Elen11/iStock via Getty Images

Investment Thesis

It is simple, really. Carnival Corporation & plc (NYSE:CCL) is in the red with a lower chance of recovery, given the devastating effects of the COVID-19 pandemic on the cruise industry. The stock had plunged along with the rest of the world then and even more so now, given the potential recession digesting the post-reopening demand and pent-up travel demand. As a result, the market pessimism was reflected in CCL’s stock price, which had plunged by 79.1%, from $42.61 in February 2020 to $8.88 on 6 July 2022.

Despite the record-high summer bookings, we are uncertain of CCL’s capability to sustain its consumer demand from H2’22 onwards, since its revenues also fell by -10% and net incomes by -22.8% YoY in FY2009 during the recession then. Combined with its gargantuan debt, lack of net income/Free Cash Flow (FCF) profitability, record-high oil prices, and bearish market sentiments, the stock could soon be heading near the sea floor, assuming another earnings miss ahead. Investors should be well aware of the massive storm ahead.

Nonetheless, assuming that the fears of the potential recession are overblown, we may expect to see CCL continue to report robust booking trends ahead, since the company reported growth in occupancy to 69% in FQ2’22, compared to 54% in the previous quarter. In addition, deposits increased by $1.4B to $5.1B for the latest quarter, indicating robust consumer bookings through 2023. Furthermore, CCL increased its fleet capacity to 91% in FQ2’22 and potentially near 100% by FQ3’22, thereby boosting its chances of a stock recovery by 2023. As a result, investors with a higher tolerance for risk and volatility may choose to nibble here.

CCL Is Still Reeling From The After Effects Of The Pandemic

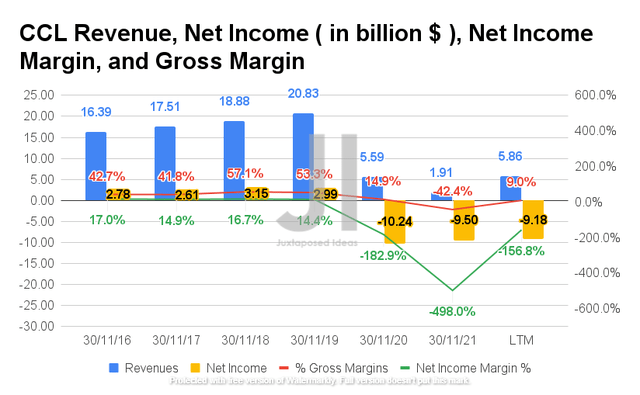

CCL Revenue, Net Income, Net Income Margin, and Gross Margin

CCL Revenue, Net Income, Net Income Margin, and Gross Margin (S&P Capital IQ)

It is evident that CCL has been devastated by the COVID-19 pandemic, given its reduced sales in the past two years. By the last twelve months (LTM), the company reported revenues of $5.98B and gross margins of 9%, a ghostly shadow of its FY2019 performance, representing a decline of 71.2% and 44.3 percentage points, respectively. In addition, CCL reported net incomes of -$9.18B with net income margins of -156.8%, representing a plunge of 75.4% and 171.2 percentage points from FY2019 levels, respectively.

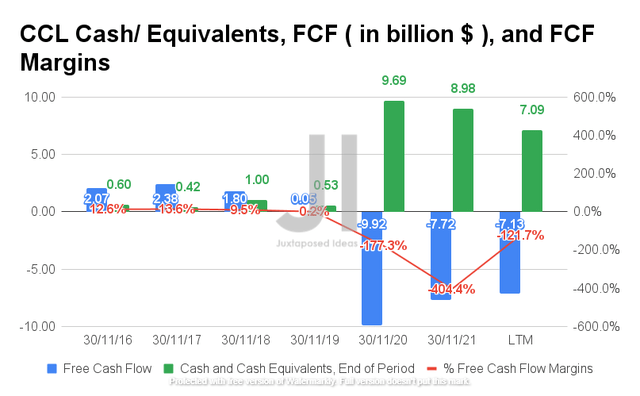

CCL Cash/Equivalents, FCF, and FCF Margins

CCL Cash/Equivalents, FCF, and FCF Margins (S&P Capital IQ)

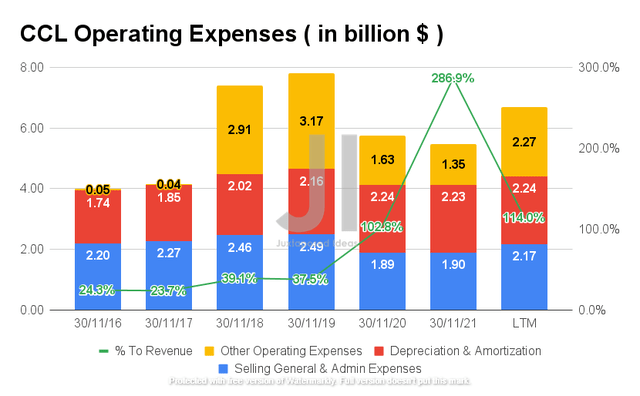

Therefore, we are not surprised by its poor FCF generation, with FCF of -$7.13B and an FCF margin of -121.7% in the LTM, representing a tremendous decline from FY2018 and FY2019 levels. Nonetheless, given its naturally high Capex business, the company still needed to expend massive amounts of capital to sustain and operate the business accordingly, with a total of $6.68B in operating expenses in the LTM. Unfortunately, these also translated to 114% of its revenue at the moment, thereby highlighting CCL’s lack of net income profitability in the short term.

CCL Operating Expense

CCL Operating Expense (S&P Capital IQ)

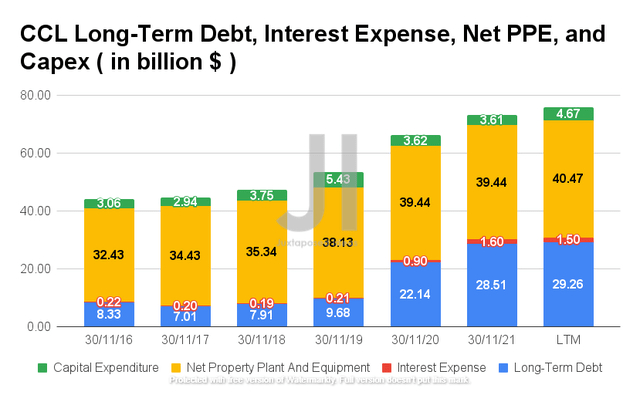

CCL Long-Term Debt, Interest Expense, Net PPE, and Capex

CCL Long-Term Debt, Interest Expense, Net PPE, and Capex (S&P Capital IQ)

Given the devastating effects of the COVID-19 pandemic, CCL had taken up massive loans nearly three times its market cap by the LTM, with a relatively high Debt/FCF ratio of -5.17 and a Total Debt/EBITDA ratio of 9.82x. The company reported $29.26B of long-term debts and $1.5B in interest expenses in the LTM, representing a massive increase of 302.2% and 714.2% from FY2019 levels, respectively. In 2022 alone, CCL is expected to pay off $1.57B in principal payments, a relatively small sum given its cash and equivalents of $7.09B in the LTM. However, by 2023 and 2024, CCL is looking at a massive $2.89B and $4.82B in debt maturity, respectively, with a potential loan refinancing on the horizon.

In contrast, CCL continued to ramp up its capital expenditure in the LTM to $4.67B to report total net PPE assets of $40.47B at the same time. These additional expenses are alarming, given that the company has been relying on long-term debts to sustain its elevated operating costs and Capex in the past two years, without the means for easy deleveraging moving forward.

CCL’s future financial performance is further worsened by the Fed’s hike in interest rates to potentially 3.8% in FY2023, the record-high oil prices, and the potential recession further delaying the recovery of its revenues by one or two years, and consequently, net income and FCF profitability moving forward. In its current state, CCL seems to be operating at the edge of its financial capacity, maybe on the verge of failure.

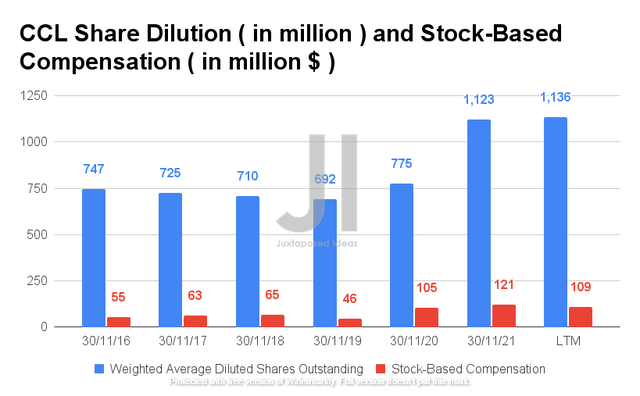

CCL Share Dilution and Stock-Based Compensation

CCL Share Dilution and Stock-Based Compensation (S&P Capital IQ)

Therefore, it was evident that CCL has had to resort to Stock-Based Compensation (SBC) in the past two years, given its lack of net income and FCF profitability. By the LTM, the company recorded SBC expenses of $109M with a total diluted share count of 1.13B, representing a massive increase of 236.9% and 64.1% from FY2019 levels, respectively. Given that CCL’s financial health has been, and likely will still be, in the red for the next two years, we may see it record higher SBC expenses moving forward, thereby further diluting its long-term shareholders. Interested investors should take note.

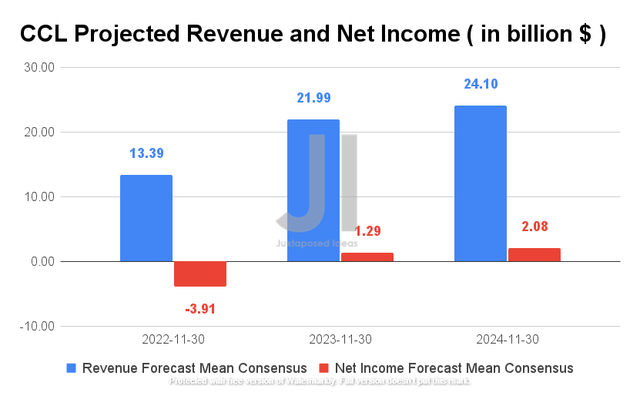

CCL Projected Revenue and Net Income

CCL Projected Revenue and Net Income (S&P Capital IQ)

CCL is expected to report a normalized revenue growth at a CAGR of 2.97% by FY2024, though its net income profitability may still be lagging by then, in comparison to FY2019 levels. By FY2025, the company is projected to report net income margins of 8.6%, a far cry from the 14.4% recorded in FY2019. For FY2022, consensus also estimates that CCL will report revenues of $13.39B and a net income of -$3.91B, representing a decline of -35.68% and -43.3% from FY2019 levels, respectively.

In addition, analysts will be closely watching its FQ3’22 performance by September 2022, given the consensus revenue estimates of 4.79B and EPS of -$0.06B. Nonetheless, we would also like to warn investors that the company has had a track record of missing consensus estimates in the past ten consecutive quarters. So, do not keep your hopes up.

So, Is CCL Stock A Buy, Sell, Or Hold?

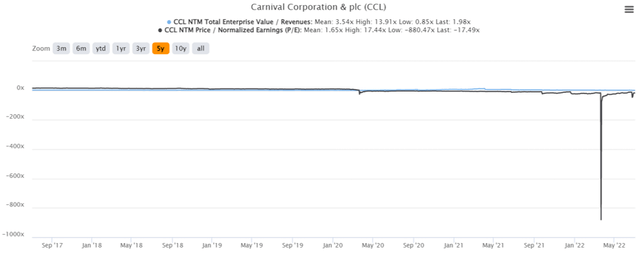

CCL 5Y EV/Revenue and P/E Valuations

CCL 5Y EV/Revenue and P/E Valuations (S&P Capital IQ)

CCL is currently trading at an EV/NTM Revenue of 1.98x and NTM P/E of -17.49x, lower than its 5Y mean of 3.54x and 1.65x, respectively. The stock is also trading at $9.23, down 66.3% from its 52-week high of $27.39, nearing its 52-week low of $8.10.

CCL 5Y Stock Price

CCL 5Y Stock Price (Seeking Alpha)

Although consensus estimates rank CCL as a buy with a price target of $16.58, we aren’t convinced by its 78.09% upside potential. The company had taken on too much debt too fast without the easy means to deleverage post-reopening cadence, though by no one’s fault given the unexpected pandemic. However, we expect to see the potential recession impacting consumer spending moving forward, similar to that in FY2009. Therefore, barring any positive catalysts such as nearly full occupancy rates through 2023, we do not expect the CCL stock to recover soon.

In addition, with no fuel hedging from FY2022 onwards, CCL may have to pass on the record-high oil prices to its consumers in the form of fuel surcharges. These would potentially hurt its business in the intermediate term, since its peers at Royal Caribbean Group (RCL) and the Norwegian Cruise Line Holdings (NCLH) are relatively insulated through FY2023. Otherwise, the company would risk incurring even more long-term debts to sustain its high Capex business, speculatively leading to a potential failure if the post-re-opening travel demand is digested.

Thus, investors with lower risk tolerance should avoid adding now despite the deceptively attractive dip, due to the massive volatility ahead. In contrast, investors who believed in CCL’s recovery may be rewarded in the long-term, if they added during the lows.

Therefore, we rate CCL stock as a Hold for now.

Be the first to comment