ImagineGolf

Introduction

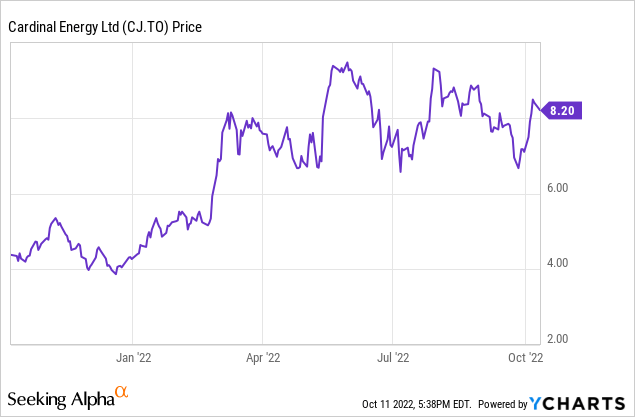

Cardinal Energy (OTCPK:CRLFF) has been one of my favorite Canadian oil producers in the past decade. The company did survive the 2020 crisis (and I made good money buying the convertible debentures at a steep discount to the principal value), and more importantly, it learned from the past mistakes. The company’s focus was redirected towards reducing the net debt and thanks to the high oil and gas prices in the past twelve months, it has now reached its objectives. This allowed Cardinal to reinstate the dividend and already hike said dividend in the current quarter. It shows that balance sheet strength and shareholder rewards can go hand in hand.

Cardinal Energy has its primary listing in Toronto where it’s trading with CJ as its ticker symbol. The average daily volume of 1.2 million shares clearly beats the OTC listing where the average daily volume is just a few ten thousand shares per day (37,000 to be exact). For the purpose of this article I will refer to the Canadian listing and use the CAD as base currency throughout this article.

As Cardinal is printing cash, its net debt decreased really fast

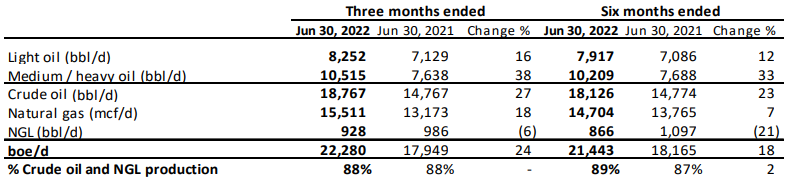

Cardinal still is an oil-heavy producer as about 88% of the oil-equivalent output consists of oil. Approximately 44% of the oil production in the second quarter of the year was light oil with medium and heavy oil representing the remaining 56% of the oil production.

Cardinal Energy Investor Relations

With an average realized price of almost C$130/barrel for the light oil and just under C$121/barrel for the medium and heavy oil, Q2 was obviously very successful for Cardinal. On top of that, the natural gas price came in at C$7.52/Mcf on an average basis and although natural gas only represents a small percentage of the oil-equivalent output, every dollar was obviously welcome to increase the net income and reduce the

I won’t dwell on the Q2 results for too long as I think we should consider that quarter to be exceptional as the average realized oil price in Q3 won’t be even close to the average Q2 price while I’m also not assuming the Q4 2022 price to come near the excellent performance in Q2. And that’s fine as Cardinal made the right decision to rapidly strengthen its balance sheet, taking advantage of the strong prices.

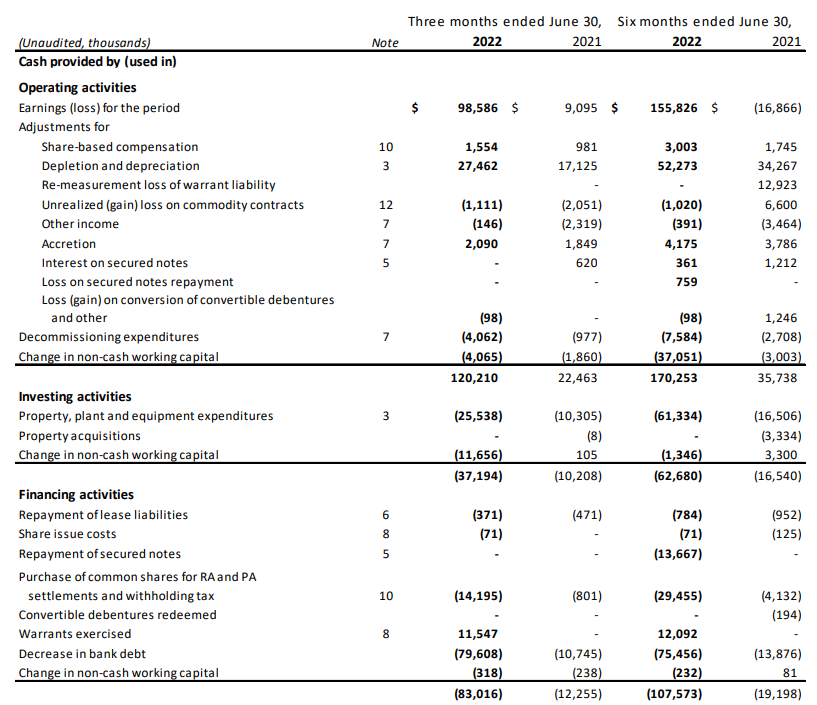

Looking at the cash flow result below, Cardinal Energy reported an operating cash flow of C$120.2M including C$4.1M in decommissioning expenditures and a C$4.1M investment in the working capital position. After adjusting the reported operating cash flow for these changes in the working capital as well as the C$0.4M lease payments, the adjusted operating cash flow was almost C$124M.

Cardinal Energy Investor Relations

Considering the total capex in the second quarter was just over C$25M, Cardinal made almost C$100M in free cash flow and about C$80M was used to reduce the bank debt and Cardinal ended the semester with a net debt of just slightly higher than the C$50M threshold it wanted to reach before hiking the shareholder payouts.

The new net debt objective has been reached, and shareholders will see a dividend hike

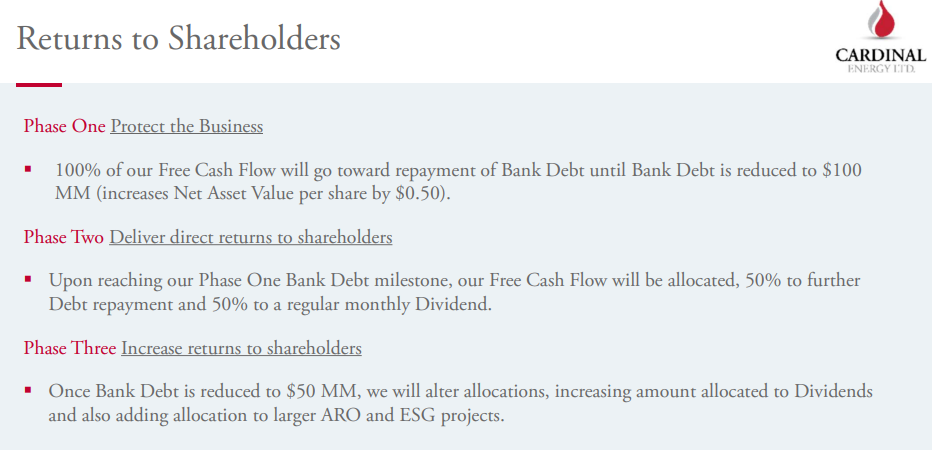

As I explained in my previous article, the company had made it very clear it planned to increase the dividend as soon as a new net debt threshold had been met.

On Tuesday, the company confirmed it was hiking its monthly dividend by 20% to 6 Canadian Dollarcent per share. This brings the annualized dividend rate at C$0.72 and based on the current share price of approximately C$8.3, this represents a dividend yield of just under 8.7%. That’s hardly a surprise as the company launched a three-pronged approach in the last quarter of 2021.

Cardinal Energy Investor Relations

Thanks to the very high oil and gas prices, Cardinal Energy was very successful in rapidly reducing its net debt. It had already reduced its net debt to C$62M as of the end of June and in a previous dividend update, it confirmed it expected to reach the C$50M net debt level early in Q4. This now appears to have happened and the dividend increase confirmation was just a formality.

Now all eyes will be on the plans for 2023 which will likely be disclosed in the next few months. Not only will it be interesting to see the total amount of capital expenditures Cardinal has planned for 2023 but also how it plans to let the dividend evolve over time.

Investment thesis

Let’s not expect a major dividend increase in 2022 as we should take into account the oil and gas price will continue to be lower than in the second quarter of the year. Using the average WTI price of US$101/barrel in the first half of the year, Cardinal’s full-year operating cash flow would exceed C$400M and after deducting the C$130M in decommissioning expenditures and capex, the free cash flow would be C$280M on a full-year basis, and that’s about C$1.75/share.

But even assuming a 20% lower oil and gas price (US$80 WTI and C$4.75 AECO), I anticipate Cardinal to generate north of C$1/share in free cash flow and this would still handsomely cover the current dividend as well as a further nominal increase. The current dividend is definitely safe but unless you expect the oil price to average $100/barrel over the next few years, don’t expect the dividend to double from here.

Be the first to comment