ArLawKa AungTun/iStock via Getty Images

Companies that are more difficult to understand can be riskier to own. But at the same time, that additional difficulty can also make them more attractive for those who can adequately value them. One wonderful example of this can be seen by looking at Cass Information Systems (NASDAQ:CASS), an enterprise that operates as a provider of payment and information processing services to a diverse pool of customers. Its work also includes services involving freight invoice rating, auditing, and the generation of accounting and transportation information. It also provides a wide array of other activities such as those involved through its bank subsidiary, Cass Commercial Bank. Recently, financial performance achieved by the company has been quite impressive. This has helped shares to rise at a time when the broader market has fallen. Despite the increase in share price though, I would say that the stock still may offer a bit of upside from here. Because of that, I do think the company still warrants a ‘buy’ rating, but only barely.

A unique business revisited

Back in late December of 2021, I decided to write my first-ever article about Cass Information Systems. At that time, I felt as though the company had a fine track record, with cash flow numbers standing out particularly well. All things considered, I believe that the stock was probably more or less fairly valued, but that the company likely offered some upside in the long run. This led me to rate the company a ‘buy’ to reflect my view at the time that shares should outperform the broader market moving forward. Since then, the company has achieved just that. While the S&P 500 is down 15.9%, shares of Cass Information Systems have generated a return for investors of 11.3%.

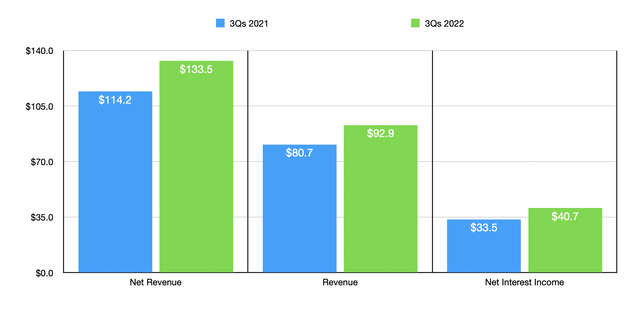

There’s a lot of information we could dig into here. But I think the best approach is to analyze how the company has performed so far this year compared to the same time last year. For the first nine months of the company’s 2022 fiscal year, net revenue came in at $133.5 million. This translated to a 16.9% increase over the $114.2 million generated the same time last year. This growth was broad-based, with fee revenue and other income rising from $80.7 million to $92.9 million. But in addition to that, the company also saw its net interest income rise from $33.5 million to $40.7 million. The company benefited from a variety of things here. For instance, financial fee revenue during this window of time jumped by 40.2%, largely because of a 28.2% increase in transportation and a 26.8% increase in facility-related dollar volumes, respectively. Processing fee revenue grew a more modest 2.3%, driven by an increase in transportation volumes of 0.2% and a 4.7% rise in facility-related transaction volumes. Net interest income, meanwhile, rose thanks to higher average earning assets and investment securities and loans. And for the most part there, yields on the investments also increased, with some of this almost certainly due to increases in the interest rate imposed by the Federal Reserve banking system.

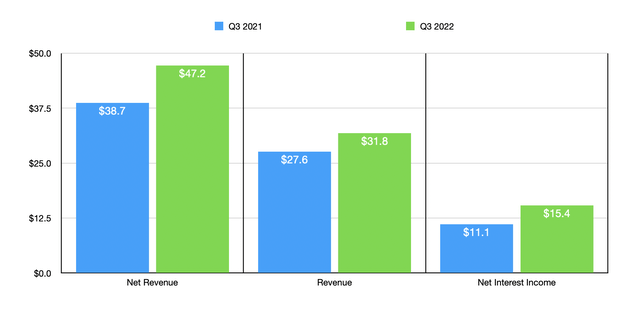

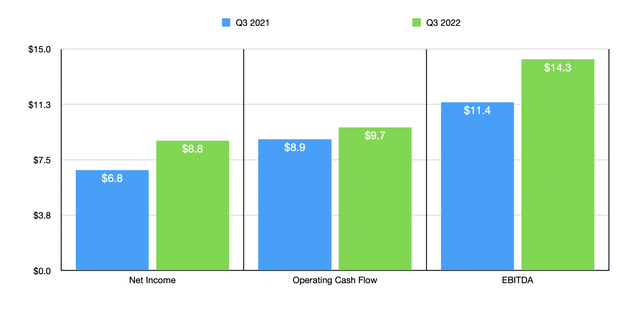

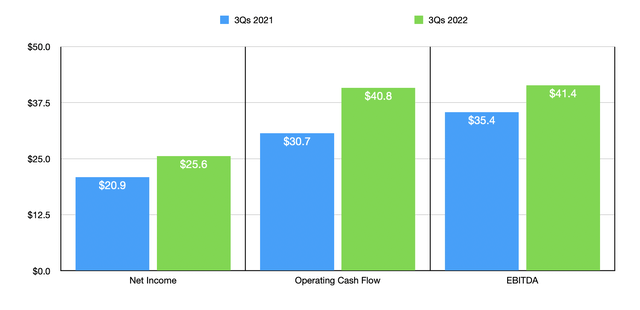

With this rise in revenue also came improved profitability. Net income, for instance, rose from $20.9 million in the first nine months of 2021 to $25.6 million the same time this year. Operating cash flow grew from $30.7 million to $40.8 million. Meanwhile, EBITDA for the company also increased, rising from $35.4 million to $41.4 million. The results achieved in the first nine months of the 2022 fiscal year involved impressive results in the third quarter alone. Revenue of $31.8 million beat out the $27.6 million achieved at the same time last year. Net interest income jumped from $11.1 million to $15.4 million over this same window of time. Collectively, this helped to push net revenue for the company from $38.7 million in the third quarter of 2021 to $47.2 million the same time this year. As a result of this, net income rose from $6.8 million to $8.8 million. Operating cash flow improved from $8.9 million to $9.7 million. And finally, we saw an increase in EBITDA, with the metric climbing from $11.4 million to $14.3 million.

Author – SEC EDGAR Data Author – SEC EDGAR Data

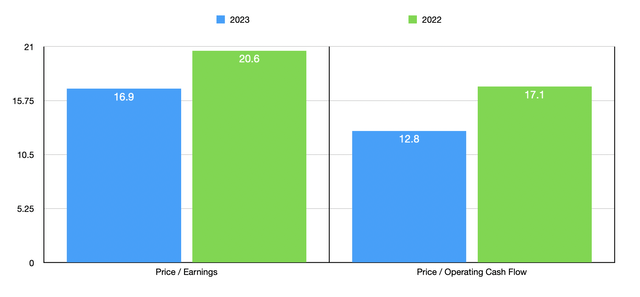

Just like so many other companies out there, the management team at Cass Information Systems has not really provided much detail as to what to expect for the rest of the current fiscal year. If we simply annualize results experienced so far, we should anticipate net income of $35 million, operating cash flow of $45.9 million, and EBITDA of $47 million. As I mentioned in my first article regarding the company, valuing it is rather tricky because of how its business model functions. The simple approach that I settled on was to look at the price-to-earnings multiple and the price to operating cash flow multiple. Using our 2022 estimates, the firm is trading at a forward multiple of 16.9 when it comes to the price-to-earnings approach and a multiple of 12.8 when it comes to the price to operating cash flow approach. By comparison, using the data from 2021, these multiples would have been 20.6 and 17.1. Another way in which I looked at the company was through the lens of its price relative to its net tangible asset value. Using the most recent data available, this figure comes out to 3.15.

Truth be told, I believe that the way in which Cass Information Systems makes it difficult to find good companies to compare it to. But I did find five firms that have similarities to it from an operational perspective. On a price-to-earnings basis, only two of the five had positive results, with multiples of 14.3 and 19.8. That would put our prospect right in the middle of the two. Meanwhile, using the price to operating cash flow scenario, the range was from 6.9 to 108.8. In this case, four of the five companies were cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow |

| Cass Information Systems | 16.9 | 12.8 |

| IBEX (IBEX) | 19.8 | 9.1 |

| Priority Technology Holdings (PRTH) | N/A | 6.9 |

| Repay Holdings (RPAY) | N/A | 11.9 |

| International Money Express (IMXI) | 14.3 | 108.8 |

| i3 Verticals (IIIV) | N/A | 12.2 |

Takeaway

From a purely fundamental perspective, it looks to me as though Cass Information Systems is continuing to grow at a nice pace. This is especially true when you look at the cash flow pictures provided by management. When it comes to valuing the company, the process is a bit tricky. But on the whole, shares don’t look exactly overpriced. For those interested in investing for the long haul, I would say that there is still perhaps a bit of additional upside from here in store for shareholders from here. Perhaps not a great deal, but enough to warrant a soft ‘buy’ rating at the moment.

Be the first to comment