olm26250/iStock via Getty Images

In this article, we’ll take a look back at Fidelity National Information (NYSE:FIS). I’ve written about this company before, and the fundamentals of the business are solid.

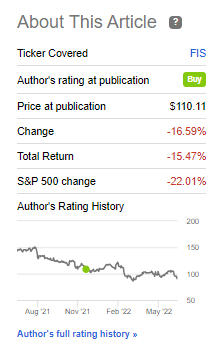

FIS performance (Seeking Alpha)

Fidelity is a Fintech company, which is also most known for these services. The company offers a wide range of financial products and services, and its core is facilitating global capital movements.

In this article, we’ll look at the company, its makeup, its recent results, and its valuation to determine whether this could be a good way to invest for you.

Revisiting Fidelity National Information Services

So, if you recall my article on Fidelity National Information Services, you’ll know that the company is a provider of fintech for merchants, banks, and capital market firms across the globe. It’s a large company with over 55,000 employees, headquartered in Jacksonville Florida. The company is both a Fortune 500 and an S&P 500 member.

The company is an impressive player, the largest processing and payments company in the entire world. What it does is focusing on the following few segments.

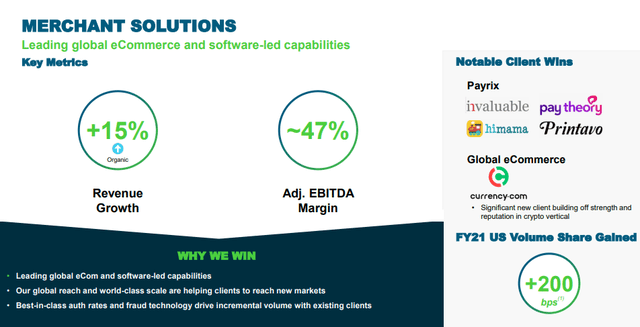

- Merchant Solutions, focusing on enabling merchants of all sizes around the globe to accept electronic payments, including credit/debit and prepaid, both from a physical location as well as a non-physical location, such as e-commerce or mobile. This includes the entire transaction chain, including authorization, settlement, customer services, chargeback, and retrieval processing. The company also offers VAP, such as security and fraud prevention, analytics, and FX as well as funding. The segment assists clients in over 140 countries, and clients include some of the largest national retailers in the US.

- Banking focuses on servicing all sizes of financial institutions for processing and application, risk management, compliance, electronic fund transfers, payment, network services, and wealth/retirement solutions, among other things. Clients are large banks, global financial institutions, regional banks, credit unions, and commercial lenders. These also include government institutions.

- Capital Market Solutions focuses on servicing clients with sell/buy-side solutions. usually, we’re talking about asset managers, brokers, security traders, insurers, and private equity firms. The services include record keeping, analytics, trading, financing, and risk management.

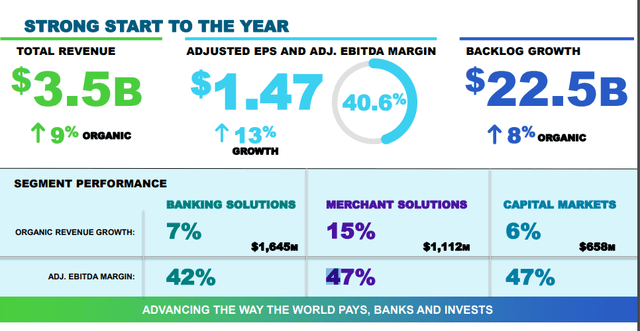

FIS sells its services through in-house personnel with market expertise. The company does have peers, but none of its peers are as big, or as specialized as is FIS. We have early 2022 numbers, and these numbers are excellent. The company reported revenue, earnings, and backlog growth, with volume growth in every single segment.

Banking saw expansion through its banking-as-a-service hub service, its banking platform and new offerings. The company’s merchant services saw expansion through geographies, and the capital markets segment saw expansion through new and improved platform offerings, including treasury, crypto and other segments.

Obviously there are headwinds and risks for a company like FIS. The fact that it got involved with crypto and the way crypto has been going is one of the risks to the company. However, despite these risks to the company, and there are a few of them, we have solid revenue growth, continued solid margins, and solid fundamentals.

FIS is the issuer processing the top 20 US financial institutions in the country. It also gained several large new customers, including a major telco company, and wealth management service processing for Mutual of America Financial group. It also kept winning clients in merchant solutions.

In short, FIS keeps on winning and scoring. YoY results for the first quarter were up in every way that matters. The company generated significant amounts of free cash flow, paid its dividend, reduced debt by around $1.2B during the quarter, and as of May, keeps working with an average interest rate of 1% and a leverage ratio of 3X. The company is fundamentally safe, and the YoY results were truly impressive. FCF alone increased 41% on a YoY basis, and the company bumped the dividend by a massive 21%, which now results in a 2%+ yield for the business.

No, it’s not a high yielder – FIS will never be a high-yielding sort of company. But with an upside like this, it can be argued that FIS doesn’t need as high a yield as other companies. The undervalued space in finance is getting crowded with plenty of buying opportunities. But this one, I believe, despite the multitude of appealing prospects, is worth your attention for what it offers.

You only have to take a glance at recent wins to know the caliber of customers the company plays with. With a backlog like this and continued organic growth thanks to increased activity in e-commerce as well as higher demand for payment solutions, it’s little wonder that business continues to increase. With the company dipping its toe in the crypto space, this company can even be thought of as a worthy, safer alternative for people interested in crypto investments.

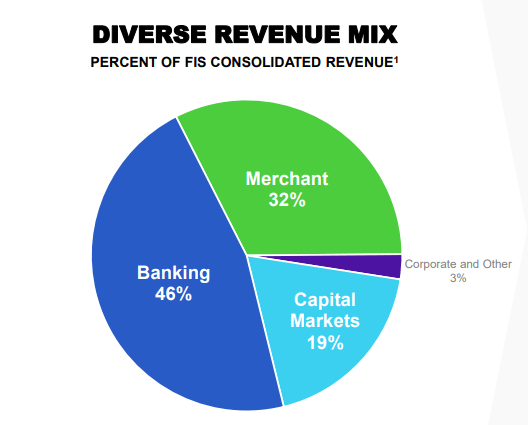

The company’s current revenue mix is decent, with a higher weight on banking.

FIS Presentation (FIS IR)

Most of this revenue is usage-based with multiple-year contracts, creating very visible streams of revenue and potential profit over time. This company is quite forecastable, which we’ll see in a while.

The business is investment-grade rated, and pays a 0.5%+ higher dividend than when I last wrote about it. Company capital allocation priorities are clear – and the company has already announced that it intends to grow the dividend to a 35% payout ratio, with 20% annual dividend growth over the coming few years – and we expect dividend growth to continue.

The company does expect negative impacts for the coming quarters, from FX, interest rate expenses, but more or less offset by revenue and volume growth.

But the main positive argument for FIS is the company’s valuation, which at this time is at a significant overall upside.

Fidelity Information Services – Upside

The crash is now seeing FIS trading below 15X P/E. That hasn’t happened for several years. If you’d invested in FIS at any time when the company was below 15X P/E, except during the 2018 decline, you would have come out of it with market-beating overall rates of return.

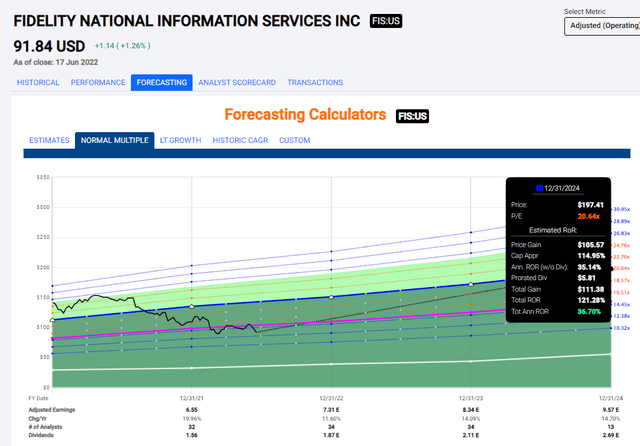

The company, despite the current macro, is expected to trade up double digits in EPS growth 2022-2024E. Accuracy for the company based on a 2-year forecast with a 20% margin for error is flawless – the analysts never miss forecasts under those circumstances. The fact is also, that the company tends to trade at a premium, not a 15X P/E multiple, which means that the company could climb significantly higher than we’re seeing here.

Some upside – or some checking of the potential upside, rather. If we stick to a 15X P/E ratio on a forward basis, the conservative estimates for the company currently call for a 21% annualized RoR, or 63% until 2024E.

But remember, FIS trades higher than this – and if we consider the company’s 5-year premium of around 20X P/E, that upside expands to 37%, or almost 122% in 3 years.

So, how likely is this? Well, as to how likely it is that the company will generate is expected earnings, that’s one question – and I consider this one pretty clear. I believe that really no matter where the market goes, the company may deliver that. The historical trends are clear, and seeing how things are going this year, it seems that the company’s trends are continuing along the same trajectory.

Now, the valuation, that’s another matter. Just because we see the company increase earnings, doesn’t mean we see a corresponding, sudden increase in the valuation – as we’ve seen historically in other businesses.

If you’re like me, you don’t mind a company trading low for several years until you get your upside – as long as you know that what you invest in is really quality. When you invest in FIS, I believe that what you’re buying is quality. The company isn’t just expected by FactSet to improve results. The combined catalyst of volume growth and new business opportunities is likely to contribute to a massive, near-term 2-5 year upside.

That’s why S&P Global analysts have an average target of $134 from a range of $105 low to $176 high. So as you can see, it’s almost a $15 higher level from the current share price. This is expressed through the average targets. 29 out of 32 analysts have either a “BUY” or an “Outperform” rating on the company.

This company is a massive “BUY” here, as I see it. It has an upside of no less than 20% here – and potentially up to 30%+ per year.

Thesis

The current FIS thesis is as follows:

- This great business is now at what I would consider being significantly undervalued. The company’s near-term future growth prospects, as well as the current option possibilities, make this a firm “BUY” for me.

- The company’s fundamentals are absolutely stellar – and I expect plenty of growth from FIS at this time.

- with a 2% yield and BBB credit rating, this company is sound – it’s not a high yielder, but it’s nonetheless a company that will continue to deliver Alpha, as I see it.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

FIS is a “BUY” here with a 20-30% upside due to undervaluation.

Here are my criteria and how the company fulfills them.

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Be the first to comment