SeregaSibTravel/iStock Editorial via Getty Images

Introduction

Carnival Corp. (NYSE:CCL) recently reported a record for the most weekly bookings in the company’s history. This article will explore what that means for potential investors in Carnival stock and whether I consider Carnival a buy, sell, or hold at the current price, given what other opportunities are in the market today.

I always like to start my articles by reviewing my previous coverage of stock because I tend to use relatively simple metrics and thought processes in my analyses and I think reviewing how well these have worked in the past is a good reference point to help understand how useful these metrics might be in estimating future returns. I’ve found that often long-winded and detailed analyses of factors that aren’t central to what matters to the market are not particularly useful for investing purposes. Yet, they can often sound convincing as one reads them. So, I like to review how my past suggestions have performed as a way to kind of “tell the story” of the effectiveness of what are often simple metrics and theses I use to analyze stocks.

I’ve written four previous articles on Carnival. The first one was titled “How Far Could Carnival Fall?” and it was published on April 2nd, 2018. It made the case that even if the bull market at the time continued for 3 more years, Carnival’s stock price would fall deep enough during the next downturn that it was worth selling Carnival stock at the time.

Now the question becomes how far we might expect Carnival’s stock price to fall. Before the last two recessions, the stock price had been a bit overvalued on a historical p/e basis, and that doesn’t seem to be the case now. However, Carnival does seem to be suffering from deeper drawdowns. For these reasons, I’ll just provide a range that we might expect between 50-70%. That would give us a range between $32.87 and $54.79 if we have a bear market after three years. Since the entire range is below where the stock price trades today, I would avoid Carnival even though it doesn’t look especially overvalued at the moment.

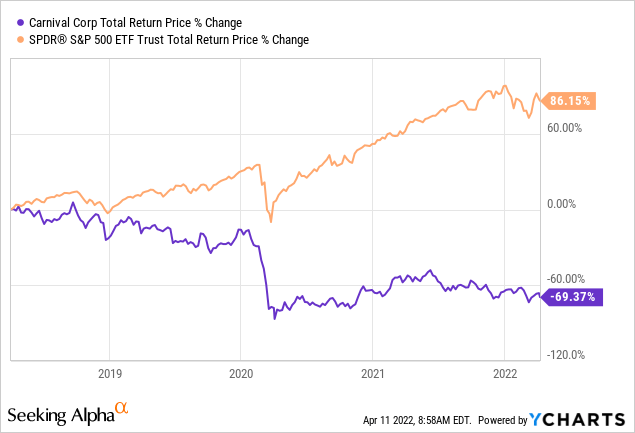

Since that first bearish article, here is how Carnival stock has performed compared to the S&P 500 (SPY)

Please note that the decline and underperformance started well before COVID came on the scene in early 2020.

My second Carnival article “Revisiting Carnival Corporation” came later that year on December 27th, 2018 after the stock had dropped over -30% and fell within the price range I had mentioned in my previous article. In that article, I had a neutral rating for the stock, and my conclusion was:

Rotational investors who like Carnival’s long-term prospects can now rotate back into Carnival and gain ~33% more shares than they had in April at no extra cost. Investors on the sidelines waiting to get into Carnival (or looking to add to current positions) should consider taking a 1/2 position (1% portfolio weight) after a -50% decline from highs around $36.35 per share, and, should the price fall far enough, a second 1% weighted purchase around $21.82.

As for me, if the price gets low enough, I’m much more interested in taking a chance on Carnival than I was in April, but I’m going to take a closer look at the business before buying.

The “rotational investors” I am referring to are those who really liked Carnival’s business at the time of my first article, and who may have rotated out of the stock in order to avoid some of the potential drawdown. I also shared the prices I would consider buying CCL. Carnival’s stock price at the time of this article was $48.13.

My third article wouldn’t come until the early stages of COVID, on February 25th, 2020, with my article “Carnival: Don’t Buy It Yet“. I wrote that article for two reasons. The first reason was that CCL’s price had fallen below the $36.35 that I had mentioned in my 2nd article, and I wanted readers to know what I had decided to do about Carnival. The second reason was that there were many high profile SA writers recommending Carnival as a “Buy” or “Strong Buy” on its recent dip leading into the pandemic, and I strongly disagreed with those authors and wanted to clearly warn readers away from Carnival. Here was my conclusion:

After reviewing Carnival’s historical cyclicality and price movements and comparing them to where I think we currently are in the cycle, combined with the issue of the coronavirus, I don’t think buying Carnival stock, even at -50% off its highs, offers a good risk/reward. So, I am removing my suggested potential buy price of $36.35. For now, I’m keeping my suggested deeper buy price of $21.82 for those who are generally bullish on the business, and I’ll revisit Carnival if it nears that price. A lot of my decision whether to buy at that point will be determined by how the virus issue plays out, and how Carnival stock is trading relative to other opportunities in the market at the time. If it were to hit that price today with the coronavirus issues behind us, I might be a buyer since there isn’t much value in the market right now. If it hits that price during a recession, there might be better values in the market that I find more attractive. We’ll have to wait and see.

As we all know now, CCL eventually fell below that $21.82 level and later I wrote my last CCL article “An Easy Reason I’m Still Avoiding Carnival” on August 20th, 2020.

Carnival’s stock price has indeed taken a little bit more of a hit this recession than it has during the past two recessions, but things are far, far, worse this time around, and the stock price should probably be low single digits in order to adequately reflect that risk. When I first started writing about Carnival over two years ago, I had always been on the fence about whether I would be a buyer, even at the right price. Its historical recovery times were very slow, and for cyclicals, I prefer for them to be faster. COVID-19’s acute impact on Carnival has pushed me off the fence, and even at today’s lower price, this stock is an ‘avoid’ for me. I expect Carnival stock to underperform the market over the medium and long term.

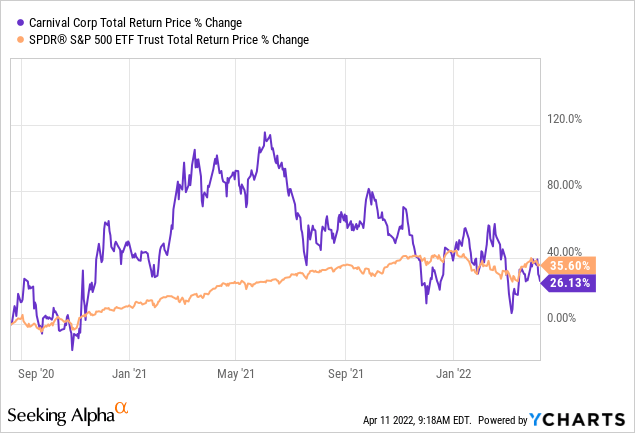

Since that article Carnival’s stock price has been volatile and risen, but as we move away from short-term speculation and into the medium-term, since the article was published, CCL has started to underperform as expected:

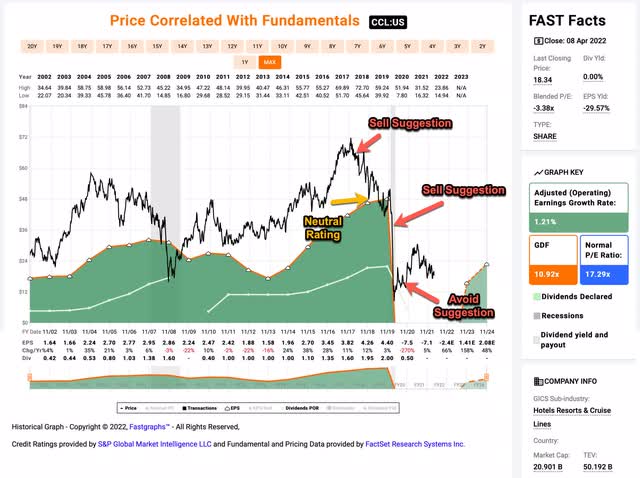

Below is a FAST Graph that illustrates my past coverage of the stock.

FAST Graphs

I think sharing my past coverage is important, not just because I’ve done a pretty good job of saving potential Carnival investors’ money, but also to show I was genuinely interested in potentially buying this stock at the right levels and I’m really not a “perma-bear” or “Carnival-hater”. I just tend to recognize dangers that other analysts miss because cyclical stocks are my specialty and I like to buy stocks when they are really cheap, preferably near the bottom of their down cycles.

CCL Stock Key Metrics

There are three key metrics I care about with Carnival. First, I care about their historical earnings cyclicality. Second, I care about their historical price cyclicality. And third, I care about their current debt trend compared to the past. Let’s start with historical earnings cyclicality.

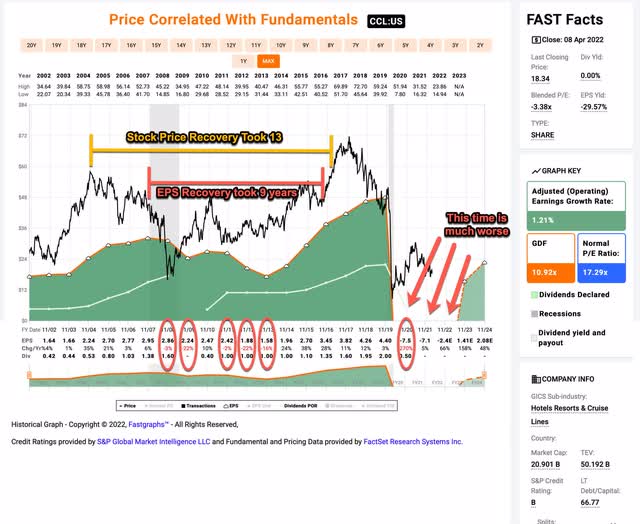

The first thing I do when I examine any stock is to look at its historical earnings cyclicality so that I know whether to classify the business as “cyclical” or not. The earnings are represented by the green shaded area in the FAST Graph below.

FAST Graphs

What I examine first are the red circles in the FAST Graph above. Those are years in which EPS declined. As we can see from 2007 to 2013, EPS declined 5 out of 6 years, and the cumulative decline from $2.95 in 2007 to $1.58 in 2013 was roughly -47%. I typically consider stocks that have EPS that declines -50% or more a “deep cyclical” stock, and CCL is right at that threshold. Since I know that the cruise line business typically has a lot of fixed overhead costs and is economically sensitive, I always considered CCL a deep cyclical stock.

This is important to establish this right at the outset because deep cyclicals require a different sort of analysis than less cyclical businesses do. The reason for this is because when earnings fluctuate a lot during down cycles, deep cyclical stocks tend to have low P/E ratios right at the start of a down cycle, which can make their fundamentals look attractive precisely at the worst time to buy them. For example, when I first warned about CCL in 2018, the P/E was only about 16. And in 2007 it ranged between 16 and 18. These were not good times to buy the stock even though it didn’t look particularly overvalued on an earnings basis.

Since earnings and earnings growth metrics are not useful for valuing cyclical stocks, I rely on my second metric, which is historical price patterns during drawdowns once I have determined I’m dealing with a deep cyclical stock.

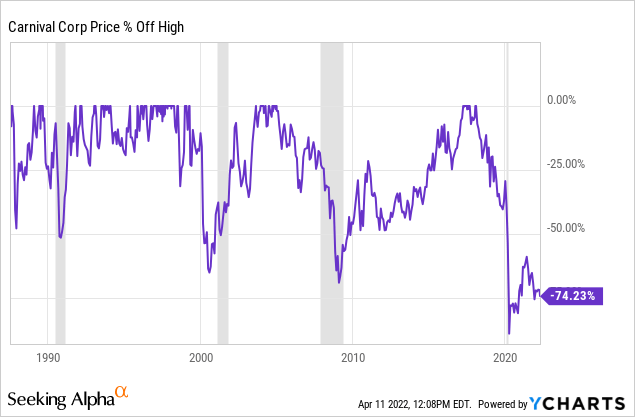

We can see from CCL’s historical price drawdowns going all the way back to the 1980s that at a minimum CCL’s stock price drops -50% during recessions and that a -60% drawdown is probably the base expectation.

Over the past 30 years, not including the current drawdown, Carnival has had four sell-offs of -35% or more as depicted in the table below:

| ~Year | ~Duration | ~Time until bottom | ~Depth |

| 1987 | 18 months | 3 months | -50% |

| 1989 | 2.5 years | 18 months | -57% |

| 1999 | 5 years | 12 months | -60% |

| 2005 | 12 years | 4 years | -71% |

Currently, CCL is about -75% off its high price, which is similar to the decline that started in 2005 and ran through 2013. However, this time around the down cycle has been much, much, worse. As I pointed out in the last FAST Graph chart, in the three years of 2020, 2021, and 2022, CCL is expected to lose a total of about -$17.00 per share, while it never had a single year where it lost money during the Great Recession. To put that loss in perspective, that is almost as much money as they made cumulatively in the 5 years leading up to the pandemic. So we basically will need about 5 years of future earnings, if things go well, just return to break even from the pandemic losses.

On one hand, that might not be too bad, given where the current price is. If CCL hit $40 per share 5 years from now (which is a reasonable expectation if things go well and record bookings are turned into profits), that would be roughly a 16% CAGR, which is a very respectable medium-term return. The problem is that the third metric, which I think is most important to focus on, is the change in debt levels CCL has had.

One of my premises, when I analyze and buy cyclical stocks, is that history will roughly repeat. So, one of the things I always check for is how things might be different this time in a way that might cause history to not repeat. Major changes in debt levels can act as a drag on future returns and therefore slow an eventual price recovery when compared to previous price recoveries. So I always check to see how debt levels have changed from one cycle to the next.

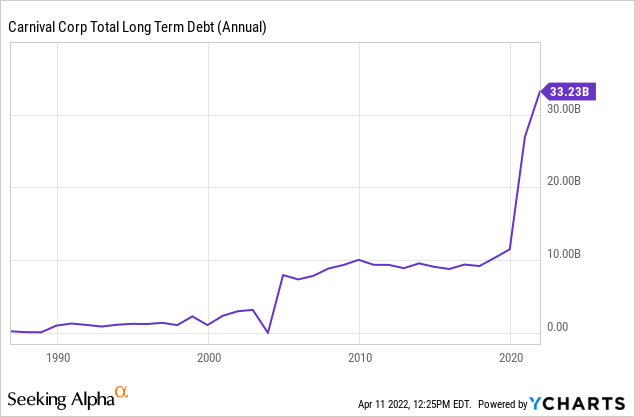

Total Long-term Debt went from a very steady $10 billion or so from 2010 to 2020 to over $33 billion during the past two years.

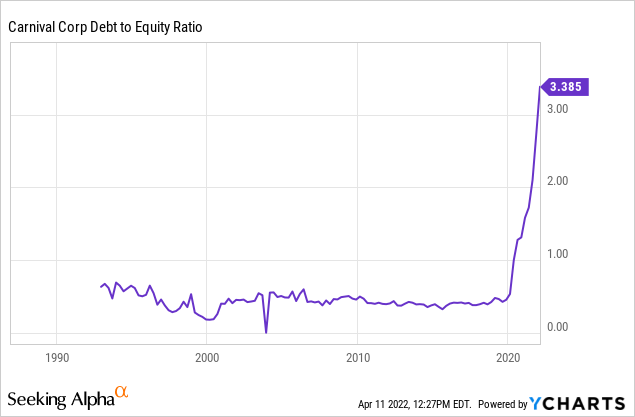

Debt-to-equity, which went from roughly .5 for most of CCL’s existence is now at 3.385. When I published my first CCL warning article in 2018, CCL’s credit rating was “A-“, and now it’s “B”. When I’m dealing with a deeply cyclical stock I typically like to see a debt-to-equity ratio that is steady or falling, or, have it be under 1. CCL is nowhere close to this. What this means is that CCL will likely have a slower recovery than previous cycles and the 2008 down cycle was already a very slow recovery. It took about 8 years for the stock to bottom and 4 more years for the stock price to recover its old highs after it bottomed. Now, even if cruising returns to pre-pandemic highs quickly, we are probably looking at a recovery, assuming it ever fully recovers, that doesn’t take place until the 2030s for CCL.

Even with record bookings, which is probably something we would expect given people have largely been avoiding travel the past two years of the pandemic, it is not going to be enough for the business to recover in a timely manner and pay back all the debt that it had to take on in order to survive.

Is CCL Stock A Buy, Sell, or Hold?

Even though Carnival’s stock is relatively cheap compared to the past, it took a long time to recover from the 2008/9 recession, this downturn has been magnitudes worse, and they are now carrying more than triple the debt levels they had in 2020. So for me, the stock remains a “sell”, even if business returns quickly to pre-pandemic highs.

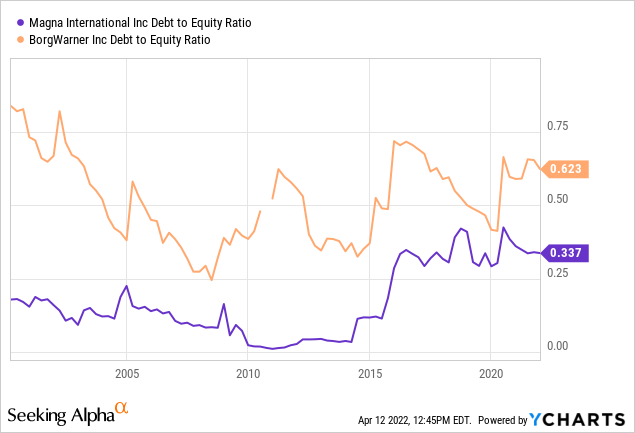

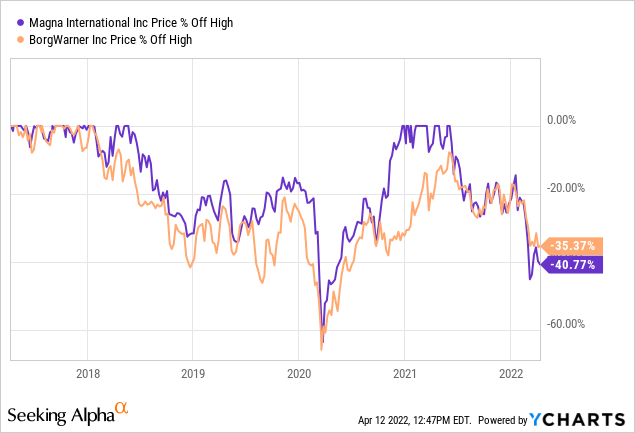

I think if a person wanted to take a chance on a deep cyclical part of the market that isn’t exactly near a bottom, but probably has decent upside potential, auto suppliers like Magna International (MGA) and BorgWarner (BWA) have also been hit hard because of COVID and semiconductor shortages, and likely have some pent-up demand still out there for new cars. Over the medium-term of 2-5 years, I think the reward potential for those two cyclicals is just as good as CCL’s, and while they could be volatile (especially if we have a recession) eventually people will need to replace their old cars over the next few years and the COVID and the semiconductor issues will fade. So, if an investor is betting on CCL with a “return to normalcy” thesis, then that likely means autos will return to normal as well and the auto parts companies are a better bet.

While these auto suppliers have been hurt by COVID as well, they never had to take on the type of debt that Carnival did. Plus, eventually, people will need to buy autos. Nobody needs to take a cruise.

While these stocks aren’t down -60% as they were in March of 2020, they are off their highs enough that if auto sales return to normal in the next 2-3 years, then these stocks could return +50%. That’s at least a decent risk/reward that makes it worth putting up with the high volatility these stocks have (especially if we have a recession before auto sales recover).

Conclusion

Because Carnival has had to take on so much debt, a week, or even a year’s worth of record bookings is not enough to provide a good risk/reward for stock investors. This is especially true because there are other cyclical stocks with a similar medium-term upside potential that do not have the risk associated with high debt levels. I would continue to avoid Carnival stock for these reasons.

Be the first to comment