Liudmila Chernetska

Retail, particularly retail that deals with fashion, can be a rather tricky business. In addition to being highly competitive, margins are small, and volatility can be commonplace even during milder economic periods. At the same time, however, a retailer that has excess cash and that generates positive cash flow can only trade so low before it becomes an attractive prospect. A great example of this can be seen by looking at The Cato Corporation (NYSE:CATO), a fashion retailer with a variety of brand names across its 1,312 locations. Although fundamentals for the company continue to deteriorate, the firm does have a significant amount of cash in excess of debt. In addition to that, shares are trading at low enough levels to make the opportunity quite low risk in nature. Due to these factors, I have decided to increase my rating on the company from a ‘hold’ to a ‘buy’, reflecting my belief today that shares should outperform the broader market moving forward.

Shopping for value

In June of this year, I wrote an article that took a rather neutral stance on Cato. On the downside, I cited the company’s mixed operating history and a general decline in the number of stores it has in operation. On the positive side, however, I found myself impressed by how cheap the stock was. But this was not enough at the time for me to rate the company as anything other than a ‘hold’. Since then, shares have fallen rather significantly, dropping by 14.3% compared to the 2.5% decline experienced by the S&P 500.

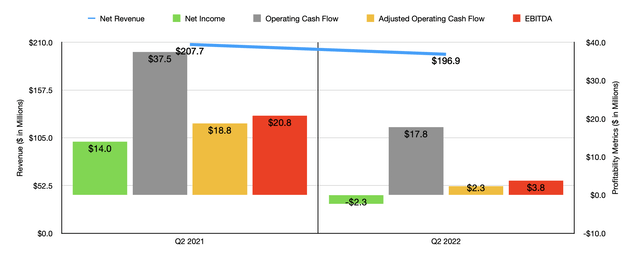

To be perfectly clear, at least some of this return disparity was warranted. To see what I mean, we need only look at data covering the second quarter of the company’s 2022 fiscal year. This is the only quarter for which new data is available that was not available when I last wrote about the firm. Revenue for that quarter came in at $196.9 million. That’s 5.2% lower than the $207.7 million generated the same time only one year earlier. This drop truly was the result of two key factors. First and foremost, the company saw the number of stores it has in operation drop from 1,325 to 1,312. And second, the company experienced a 5% decline in comparable store sales.

The bad thing about retailers is that they tend to have fairly low margins. This means that a small negative change when it comes to revenue can have an outsized negative impact when it comes to profitability. As a result of the decline in revenue, net income at the company dropped from $14 million in the second quarter of 2021 to negative $2.3 million the same time this year. The biggest impact here came from the company’s cost of goods sold rising from 56.1% of revenue to 67.6%. This, in turn, which driven primarily from higher sales of marked-down goods, as well as increased freight, distribution, and occupancy costs. Other profitability metrics unfortunately followed suit. Operating cash flow plunged from $37.5 million to $17.8 million. Even if we adjust for changes in working capital, it would have dropped, declining from $18.8 million to $2.3 million dollars. And finally, EBITDA for the company fell from $20.8 million to $3.8 million.

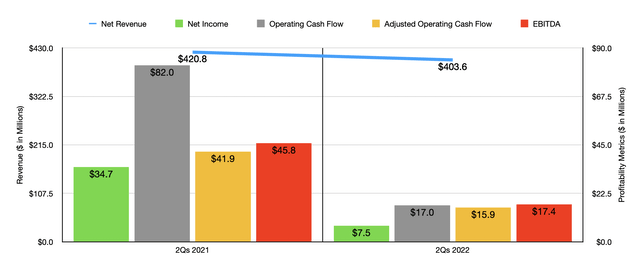

This weakening was not a one-time event for the company. Results for the first half of the 2022 fiscal year as a whole have also come in a week. Revenue fell from $420.8 million to $403.6 million, driven by a 4% decline in comparable store sales and the aforementioned drop in store count. Net income dropped from $34.7 million to $7.5 million. Operating cash flow declined from $82 million to $17 million, while the adjusted figure for this dropped from $41.9 million to $15.9 million. And finally, we saw EBITDA drop year over year, falling from $45.8 million to $17.4 million. Generally speaking, this kind of picture is really bad to see in the retail space. But one thing I am drawn to is the fact that the company has no debt on its books and has cash and cash equivalents of $157.5 million. To put this in perspective, the firm’s market capitalization right now is $196.2 million. So this significant amount of cash reduces its enterprise value to only $38.7 million.

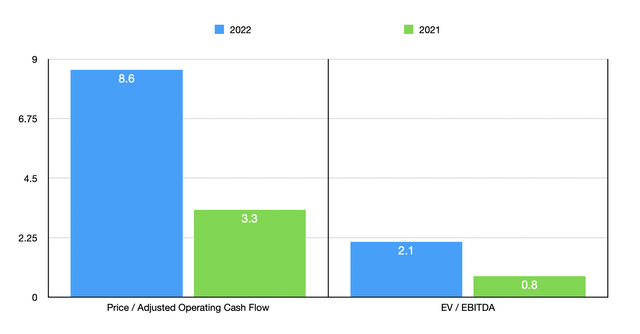

We don’t really know what to expect for the rest of 2022. But if we were to annualize results experienced for the first half of the year, we would anticipate adjusted operating cash flow of $22.7 million and EBITDA of $18.2 million. Using these figures, we would calculate that the company is trading at a forward price to adjusted operating cash flow multiple of 8.6 and a forward EV to EBITDA multiple of 2.1. By comparison, using the data from the 2021 fiscal year, these results would be 3.3 and 0.8, respectively. To put this all in context, I compared the company to five similar businesses. On a price to operating cash flow basis, these firms ranged from a low of 3.2 to a high of 12.5. In this case, using our forward figures, all five companies were cheaper than our prospect. Using the EV to EBITDA approach, the range comes in at between 1.6 and 4.1. This makes two of the five cheaper than our target.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| The Cato Corporation | 8.6 | 2.1 |

| Destination XL Group (DXLG) | 6.7 | 4.1 |

| Tilly’s (TLYS) | 7.6 | 1.7 |

| J.Jill (JILL) | 3.2 | 3.1 |

| Express (EXPR) | 7.7 | 2.7 |

| Citi Trends (CTRN) | 3.4 | 1.6 |

Takeaway

Truth be told, I don’t believe that Cato is a high-quality company at all. I don’t like the continued decline in store count, nor do I appreciate the negative comparable store sales. On the other hand, shares are very cheap and the overall risk associated with the business because of the tremendous amount of cash on hand looks limited. For those who do decide to buy the stock, I would keep a watchful eye for significant changes in the value proposition. An especially watchful eye is important when buying a company that is not a quality operator. But for those who don’t mind some volatility and risk, I would say that Cato makes for a soft ‘buy’ right now.

Be the first to comment