JP Yim/Getty Images Entertainment

Thesis

On August 9th, Capri Holdings Limited (NYSE:CPRI) announced results for the June quarter and outperformed analyst expectations both with regards to revenues and earnings.

Capri stock is up by about 14% since I have initiated coverage with a “strong buy” recommendation. Given Capri’s healthy June quarter performance and solid guidance, I am confident to reiterate my strong buy recommendation and $84.09/share target price.

For reference, Capri stock is down 26.7% YTD, versus a loss of about 15% for the SPX.

Capri’s June Quarter

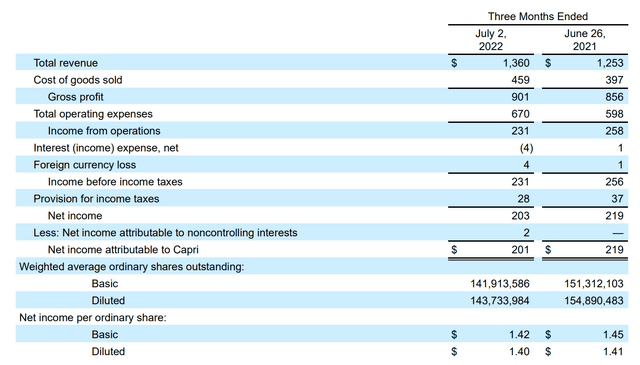

During the period from April to end of June, Capri generated total revenues of $1.36 billion, representing a year over year increase of 8.5% and 15.2% in constant currency. Adjusted gross profit was $900 million (66.2% margin), versus $853 million (68.1% margin) for the same period one year prior. The company’s net income stayed roughly flat: $201 million ($1.40 EPS) for the June quarter 2022 compared to $219 million ($1.41 EPS) for the June quarter in 2021. Analysts had expected revenues for Capri of $1.29 billion (9% beat) and EPS of $1.35 (12% beat).

John D. Idol, Capri’s CEO, commented:

We are pleased with our first quarter performance with revenue, gross margin, operating margin and earnings per share all exceeding our expectations. Better than anticipated results were driven by strong momentum across all three luxury houses reflecting the power of our brands as they continue to deepen consumer desire and engagement.

Capri June Quarter 2022 Presentation

With respect to Capri’s specific brands, results for the June quarter were as follows: Versace, which accounts for about 20% of total sales grew revenues by14.6% year over year to $275 million and generated operating income equal to $52 million. Michael Kors, the largest segment with about 67% of total sales, recorded total revenues of $913 million and a year over year growth of about 5%. Operating income for the MK brand came in at $222. Finally, Jimmy Choo with about 13% of the group’s total sales grew revenues by 21.1% to $175 million and respectively $19 million of operating income.

Capri closed the quarter with $221 million of cash and short-term investments against total debt of $1.419 million. Investors might appreciate that during the quarter, Capri repurchased about $300 million worth of shares. This is about 4% of the company’s total shares outstanding and would equal an annualized shareholder distribution of nearly 20%! As of by end of June 2022, Capri still has $700 million of share repurchase authorized.

Strong Guidance

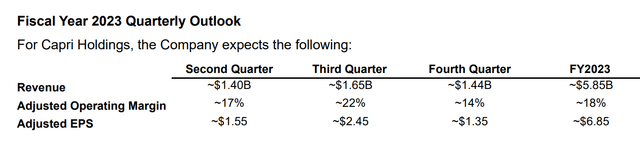

Capri guided a very strong outlook for the full fiscal year 2023, considering the highly challenging macro-environment. Total revenues are expected to be about $5.85 billion, which would represent a topline year over year growth of about 3.5%. Despite the rising costs, the company expects the same gross margin as for fiscal 2022 and operating margin of approximately 18%. Diluted EPS are estimated at $6.85.

Most notably, management expects ending inventory for the fiscal 2023 to be lower than for fiscal 2022— highlighting both strong product demand and reasonable chain management. Capri’s CEO said:

Looking forward, we remain optimistic about the long-term growth potential for Versace, Jimmy Choo and Michael Kors. With our portfolio of iconic, founder-led fashion luxury brands, Capri Holdings is positioned to deliver multiple years of revenue and earnings growth.

Capri June Quarter 2022 Presentation

Some Uncertainty

Although Capri stock is cheap and the company has proven financial resiliency during a tough June quarter, I advise to remain cautious and conservative. Capri remains a consumer-centric business with 100% of the group’s revenues exposed to discretionary spending. If the economic outlook would darken considerably, I personally would expect that CPRI stock would trade lower. During the company’s earnings call, Capri’s CFO commented the uncertainty as follows:

Now none of us know what’s going to happen in the back half of the year with the consumer. But it appears that the luxury industry is quite robust and quite healthy.

Implication and Recommendation

After a strong June quarter for Capri, I am confident to reiterate a strong buy recommendation for the stock. Arguably, there are only few consumer-centric companies that can deliver comparably strong results during a period that has been pressured by multiple headwinds, including inflation, central banks rising interest rates, crashing asset prices and a weak global economy. Capri claims that

… Capri Holdings is positioned to deliver multiple years of revenue and earnings growth as well as increased shareholder value.

I agree and would not be surprised if CPRI stock would trade at >$80/share somewhere in mid-2023.

My coverage initiation article on Capri Holdings: Capri Holdings: Strong Brand Portfolio Indicates Strong Buying Opportunity

Be the first to comment