Darren415

This article was first released to Systematic Income subscribers and free trials on Nov. 11.

In this article, we catch up on Q3 results from the Business Development Company Carlyle Secured Lending (NASDAQ:CGBD). CGBD is currently trading at a total dividend yield of 12.7% and a valuation of 81%. The company delivered the second quarterly dividend hike in a row as it benefited from rising short-term rates and as portfolio quality improved with one position coming back to accrual.

We have held CGBD in our High Income Portfolio since last year and continue to have a Buy rating on the stock. The company has delivered the second highest BDC total return this year (out of our 29-name coverage universe), outperforming the sector by double-digits.

Quarter Update

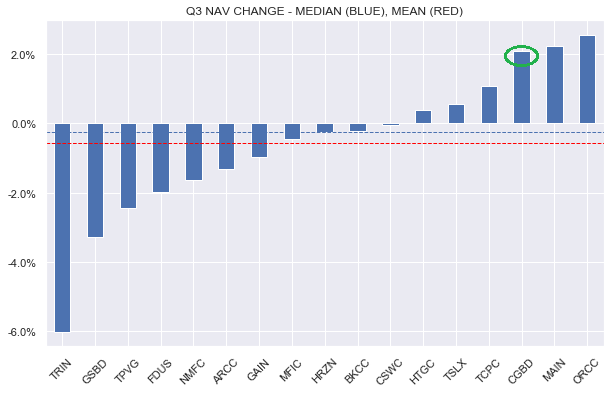

CGBD NAV increased by 2% over Q3 – one of the strongest results so far in this reporting season.

Systematic Income

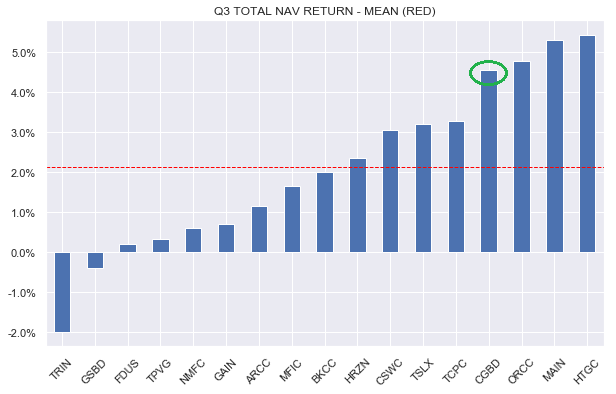

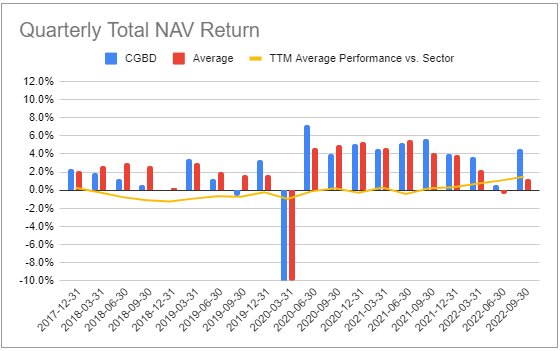

Total NAV return was a terrific 4.6% for the quarter.

Systematic Income

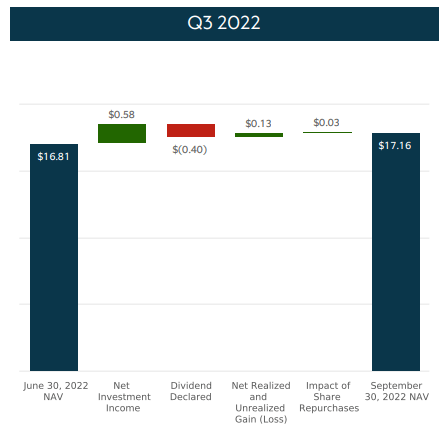

The gain in the NAV was a result of retained income of $0.18 ($0.58 net income vs. $0.40 dividend) as well as unrealized gains from improvements across watchlist holdings. There was also a continued small positive impact from share repurchases given the stock’s steep discount.

CGBD

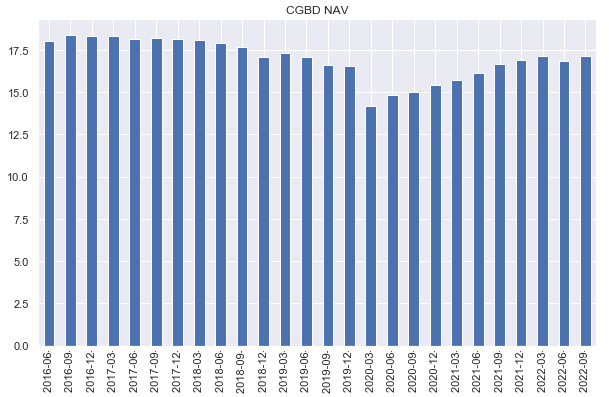

The stock’s NAV is now trading above its pre-COVID level though it’s still off its 5-year peak.

Systematic Income

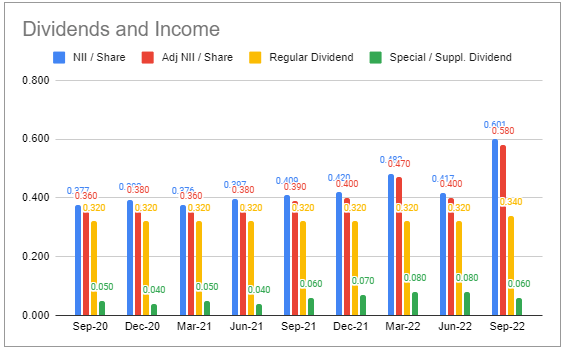

Adjusted net income (which conservatively treats preferred interest expense as debt interest expense) rose sharply to $0.58. This included one-off income of $0.14 due to restoring Direct Travel to accrual. This move was guided in the previous quarter so is not totally unexpected. Even taking this into account however, net income still rose by 10%.

Systematic Income BDC Tool

The company hiked its base dividend for the second quarter in a row to $0.36 and increased the supplemental by $0.02 to $0.08. The $0.44 Q4 dividend is a 10% increase over Q3 and a 13% increase over Q4-2021.

Income Dynamics

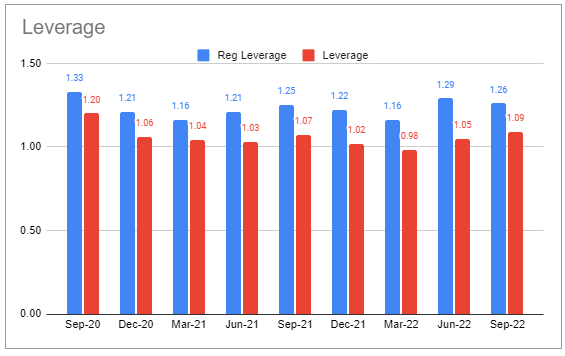

The company’s net leverage increased modestly and remains at the lower end of the company’s target range. This suggests a potential further tailwind to net income.

Systematic Income BDC Tool

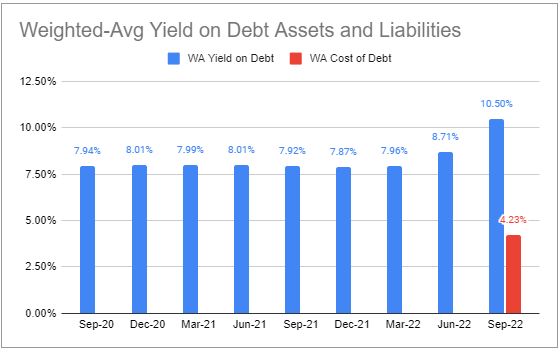

Weighted-average yield on debt holdings jumped sharply to 10.5% – a result of rising short-term rates. The company’s 99% floating-rate assets are at the top end of the sector, however its 80% floating-rate debt is slightly above the average.

Systematic Income BDC Tool

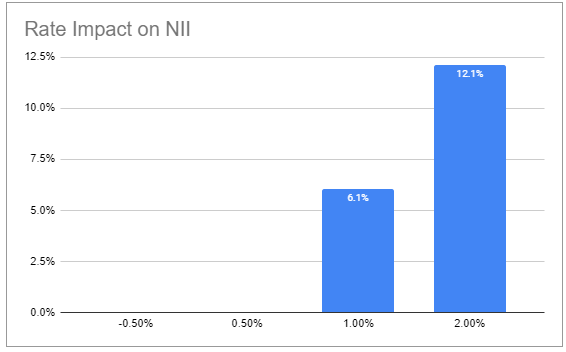

Net income will continue to benefit from rising short-term rates though at a lower level than the sector average due to its relatively high level of floating-rate debt.

Systematic Income BDC Tool

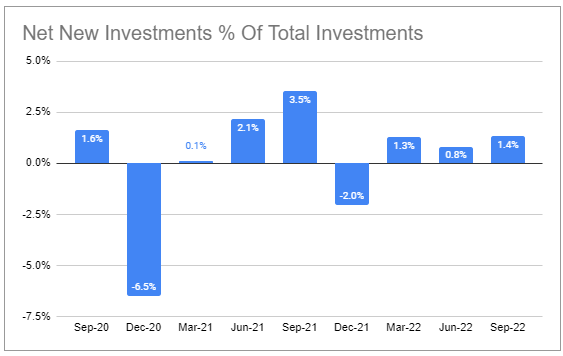

The company continued to add net new assets, creating a small tailwind to net income.

Systematic Income BDC Tool

Portfolio Quality

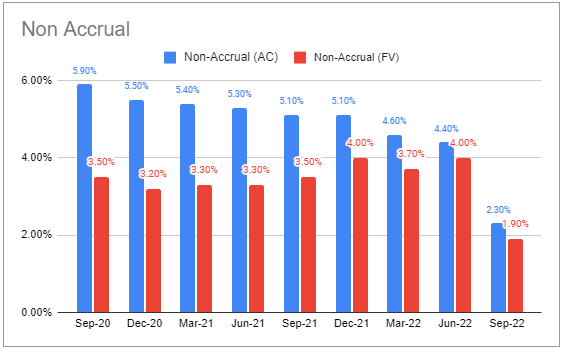

Non-accruals fell sharply as Direct Travel was brought back to accrual -expected from previous guidance. The current figure of 1.9% is now below the sector average, though slightly above the median.

Systematic Income BDC Tool

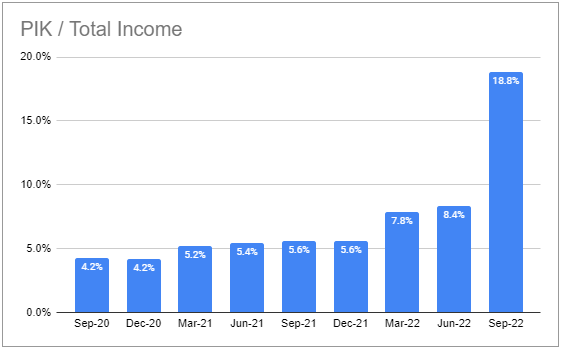

PIK income appeared to spike. It’s not clear exactly what is going on here but the total amount of loans on PIK basically remained the same, being 10% of the portfolio in Q3 and 9.7% in Q2. This is why this increase does not look like a red flag to us.

Systematic Income BDC Tool

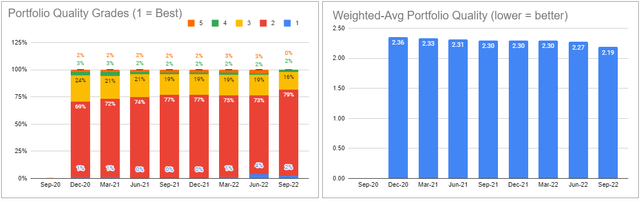

Unlike the broader sector, portfolio quality based on internal ratings actually improved. This is likely related to the mentioned reduction in non-accrual.

Management have guided that while interest coverage is above 2x at the moment, it will move below 2x as rates move higher. This is clearly low however it’s unlikely to keep moving much lower as the Fed is expected to pause around 5%, particularly in light of the latest downside surprise in the CPI.

Valuation And Return Profile

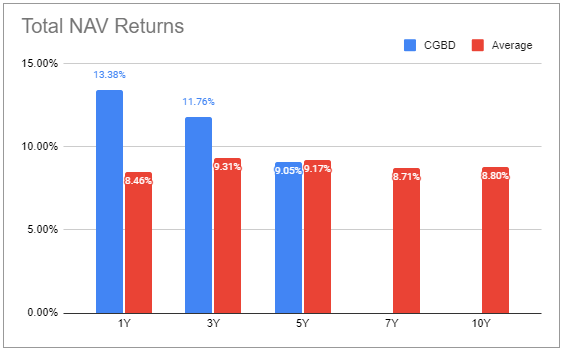

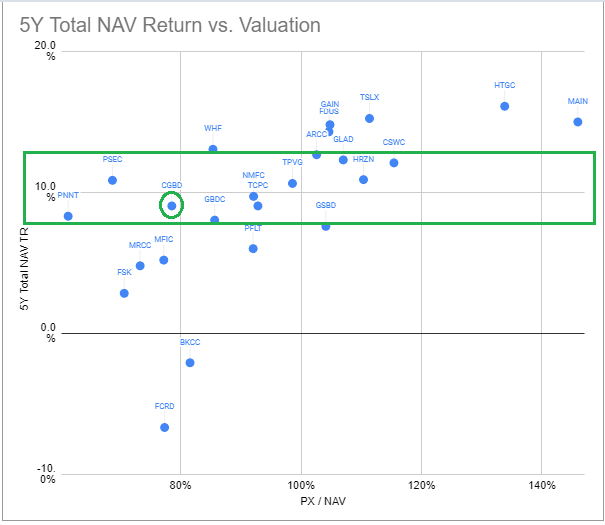

Investors might be surprised to learn that while CGBD continues to trade at a fairly depressed valuation, even after sharp gains recently, its historic total NAV returns are more than respectable, exceeding the sector average on the shorter time horizons and matching on longer time horizons.

Systematic Income BDC Tool

This quarterly breakdown shows its strong run over the last couple of years. Specifically, it has outperformed the sector in the last 5 quarters. Its period of underperformance ended around the COVID period. The company has been building out its investment team over the last couple of years and this has likely had its intended effect.

Systematic Income BDC Tool

If we combine the current valuation and 5Y total NAV returns what we see is that CGBD comes out on the lower end of BDCs that have delivered 5Y total NAV returns around 10%. What sets it apart from even lower-valued BDCs like PNNT and PSEC is that unlike these two it’s a plain-vanilla secured loan company, arguably, creating a larger margin of safety than these higher-beta BDCs.

Systematic Income BDC Tool

Takeaways

Overall, CGBD remains one of the most attractive positions in the BDC space at the moment. It continues to deliver strong results alongside a steady improvement in portfolio quality. Its share buybacks continue to add to the NAV and support the stock. And although its net income beta is below the sector average it is still positive and net income should continue to rise on the back of short-term rates even if we see a pause in the Fed’s hikes over the next couple of months.

There were also some management changes to highlight. Linda Pace is stepping down as CEO but will continue to serve as Chair of the Board. Aren LeeKong will take over as CEO having previously spent time on the Board. This shouldn’t have a material impact on the company’s operations.

Be the first to comment