Massimo Merlini/iStock Unreleased via Getty Images

The big difference between the French and the Italian fashion system is that in the former generational change has already taken place. Between the two European systems – world leaders in fashion and luxury – the sterile rivalry of the 80s and 90s has long been transformed into healthy competition and, in recent times, even into collaboration. The reason for the difference that remains between Italy and France is simple – beyond the Alps, maisons and brands were born decades before the Italian ones and the passage of time has imposed changes. But now the time seems to have come for drastic choices also in Italy. Only the designers who died prematurely, such as Gianni Versace or Franco Moschino, were able to avoid them. The others – if they have not sold, almost always, to the French – are still all alive and in many cases kicking, as the Americans say, from Giorgio Armani to Valentino Garavani. Between the A of Armani and the Z of Zegna there are some companies that have at least partially dealt with the generational shift. Versace was acquired in 2017 by Michael Kors and in 2018 the group was renamed Capri Holdings, but Donatella, Gianni’s sister, remains the creative director of the Versace Maison.

We were not very optimistic about Capri Holdings (NYSE:CPRI) in our first article, but today after having looked at its recent results we are more positive and we move our rating to a buy.

What has changed? Q1 Results development

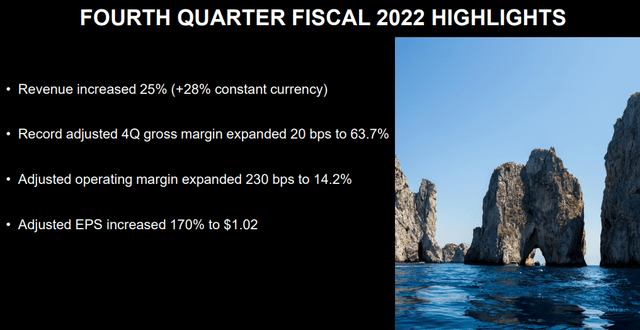

Results were above our expectations. John D. Idol company CEO commented that “revenue and earnings results significantly exceeded our original expectations. Capri Holdings achieved the highest revenue, gross margin and earnings per share in the company’s history”. Looking at the results, revenue was at almost $1.5 billion posting a +25% compared to Q1 2021. Adjusted gross margin has expanded by 20 basis points and adjusted operating margin stood at 14.2%. Cross-checking Wall Street analyst estimates, Capri Holdings reported an EPS of $1.02 versus the $0.82 implied by the market. Performances were driven by all the company’s businesses. We highlight also the strong FCF generation from the accessory models.

Capri Holdings Q1 Results

Conclusion

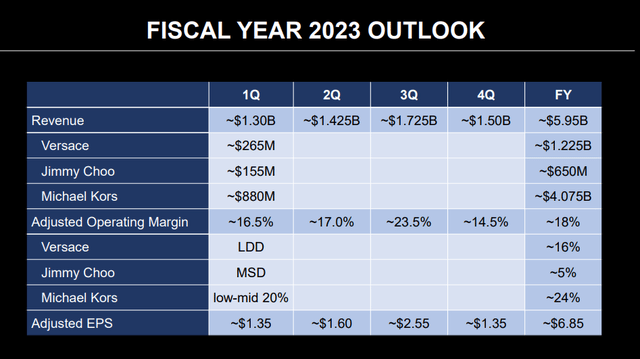

First of all, it is worth mentioning that at the Mare Lab we are optimistic about the whole sector. Our internal team sees fashion luxury companies as positively impacted by the inflationary pressure, and revenge shopping is a reality after COVID-19. More specifically, we see Versace and Jimmy Choo as a “turnaround” story. Profits for the two fashion houses are still behind their closest peers and we see it as a positive catalyst that the new Versace CEO Emmanuel Gintzburger is from Alexander McQueen. After the Q1 three-month numbers, our internal team has increased the company’s account. Our EPS guidance to $6 vs. our previous of $5.5 (still below management’s expectation), but we derive a target price of $74 per share vs. the current trading at $50, so we moved to a buy rating. It is worth mentioning that during the Q1 release, the company approved a new buyback plan for up to $1 billion of its outstanding ordinary shares, this will further provide capital appreciation over the longer term.

Capri Holdings 2023 outlook

Be the first to comment