Joe Raedle/Getty Images News

The supply chain disruptions that COVID caused had a more damaging impact on certain industries more so than others. Given the sheer size and expanse of the market, new cars were of particular note in terms of the impact on pricing and demand. In other words, as the supply of new cars dried up, consumers were forced to look at used options, which drove prices through the roof given too much demand for too little supply.

That worked out beautifully for used car retailers, like Carvana (NYSE:CVNA), but as we now know, that joy was all too brief. Carvana is now facing a very real threat of bankruptcy risk as it waited too long to adapt to rapidly changing conditions in the market.

The last time I covered Carvana, I finished the article with this:

“I think the chart looks great for a quick trade, but this is not a stock you want to own long-term.”

The article stats show that I put a buy rating on Carvana, and that it’s down 88% since then. That’s true, but before you judge me too harshly, I did say to make a trade and then get out. Carvana very quickly broke down after that, and the rest, as they say, is history.

So what do we do now? It is my view that Carvana has become a battleground stock and because of that, the traditional ways to determine whether to buy or sell become more difficult to use. Expect extreme volatility like we’ve seen this week, and respect the chart. Above all, the chart will tell you whether Carvana is going to be able to stave off bankruptcy, and therefore, becoming a worthless stock. Below, I’ll explain why I think it’s best for all but the highest risk takers to simply stay away from this one.

Oversold, but is it enough?

That’s the question for investors; we know Carvana is in a huge mess fundamentally, which is why its stock is down ~99% from the peak. Whether or not you choose to buy this stock, to my eye, is based upon whether you believe Carvana will survive. If it does, $5 is probably a bargain long-term. If not, your equity value will go from $5 to probably nothing. This is a binary bet on a company’s survival, and the risk/reward deteriorates with every tick of the share price higher.

StockCharts

Obviously, the chart is hideous. That is, unless you’ve been shorting it, in which case you probably have never beheld such beauty. There are two key resistance lines that should be watched carefully if the stock rallies. First, the prior low at $6.50/$6.70, which I’ve drawn in above. That is likely to prove a formidable obstacle for the bulls, if they can manage to move the stock that high. After that, the rapidly-declining 20-day EMA is the next obstacle, which has been a brick wall for pretty much all of 2022. It won’t take long for the 20-day EMA to fall below the price resistance level I noted, so depending upon the time frame, the EMA may take precedence. The point is, there are two levels that I think are going to be tough for bulls, regardless of which one occurs first.

Let’s now focus our energy on the fundamental situation, which looks pretty bleak to my eye.

Desperation

To be fair, I like Carvana’s attempt to disrupt what is an industry that basically nobody enjoys being a part of. Consider the last time you bought a car from a traditional dealer, and then consider if you found that experience to be pleasant. I certainly did not, and based upon the rapid expansion of Carvana’s volumes over the past few years, it appears the market is ripe for disruption. In that way, Carvana and others that use the same model are attempting to make an unpleasant experience pleasant for consumers.

The problem is that this simply isn’t enough. At some point, you have to start generating enough cash to run the business sustainably, and that has proven elusive for Carvana, and indeed, Vroom (VRM) and others like them.

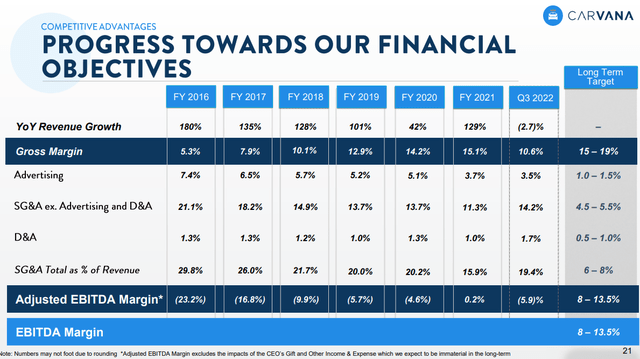

Below we have the company’s long-term financial goals, which look like a farce at this point.

Investor presentation

The idea that Carvana has any sort of reasonable shot at hitting 8% to 13.5% adjusted EBITDA margin is nonsense in the face of the evidence presented to investors right now. Gross margin is supposed to be in the 15% to 19% range, nearly double where it currently is today. SG&A is supposed to be cut by two-thirds. None of these targets are reasonable and for that reason, I’m simply ignoring them. Targets have to have some basis in reality, and you cannot convince me these are realistic.

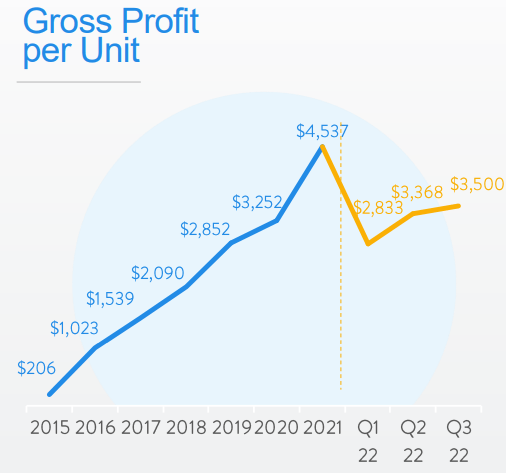

Let’s take a closer look at some of the issues facing Carvana, starting with gross profit per unit, or GPU.

Investor presentation

This is absolutely critical because it is the primary profitability metric for Carvana (and other used car retailers). There was a massive decline into 2022 and while Carvana is starting to come out of it, it’s nowhere close to 2021 levels. The company is simply spending too much for $3,500 in GPU to work long-term, which is why it’s facing bankruptcy risk today. With new car supply gradually coming back, I don’t see a path for the company to have pricing power sufficient to move the needle here.

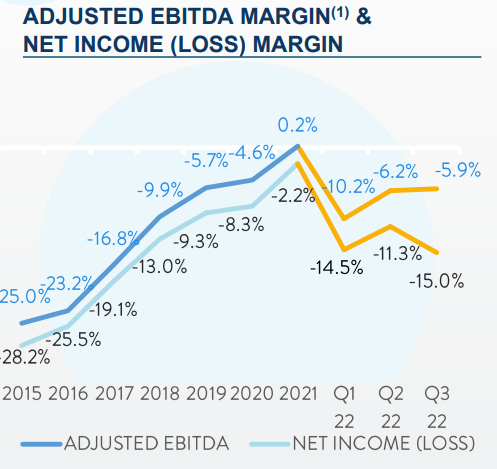

Similarly, we can see that consolidated profitability has fallen off a cliff.

Investor presentation

Given the GPU numbers, this is no surprise, of course, but it’s also no less important for it. No company can operate with -15% net income margins for long, and given Carvana’s already-high leverage (more on that below), the leash for this kind of thing is going to be quite short.

A plan is in place, but will it work?

That’s the key question if, for some reason, you’re interested in owning this stock. As I said above, if the turnaround works, returns from $5 are likely to be enormous. If it doesn’t, you’re almost certainly looking at a $0 stock eventually. Let’s take a look at some of the things management is trying to stave off the latter scenario.

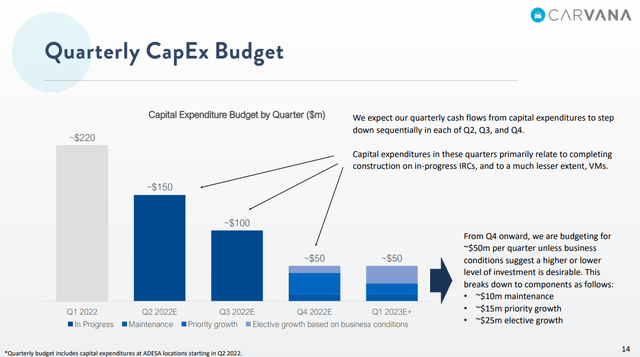

Investor presentation

First up, the company is slashing its capex budget, which is something companies that are facing bankruptcy tend to do. This is one of the easiest and fastest ways to preserve cash, because you simply stop investing in growth projects. The savings are going to be sizable, given capex was $220 million in Q1 of this year, but is expected to be at ~$50 million per quarter going forward. That also means there is essentially no investing in future growth, which of course, is (was) a key tenet of Carvana’s value proposition for shareholders. That’s the trade off, however, when the business cannot support itself and something has to give.

The company is also trying to rapidly reduce the amount of SG&A it spends on each vehicle, because as we saw with the profitability numbers, SG&A is simply too high. The company has some levers it is pulling, which you can read about here. It’s all the stuff you’d expect: headcount, compensation and benefits costs, advertising, etc. We’ll see if it works but one thing is clear; Carvana has a very long way to go in terms of getting to a point where it’s sustainably profitable.

Cash is a huge problem

The net of all of this is that Carvana has been unable to support itself through normal operations. After all, a chronic lack of profitability will do that. Let’s wrap this up with a discussion of the company’s balance sheet and cash generation, starting with the former.

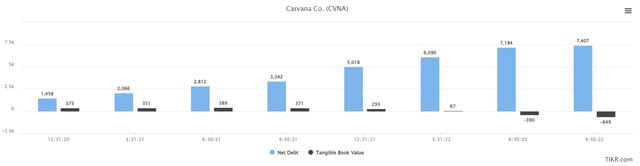

TIKR

Net debt is now $7.4 billion, which is almost eight times the company’s current market cap. This amount of leverage is unsustainable, and it also means that additional debt capital funding is likely off the table. The company’s bonds (here, here, here, and here) are trading at 30 or 40 cents on the dollar, and yielding 30%+ as a result. Bond traders are pricing in a high likelihood of bankruptcy risk, and the data above is a big reason why. Carvana has tapped out the debt markets to the extent possible, as far as I can tell, which severely limits its options going forward. And that is to say nothing of the tens of millions of dollars of carrying costs of this debt, which only exacerbates the company’s ability to operate profitably and generate cash.

I’ve plotted tangible book value as well, to show the deterioration in that metric and that value is being destroyed every quarter. Carvana’s theoretical liquidation value is now -$649 million as its investments are producing negative returns over and over again.

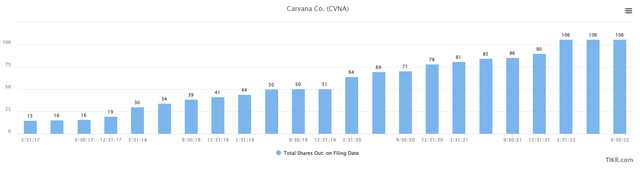

Another option for beleaguered companies is dilution, but Carvana has done plenty of that as well.

TIKR

The share count is up to 106 million as of the end of last quarter, and at this point, the time to issue shares has passed. When the company would only get $5 per share, the amount of dilution it would take to raise a meaningful amount of capital would be enormously damaging to the equity price. That may still happen if things get bad enough, and at this point, I certainly would not rule it out.

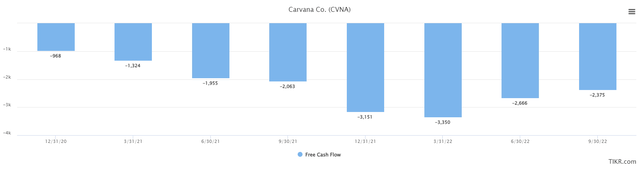

If we boil all of this down, Carvana’s primary issue is it cannot figure out a way to produce positive cash flow. Data below is trailing-twelve months in millions of dollars.

TIKR

Free cash flow has been negative pretty much since the company’s inception, and I don’t see a path forward here. Given that, my base case is that Carvana is more likely than not to go out of business. Of course, if some of the actions being taken work, that could be staved off for some time. However, I don’t think the ultimate outcome will change, just the path to get there.

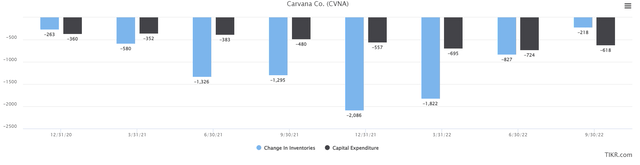

Two primary components of Carvana’s negative free cash flow have always been capex and inventory. We already looked at capex, and the company is slashing it to the bare minimum to preserve cash. Let’s also look at inventories. This data is trailing-twelve months and in millions of dollars.

TIKR

We can see capex is $618 million on a TTM basis, but that should gradually come down to ~$200 million based upon guidance. The other problem is inventory, which you can see has been a huge use of cash in prior quarters. That has been cut very sharply but that basically means that Carvana cannot execute its growth plans. As I mentioned before, it’s in a situation where it has to choose survival over growth. Perhaps more than anything, this inventory data shows the pain it must take to live another day. We could see this number go positive in the next few quarters as Carvana could choose to essentially stop buying cars and sell down what it already has. That could quite significantly boost FCF, but at the expense of market share and growth. We shall see.

The bottom line

Trying to value a stock like Carvana is a bit pointless given it is going to trade with extreme volatility based upon news events, rather than fundamentals. However, for some perspective, here’s a chart of price-to-sales historically.

TIKR

The stock is at 0.04X next twelve months sales, which is, of course, an extremely low valuation. Now, if you believe that Carvana will somehow come out of this, you probably find this to be a compelling value. I happen to think Carvana is going to go out of business, so I don’t really care what the valuation shows; nothing is cheap enough if the equity is going to be worthless.

I’m not willing to short this stock, but I implore you to really examine the evidence to see if you think Carvana will survive before considering buying this stock. The risk of it going to zero is extremely high, and for that reason, I’m simply staying away. If you own it, my advice is to take the $5 per share and run as quickly as you can, and never look back. Could it go higher? Sure. Is it worth the risk of holding to find out? In my mind, the answer to that is quite clear.

Be the first to comment