Lu Zhang/iStock Editorial via Getty Images

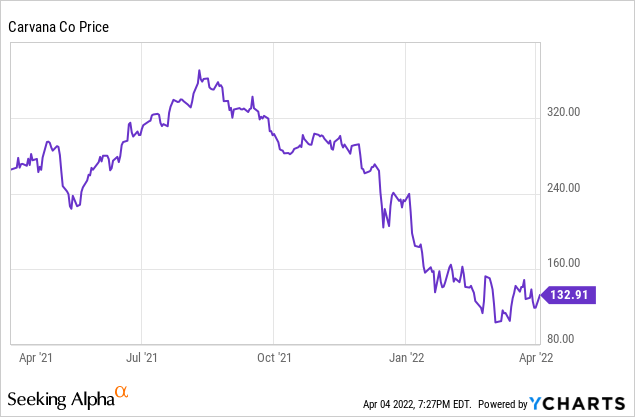

When we look at the minefield of tech stocks that have fallen severely over the past few months, it’s hard to pick out a “biggest loser” among them because there are certainly dozens of stocks that have been hit dramatically hard. Carvana (NYSE:CVNA) is no exception here – the automobile e-commerce site has shed approximately two-thirds of its value, due primarily to investors’ macro fears and the de-risking that has taken place in portfolios since January began.

The key question now for investors: with Carvana having lost more than 50% since the start of January already, and with the market seeming to want to put Q1 behind us and rally into the remainder of the year, is now the right time to buy Carvana on the dip?

I’ll cut to the chase here: I was previously bearish on Carvana, citing concerns on valuation as the primary driver for that downside view. When I last wrote on Carvana in November, I noted that the company’s ~5x forward revenue multiple for a very low-margin business that faced growth deceleration risks was too rich. Now, with that concern largely abated with Carvana’s huge fall from highs, I’m now neutral on the stock.

That being said, I still continue to note two major fundamental concerns with Carvana that prevent me from going long:

- Is Carvana’s strategy shifting entirely away from the asset-light model with its acquisition of Adesa, and will investors begin to view this business differently and at lower multiples in the future?

- Growth concerns: there are a number of headwinds to Carvana’s growth, including a tapering of retail unit sales (itself a function of the upward spiral in used car prices) as well as rising interest rates. With Carvana no longer growing at a ~2x y/y rates of the past, will it be able to sustain investor enthusiasm?

My recommendation remains to sit on the sidelines for Carvana. While the massive fall from peaks certainly presents an interesting buying opportunity, I’m not confident enough in the strength or durability of Carvana’s fundamentals and its business model to take on a stake just yet.

Adesa – Carvana’s largest acquisition ever

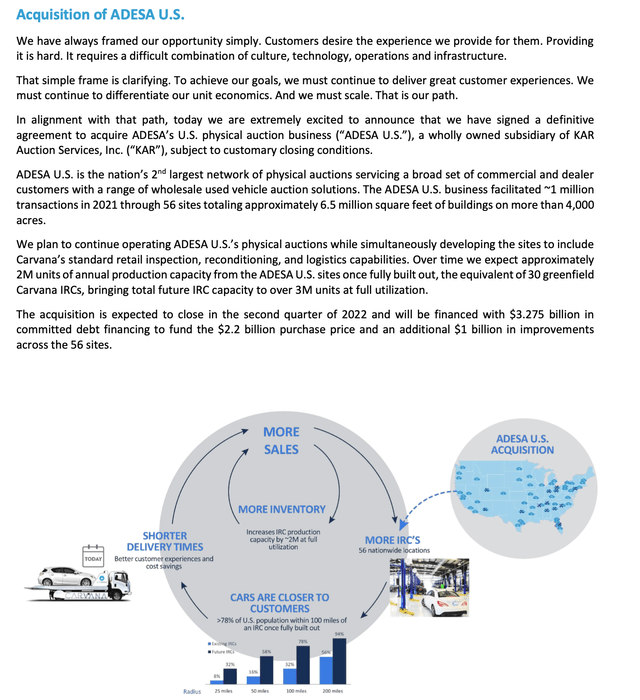

Let’s now discuss the first risk, which is the major news shakeup for Carvana since the year began. In late February, Carvana announced that it would acquire a company called Adesa, which is the second-largest car auction dealer in the U.S. selling specifically to commercial buyers and independent car dealerships. The snapshot below, taken from Carvana’s most recent Q4 shareholder letter, showcases a few additional details:

Carvana – Adesa acquisition (Carvana Q4 shareholder letter)

The price tag: $3.2 billion in aggregate. The company is spending $2.2 billion to acquire the enterprise itself, and then planning on spending $1 billion in capex to upgrade the Adesa physical network.

Some additional quick-facts and initial reactions to this deal:

- Carvana is already shouldering a lot of debt. Carvana is already in a negative $3.0 billion net debt situation, which distinguishes quite drastically from other internet businesses which are typically flush on cash. This deal doubles that debt load. Reminder that Carvana just broke even on an adjusted EBITDA basis, meaning its firepower to actually service this debt is limited. And with interest rates rising, this debt could prove even more challenging to service.

- The enterprise purchase price is 22x adjusted EBITDA. Adesa generated $100 million in adjusted EBITDA on $800 million of revenue in 2021. The 22x multiple that Carvana is spending on this business (not including the capex spend that it’s planning to incur) is quite steep for a “legacy” business that presumably doesn’t carry much growth potential.

- Real estate synergies – are they worth this premium? One of Carvana’s main reasons for being Adesa is to give it physical locations to place its IRC activities (vehicle reconditioning), plus potentially increase inventory storage capacity to allow for faster and cheaper shipments to the end-customer. But did it have to spend this much to acquire Adesa instead of investing in pure IRC facilities?

- Is Carvana shifting away from its original asset-light business model? Earlier on in its lifespan, Carvana encouraged investors to view the business as asset/capital-light and as the new way that consumers would purchase cars with limited dealer real estate. Carvana still doesn’t have dealerships, but it has ~30 “car vending machines” plus now a physical auction network. Is the company essentially now becoming more of a traditional auto reseller, and will investors catch on and stop assigning it with a tech premium?

Overall, I’m quite concerned that Carvana is biting off more it can chew with its acquisition, and doubling the debt load to ~$6 billion while having limited EBITDA is quite a daunting proposition.

Is organic growth running into a wall?

The other major item investors have to worry about: aside from the acquisition risks, is Carvana’s organic/core business facing a slowdown? We know that used-car demand (as well as prices) have spiked during the pandemic, but how many of these tailwinds can be sustained? Investors are used to seeing Carvana’s incredible revenue growth rates at this point (exceeding 2x y/y), but as we now see tougher comps in 2022 versus 2021, the optics on this business may change quite substantially.

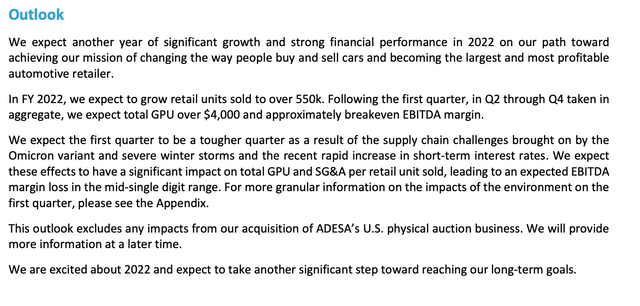

It’s not just a matter of tougher comps versus a pandemic-boosted 2020/2021, however. Carvana has cited a number of challenges heading into 2022:

Carvana outlook (Carvana Q4 shareholder letter)

The outlook spells a number of key risks, including a COVID conditions/a severe winter storm that has throttled the supply chain (specifically on the logistics side), as well as rising interest rates. Given the majority of U.S. consumers finance the purchase of a car with debt (especially with rising prices), how will the upward shock to consumer rates we’ve seen this year impact used car demand?

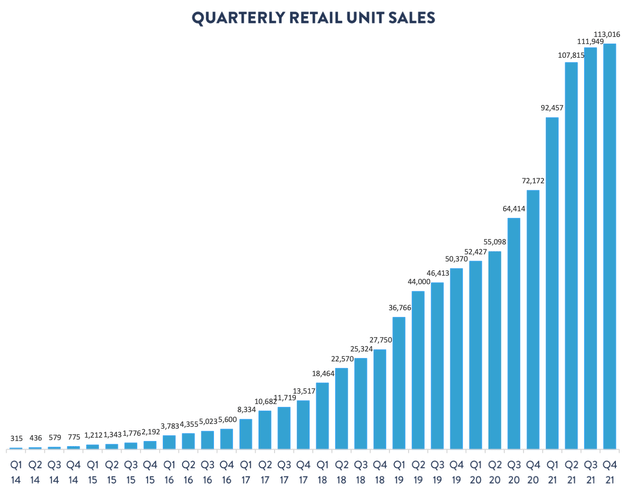

Already, we can see Carvana’s retail unit sales flattening. In the chart below, you can see how many cars Carvana sold to end-consumers each quarter (excluding its wholesale business). Though the company used to grow considerably each quarter, over the past three quarters we’ve seen Carvana’s quarterly unit sales flatline around ~110k. Is this the “new peak” for Carvana?

Carvana retail unit sales (Carvana Q4 shareholder letter)

It’s not difficult to understand why unit sales may be slowing down. Offices are calling workers back in, the suburban moving craze/de-urbanization of America is reversing trend, and car prices are much higher than before. And aside from car prices, what about gasoline prices? With prices at the pump reaching $5-6 or more across most of the U.S., many consumers are rethinking public transportation or reduced driving now that gasoline prices have skyrocketed. Needless to say, all these factors dampen the demand for cars.

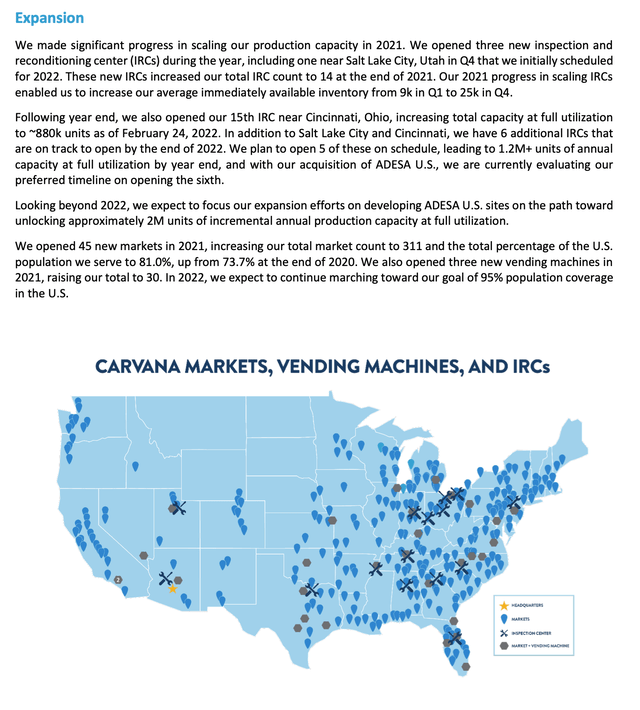

It’s worthwhile as well to remind investors that Carvana has grown over the past few years principally by expanding into new markets. But now, the company already covers the vast swath of the U.S., and already has a presence in the densest areas. In 2021, Carvana entered only 45 new markets, less than half of the new market entries that it made in 2020. Going forward, adding territory will not be as “lucrative” as a source of customer growth.

Carvana market coverage (Carvana Q4 shareholder letter)

Key takeaways

There are too many “question marks” clouding Carvana’s near-term landscape for my liking. The $3 billion debt-fueled acquisition of Adesa adds a major risk variable into the equation, while macro factors like rising interest/gasoline prices pose risk to Carvana’s organic growth. Continue to avoid this stock.

Be the first to comment