Oselote

If you are an HODL believer, dividend lover, Cathie Wood fan, or you just want to earn some money in the markets, you will like this article. It will save you from a few losses, and maybe even help you earn enough for a luxury vacation in the Swiss Alps or Aspen Mountains of Colorado. As a European, I’d definitely go for Switzerland. The slopes are amazing there.

In this article, I will show you how the Fed is thinking about the economy and hopes to escape the harsh recession. We will see that even if the recession is mild, the market decline can be very rough. Unfortunately, your portfolios can get scratched, as market turmoil can become even more severe than we’ve seen just this year. If you want to earn in such a market, you need to sell the broad market. If short-selling is not for you, then you are going to need to be very picky. Investing in winning sectors alone can bring pain and no gain.

Hikes, hikes, and more hikes

Usually, it’s very difficult to understand what the Fed’s Chairman means when he speaks. Because he doesn’t talk just in English, he uses his own language: Fedspeak. Although the Chairman, Jerome Powell, tries his best to speak in clear English, there is still too much Fedspeak in his speeches. Thanks to the media, we can get some scattered comments interpreting what he really meant at the recent press conference on November 2nd. The general interpretation is that the Fed is more hawkish than expected. But what does it mean for our money? After spending quite some time with the Fedspeak/English dictionary, my team and I gave a very in-depth look at the recent Fed’s press conference and are eager to share our thoughts with you.

Many investors hoped that the Fed would announce a pause in hikes or slow down the rate increases, because the pressure on inflation seems to have eased. Shipping costs went down, supply-side issues look resolved, and so on. Mr. Powell, however, doesn’t see decreasing inflation. He really dislikes it, and therefore raised interest rates further. You can feel his disappointment especially well in this part of the speech:

Because we haven’t seen inflation coming down. The implication of inflation not coming down and what we would expect by now to have seen is that as the, really as the supply side problems have resolved themselves, we would have expected goods inflation to come down by now, long since by now. And it really hasn’t although it’s, actually it has come down, but it’s, not to the extent that we had hoped.

In this extremely frank and honest paragraph, he highlights that inflation is not driven by supply-side factors anymore. It is driven by demand-side factors. To put it another way, consumer demand is too high because the lending is too cheap. The Fed can’t do anything about shipping costs, but it can do a lot with cheap lending. And it does. It makes the lending more expensive.

Can such a policy lead to a recession? Sure it can. This point was actually also discussed at the press conference, but was not covered properly in the media. Luckily for me, otherwise you would not read this article.

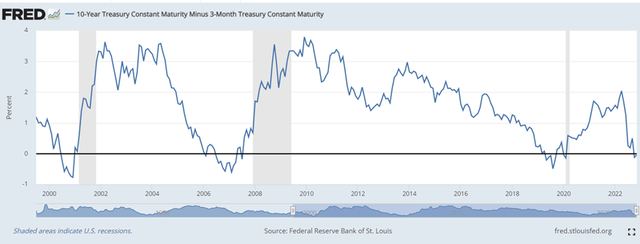

There are several indicators that predict recessions quite well. One of them is the spread between 3-month and 10-year yields on US government bonds. If it is negative, then it means that it is cheaper to borrow money for 10 years rather than for 3 months. The spread becomes negative when investors expect long-term rates to go down. They believe the recession will decrease the demand for credit and its price: the interest rate. Just recently, the spread became negative, meaning that the market is quite certain about the coming recession.

Source: 10-Year Treasury Constant Maturity Minus 3-Month Treasury Constant Maturity

Michael McKee from Bloomberg was brave enough to ask Jerome Powell if he was aware of the coming recession:

That curve is only 2 basis points away from inversion now, so I’m wondering why you are so confident that you have not over tightened particularly given that rates work with a lag.

The Chairman didn’t seem confused by the question. He actually seemed to expect it, and suggested another explanation behind the spread inversion:

It can be doing that because it affects, it expects cuts or because it expects inflation to come down. In this case, if you’re in a situation where the markets are pricing in significant declines in inflation, that’s going to affect the forward curve. So yes, we monitor it, you’re right.

As you know, bond yield incorporates the inflation premium. The higher the inflation, the higher the rate is. Otherwise, it would be unprofitable for creditors to lend money. As I showed in a previous article, the expected long-term inflation is still low compared to short-term inflation. Therefore, Chairman Powell thinks that the 10-year rates should be lower than the 3-month rates. Can it be true? Certainly. The issue is that before every recession, there is always some increase in inflation. If we look at August 2008, just a month before the collapse of the Lehman Brothers, then we see inflation rates above 5% compared with 2-3% in 2006-07. Inflation in 2000— before the burst of a dot-com bubble— was 3%, 2% above Fed’s target. So Powel’s explanation could also work in the past. That being said, the recession always followed the spread inversion.

Recession: harsh or soft?

The interesting question is, what kind of recession will we be faced with? Will it be harsh and severe, or will it be mild and soft? In Fedspeak, the mild variant is called the “soft landing.”

The Fed’s Chairman was asked what he thinks about the recession prospects. He answered in typical Fedspeak, saying that the window of soft landing narrowed, but such a scenario would still be possible. I tried to understand why he thought that the recession could be mild.

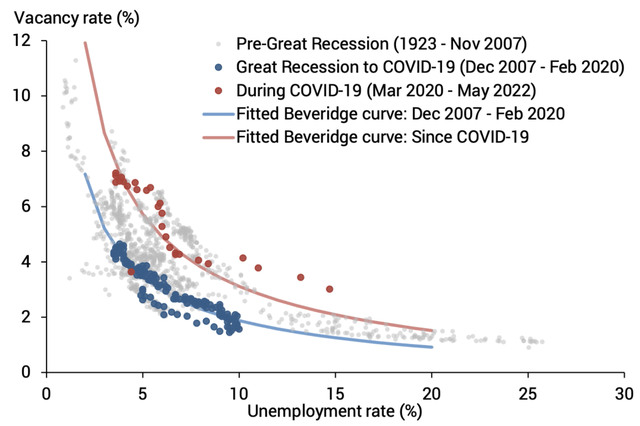

There is one interesting interdependence in economic theory called the Beveridge Curve. It shows how job vacancies are connected with the unemployment rate. The vacancy rate shows us the number of opened and unfulfilled job occupations divided by the total number of job occupations on the market. The unemployment rate illustrates the number of people who are searching for a new job and don’t work, divided by the total work force.

The chart below shows us that during the COVID-19 pandemic, the same number of vacancies corresponded to a higher unemployment rate than before. There was such a change in the data because there were no vacancies for certain specialists during the pandemic. Many professions were not needed due to lockdowns. For example, waiters were not required because restaurants were closed.

Source: Sliding safely down the Beveridge curve

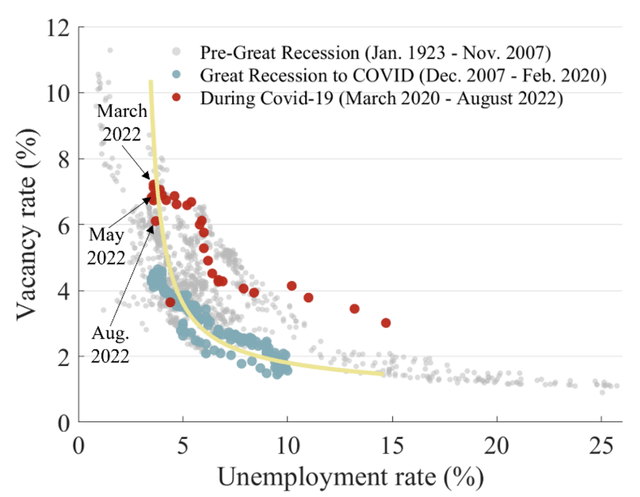

Over the recent months, the situation has changed. In the chart below, we can see that there is an extremely high number of vacancies in the economy, but unemployment remains low. There is still too little data to understand if the relationship holds when vacancies decrease. But if it holds, and that is a big if, the Fed will be able to cool down the economy and decrease the number of new hires to avoid a high unemployment rate. If we speak in graphical terms, we will move down along the yellow curve if the relationship holds.

Why is it important? A high number of job vacancies is a key driver for higher salaries. You usually get a much higher salary when you change your employer. Therefore a lower vacancy rate will correspond to lower inflation. If unemployment doesn’t increase by a lower number of job openings, then we can speak about a soft landing. In this case, the Fed’s wishes would come true.

Source: Sliding safely down the Beveridge curve

We don’t know if such a positive scenario will work out. The Fed doesn’t know either. As I said, there is still too little data. What is important is that the Fed is not afraid of a recession. Instead, it is much more worried that the inflation expectations may get entrenched because it doesn’t know when it can happen. And if that happens, then it would be very difficult to win against them.

if we were to over-tighten, we could then use our tools strongly to support the economy, whereas if we don’t get inflation under control because we don’t tighten enough, now we’re in a situation where inflation will become entrenched and the costs— the employment costs in particular, will be much higher potentially.

For me, it sounds like a recession is the price the Fed is ready to pay for lower inflation.

High rates, high risks

The most worrisome fact for me is that interest hikes can lead to some unexpected events. The world has been living with high rates for a long time, and nobody expected them to rise so quickly. Some hazards could materialize in such a situation because the risks always hide in the places where things seemed too good just recently.

What if something happens at the high-yield market where the rates almost reached COVID-19 peak? Or some tech funds will go bankrupt because of a too-high exposure to rapidly declining stocks? May it lead to some systematic risks? Certainly. We just don’t know which ones. A similar story happened in the early 2000s.

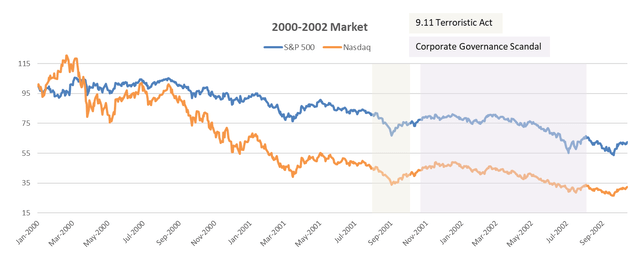

The dot-com bubble in the late 90s was possible because investors didn’t perceive investments in stocks as risky investments. The risk premium of the stock market over the bonds was very low, which resulted in self-complacency in corporate governance. When the stocks stopped rising, severe issues became evident. Serious corporate scandals shocked the US and accelerated the market decline. Funnily enough, it didn’t have a severe impact on the economy, which still managed to land softly.

Markets can react harshly even by a soft-landing

In the 90s, Nasdaq consisted of emerging internet companies that promised a bright future. Investors were fascinated by the idea of the World Wide Web and were ready to spend every penny on internet stocks. It didn’t matter what the company was doing, it was just important that it was doing something via the web. The Internet mania of the 90s— later called the dot-com bubble— ended in the early 2000s when the Fed started hiking up interest rates.

As soon as the Fed came into play, Nasdaq started its protracted decline. It went down from 4,235 in January 2000 to 1,360 in November 2022 when 65% of the index was gone. Although it was definitely not just the Fed’s policy that contributed to the decline. The unprecedented terroristic attacks and the corporate scandals of the time proved that the internet couldn’t solve every problem. At the same time, the S&P 500 declined too. Even though it consisted of large solid companies, the index decreased dramatically. Its decline started later than Nasdaq’s but was of a similar magnitude. 55% of the value disappeared. As some may say, generals are the last to be killed.

If we look at the current market, then the ARKK fund will be strongly reminiscent of Nasdaq from the early 2000s. While Nasdaq itself comprises well-established high-tech companies that became the backbone of the US economy, the ARKK fund started declining as soon as the Fed acknowledged that inflation was no longer “transitional” and started its anti-inflationary crusade. Although the main indices were quite stubborn over the first months, they could now withstand the pressure for a long time. At least until they gave up and started falling too. So far, ARKK has declined by almost 70%, Nasdaq by 30%, and the S&P by about 20%. Can the decline of the main indices reach ARKK’s magnitude? Probably not. Can they decline further? I am confident that “yes.” The early 2000s show us that the indices can go down a lot, even if the economy lands softly.

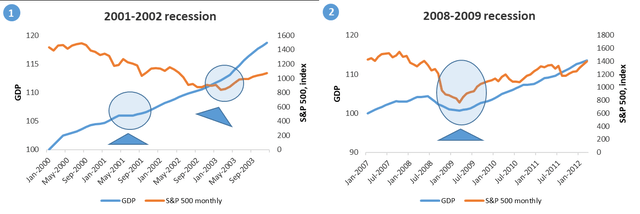

To illustrate this, I will show you two very important charts. Over 2001-2002, the economy barely decreased, while it contracted severely in 2008-2009. But the S&P 500 declined almost by the same magnitude during the “soft landing” in 2001-2002 and the Great Financial Crisis.

Author’s work. Yahoo finance, St. Louis Fed

Indices decreased during the recession and not before. It happened like this in the 2000s, as well as in 2008-2009, the 60s, 70s, 80s, and in many other crises. Why should we think that it will happen differently this time around?

Safe havens vs. short selling

Short selling seems to be the most profitable strategy in the declining stock market. But it has a limited potential: you can’t earn more than 100%, while, if the market goes up, you can lose a lot. Therefore, not everybody likes short selling. Many of us prefer parking our savings in safe havens during the market storm.

The energy sector was such a haven earlier this year, as it showed a spectacular year-to-date performance of 65% backed by high oil and gas prices. But will the energy boom last? Unfortunately, history doesn’t speak in favor of the broad sector investing at the end of the cycle, even if we speak about investing in the energy sector. I believe you need to be really careful while choosing any stock in the bear market, no matter what sector it belongs to. I’d be happy to discuss energy investing much more in detail in my upcoming articles.

Bulls say

S&P 500 bulls would claim that the Fed will be able to reach soft landing without a dramatic market decline. Financial supervision is much more robust than in the past, therefore fat tail risks will not materialize. Fed will soon pivot and it will offer an attractive entry point for investors.

Conclusion

The Fed will do whatever it takes to win the war against inflation. It hopes for a mild economic slowdown, which may happen, but also may not. It doesn’t matter to us how the economy will land, because the odds are in favor of further market decline in any case. The short positions on the S&P 500 can be really interesting in these markets despite all the risks associated with it. If you prefer to hide your savings in safe havens such as energy stocks, you will need to choose stocks really carefully. I will speak in more detail about the prospects of the energy sector in my next articles.

Be the first to comment