dilution for XFLT shareholders. Something else interesting happening in the CLO Equity CEF space is a couple of valuation dislocations. First, OXLC looks to be trading at a lower premium than ECC which is unusual. The chart below and subsequent charts are based on our daily estimates of CLO Equity NAVs, since they are only officially published monthly.

Systematic Income

This could be due to the higher-beta nature of OXLC so maybe investors are bailing in expectation of underperformance in a recession. We should know the June NAV soon enough and it should be quite a bit lower – the estimated valuation is an 8% premium (rather than the 4% discount based on the May NAV) given what’s happened to credit in June. For instance, the XFLT NAV is 5% lower in June and that fund is only partially allocated to CLO Equity.

Systematic Income

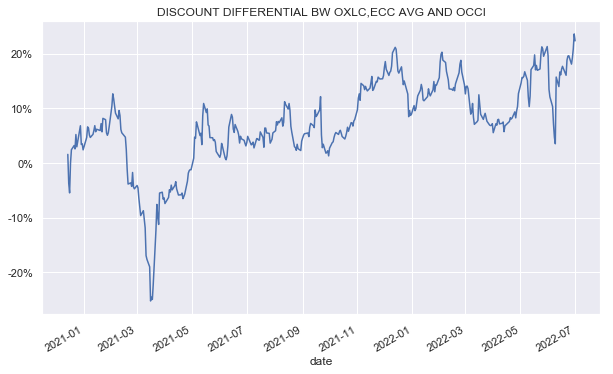

The second dislocation is the cheapness of OCCI versus OXLC and ECC – the valuation differential has moved to 20% – a level where it has tended to top out. The last time we highlighted this level was when it was reached in May. OCCI then bounced quickly to close the valuation gap by 15% before blowing out again. Might be worth another look for more tactical investors.

Systematic Income

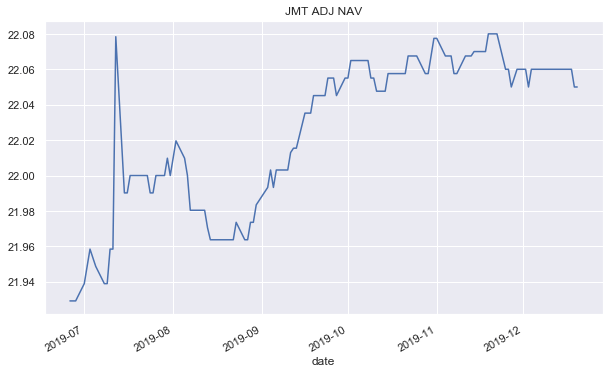

There was a question on the potential liquidation of Nuveen Preferred & Income Term Fund (JPI) given it’s a term fund. A common view is that a term fund that tries to liquidate its holdings may be forced to do so at a large discount / bid-offer which would obviously negatively impact its NAV.

This is certainly possible so it’s not something we can dismiss out of hand. However, it’s also important to say two things. First, previous funds that have terminated have not been obviously hurt by this. For example, if you look at the NAV of JMT – another Nuveen term fund – which terminated at the end of 2019 and which held non-agency RMBS – much less liquid securities than preferreds – you can’t actually see its NAV fall into the termination. If anything it rallies into the termination.

Systematic Income

Also, in terms of the mechanics of liquidation, if it happens, JPI managers speak to other institutional investors – they are not sitting there hitting bids on their Schwab account. And while hundreds of millions of fixed-income assets sounds like a lot to us it’s not all that much in the institutional space.

And keep in mind that a wide bid/offer works both ways – institutional investors who want to acquire assets would also normally have to pay a wide bid/offer so very often they would be happy to execute at mid with another institutional investor who is selling assets.

JPI could also potentially sell its assets to other Nuveen funds – Nuveen is not a small shop and could probably accommodate purchasing some of its assets. Finally, JPI could as easily not terminate. JPT – their 2022 preferred term CEF – didn’t terminate. Shareholders voted to extend the fund and Nuveen ran a tender offer for those investors who wanted to get out at the NAV. This was a win-win in our view as it kept a fund running for future relative value opportunities while delivering economically on its term structure. Elsewhere, loan fund Eaton Vance Senior Floating-Rate Trust (EFR) released its shareholder report for the six-month period ending in April. Annualized NII fell 3.5% relative to the previous year despite an increase in borrowings of 15%. This might seem weird given we’ve been told to expect big jumps in income based on what short-term rates have done but it’s important to reiterate that Libor was below 1% as late as the start of April (it finished April at 1.36%) and the Libor floors of the fund range between 0.5% and 1.5% so its income would only have gotten a boost very recently due to the lag in Libor resets. This is at the same time as its leverage cost started rising at the start of the year.

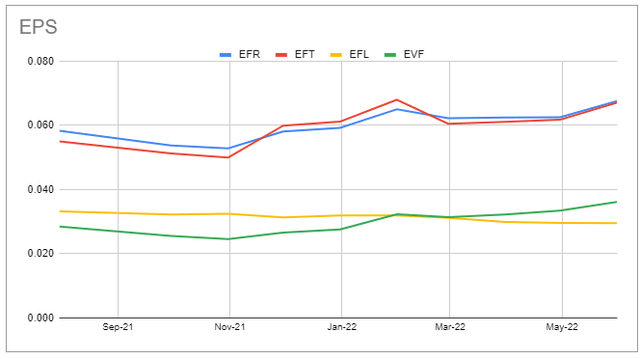

A look at the higher-frequency quarterly income updates from EV (also put out by PIMCO, Nuveen and BlackRock on the Coverage tab of our CEF Tool) shows that May mostly saw an income uptick in the 4 Eaton Vance funds. This should keep going higher steadily over the remainder of the year.

Stance & Takeaways

As discussed above we continue to find the broader credit CEF space pretty attractive. And although discounts do look a bit rich to us relative to where underlying yields are trading, the overall picture presents a good setup for adding new capital to the space. Of course, if the base case is correct and the economy does enter a recession, we are very likely to see additional volatility, particularly while the Fed is more constrained in supporting the market.

Overall the value on offer is attractive to add now in our view. Among others, we like the Credit Suisse High Yield Bond Fund (DHY), the Western Asset Diversified Income Fund (WDI) and the Nuveen Preferred & Income Term Fund (JPI).

Be the first to comment