courtneyk

Description

CCC Intelligent Solutions Holdings Inc. (NYSE:CCCS) provides insurance companies with software for managing claims and underwriting in the cloud, which in turn benefits policyholders. As the property and casualty insurance market continues to expand, the company is well positioned to meet the demand for digital tools by offering access to its extensive proprietary data and network capabilities.

I love CCCS’ business, but the current valuation does not provide enough margin of safety to invest.

Company overview

The company CCCS develops and distributes cloud-based applications for the property and casualty insurance sector. Insurers can better manage crucial operations like claims and underwriting with their assistance, and their customers can benefit from enhanced service thanks to the solutions they offer. The CCCS software is compatible with both modern and legacy platforms. I recommend reading the CCCS S-1 for more in-depth product information.

P&C companies require technology that extends beyond their own organizations

The property and casualty (P&C) insurance sector is a major economic force. The property and casualty insurance market in the United States is expected to reach $840 billion by 2022. In addition to a sizable total addressable market (“TAM”), the fact that most companies and individuals feel compelled to purchase insurance has contributed to the P&C insurance sector’s sustained expansion over the years.

While its significance might suggest that the industry operates smoothly, this is far from the case. Rising customer expectations, new players, better and faster technologies, and cost pressures are just a few of the challenging market dynamics that P&C insurers must contend with in today’s environment. Another key problem is that insurance companies often use on-premise legacy systems to aid in policy and claims processing, but these systems can be costly to maintain and can hinder the company’s ability to innovate and adapt to changing market conditions.

To make matters even more complicated, the property and casualty insurance industry is supported by a network of businesses that collaborate to service, underwrite, finance, and repair insured assets. To enable these collaborations, insurance companies invest in information, infrastructure, and services. To facilitate the numerous interactions and handoffs required to process insurance events, I believe insurance companies require technology that extends beyond their own organizations and into the broader economy.

Another area where modern technology could help is the workflow process in the property and casualty insurance industry. Using a case study from CCCS’ prospectus, in the automotive insurance sector, which accounts for nearly half of the U.S. property and casualty insurance industry, processing a single event can necessitate hundreds of transactions involving consumers, lenders, original equipment manufacturers, dealers, and others. Because of the reliance on local decisions and data, the transactions become more complex, as does the risk of fraud and other forms of claim leakage.

As the industry expands, better digital tools will be required to manage it, and I believe CCCS is well-positioned to provide them.

CCCS stands out due to their proprietary assets

CCCS stands out from other potential P&C platform companies due to their proprietary data and network assets, as well as their history of cloud platform innovation.

To begin, CCCS is a well-known company in its field, and its innovations are grounded in decades’ worth of data and substantial network resources. The S-10 claims that CCCS can offer insights, analytics, and AI-driven workflows because of the company’s access to a wealth of proprietary data assets and over a trillion dollars’ worth of historical data. In addition, the P&C insurance industry can take advantage of the CCCS network’s ability to deploy cross-market solutions and deliver seamless customer experiences because the network was built from the ground up. In my opinion, it would take a sub-scale player a very long time to catch up to CCCS in terms of data and network assets, making them highly differentiated and thus difficult to replicate. A virtuous cycle is another term for this situation. CCCS’s product portfolio will improve as the company develops and collects more data (either via R&D or organic improvements via better AI). This would allow them to steadily widen their advantage over rivals, resulting in expanded market share thanks to an inherently superior product.

Further exploring the “how,” CCCS’s cutting-edge cloud-based applications help the P&C insurance sector organize their operations, improve their judgment, and computerize their laborious processes. They have an established R&D machine and a solid history of developing and releasing innovative software on their cloud platform. For instance, as cited from the S-1, CCCS’s mobile and AI innovations have been widely adopted by customers across the industries they serve; these solutions enable the digitization of claims and repair workflows by letting insurers and repairers engage with customers via mobile and other channels to electronically capture granular local information.

CCCS stands out from the pack, in my opinion, because of the depth of their data and their industry-leading network, as well as the speed with which they can innovate and deploy new software solutions via their cloud technology platform.

CCCS is a trusted partner to its clients

Trust and reputation are two things that I think are very important to financial institutions like banks and insurance companies. The client’s considerable resources necessitate that they partner with a proven industry leader rather than a fledgling upstart. I think CCCS has this advantage, and it’s hard to copy because time and experience are necessary ingredients.

CCCS has extensive experience in the insurance industry and a comprehensive knowledge of the sectors and ecosystems in which it operates. Based on my observations, they are able to apply their knowledge of the subject matter to develop individualized strategies for each client that ultimately aid in the accomplishment of the latter’s business goals. CCCS’ deep and trustworthy relationships with many customers are a direct result of CCCS’s recognition of the value CCCS add as an independent third-party facilitating interactions between ecosystem participants. After considering everything, I am confident in CCCS’s ability to facilitate cross-market programs and partnerships, as the company has done so successfully for decades.

To give some background, CCCS has worked hard over the course of several decades to establish solid partnerships with industry-leading insurance providers, collision repair facilities, original equipment manufacturers (OEMs), and others. A company-wide Net Promoter Score of 80, as reported by CCCS S-1, demonstrates the importance they place on customers. I think CCCS is a trusted partner to its clients, enabling them to collaborate and adapt business based on customer feedback and changing expectations, which helps them stay ahead of the competition.

CCCS solution can be easily deployed across various environments

It is stated in the prospectus that CCC’s platform is hosted in a safe multi-tenant cloud environment and processes 2.7 billion database transactions daily with the help of its over 500,000 active users. From my perspective, CCCS is able to rapidly adapt to shifting market conditions and customer demands thanks to the platform’s adaptability.

I stress this because many large institutions employ a variety of cloud infrastructures, and it is essential to have a solution that can be deployed across these.

Valuation

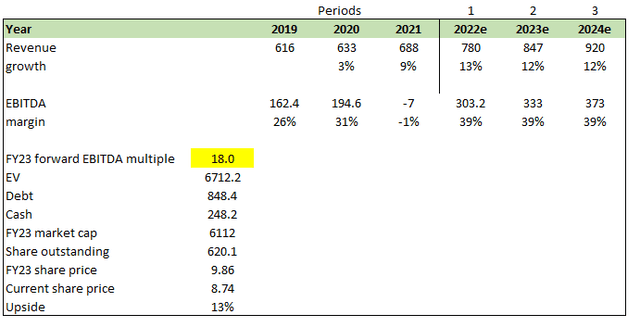

I believe CCC Intelligent Solutions Holdings Inc. is worth USD9.86/share in FY23, representing 13% upside from the date of writing.

This value is derived from my model based on the following assumptions:

- Revenue will meet management’s guidance in FY23 and continue growing at high-single digits, which is in-line with historical. I am not including any M&As into my growth estimates, so there could be further upsides.

- I expect CCCS to meet FY23 EBITDA guidance as well and also to achieve similar margins moving forward

- CCCS currently trades at 18x forward EBITDA and I expect no changes since it is near the average. Of course, it could go back to 21x, which would represent further upside.

KEY RISKS

Revenue concentration

CCCS relies heavily on a few customers in the P&C insurance industries, and the loss of even a single customer could have a catastrophic effect on the company’s financial health.

Poor negotiating power against large customers

Some customers, due to their size, have considerable negotiating power when it comes to new licenses and renewals. CCCS could be forced into a situation to constantly provide discounts. While this is great, it puts a lid on how much average selling price can grow.

Reputation risk

As I previously stated, reputation and trust are critical in this industry. It could be disastrous if CCCS became embroiled in unnecessary scandals or criminal acts.

Summary

Assisting insurers with crucial processes like claims and underwriting while also enhancing customer experiences is a major challenge that CCCS solutions aim to meet. Due to its extensive proprietary data and network capabilities, the company is in a great position to offer digital tools to the rapidly growing P&C insurance sector. There are a lot of reasons why CCC Intelligent Solutions Holdings Inc. could be a good long-term investment, but I believe investing at a lower valuation would be wiser.

Be the first to comment