DragonImages/iStock via Getty Images

Investment thesis

Q3 FY9/2022 results highlighted strong order growth, stable margins, and a business with both defensive characteristics and long-term secular growth. The shares have corrected 40% YTD but we see no major downside risk and believe this business will continue to compound. We rate the shares as a buy.

Quick primer

Carl Zeiss Meditec (OTCPK:CZMWF) is a German medical technology and device company specializing in ophthalmology (disorders and diseases of the eyes) and microsurgery, with the former making up nearly 80% of total revenue. Its key competitive product is intraocular lenses (or IOLs) in the premium category used to treat cataract patients, with a global market share of 12% (page 12). It also manufactures LASIK laser vision correction machines. The core geography is Asia Pacific making up 50% of total revenue, with China being the single largest market. It is 59.1% owned by unlisted parent Carl Zeiss Group.

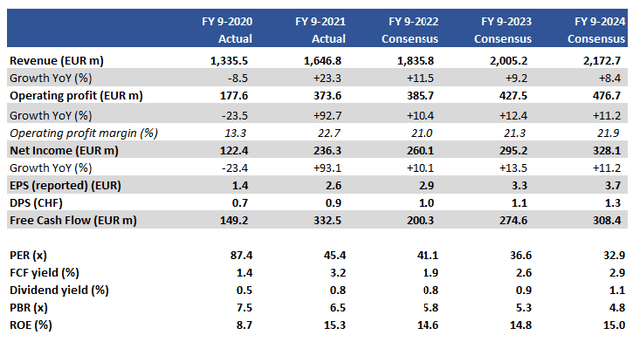

Key financials including consensus forecasts

Key financials including consensus forecasts (Company, Refinitiv)

Our objectives

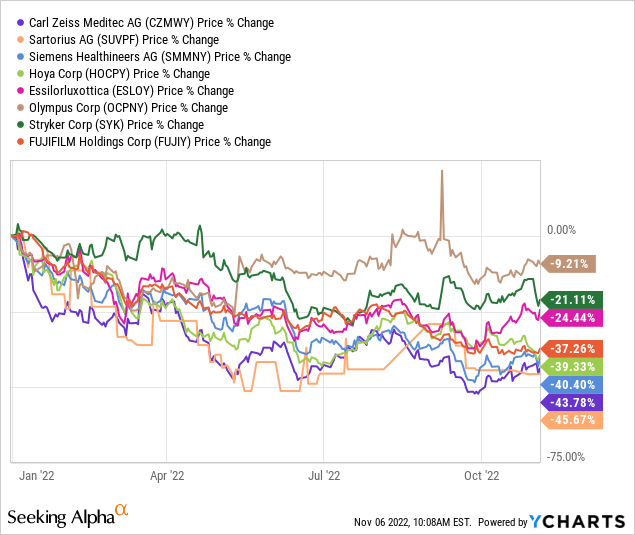

A glance at the share price performance YTD of lens/ophthalmology-related companies shows that Carl Zeiss Meditec has underperformed its peer group, although arguably Olympus (OTCPK:OCPNY) is a gastrointestinal endoscopy play and other firms are more diversified such as FUJIFILM (OTCPK:FUJIY) active in pharmaceuticals and Hoya (OTCPK:HOCPY) in semiconductor mask blanks.

Carl Zeiss Meditec strikes us as a compounding business, growing earnings on a sustainable basis as it expands overseas and benefits from trends in aging demographics and increasing cases of myopia at a global level. In this piece, we want to assess whether the shares have upside risk given recent trading and earnings outlook.

Strong order visibility

Q3 FY9/2022 results highlighted strong underlying demand for both its key business segments, with orders growing 36% YoY recording a historic quarterly high. Geographically, the key demand driver was Asia Pacific, followed by the US. There are some concerns over lengthening lead times to over six months to deliver microsurgery products. However, it would appear that overall the company is managing to grow despite challenging conditions from continued lockdowns in China, the Russian invasion of Ukraine, and supply chain problems.

FX-adjusted Q3 FY9/2022 sales YTD grew 9.8% YoY which is attractive, and EBIT margins remained at 20.7% which fell from 23.9% last FY but was due to proactive spending in marketing and R&D as opposed to cost inflation or price discounts. Gross margins reached 58.9% compared to 58.4% last FY due to an improving sales mix.

There have been some challenges that are evident in the cash flow. Operating cash flow has fallen significantly YoY as the company built up inventory related to safety stock for key components given the tight supply. This will negatively impact free cash flow generation but we believe management is taking the correct course of action to meet visible customer demand.

The longer-term positive themes are still in place. Demand for cataract procedures is expected to increase from 25 million annual procedures to over 35 million by CY2027 (around 6% CAGR), and demand for the company’s more premium offering is expected to increase as needs grow for more value-add lenses such as bifocals (page 12). There is a secular theme in increasing global cases of myopia (short-sightedness) which will drive demand for more LASIK and other refractive procedures, given the high user adoption of smartphones by the young and the intensive use of laptops and computers at work (page 13).

Stable margins to come

The company has steadily increased its operating margins from the low teens to above 20% over the last 5 years, and in the medium term has plans to continue investing in the business to expand. However, management believes that it can maintain margins above 20% whilst doing so. Is this a realistic prospect?

The sales mix continues to improve, generating what the business terms ‘recurring revenue’ in the form of consumables, implants, and services. Although there is no disclosure over how much contribution such revenue makes, management has commented that demand looks to be ‘mostly sustainable’ and should be able to offset any increase in operating costs such as R&D and marketing whilst the company aims for expansion.

With the current macro environment, investors are weary of cost inflation. Here the company appears to be a price-maker for its products with high underlying demand. Hence, there appear to be no immediate and major external influences that will negatively affect profitability.

Whilst we do not expect operating margins to head towards 30%, maintaining it at around 20% appears both realistic and attainable under current conditions.

Valuation

On consensus forecasts the shares are trading on PER FY9/2023 36.6x and a free cash flow yield of 2.6%. These are not cheap valuations, but we can be explained by 1) the defensive and high-return nature of the business placing a premium, and 2) the company benefits from strong secular growth themes that are highly visible and understood by the market.

Risks

Upside risk stems from trading strongly ahead of FY9/2022 guidance, increasing profitability as recurring revenues increase. The company is cash rich, with approximately EUR746 million/USD746 million net cash available for M&A for acquisitive growth as well as a potential increase in shareholder returns.

Downside risk comes from political risk with China being a key earnings driver for the business, as well as potential fluctuations in orders given continued lockdowns. An appreciating Euro against the US dollar will have a negative impact on translation.

Conclusion

Carl Zeiss Meditec is executing well, driving demand from key geographic markets for both its business activities. Valuations are not hugely discounted but we see the share correction YTD as an opportunity to invest. The business is not a high-growth MedTech but a decent and stable quality franchise business with strong market leadership and high earnings visibility.

Be the first to comment