Fahroni

Car sales remain low, at levels usually seen only in recessions. Rising interest rates scare auto industry investors, but volume will likely gain in coming years, considering supplies and coming price cuts.

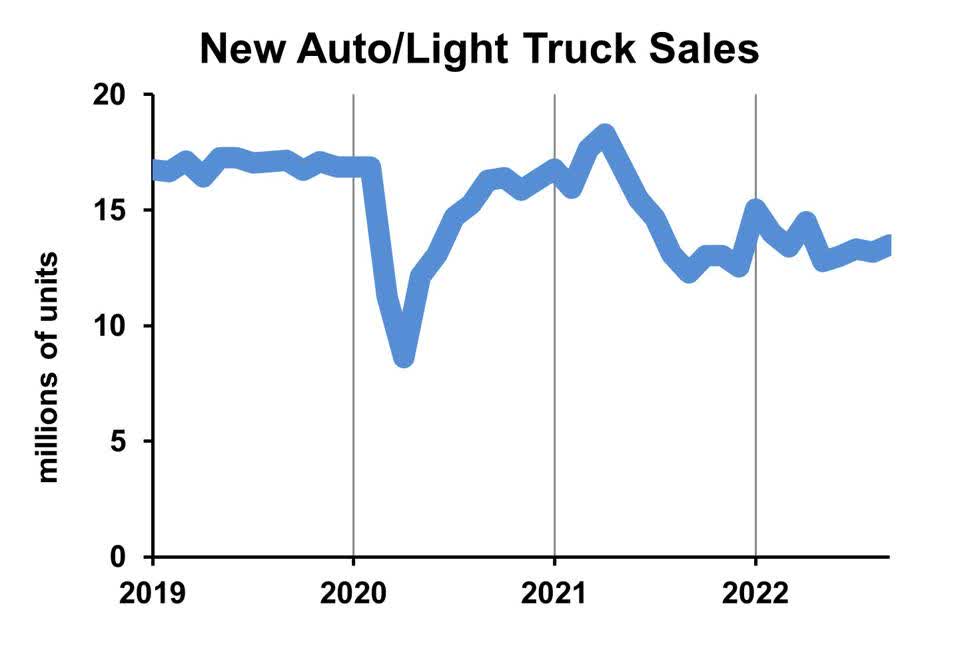

Car Sales (BASED ON DATA FROM U.S. BUREAU OF ECONOMIC ANALYSIS)

Recall the surge in auto and light truck sales after the lockdowns in 2020. Consumers who kept their jobs spent less but took in more cash, thanks to stimulus checks from the government and wage increases. They went looking to up their rides. But by the time the auto industry realized production needed to be boosted, computer chips were in short supply. There had been talk of chip shortages back in 2019, and then the pandemic-induced demand for laptops and video conferencing gear used up all chip capacity. (This is explained in an earlier Forbes article.)

Prices of both new and used cars increased rapidly in recent years. Now consumers see high prices at car dealers and higher financing costs. The interest rates recorded by the Federal Reserve for car loans have not increased too much, fewer zero percent interest rate deals are offered. CarFax reported in early October, “This month, there are fewer 0 APR offers available than ever before. Bonus cash has been reduced or, in some cases, eliminated. Consider this: In November 2020, we listed more than 125 models with zero percent financing. This month, there are only around 20.”

The costs of those programs surged as interest rates rose. Corporate borrowing costs on short-term loans rose from 0.07% at the end of 2021 to 2.80% last month. This is a much larger increase than consumer rates from banks and finance companies.

The good news is that car and light truck availability is improving. August inventory on dealer lots was the highest in a year, according to Robert Hughes’ good summary of recent data. Chip supply is improving, thanks to both increasing capacity and weaker demand for laptops.

More good news is that consumers will buy as dealer inventory increases and as prices come down. Recall that for years consumers saw steep discounts from sticker prices. Then last year they had to pay sticker and often more for hot-selling models.

Auto manufacturers and dealers have plenty of room to cut prices to keep volumes up, and they will do so. Car prices had no inflation in the years immediately prior to the pandemic. Production efficiencies offset the small increases in labor costs. But now the car prices are 16% above pre-pandemic levels, which says they can come down a lot without hurting auto companies’ desire to produce cars and dealers’ interest in selling them.

Recent low new car volume has also led to pent-up demand – probably – which may be accentuated by the improved technology on newer models.

Some consumers are not in a position to buy a new car, which is always the case. But those who buy new rather than used are more likely to have kept their jobs in the pandemic. They are probably driving less because of remote work, but some have moved away from close-in neighborhoods and are driving more for shopping and entertainment.

The Federal Reserve’s tighter monetary policy will slow the overall economy, and we usually look to big-ticket consumer purchases as an avenue for higher interest rates to slow down spending. This time around, though, consumers have substantial savings left over from their stimulus checks and pay raises, and some of that money will be spent on new cars.

For car manufacturers and dealers, unit volumes will increase but profit margins will shrink. Most likely net earnings will fall, though some companies may benefit more from the quantity effect than they are hurt by the price effect.

The strength of the car industry’s future sales dampens the Fed’s ability to slow the overall economy, but other sectors can shrink more easily.

Consumers who don’t need financing will find this a very good change, with more models to choose from and better prices. And even those who borrow most of the costs may be better off after some incentive programs are implemented.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment