Sakorn Sukkasemsakorn

Investment Thesis

There are 2 challenges facing Capstone Green Energy Corporation (NASDAQ:CGRN). It has to strengthen its Balance Sheet and turn the business into a profitable one. But to solve the first, it has to convince investors and/or financial institutions that it can deliver the second.

The business is viable as the historical losses are because it is operating below the breakeven levels. There is a growing market but CGRN needs time to rebuild back its sale volume.

All these are positive factors in seeking additional funding. It also makes CGRN an attractive acquisition target. But the funding has to be substantial. While the current Reproduction Value is greater than the market price, we have to look at the share price post-funding.

On such a basis, I estimated that at the current market price of USD 1.80 per share is a fully valued one. I would recommend going in if the price falls to USD 1 per share.

Introduction

CGRN is an ailing US micro turbine manufacturer that has not been profitable since its IPO in 2000. Micro-turbines are tiny gas turbines that can generate both electricity and heat. CGRN is probably among the pioneers to commercialize micro turbine technology.

Because of its history of losses, CGRN currently faces some Balance Sheet challenges. These were recently covered in Seeking Alpha. Refer to “Capstone Green Energy: Abysmal Q4 Causes Debt Default, Bankruptcy Might Be In The Cards“.

To resolve its current Balance Sheet problems, it has to demonstrate that it has a viable business. Specifically, it should:

- Identify the reasons for its losses and show that they can be addressed.

- Show that the current Book Value does not reflect its business value.

I will show in the following sections that both are possible. The business has value and management may seek Chapter 11 protection to enable CGRN to be restructured. Alternatively, CGRN may be acquired.

Irrespective of the routes to solve the Balance Sheet problems, they would involve some new equity issuance. I estimated that post-funding, the value of the shares to be between USD 1.26 to USD 2.89 per share. I am more inclined to think that at the current price of USD 1.80 per share, it is fully valued.

Losses

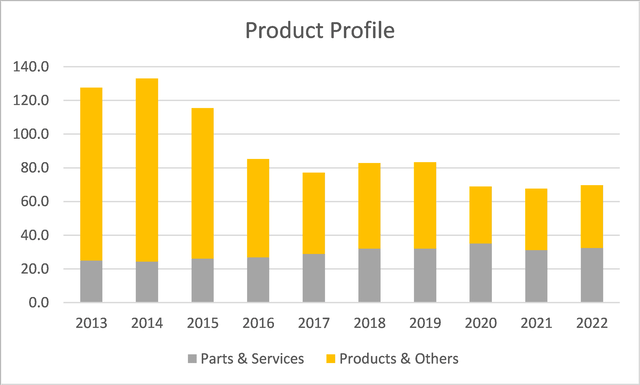

I tracked the past 10 years’ sales and broke them down into 2 product segments as illustrated in Chart 1.

- Parts & Services. This has grown at a 3.1 % CAGR from 2013 to 2022.

- Products & Others. This was derived by deducting the total revenue from the Parts & Services revenue. This segment shrunk so that the 2022 revenue was only a bit more than 1/3 of the 2013 revenue.

The Parts & Services segment will probably continue to grow due to CGRN’s product sales over the past 2 decades. This is notwithstanding the move into Energy as a Service (EaaS).

The positive thing is that CGRN had managed to achieve a higher sales volume in the past for the Products & Others segment. It needs to recapture back the “lost” sales.

Chart 1: Product Segment Revenue (Author)

The growing market for micro turbines

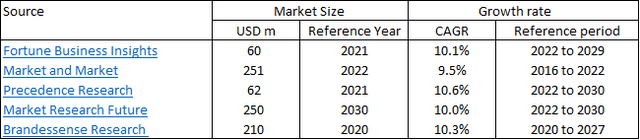

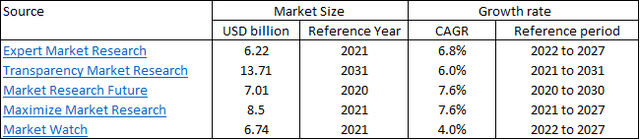

The declining Products & Others segment’s sales is a surprise as the market for micro turbines is growing. Refer to Table 1.

I estimated that the 2022 global market for micro turbines to range from USD 60 million to USD 250 million with an average of USD 150 m. This is not exactly a large market and based on this, CGRN would have about ¼ of the average global market.

Looking at Chart 1, you would agree that CGRN probably lost market share over the past 10 years. The positive side is that the consensus growth rate is about 10% CAGR. This means that the market would double by 2030. If CGRN just maintains its current market share, its Products & Others segment revenue could be doubled the current one.

Table 1: Market for Micro Turbines (Author)

Operating below break-even

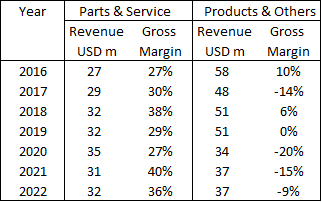

CGRN losses are because it is operating below its break-even level. I carried out a back-of-envelop analysis of the break-even based on the data that was available from 2016 as shown in Table 2.

You can see that the gross margin problem is with the Products & Others segment. For this segment to achieve a positive gross margin, it needs about USD 50 million in sales.

This is of course not the breakeven level as CGRN needs to generate sufficient revenue to cover the fixed costs.

Table 2: Segment Gross Margins (Author)

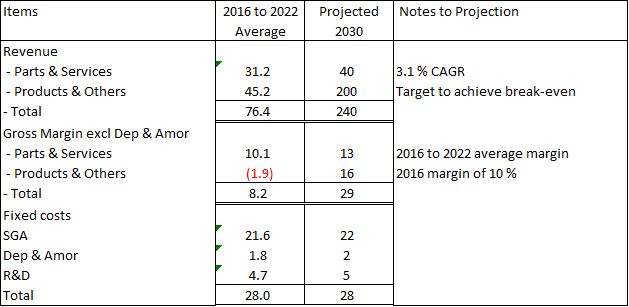

I estimated that the average fixed costs incurred by CGRN annually to be about USD 28 million. I then worked on a possible breakeven scenario as shown in Table 3.

To cover its fixed costs, CGRN needs to generate at least USD 28 million of gross profit. This requires its annual sales for the Products & Others segment to be about 4 times its long-term average i.e. about USD 200 million.

The question then is whether the market is big enough for CGRN to achieve this. I had earlier projected that the market in 2030 would be doubled by the current estimates. Considering that CGRN needs USD 200 million from the Products & Others segment to break even, it seems a tall order.

Table 3: Breakeven Analysis (Author)

But CGRN’s expertise is not just in micro turbines. It also has patents for air bearings which seemed to be a much bigger market as shown in Table 4. Several of the sources have cited CGRN as one of the players in this sector.

CGRN announced commercializing this product in 2018:

“…first commercial order to sell air bearing assemblies to be used by a Fortune 500 industrial manufacturer of gas facility solutions for one of their commercial gas handling products.” Source: CGRN Press Release May 2018

Table 4: Market for Air Bearings (Author)

I could not find any reason why CGRN did not expand the air bearing business. Most of the product descriptions in its Annual Report focused on micro turbines.

Given the micro turbine market size, I would have thought that the expansion of EaaS is not as impactful as expanding the air bearing business.

To sum up, this is a viable business:

- There is a growing demand for micro turbines. If the green energy movement takes off, the demand could even be bigger.

- There is the potential for CGRN to expand into air bearings where there is bigger demand.

- Historically CGRN had achieved a Products & Others segment sales that are 3 times larger than the current one.

There are also prospects of improving the breakeven level. In Table 3, I derived a gross profit margin (excluding Dep & Amor) of 12.1 %. It is a conservative one as between 2013 and 2022, the actual gross profit margin (accounting for Dep & Amor) ranged from 10.6 % to 18.3 % with an average of 14.6 %.

Based on sensitivity analyses, there are scenarios where the total revenue is about USD 140 million to break even. Profitability is doable.

Valuation

As CGRN does not have a profit track record, I did not attempt to value it based on a DCF approach. Instead, I used the Reproduction Valuation method. This is an Asset Valuation approach made famous by Professor Greenwald.

The Reproduction Valuation method looks at what it would cost to rebuild the business or start a competing business in the same position.

“The first thing to decide when performing an Asset Valuation is if the industry is a viable one or not. If it’s not then the company will be liquidated and the assets should be valued at their liquidation value…If the industry is viable and the company a going concern, then a company’s productive ability constantly has to be renewed to be competitive, i.e. the assets have to be replaced over time. Hence, you have to look at the cost of reproducing those assets with today’s technology and prices.” Source: The Greenwald Method, Investingbythebook.com

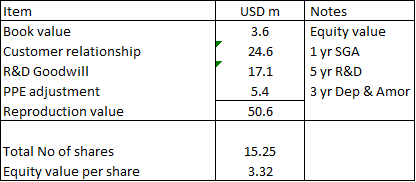

Table 5 illustrates the computation of the Reproduction Value for CGRN. I assumed that the Book Value did not capture all the value and hence I adjusted it by the cost to reproduce the business. There were 3 adjustments:

- Customer relationships. According to CGRN “…Our worldwide distribution network was developed from the ground up and has become a valuable asset.” CGRN has trained its distributors to provide applications engineering support for its products. I estimated that anyone starting from scratch would have to spend at least one year of SGA to set up a trained distribution network.

- R&D goodwill. CGRN expensed off its R&D expenditure. It has today several patents. I assumed that these are worth at least 5 years of its annual R&D expenditure.

- PPE. Given the current inflation, it would cost more to reproduce its plant and machinery. I have assumed that the current Book Value understated this by 3 years of its depreciation and amortization.

Based on the above assumptions, I estimate CGRN’s Reproduction Value to be USD 3.32 per share. This far exceeds the market price of USD 1.80 per share (as of 3 Oct 2022).

Table 5: Computation of Reproduction Value (Author)

It is possible to get higher Reproduction Values as the R&D or even the Customer relationship estimates could be higher than those shown in Table 5. The main point is that the Book Value did not capture all the values of CGRN.

But this does not mean that the value of equity for the existing shareholders is USD 3.32 per share. This is because the Reproduction Value of USD 3.32 per share assumed that CGRN does not need to raise additional funds.

Additional funding scenarios

Over the past 10 years, CGRN had an average negative Cash Flow from Operations of USD 17 million per year. Assume that it would require 3 years to turn the business into a profitable one. This meant that CGRN would require about USD 51 million to fund the operations before it can be profitable and be cash flow positive.

At the same time, its EaaS business would also require some funding. In 2022, USD 8.7 million was invested in its rental fleet. To grow this to 2030 at the same rate, I guesstimated that it would require about USD 70 million.

These are of course back-of-the-envelope calculations. The point I am making is that to turn CGRN into a profitable one would require about USD 120 million in funding.

I assumed that it is all funded via equity. CGRN currently has a Total Capital Employed (SHF + Debt) of USD 65 million. We are then looking at a required Total Capital Employed of USD 185 million for a “steady state” situation.

To generate a 10% return, CGRN would need to generate about USD 18.5 m EBIT. Looking at Table 3, it means either higher revenue and/or gross profit margins than what were projected. If nothing else, it suggests that CGRN should seriously consider expanding into the air bearings market.

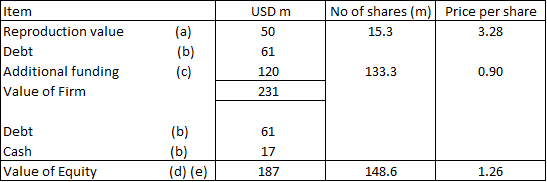

Then there is a question of the value of the existing shares. This will depend on the value of the business and the price of the new shares to be issued. I looked at 2 scenarios:

- Scenario A – Reproduction value of USD 50 million and the new shares to be issued at a 50% discount to the current market price.

- Scenario B – Reproduction value of USD 100 million and the new shares to be issued based on the current market price.

Scenario A is a conservative one. I estimated the value of the shares post-funding to be USD 1.26 per share as illustrated in Table 6.

Based on Scenario B, the value of the shares would be USD 2.89 per share.

The current market price of USD 1.80 per share could be obtained with USD 75 million Reproduction Value and new shares issued at a 35 % discount to the current price.

Table 6: Estimating the value of shares (Author)

Notes to Table 6:

a) This is just the Equity component and included Cash.

b) Cash and Debt based on latest reporting.

c) This remains unchanged for all Scenarios.

d) Value of Equity = Value of Firm + Cash – Debt

e) Value of Equity per share = Value of Equity / Total number of shares.

f) The price per share for the Additional funding was assumed to be a 50% discount from the current market price in this example.

In my model, I assumed that the value of the Firm is based on a sum-of-parts valuation = Reproduction Value + Debt + Value of Additional funding. Note that I added Debt here because the Reproduction Value represented just the Equity portion.

By assuming 100 % equity for the additional funding, I have assumed the worst-case scenario for the current shareholders. I would like to think that management would be to secure some of the funding with Debt.

I of course do not really know the funding scheme. Nevertheless, I hope that my analyses provided an indicative range for the value of the shares.

- I would say that USD 2.89 per share is a very optimistic one.

- The current market price seems to be a fully valued one.

- The realistic view would be to take it between USD 1.26 per share to USD 1.80 per share.

Limitations

I would treat the values obtained above as broad indication of the intrinsic values for several reasons.

First it is obvious that the value of the shares would be tied to the value of the business. I had valued CGRN using a Reproduction Model. As an outsider without sufficient details, I can only guesstimate the costs to reproduce the customer relationships, R&D efforts and PPE replacements. Getting a realistic value is critical.

Secondly, I had assumed all equity funding. If I had split the USD 120 million funding into equity and Debt components, the computed values of the shares would be higher than what I had obtained.

For example, if the funding was split equally between equity and Debt, the computed values of the shares would be about 25% higher than what I obtained earlier.

Thirdly, the value of the Firm as per Table 6 was based on Asset Value. The income side as represented by Table 3 was treated as independent. A more realistic model would be to link the income part so that the value of Firm would also be tied to the income. Then changes in the Debt Equity ratio of the funding would affect the income as well as the number of shares.

But I did not go down this road as I do not know how the funding would be addressed.

Finally, I used the Reproduction Value on a “stand alone” basis. Professor Greenwald actually using it in conjunction with the Earnings Power Value to triangulate the intrinsic value.

Nevertheless, I believe that my analyses provided some indicative ranges to the value of the shares.

Conclusion

CGRN’s immediate challenge is to repair and rebuild its Balance Sheet. To do this, it would need additional funding.

But for CGRN to interest investors and/or financial institutions, it needs to show that the business is viable. This is not impossible as it has the products and distribution network. The market is growing and there is the possibility of extending its offerings to the air bearings market.

CGRN losses are because it was operating below its break-even levels. While management has adopted several measures to reduce cost, I think it is more a sale volume game than a profit margin one.

CGRN had achieved much higher sales volume in the past when the market was smaller. So it is not something impossible.

There is value to the business. But the value to the existing shareholders depends on how management raises the additional funding. If it is all with new equity, I am more inclined to think that the current price represents the fair value.

I am not too concerned whether “bankruptcy is in the cards”. In fact I would expect management to seek Chapter 11 protection to give them time to seek the funding.

But there is an alternative route. CGRN could be a takeover target as this is a viable business. If I was the acquirer, I would probably make an offer based on a discount to the current market price.

What does all this mean for the existing shareholder?

- If you had bought it at USD 3 share or higher, you are likely to incur a loss.

- If you had bought it at USD 2 per share you should get out while you can.

- But should it fall to around USD 1 per share, I would go in.

Be the first to comment