leminuit

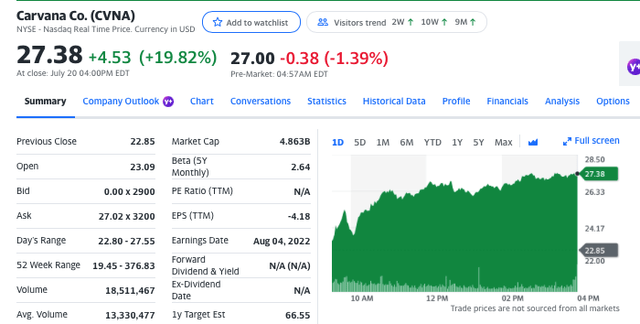

In June 2022, I wrote a fairly comprehensive three-part series on Carvana Co. (NYSE:CVNA). Although I had no intentions of writing an additional free site piece before Carvana reports its Q2 FY 2022 earnings, on August 4th, I have been fascinated by the amount and frequency of vitriol on display at Twitter (TWTR) and written about Carvana. Not only are 90% of the comments negative to super negative, the word “bankruptcy” gets cavalierly tossed around on a regular basis. And some of these folks go as far as to strongly suggest Carvana will file bankruptcy before September 30, 2022. I would argue even an outside and objective observer, someone with no skin in the game, might similarly conclude the collective Twitter commentary on Carvana is a cesspool of mis-information, lies, and hyperbolic statements.

Ally Financial Allays Fears

Some of those negative comments center on Ally Financial Inc. (ALLY) given its strategic relationship with Carvana. Therefore, yesterday, at 6am, I wrote an article to my group discussing why Ally Financial’s Q2 FY 2022 results were pretty bullish for Carvana.

Enclosed below are the excerpts that I am sharing from yesterday’s article. Also, perhaps Mr. Market synthesized Ally Financial’s results the same way as me. The reason I say this is because, yesterday, Carvana shares ripped, closing up nearly 20%, with north of 18 million shares changing hands.

My original July 20, 2022 6am Note

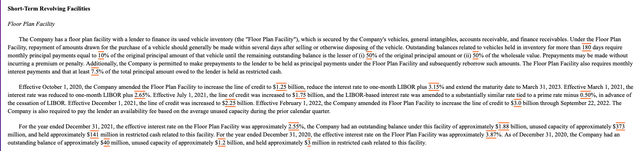

This is a very quick note on Ally Financial’s Q2 FY 2022 results and conference call. Ally Financial is Carvana’s Floor Plan Facility lender. Floor plan financing is the working capital that car dealers utilize, enabling them to finance their inventory as this financing facility is secured by the value of that underlying inventory until the vehicle is sold in which case Carvana gets cash (and pays down the facility) or when the loans are securitized (and then pays down the facility).

As you can see below, from Carvana’s FY 2021 10-K, this is a $3 billion facility through September 22, 2022. Also, please note, Ally has dramatically increased the size of the facility since October 2020.

Let’s Talk Ally Financial

Let’s start by sharing a few excerpts from Ally’s Q2 FY 2022 conference call.

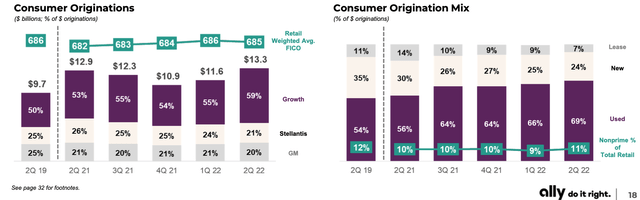

In Q2 FY 2022, industry wide, new vehicle sales were down 21% and used vehicle sales were down 17%. Despite this, Ally had its highest consumer originations since 2006!

Within auto, consumer originations of $13.3 billion represented our highest quarterly flows since 2006 and originated yields expanded 75 basis points quarter-over-quarter to 7.8%. Industry vehicle sales were down 21% and 17% year-over-year across new and used, respectively. Despite that headwind, our ability to generate strong consumer originations shows the scale of our auto business and depth of application flow. Credit normalization in the second quarter continued in line with expectations and retail NCOs of 54 basis points remained well below pre-pandemic levels. We are monitoring for market indicators of consumer health, including wage and price inflation, employment conditions, deposit balance changes and overall debt payment trends.

(Source: Ally Financial’s Q2 FY 2022 Conference Call) (emphasis added).

On the Q&A portion of the call, Jeff Brown, CEO said the following about Carvana (emphasis added):

Yes. Ryan, thanks for the question. So, we hear and we see the yellow lights flashing too. And we do think the overall industry is tightening and competitive pressures are intensified. So, we would definitely agree with those statements, but I think it comes back to a little bit the power of the model that we built and the relationships that we have established. So, I mean I don’t think you can overstate the importance of growth in the dealer count, which is now 22,400 ish dealers, that’s up 20% over the past several years. And then also just the relationships we have established with big players and new players like EchoPark, Carvana and others. And while there is questions around their models, we are still seeing really strong flows from them in really high-quality paper. And so for us, we have not at all change underwriting standards, I think our FICO chart or FICO analysis is pretty boring through time. It really hasn’t changed. Jenn just talked about LTV. We really haven’t seen that change, DTI. Credit quality of the book remains really well intact. Obviously, the question, Jenn and I, when we sit down with our auto teams and our credit partners and our CRO, debate is around this outer look on severity. If you get a meaningful decline in used car prices, does that expose us, again, you don’t see speculation in auto lending. And we think, to Jenn’s point, you priced in all that risk already in our assumptions around used cars. So, for us, it’s back to you take care of your customers, you serve them very well, and it provides nice rewards in terms of just seeing really strong flows. I would also look at other stats around what are we seeing. Have we seen any changes in auto decisioning, we are not. So, right now, credit underwriting remains disciplined. I think the reason we are winning is we are just getting a bigger lock. We make it easy for dealers. And so the flows are really strong.

(Source: Ally Financial’s Q2 FY 2022 Conference Call)

And here is commentary from Jenn LaClair, Ally’s CFO (emphasis added):

Yes, sure. And let me just hit on what I think most bots at least are picking up across the media and the outlets this morning. I mean, look, we had incredibly robust retail auto originations this quarter, the highest level that we’ve had since 2006 and the vast majority of the increase in our reserving this quarter is a result of loan growth and its accretive loan growth, serving our customers, positioning us well to drive accretive returns over time to generate that 16% to 18% plus percent ROTC that we guide to. And so we are kind of unapologetic about our reserve build this quarter. And the vast majority of that again was retail auto growth as well as growth in some of our other newer products. Moshe, from there, we will see reserves bounce around a couple of basis points. I mean, as you’re pointing out, we’re up 2 basis points on coverage rate. A lot of that’s just seasoning of the portfolio, timing of when originations flow on and the portfolio slows off, especially the post-COVID portfolio vintages. But we see pretty likely stable from here. It could migrate down more towards that day 1 CECL level over time, but we are not in a hurry to do that, especially considering some of the uncertainty on the horizon relative to macros.

(Source: Ally Financial’s Q2 FY 2022 Conference Call)

Ally’s Q2 FY 2022 Slide Deck

If you look at Ally’s Q2 FY 2022 slide deck, let’s review a few key slides (see this link).

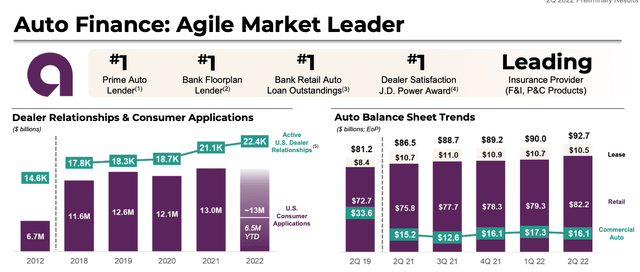

As you can see, Ally is the number one prime auto lender, number one bank floorplan lender, and has the largest retail auto loan book. And 69% of its Q2 FY 2022 loan volumes were in the used vehicle segment.

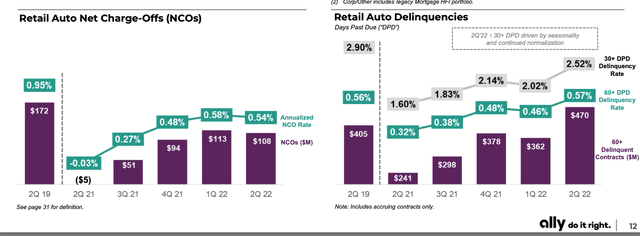

Ally Financial’s Q2 FY 2022 IR Deck Ally Financial’s Q2 FY 2022 IR Deck

And despite all of the headlines that you read about the sky falling, a major recession is on the horizon, the U.S. consumer will collapse, yada-yada, Ally’s 30 day Auto delinquencies are below Q2 FY 2019 levels. In other words, the economy was much stronger in Q2 FY 2019 as it confronted far fewer headwinds (and Covid-19 didn’t exist) and interest rates were lower back then, and yet, charge-offs and delinquencies were lower in Q2 FY 2022 than Q2 FY 2019.

So if you take a step back, as Ally is the biggest in the business, on the prime side, the business is fine. I too see the media’s obsession with writing about used car bubbles and raising interest rates and the sky is falling scenarios. However, as of July 19, 2022, Ally Financial isn’t seeing these wild theories and fears show up in its actual high frequency data.

Also, if you’re paying attention, for anyone actively in the market and looking to buy a new vehicle, the average price in Q2 FY 2022 was about $45,000. And if you want to buy some of the more popular models, be prepared to pay $5K to $10K over sticker, depending on the vehicle. In other words, relative to new cars, used car prices are relatively more attractive as $45K is simply out of reach, notably in a higher rate environment, for many people. Secondly, if you look at how weak 1st half overall used car sales volumes were, perhaps not surprisingly given all of the shocks (war in Ukraine, rising rates, lowest consumer confidence in the history of the University of Michigan survey, and the highest inflation in 41 years), I would argue that we are setup for a rebound during the 2nd half of FY 2022, for both the used car market and new car market, as having a vehicle is a necessity if you work. Perhaps, the only exception is if live in the urban core, where you can easily access public transit to commute to work and be out and about to live your life.

Christian Leone’s High Stakes Game of Liar’s Poker

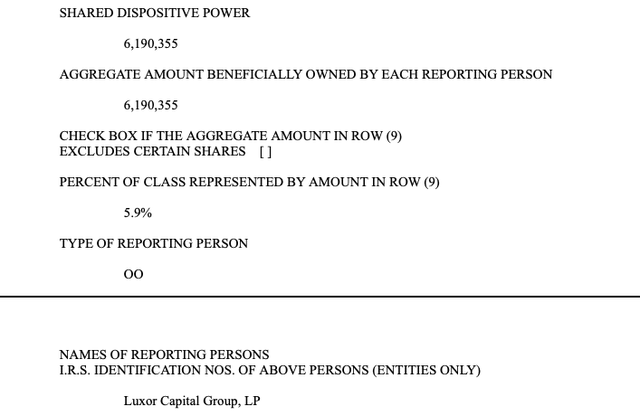

To justify writing a fourth note, I am going to add some additional content. Last Friday night, after the bell, Luxor Capital, filed an updated SC 13 form indicating that the hedge fund upped its stake in Carvana from 830K shares to just shy of 6.2 million (so nearly a 5.4 million share increase).

Enclosed below please see the SC 13 filing by Luxor Capital.

Given the dramatic drop in the Nasdaq, during Q2 2022, it is hard to precisely know Luxor’s real-time assets under management (“AUM”), but various Google searches suggest this was at least a $7 billion hedge fund, at the end of Q1 2022.

Luxor Capital was founded by Christian Leone. Here is a quick biography from Crunchbase:

Christian Leone is the founder of Luxor Capital Group, LP. In addition to being CEO, Mr. Leone is a Portfolio Manager and sits on the firm’s Investment and Risk Committees. Mr. Leone began his career with Goldman, Sachs & Co., where he worked in the U.S. and European high yield and distressed debt groups. In March of 2000, he left Goldman to

start WideRay Corporation, a Sequoia Capital funded wireless hardware, software and network infrastructure company. Mr. Leone left WideRay in 2002 to start Luxor. He graduated from Stanford University with a B.A. in Economics.

As you can see, as of March 31, 2022, Luxor Capital owned 830K shares.

Incidentally, a very good investing friend of mine, someone I text with about markets almost daily and speak with on the phone, about once per week, is the Chief Investment Officer of a $1 billion family office in NYC. Back in the day, he had a number of interviews with Luxor and Christian. Moreover, as he has mentored a number of promising young analysts, one of his proteges was hired by Luxor (I’m not sure if this analyst is still there or not). Anyway, my long-winded point is that my friend said, and he knows this on a first hand basis, Christian and the team at Luxor are really smart.

The July 15, 2022 Value Hive Podcast

For any eager beavers out there that are super intellectually curious, you might enjoy this 95 minute podcast discussing the bull/ bear case on Carvana. It was recorded on July 15, 2022. I thought it was good and I learned a few qualitative nuances about the business.

And within that 95 minute Value Hive podcast, Marc Cohodes, a fairly well known short seller, was very vocal and frequently mentioned the name Cliff Sosin. When I googled Cliff Sosin, I found this September 16, 2019 YouTube video.

I don’t know much about Cliff and am not familiar with his track record per se, but I did find the first twenty minutes of this YouTube video thoughtful, and it is clear he has done a lot of work and spent countless hours speaking with management and really trying to understand the business.

Again, if you are super intellectual curious I would strongly suggest you invest the 95 minutes to listen to the July 15, 2022 Value Hive podcast as well as the first 20 minutes of Cliff Sosin’s September 2019 YouTube interview.

The Technicals – About To Cross The Rubicon?

As if are close to the Carvana story, then you are probably well aware that there are only about 105 million shares not held by the Garcia’s, as they own about 83 million out of 188 million total shares. And as of June 30, 2022, there were 29.82 million shares sold short. And, by the way, the July 15, 2022 short interest data will be published, after the bell, on July 26, 2022.

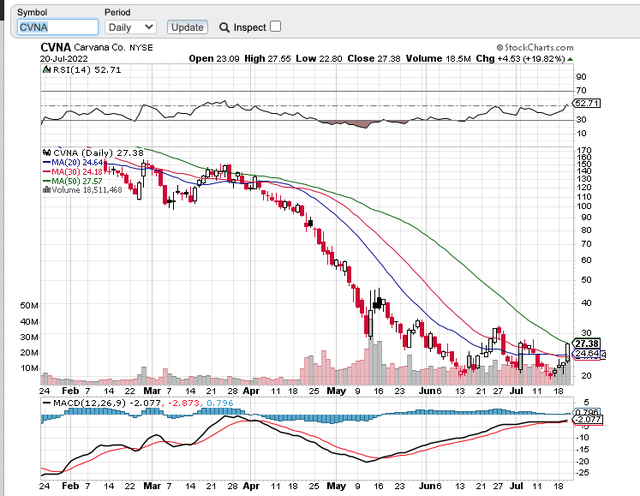

Given this really tight float, perhaps more so if major holders such as T Rowe Price, Baillie Gifford, and a few other big holders held on (we won’t know until August 15, 2022 or unless they file their June 30, 2022 positions earlier), readers need to be aware of the technicals. Enclosed below is Carvana’s chart and as you can see, yesterday’s close was within $0.20 of crossing the Rubicon (closing above its 50 DMA). As you can see, the shorts and the bears have been able to prevent Carvana from get over its 50 DMA. This will be an interesting tug-a-war as crossing the 50 DMA, notably on a closing basis, could light up the algos, especially given the elevated short interest on a tight float.

Putting It All Together

In today’s piece, I wrote to share the importance of how strong Ally Financial’s Q2 FY 2022 loan volumes were, notably compared to the overall used vehicle market, as well as how well its auto credit book is performing despite all of the scary media headlines about the sky falling. Secondly, despite all the Twitter conspiracy theories, Christian Leone seems to have upped the ante, by recently betting an incremental $150 million, at the Liar’s Poker table. It is one thing for the sell side to look at a falling knife of a stock chart and flip from bullish to bearish given gravity of the negative sentiment or for Barron’s to write a number of negative pieces on Carvana, but it something entirely different when a smart money hedge fund ponies up $150 million. Lastly, if you are an eager beaver, I strongly suggest you check out the 95 minute July 15, 2022 Value Hive podcast on Carvana. As I said, I even learned a few things, and I enjoyed the hearing the contrasting bullish and bearish arguments.

Lastly, I think Carvana is mis-understood and sentiment can’t get any worse. I would argue this is one of the most interesting stocks and games of Liar’s Poker in the stock market today. As for me, I’m long, just like Christian Leone.

Be the first to comment