adventtr

Decent Growth, After Some Puts And Takes

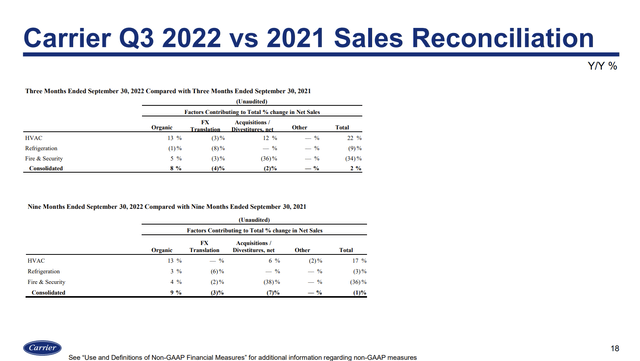

Carrier Global Corp. (NYSE:CARR) has been a solid performer operationally in 2022, although it can be hard to see when looking at the headline results. Carrier had two big M&A deals in the past year. They first sold the Chubb business in their Fire and Security division and later bought out JV partner Toshiba in their core HVAC division. These moves had a slight negative effect on sales with the loss from Chubb more than offsetting the gains from the Toshiba deal. Carrier also faced considerable foreign exchange headwinds this year due to the strong dollar. Backing out these impacts, sales grew 8% organically so far this year.

Carrier 3Q 2022 Earnings Slides

This is decent growth for an industrial company given the economic environment. Despite inflation, the company has succeeded at raising prices by more than their costs have increased. They have also managed to maintain similar unit volumes despite supply chain constraints. Order backlog continues to build, so future sales are supported as supply chain pressures ease.

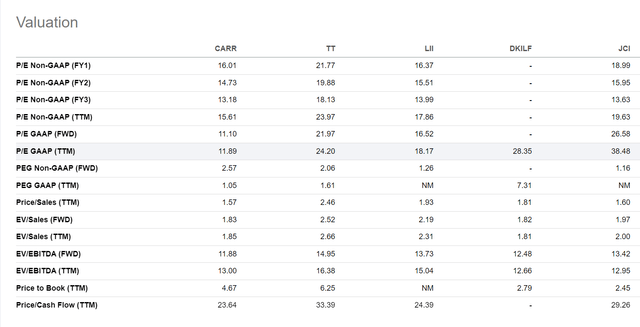

Despite this operational performance, the stock is down more than 30% since my July 2021 article where I rated it a Hold, and it has also underperformed its peer group.

This decline has left Carrier once again cheaper than its peers with positive growth drivers headed into 2023.

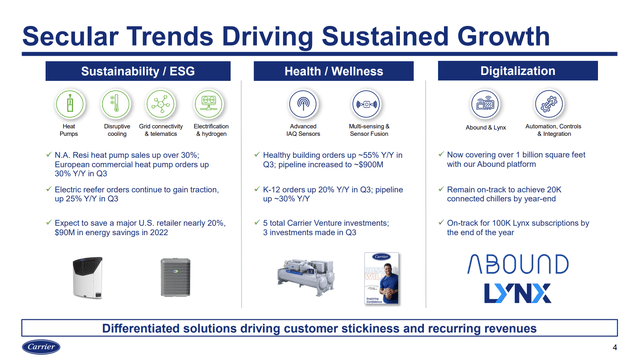

Growth Drivers

Carrier is still a beneficiary of long-term trends towards sustainability and automation. With strong environmental pressure in many locations to burn less gas, heat pump sales are up 30% in both North American Residential and European Commercial. Electrically refrigerated trucks and containers are also seeing demand growth. The desire for better indoor air quality is also helping Commercial HVAC sales. One of the key customer segments in this area is public schools, where orders are up 20%. Finally, the drive toward automation is helping sales of Carrier’s Abound and Lynx platform which allows remote monitoring and control of systems. This also helps Carrier’s push to increase recurring aftermarket service revenues. The plan is to reach $7 billion in annual aftermarket sales in 2026 compared to $4.5 billion in 2021. These sales are higher-margin and more predictable than equipment sales, which should help smooth out overall company performance through a recession.

Carrier 3Q 2022 Earnings Slides

Outlook

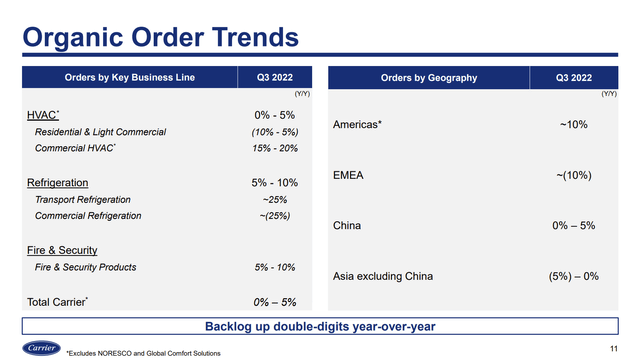

Carrier is still not immune to macro issues, but there are several hot customer segments to offset the cold ones looking into next year. Looking at order trends, the big push from the “stay-at-home” trade in Residential HVAC is indeed cooling down. However, with offices and schools reopening, as well as the environmental sustainability trend, Commercial HVAC orders are up high teens compared to last year. Transport refrigeration is another strong area, especially North American truck sales. Geographically, the Americas are the strongest region and orders are down in Europe. China is starting to grow again after the worst of the lockdowns while the rest of Asia is down slightly due to lower refrigerated container orders.

Carrier 3Q 2022 Earnings Slides

Management noted on the earnings call that some supply chain issues are finally easing, or at least the company has been successful at finding alternate suppliers. Other parts are still hard to get, including electronic components for security systems.

In addition to the sales growth, Carrier is continuing its productivity improvements to lower manufacturing costs. Material costs could also be a tailwind in 2023 as the prices of many commodities such as energy and metals are already on the way down.

It is too early for the company to provide guidance for 2023, but analyst consensus is for EPS of $2.52. This is a $0.20 or 8.6% increase over both company guidance and analyst projections for 2022. With overall order trends for the company up 0-5%, this EPS growth looks achievable. Potential tailwinds for EPS in 2023 include continuing reduction in commodity costs, supply chain improvements, a weakening US dollar, and share buybacks.

Capital Management And Valuation

Carrier’s free cash flow YTD has been low at only $0.4 billion. FCF finally went positive in 3Q but with supply chain pressures only now easing, the company lowered its full year FCF guidance to $1.4 billion from $1.6 previously. The Chubb sale was well-timed from a cash flow standpoint as it generated $2.9 billion of cash, however. The overall $3.3 billion of cash generated so far this year covered $0.5 billion of cash outflow for the Toshiba JV deal, $0.9 billion of debt paydown, $1.3 billion of buybacks, and $0.4 billion of dividends.

With the incremental $1 billion of FCF expected in 4Q, Carrier’s dividends are well-covered, and the company has authorized additional buybacks up to $2 billion. Looking forward, Carrier expects to get back to 100% free cash flow conversion as supply chain improvements free up working capital.

Net debt now stands at $5.9 billion, making the leverage ratio a comfortable 2.1 net debt/adjusted EBITDA. (Adjustment backs out the gain from the Chubb and Toshiba deals.) Interest coverage is also excellent with operating income over 27 times net interest expense last quarter.

With improving cash flow, the company appears on track for a dividend increase in February from the current $0.15 per quarter which is a low 1.7% yield.

After the stock’s underperformance vs. peers, Carrier now ranks cheapest vs. peers on several metrics including forward P/E, EV/EBITDA, and P/OCF.

Conclusion

Carrier shares have been beaten up since I rated them a hold in 2021. Even compared to peers, the stock has underperformed. The company has actually performed well operationally in 2022 in a tough environment, but results were obscured by M&A impacts. Looking ahead, there are both hot and cold areas of customer demand, averaging out to low positive order growth for the company. This can translate into better EPS growth through continued productivity enhancements, lower commodity costs, and share buybacks.

In its first year as a public company after the April 2020 spinoff, the stock was a star performer that quickly closed the valuation gap vs. peers. Since then, the gap has reopened, and the overall market has gotten cheaper also. The strong order backlog growth should lead to strong sales in 2023 even with a macro slowdown making Carrier stock a buy.

Be the first to comment