Thinkhubstudio

|

Dear friends and valued investors,

This letter is coming about a month late. It wouldn’t be a fib to tell you I’ve been unusually wrapped up the past two months, having attended CNBC’s Delivering Alpha conference and the Wolfram Technology Conference, along with other travel. Yet that is not why I put off writing. Nay, this letter has been slow in the making almost entirely because of the level of mental and emotional energy required to write it. In terms of global asset prices, 2022 has been the most challenging market since 2008-09, each bounce meeting further unrest. Nearly every market participant, save short-sellers1, has been humbled.

An investor asked me last December what the outcome might be if inflation were to persist and we returned to Volcker era rates. My answer: a bloodbath. And to a great degree that is what we’ve all witnessed. We just didn’t have to reach Volcker era rates to get there. I wrote and talked about the inflation risk and how rates would have to rise materially. I’d thought we were positioned well, and perhaps we were on a relative basis. But as it turned out, this has been a market interval with nowhere to hide. It’s not that I didn’t imagine the Fed would make a drastic pivot, but that so little was priced into the market as of earlier this year. My sense is the market has fallen too far for many positive cash flow companies, while not far enough for those with the opposite.

Surprisingly, volatility pricing and longer-term interest rates (and inflation expectations) have remained exceptionally subdued year-to-date. In other words, the market isn’t too worried about the medium to longer-range. Or at least not yet.

Increasing ((Rate)) Pain

There is nothing more fundamental in finance than the relationship between interest rates and asset values. Rates are to values as credits are to debits; as temperature is to water. Rates are the hammer. Asset values are the nails. All else equal, asset values act inversely as rates (treasuries) rise or fall. Investors will require (or seek) some return over the risk-free rate—a risk premia.

The most threatening outcome in any economy is a worthless or rapid devaluation of the currency. Hence, higher rates and pain for a period are but a small price to pay for the prospective benefits: a healthy currency, a return of intelligent capital allocation, reasonable interest on savings and treasuries, and so on.

The last couple letters have been of the same aura. Really the bear market began in October or November of last year. We kept waiting on and hoping for a turn in economic and market fortunes which has yet to come. It is difficult at times even for me to keep in mind that price declines were expected all along—we just didn’t know exactly when they would occur. In the midst of those declines, our nature takes over, acting as a (generally) healthy defense mechanism. That is, we extrapolate those losses into the future and make a mental estimate, consciously or not, of how long it will take to be in the poor house. This is healthy. We certainly want to steadfastly assess and reassess if we’re holding assets that will, at minimum, preserve capital and purchasing power over time.

Rough patches are nonetheless inevitable. Even if we were to know, conceptually not literally, that our holdings would perform well five to ten years out, periods of decline remain unavoidable.

As I said in my July post, the key in this moment is, candidly, to make it to the other side:

“The kinds of companies that will hang on are those that produce sufficient cash flow during the ‘storm’ to self-finance operations. The cost of money (i.e., debt and equity financing) gets more and more expensive, and for many firms evaporates entirely. It’s a self-fulfilling cycle where firms able to issue debt or equity during the good times all the sudden need more to fund operations, rollover maturing bonds, or both. One can see how, even with positive cash flows, a company without adequate cash reserves to meet maturing bond obligations could rapidly devolve if not able to issue bonds anew to pay off the old.”

“Ultimate success in markets will always [eventually] go to those with (A) quality holdings and (B) the endurance to hold on. Bear markets and 30 percent +/declines are not out of the ordinary. Neither is the average investor’s tendency to buy and sell at the worst possible times.”2

—Surviving the Tempest, July 2022

We know well by now that this thing isn’t a straight line. Howard Marks, speaking at Talks at GS in June, put it this way:

“It’s really hard to be above average… everything you do in the interest of being above average exposes you to the risk of being below average. You over-weight certain stocks. That’s a potential error. You avoid certain stocks. That’s a potential error. You diversify abroad versus the US. That’s a potential error…. There’s nothing you can do in the interest of being above average that does not expose you to the risk of being below average. So, if you dare to be different, you have to be willing to be wrong… Emotion tends to get us to do the wrong things at the wrong time. And we have to resist that.””ii

It is awfully tough though to avoid throwing in the towel at the wrong time. Yet, reflexivity reckons markets cannot [or will not] turn until a tipping point of capitulation. In other words, until enough investors/traders/managers have thrown in the towel. Recent events have led to many closing up shop,iii with an increasing number experiencing outright ruin.

Assuming we can keep our heads above water, these challenging intervals are catalysts for progress. When I look back to some of our most important advancements, many emerged as the result of head scratching, inquiry, and experimentation, brought about by problematic or tricky times. Hence, confusion is not always a bad thing. Nor silence in its midst. I’d prefer silence and searching to the marketing consultant’s advice of constant communication (with a pretense of knowledge).

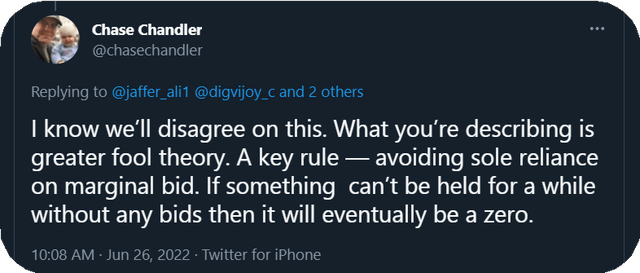

Greater Fool Theory

On June 26th this year, I tweeted the following in response to a friendly discussion on bitcoin: “A key rule—avoiding sole reliance on marginal bid. If something can’t be held for a while without any bids, then it will eventually be a zero.”

On that note, it took less than the span of a cricket match for one of the largest crypto exchanges to go bust. FTX went from an ostensible $30 someodd billion valuation to less than zero in under 48 hours. The company’s assets were primarily in tokens—specifically its own, which could be issued on a whim. That token’s value was, in turn, rooted—lock, stock, and barrel—on what the next buyer was willing to pay.

Now, one might successfully argue that all market values are effectively set by the most recent (or marginal) transaction. True but missing crucial context. What happens when buyers dry up? Can the entity or asset continue to operate (as a ‘going concern’) or at least sit idly by (say, in the case of land) whilst offers are AWOL? If the answer is no, then such asset will eventually go to zero permanently, and in your lifetime.3

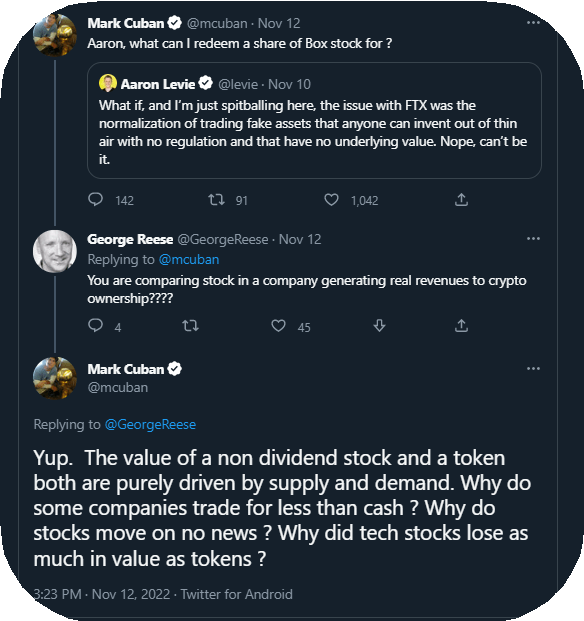

Responding to the FTX drama, the famed shark and Mavericks owner Mark Cuban (who I often agree with) stated that stocks were fundamentally the same as cryptocurrencies and tokens:

“The value of a non dividend stock and a token both are purely driven by supply and demand. Why do some companies trade for less than cash? Why do stocks move on no news? Why did tech stocks lose as much in value as tokens?”iv He went on, “If there is no demand for your shares… what are they worth?”v

By ‘value’ he means price—synonymous with the term ‘market value’ but distinct from true or intrinsic value. Indeed, price is driven by supply and demand. But what happens when demand goes away? In the case of absolutely no market activity, are you left with something that can sit for some period or something that is abruptly worthless? Thus, Cuban’s err is far more than a minor defect of reasoning. It is the rash and reckless generalization of the nuanced; the failure to distinguish mechanics from fundamental principles. In claiming demand is all that matters, he mistakes market activity for value; confuses randomness with accuracy, Brownian motion for precision.

To assert supply and demand (and its offshoot, current market price) is all that matters is to posit—as a first principle—that the inherent character and substance of something is irrelevant. It is to presume the moment’s perception singularly significant, fads alone the crucial factor. And if history informs at all it finds such a view strikingly misguided. Spreading this way of type of naïve view invites fraudulent behavior.

The FTX Problem

A blog post by a senior executive at FTX4 stated the following (emphasis mine):

“I’m not an expert on traditional finance but my impression is that it’s a lot more boring; largely brokers will just try and have margin requirements conservative enough that it’s very unlikely for you to actually lose all your money… If you abstract away the financial details there’s also a question of like, what your utility function is. Is it infinitely good to do double-or-nothing coin flips forever? Well, sort of, because your upside is unbounded and your downside is bounded at your entire net worth. But most people don’t do this, because their utility is more like a function of their log wealth or something and they really don’t want to lose all of their money. (Of course those people are lame and not [Effective Altruists]; this blog endorses doubleor-nothing coin flips and high leverage.)”vi

Just a brief dive into such statements reveals both their absurdity and the importance of a strong statistical grasp for anyone in capital markets. Betting the farm on a 50-50 coin flip more than a handful of times quickly converges to a greater than 95% chance of losing it all. To visualize this, imagine the odds of landing five consecutive heads. What are the chances the coin lands in your favor every single time? If you were to do this experiment a hundred times, you’d find success in, give or take, three occurrences.vii This is the most fundamental and simple of probability questions.

Further, the executive states your downside is bounded to your net worth before explicitly endorsing “high leverage.” One who has invested x dollars with 90% borrowed, they do not miraculously evade the obligation if the x goes to zero. Aside from personal bankruptcy (which comes with its own costs5), they will be using future income to payoff today’s horrendous bets.

Flows

The preceding discussion should not be taken to imply marginal bids and market activity as unimportant. They certainly are, to the extent one cares about market prices. And one would certainly care about market prices at the time they need to liquidate (sell) the relevant asset. True value, or what something is justifiably worth on a discounted basis, converges with market prices in the long term. In the here-and-now—at each infinitesimal moment—it’s all about liquidity and fund flows.

The question is, who is going to sell and why? Forced selling drives down prices. Panic sets in. Fear sets in. Prices fall more. Levered asset holders must sell to meet margin calls. Panic turns to irreversible devastation. This spiral occurs, as my father-in-law would say, with amazing regularity. The only question that really matters is, will what you hold in these moments be permanently worthless or not?

Conclusion

In conclusion, I want to thank you again for your trust and fortitude. This is not an easy time to be an investor. But that’s the expectation. When has it ever been easy, except in hindsight? Let us make the best decisions we can with the information we have at the time—never relying on fads, nor trends, nor arguments from authority.

“People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game.”

“Remember, things are never clear until it’s too late.”

—Peter Lynch

All the best,

B. Chase Chandler | Founder & Chief Investment Officer

Footnotes1 To illustrate the difficulty of short-selling, Stanley Druckenmiller speaking at Delivering Alpha told the story of Jesse Livermore, “the greatest shortseller ever.” Livermore made $100 million during the 1929 crash. Then a few years later in the mid-1930s, apparently having lost it all, jumped off a Manhattan building. 3 Nitpickers would point out, gleefully imagining they’ve caught a logical error, that eventually all assets go to zero. This is nothing more than fuzzy thinking as it tosses out such important context as to be a worthless statement. Sure, all assets will go to zero, say when the world ends. But the objective is to be invested in that which will be around long enough to serve its intended purpose. 4 For the sake of brevity, I will avoid detailing the intertwined and (apparently) fraudulent network of FTX related entities. 5 Both personal and financial (e.g., cost of starting over). Referencesi Howard Marks, co-chairman of Oaktree Capital Management. Goldman Sachs. (2022, June 29). website: https://www.gold-mansachs.com/insights/talks-at-gs/howard-marks-2022.html, https://www.youtube.com/watch?v=wkJXQ46ma8I ii Ibid, iii https://www.bloomberg.com/news/articles/2021-11-11/hedge-fund-perma-bear-clark-surrenders-to-historic-bull-market,https://twitter.com/INArteCarloDoss/status/1580950227527180288 iv https://twitter.com/mcuban/status/1591542216652095494 v https://twitter.com/mcuban/status/1591832439550533635 vi https://forum.effectivealtruism.org/posts/j7sDfXKEMeT2SRvLG/ftx-faq; https://twitter.com/0xHonky/status/1591630071915483136 vii https://socratic.org/questions/you-toss-5-coins-what-is-the-probability-that-all-5-show-heads |

DisclosuresCanterbury Tollgate (“CTG”) is a dba for Weise Risk Advisors LLC, a Tennessee registered investment adviser, and the general partner for CTG Fluxion, LP. Information presented is for discussion and educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. While CTG believes all information herein is from reliable sources, no representation or warranty can be made with respect to its completeness. Any projections, market outlooks, or estimates in this presentation are forward-looking statements and are based upon internal analysis and certain assumptions, which reflect the views of CTG and should not be construed to be indicative of actual events that will occur. As such, the information may change in the future should any of the economic or market conditions CTG used to base its assumptions change. The description of investment strategies in this presentation is intended to be a summary and should not be considered an exhaustive and complete description of the potential investment strategies used by CTG discussed herein. Varied investment strategies may be added or subtracted from CTG in accordance with related Investment Advisory Contracts by CTG in its sole and absolute discretion. Any specific security or investment examples in this presentation are meant to serve as examples of CTG’s investment process only. There is no assurance that CTG will make any investments with the same or similar characteristics as any investments presented. The investments are presented for discussion purposes only and are not a reliable indicator of the performance or investment profile of any composite or client account. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable. Any index or benchmark comparisons herein are provided for informational purposes only and should not be used as the basis for making an investment decision. There are significant differences between CTG’s strategy and the benchmarks referenced, including, but not limited to, risk profile, liquidity, volatility and asset composition. You should not rely on this presentation as the basis upon which to make an investment decision. There can be no assurance that investment objectives will be achieved. Clients must be prepared to bear the risk of a loss of their investment. Any performance shown for relevant time periods is based upon a composite of actual trading in accounts managed by CTG under a similar strategy. Except where otherwise noted, performance is shown net of management and incentive fees (where applicable), and all trading costs charged by the custodian. Performance of client portfolios may differ materially due to differences in fee structures, the timing related to additional client deposits or withdrawals and the actual deployment and investment of a client portfolio, the length of time various positions are held, the client’s objectives and restrictions, and fees and expenses incurred by any specific individual portfolio. Dividends and other cash distributions are not automatically or directly reinvested in securities held by CTG. CTG results before October 2020 are unaudited, shown net of management fees, and represent portfolio holdings for the aggregate of discretionary separately managed portfolios with assets greater than seven hundred and fifty thousand USD at the start of the period. Results during this period were calculated using third-party software (Clearing Brokers’ Portfolio Analyst) and may not reflect individual account or investor results. Returns will vary depending on date of investment, type of account, and investor preferences. Non-discretionary accounts, ETF, and index allocations are not included in performance results. Beginning October 2020, CTG Fluxion, LP results are shown net of management fees and performance allocation accruals as estimated by the fund’s administrator, Yulish and Associates. Results shown are unaudited. CTG Fluxion, LP and Weise Risk Advisors, LLC dba Canterbury Tollgate are each required by relevant securities regulations to be audited. CTG Fluxion, LP began its initial custody audit in late December 2020. Investing involves risk, including possible loss of principal. Past performance is not a guarantee of future results. Information presented is believed to be accurate but may contain errors. These materials are confidential and may not be disseminated without the prior written consent of Canterbury Tollgate. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC, and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. Russell, Russell 1000®, Russell 2000®, Russell 3000® and Russell MidCap® are registered trademarks of the Frank Russell Company. MSCI, and the MSCI index names are service marks of MSCI Inc. (“MSCI”) or its affiliates. Neither MSCI, its affiliates nor any other party involved in, or related to, making or compiling any MSCI index makes any representations regarding the advisability of investing in such Index Contracts. Neither MSCI, its affiliates nor any other party involved in, or related to, making or compiling any MSCI index makes any warranty, express or implied, or bears any liability as to the results to be obtained by any person or any entity from the use of any such MSCI index or any data included therein. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment