Eoneren

Capital Southwest (NASDAQ:CSWC) provides passive income investors with a double-digit dividend yield that is covered by net investment income, a focus on First Lien investments, and the potential for high total returns.

Despite the fact that Capital Southwest is trading at a premium to net asset value, the BDC’s disciplined management style and high-quality investment portfolio justify a higher net asset value multiple in my opinion.

Capital Southwest also declared a special dividend of $0.05 per share to be paid in the fourth quarter and increased its regular dividend by 4% to $0.52 per share per quarter.

Capital Southwest Offers Investors Portfolio Stability

With a recession becoming more likely, passive income investors seeking BDC investments and high, double-digit dividend returns on their invested capital may want to select those business development companies that provide a high level of portfolio quality, such as Capital Southwest.

The lower middle market, which includes private companies with annual EBITDA of $3-20 million, is the focus of Capital Southwest’s investment strategy. Capital Southwest invests more opportunistically in the upper middle market, which consists of larger companies, typically those with an annual EBITDA of at least $20 million.

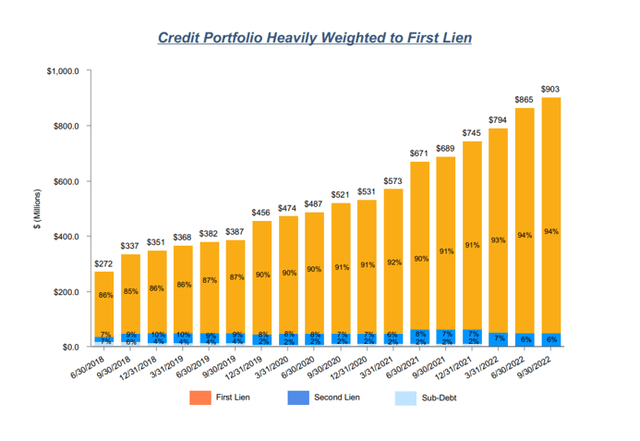

Capital Southwest’s emphasis on First Liens, in my opinion, distinguishes it as a standout BDC. First Liens are the safest type of debt investment because they are paid off first if a company defaults on its debt obligations. Because of the legal protections afforded to First Lien holders, First Lien investments typically yield less than unsecured debt.

Capital Southwest’s debt portfolio consisted of 94% high quality first liens and 6% second liens as of September 30, 2022. The portfolio’s value reached an all-time high of $903 million at the end of the previous quarter and has shown consistent growth even during the Covid-19 pandemic, which called into question many borrowers’ ability to repay their loans.

Credit Portfolio (Capital Southwest Corp)

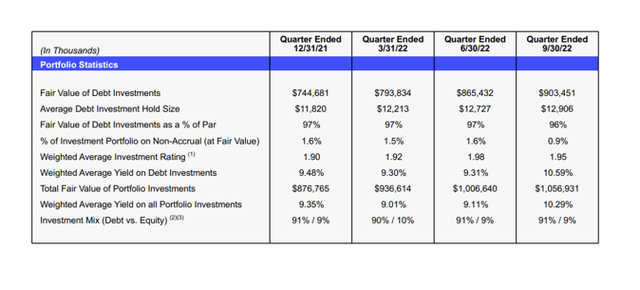

The credit quality of Capital Southwest’s portfolio is good, but not perfect. At the end of September, the BDC had 0.9% of its investments on non-accrual, representing an at-risk investment value (at fair value) of $9.4 million. Having said that, the BDC’s non-accrual ratio improved from 1.6% QoQ.

Portfolio Statistics (Capital Southwest Corp)

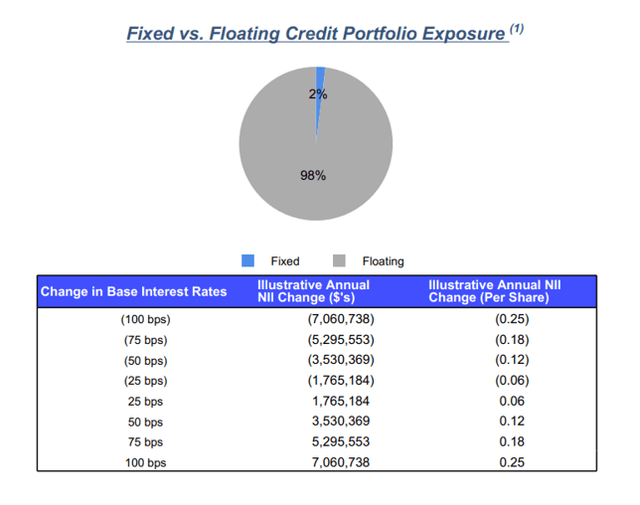

Floating Rate Exposure

Capital Southwest is carefully originating loans with floating rate exposure. 98% of the BDC’s investments have floating loan rate terms, protecting the company from rising interest rates. Because of the floating rate exposure (see the BDC’s sensitivity table below), I anticipate improved dividend coverage and the payment of special dividends in the future.

Credit Portfolio Exposure (Capital Southwest Corp)

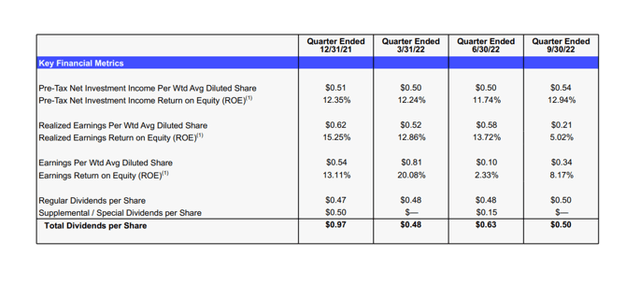

Dividend Pay-Out Ratio And Dividend Growth

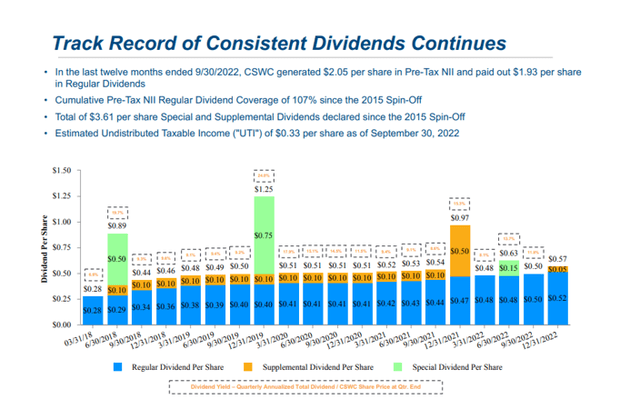

In 3Q-22, Capital Southwest covered its dividend with net investment income. The BDC earned $0.54 per share in net investment income, which exceeded Capital Southwest’s quarterly dividend of $0.50 per share. In the last twelve months, the dividend pay-out ratio was 94%, and the BDC increased its dividend three times.

Pay-Out Ratio And Dividend Growth (Capital Southwest Corp)

Most recently, the business development company increased its regular dividend to $0.52 per share per quarter, a 4% increase QoQ.

Capital Southwest also announced the payment of a special dividend of $0.05 per share, to be paid in 4Q-22. The ex-dividend date for the regular and the special dividend is on December 14, 2022.

Consistent Dividend Track Record (Capital Southwest Corp)

Capital Southwest’s Valuation

Capital Southwest pays a 11.4% dividend yield and trades at a 10.2% premium to net asset value. The BDC’s net asset value was $16.53 at the end of September, up $0.01 per share QoQ.

Capital Southwest has traded at a higher net asset value in the first six months of this year, but market concerns about rising interest rates have resulted in a broad selloff in the sector in 2022, resulting in a compressed valuation multiple for CSWC.

Why Capital Southwest Could See A Lower/Higher Valuation

Capital Southwest, in my opinion, is a well-managed business development company with a high degree of safety due to its focus on the highest quality forms of debt, First Liens.

Having said that, the non-accrual ratio, as well as overall portfolio performance during a recession, pose a risk for Capital Southwest. If non-accruals rise, Capital Southwest’s stock may trade at a discount to net asset value.

However, as long as the non-accrual ratio remains manageable, around 1.0-1.5%, I believe the stock could trade at a higher NAV multiple.

My Conclusion

Capital Southwest is a high-quality BDC for investors seeking high, double-digit dividend returns on their invested capital.

The business development company has developed a focus on the highest quality forms of available investment debt and has a well-managed debt portfolio with good credit quality.

The BDC’s floating rate exposure is an important asset for passive income investors, as it may result in improved dividend coverage and the payment of special dividends in the future.

Be the first to comment