Maridav/iStock via Getty Images

Carnival Corporation (NYSE:CCL) (NYSE:CUK) is the British-American entertainment cruise giant whose shareholders have been living in a state of a nightmare for the better part of the last two years. The company has been going from bad to worse as macroeconomic headwinds keep working against an otherwise good business, with them seemingly unable to catch a break all the way since the offset of the 2020 pandemic. We have already had a chance to do coverage on the cruise operator twice, with the last time being in our February article under the title of: “Why Carnival Is Still A Bad Idea”.

In the article, we have outlined our views on why the company, even if significantly discounted from the pre-pandemic price levels, still remains fundamentally unattractive and borderline uninvestable. Since the publishing of the article, shares of the cruise giant have collapsed a further 50%, mainly affected by a series of negative macroeconomic factors that started weighing themselves against the cruise stock operator. Today, as the shares of the entertainment cruise giant are now trading around the $11 per share level, we thought it would be a good time to revisit and reevaluate the most popular cruise stock.

Deleveraging The Balance Sheet

Carnival Corporation is a company that has found itself in between a rock and a hard place being forced to dock its entire cruise fleet during the pandemic as a result of the lockdowns, while at the same time still having to burn through almost $2 billion per quarter during most of the pandemic. With almost no cash-generating potential, the company has largely financed itself by either debt or equity financing, which ultimately caused almost irreparable damage to the company’s balance sheet, with some going as far as to question if the company is going to stay afloat.

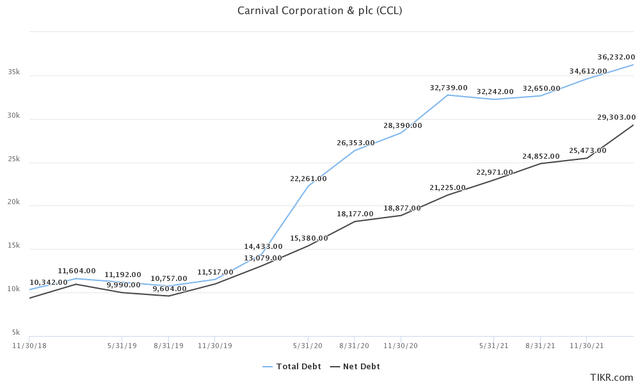

The main issue at hand is the one concerning the outstanding debt the company has incurred in the period over the last two years. As per the latest quarterly filing, the company had $36.23 billion in total debt and $29.30 billion in net debt. That is a significant increase from the pre-pandemic levels of debt when the company carried only $14.43 billion in total debt.

Outstanding Debt (TIKR Terminal)

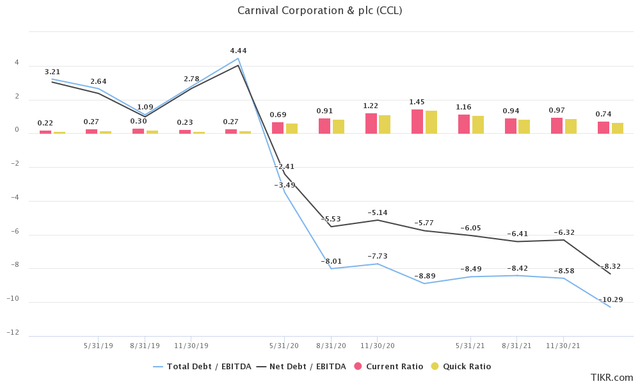

In order to place matters into perspective, the cruise operator went from a pre-pandemic first quarter 2020 current ratio of 0.27x and a quick ratio of 0.18x to the same 0.74x and 0.67x ratios in the first quarter of 2022. For the same period, Total Debt/Equity increased from 59.4% to 351.4%, while Total Debt/Capital increased from 37.3% to 77.8%.

Solvency and Liquidity Ratios (TIKR Terminal)

In the same manner, with yet another quarter of negative EBITDA, they went from a manageable Total Debt/EBITDA ratio of 4.44x and a Net Debt/EBITDA ratio of 4.02x all the way to today’s negative 8.32x Net Debt/EBITDA ratio.

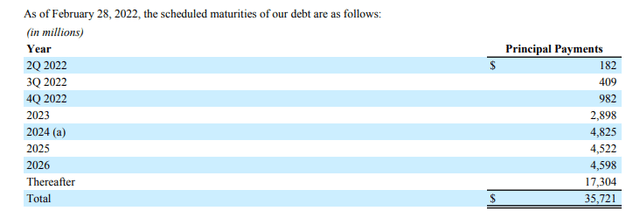

Management was successful to a certain extent in refinancing and kicking as much of the debt as possible down the road in terms of maturity. For the rest of the year, they only face $1.57 billion of debt repayments, with the pace picking up in 2023 and 2024, with $2.89 billion and $4.82 billion respectively

Debt Maturity Schedule (Q1 2022 Quarterly Report)

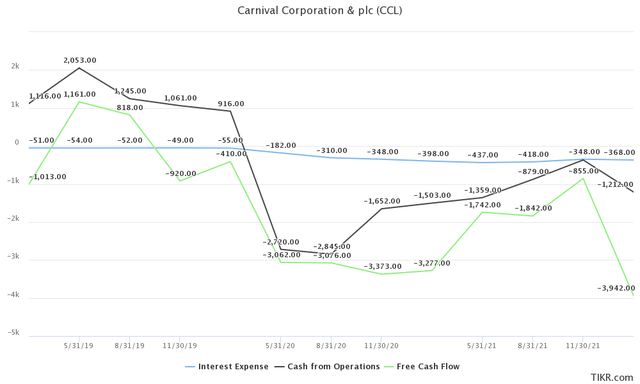

Another interesting thing is to take a look at the latest quarterly interest expense. As per the report, the company needed $368,00 million in order to service its debt. That is more than seven times interest payments as we compared the data to the pre-pandemic levels when the company needed on average $50,00 million per quarter to service its debt while being in a stronger financial position. Management tells us that is going to need another $1.1 billion until the end of the year in order to service the debt interest, which effectively places the expected interest expense for 2022 at roughly $1.4 billion.

Interest Expense to FCF and CFO (TIKR Terminal)

The most worrying sign of all is that the company still has not stopped burning through significant amounts of cash per quarter, even after most of its fleet started cruising in the first quarter. Carnival Corporation burned through almost $4 billion in free cash flow this quarter, with the cash from operations staying consistently negative. This places a strong emphasis on the two next quarters and the company’s execution. They must start generating some positive free cash flow and cash from operations if they happen to avoid a collision course that is going to take them under.

Cash Generating Potential (TIKR Terminal)

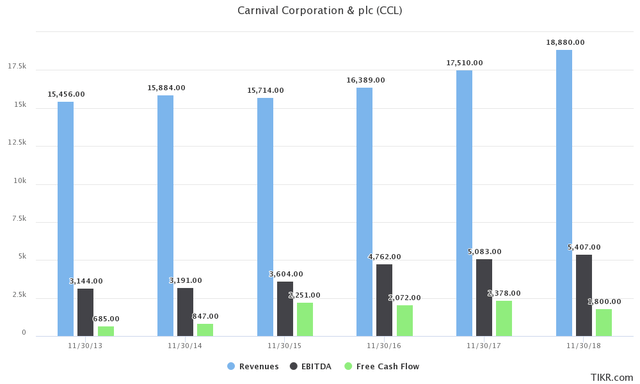

Doubling down on the question of debt repayments, it would be useful to take a look at the company’s pre-pandemic cash-generating potential. Even if the cruise giant reestablishes normal day-to-day operations in 2023 and manages to produce similar cash flow levels, how the debt is going to be repaid remains an open question. Back at the time, the company was mostly FCF positive, taking home roughly $2 billion in free cash flow from its around $5 billion in cash from operations yearly.

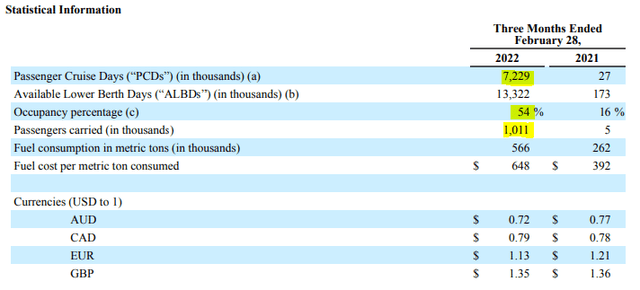

Carnival Q1 Statistics (First Quarter 2022 Report)

Still, management comments on the latest earnings call do promise a somewhat brighter future. The company already had a bleak resemblance to normal business operations during the first quarter, with 7.22 million sold PCDs and 1.01 million passengers carried with a total 54% occupancy rate. First indications of second-quarter performance are positive with more than a 70% occupancy rate already noted, with almost 40 voyages recorded with full occupancy of 100%. As it stands, the cruise fleet is set for a very busy summer.

We furthered our fleet optimization efforts by taking delivery of three larger-more efficient ships during the quarter, Costa Toscana and AIDAcosma, the company’s fifth and sixth ships powered by LNG and Discovery Princess. We also announced the removal of another three smaller-less efficient ships, bringing the total to 22 ships, significantly reducing our rate of capacity growth. Upon returning to full operations, nearly 25 percent of our capacity will consist of newly delivered ships, which we believe will expedite our return to profitability and improve our return on invested capital. As of March 22, 2022, 75% of the company’s capacity had resumed guest cruise operations as part of its ongoing return to service. The company’s enhanced COVID-19 protocols have helped it become among the safest forms of socializing and travel, with far lower incidence rates than on land. The company expects to have each brand’s full fleet back in guest cruise operations for its respective summer season where it historically generates the largest share of its operating income.

Arnold Donald, CEO – Q1 2022 Earnings Call

The Latest Insider Activity

Previously, we have made a point of criticizing what we referred to as the “very loud and noticeable lack of insider purchases” by the senior management at Carnival Corporation. Considering that the shares of the company are down almost 84% since the all-time high and also 77% since the pre-pandemic levels, we have pointed out that it is very interesting that senior leadership was still not willing to engage in any purchases.

Following the logic that there is no one better informed about the current state of things than the company insiders, we await some activity in terms of major insider purchases to possibly signal that the company is expecting extraordinary results to follow. In the end, we always go back to the famous Peter Lynch quote: “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise”.

Insider Activity (Open Insider)

In times like these when solvency comes under question and the company’s future remains uncertain, I find that monitoring the activity of the company’s highest-ranking insiders is more valuable than ever. In light of this, two weeks ago, we seem to have had the first major insider purchase in years. Randall J. Weisenburger, serving as a board member and director since 2009, exercised a purchase of 100,000 shares of Carnival at the price of $11,76, in a trade worth $1,175,500. The same insider seems to have bought the dip back during the pandemic when he exercised a trade committing $10,000,000 towards purchasing 1,250,000 shares of the company at $8,00 per share. Back then, others seem to have been willing to engage in insider activity as well once the price was brought down to the single digits. If Carnival breaks the $10,00 per share level, it wouldn’t be that unreasonable to expect the same sort of activity this time around as well. However, it is worth pointing out that the fundamental position the company is finding itself in now and in April of 2020 is not even near the same.

Discussing The Dilution

The news surrounding the latest insider purchases is not the only positive development as of late. A more encouraging sign comes in terms of the change in the management’s approach to equity financing or more precisely their approach to the question of shareholder dilution.

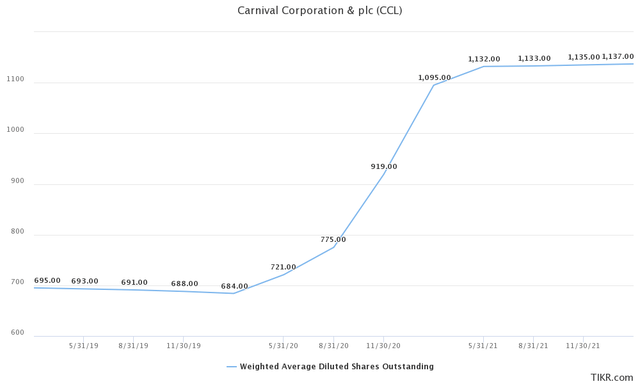

Share Dilution (TIKR Terminal)

With the company burning through enormous sums of cash during the pandemic and generating almost no cash of its own, it started relying on issuing new shares in order to finance its activities and stay afloat. This rather difficult, but still necessary course of action came at a huge cost to the shareholders, with the average shareholder being diluted by almost 66% since the offset of the pandemic. In December of 2019, Carnival Corporation had 684 million shares outstanding according to their fillings. In the process that has taken place, that number was increased to 1137 million shares outstanding according to the latest filing. To be completely frank, the two major competitors in the space, Royal Caribbean (RCL) and Norwegian Cruise Line (NCLH), seem to have largely done the same, with both companies significantly diluting their shareholders during the pandemic.

Final Conclusion

From our point of view, as the negative macroeconomic factors weigh themselves against the future prospects of Carnival, we find it is more likely that things will get much worse before they get any better. We believe that the share price will continue to experience further down-pressure and is most likely going to reach the single-digit level once more. This is precisely when things will be getting more interesting and when we will be willing to more seriously consider playing into the turnaround potential of the cruise operator.

Either way, we should closely monitor the cruise operator’s performance over the next two quarters, as they might prove vital in keeping the business afloat in a long-term sense. The company needs to deliver on high occupancy rates and start finally generating some positive cash flow, proving that the slowdown in discretionary spending and the pending recession will not affect the demand for cruises and ultimately prove a nail in their coffin.

To summarize everything, until the share price starts accordingly reflecting the fundamental position in which the company finds itself and until we are able to witness some strong signs of execution, I would argue that most investors are still better off jumping ship and cutting their losses. However, if we do see shares of the company trading near the $6-$7 level again, the risk-reward profile of the potential investment might prove too difficult to say no to. As of yet, Carnival Corporation appears to be set on a collision course as time seems to be slowly running out.

Be the first to comment