tonefotografia/iStock via Getty Images

Investment Thesis

Align Technology (NASDAQ:ALGN) is the leader in its industry. Its number one product is its Invisalign transparent aligner which is used to straighten people’s teeth and is a popular alternative to traditional wired braces because the aligners are less noticeable. Fueled by Invisalign’s popularity, ALGN has rapidly grown revenues for the past few decades. However, the current uncertainty of the macroeconomic environment has hurt ALGN financially, and as a result, the stock has dropped 71% year to date. ALGN’s share price compares favorably to the multiples the market has paid for the stock over the past few years. However, ALGN is still too expensive for me, and there are better opportunities elsewhere.

Business Description

ALGN is headquartered in Tempe, Arizona, and employs 24,020 people in the Health Care Supplies industry. ALGN is in the business of straightening people’s teeth, and they are most known for their Invisalign product which is an alternative to wire braces that most of us dreaded in middle school and high school. Invisalign technology uses transparent aligners that consumers use to straighten their teeth. Through Invisalign, ALGN is the leading company in clear dental aligners.

The process is easy and only requires two steps. Step one, you set up an appointment with an Invisalign Doctor. By using ALGN’s iTero Element scanner, the doctor will take a quick and accurate 3D digital scan of your teeth and map out a personalized treatment plan just for you. Step two, you begin transforming your smile. You will receive your first batch of aligners and meet with your doctor to ensure they fit correctly. Your doctor will schedule subsequent check-up appointments to evaluate your progress and give you your next batch of aligners. The Invisalign aligners are almost completely transparent and easy to remove when brushing your teeth and before eating meals. The treatment timelines vary from patient to patient, but you can start seeing results in the first few weeks, with some cases resolved in as little as six months. So, if you’re interested in straightening your smile without setting off a metal detector, click here to get started.

Most of ALGN’s sales come from the United States, followed by Switzerland and China. ALGN organizes its operations into two reportable segments: the Clear Aligner segment and the Systems and Services segment. The Clear Aligner segment is made up primarily of Invisalign products. In contrast, the Systems and Services segment includes the iTero intraoral scanning system, used for orthodontic treatment and restorative dental procedures. The majority of ALGN’s revenues come from the Clear Aligner segment, which reported revenue of $732.8 million last quarter ending September 30, down 12.5% from the same quarter the previous year. The Systems and Services contributed $157.5 million in revenue last quarter, which decreased 11.7% from the same quarter the previous year.

What’s The Story

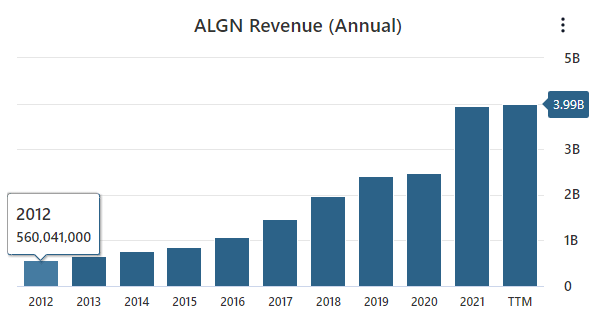

Over the last decade, ALGN has done an excellent job of increasing its revenue. Back in 2012, ALGN had $560 million in revenue. It took ALGN four years to double its revenue, with over $1 billion in sales in 2016. Then ALGN needed just three years to double its revenue again in 2019, with over $2.4 billion in sales. ALGN has continued to grow its revenue rapidly, with $3.99 billion over the past 12 months. This top-line data tells us that ALGN is a classic growth stock that doubles its revenues every three to four years, so ALGN’s products make its customers smile, and its revenue growth makes its investors happy.

Data by Stock Analysis

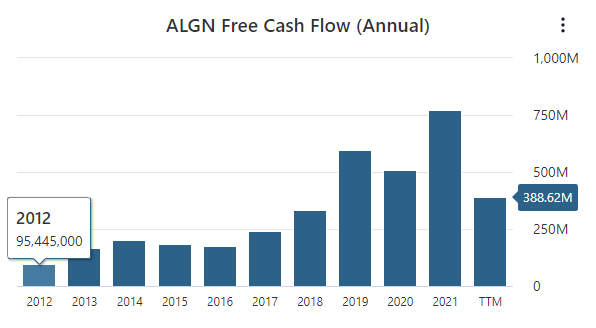

ALGN’s top-line growth looks great. However, the company has also done an excellent job generating free cash flow. From 2012 to 2021, ALGN grew its free cash flow from $95.4 million to $771 million, which is over 700%.

Data by Stock Analysis

This level of growth is phenomenal; however, over the past 12 months, ALGN’s free cash has dropped by 50% from 2021 levels. As a result, ALGN’s share price has collapsed, dropping 71% year-to-date, and things do not appear to be improving. For example, ALGN badly missed expectations on the most recent earnings report. ALGN reported an EPS of $1.36, which missed by a staggering $0.81. In addition, ALGN reported revenues of $890 million, which was also a wide miss by $82.6 million. Management blamed the poor results on continued macroeconomic uncertainty, weaker consumer confidence, and unfavorable foreign exchange rates across currencies.

These results are bad, but I am not worried much about current macroeconomic trends or weaker consumer confidence as a long-term investor. Most companies are affected by these negative trends to some degree. Cyclical companies are affected more than consumer staples by bad economic conditions, but times of poor economic conditions are an inevitable part of investing. Therefore, if the only thing wrong with a business is that the macroeconomic outlook is terrible, and I believe that the company will be earning significantly more in ten years than it is today, then I think of this as a buying opportunity. Stocks are one thing that many people are hesitant to buy when they’re on sale, and judging by ALGN’s 71% price drop this year, it appears to be on sale.

Unfortunately, there are more concerns for ALGN’s business than just macroeconomic uncertainty and weaker consumer confidence. ALGN invented clear aligners with its Invisalign product and secured a patent that helped ALGN dominate the market for decades. As we know, though, eventually, patents expire, ALGN’s patent expired in 2017, and competition in this industry has increased. Increased competition in an industry is something to be concerned about, especially if the competitors offer lower pricing. Then again, competition can be a good thing because it forces companies to innovate and avoid complacency. From the charts above, ALGN has handled the increase in competition pretty well since it lost its patent in 2017.

Opportunities for Growth

As I mentioned in the previous section, sometimes an increase in competition can be good because it forces innovation, and ALGN appears to be innovating. During the last quarter, ALGN launched several new technologies that they believe will strengthen the Align Digital platform. These technologies include ClinCheck live update software, Invisalign Practice App, Invisalign Personal Plan, Invisalign Smile Architect, the Invisalign Outcome Simulator Pro with in-face visualization, Cone Beam Computed Tomography integration with ClinCheck software Invisalign, virtual AI software and iTero-exocad Connector. This is a lot of new technology, but ALGN is attempting to lead a digital revolution within the Orthodontics industry to help their doctor customers deliver the best experience possible to their patients.

In Q3, ALGNs Systems and Services segment reported an 11.7% decline in revenues, year over year. On the surface, this doesn’t look good, but there is a silver lining. The 11.7% decline year over year was primarily caused by lower scanner volume. This makes sense because a scanner is a large purchase, and businesses often postpone larger purchases during economic uncertainty. The silver lining is the Systems and Services revenue was partially offset by higher services revenue from its larger installed base. That means that ALGN doesn’t just make money from selling the iTero Scanners but also offers subscriptions for services that iTero customers can subscribe to. Therefore, this recurring revenue stream grows as the iTero install base grows.

This is an excellent business model and is the same business model that Apple (AAPL) used to become the largest company in the world. Is it fair to say that ALGN is the AAPL of orthodontics? This may be a stretch, but ALGN’s Systems and Services business has been growing fast. Over the past three years, it’s expanded its System and Services revenue by 156% while its Invisalign business grew 92%.

Valuation

To estimate ALGN’s intrinsic value, we will run a comparative analysis based on ALGN’s 5-year average P/E ratio multiplied by its current earnings. Since it’s best to use multiple valuation methods to find a stock’s intrinsic value, we will also run a discounted cash flow analysis on ALGN. We will begin with the comparative analysis and look at a few different scenarios, including the bull case, bear case, and base case, based on ALGN’s P/E ratio over the past five years.

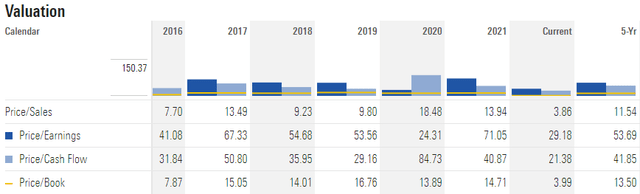

ALGN Data by MorningStar

ALGN’s average P/E ratio over the past five years has been 53.69. This figure multiped ALGN’s next year’s average earnings estimate of $8.22, gives us a base case intrinsic value of $441.33. The highest P/E ratio the market has paid for ALGN over the past five years was 71.05 in 2021, while the lowest multiple paid for ALGN was 24.31 in 2020. Applying these multiples to ALGN’s next year’s earnings estimate gives us a bullish intrinsic value of $584.03 and a bearish intrinsic value of $199.82. The last scenario we’ll look at is if the market values ALGN at its sector median P/E ratio of 24.73. This multiple applied to ALGN’s next year’s earnings estimate gives us an intrinsic value of $203.28.

The table below shows a breakdown of these scenarios. As you can see, at ALGN’s current share price, all four scenarios give investors a positive return.

| Scenario | P/E | Next Year’s Earnings Estimate | Intrinsic Value Estimate |

% Change |

| Bear Case | 24.31 – ALGN’s P/E in 2020 | $8.22 | $199.82 | 3.11% |

| Base Case | 53.69 – ALGN’s 5-year average P/E | $8.22 | $441.33 | 127.74% |

| Bull Case | 71.05 – ALGN’s P/E in 2021 | $8.22 | $584.03 | 201.38% |

| Sector Median Valuation | 24.73 | $8.22 | $203.28 | 4.90% |

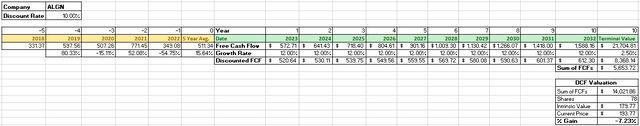

Moving on to the DCF analysis, we’ll take the average of ALGN’s trailing 12-month free cash flow and the last four years of free cash flows, which is $547 million. ALGN will be a fast-growing company over the next decade, so we’ll use a 12% growth rate for the next 10 years. Then to figure out the terminal value, we will use a growth rate of 2.5% into perpetuity. Finally, we will use a discount rate of 10%. With these inputs, we land at an intrinsic value of $179.77 per share for ALGN. This would give investors a -7.23% gain from the current share price. That’s not a great return, but considering the upside seen from the comparative analysis, ALGN has more upside than downside.

Author’s Work

Summary

ALGN is an excellent company with fantastic products and an outstanding business model. Competition within the transparent aligners industry is ramping up, but so far, ALGN has maintained its top spot. It’s been a challenging year for ALGN. Still, due to the current macroeconomic uncertainty, weaker consumer confidence, and unfavorable foreign exchange rates across currencies and as a result, ALGN’s share price has dropped 71% year to date. I expect ALGN to recover well when the macroeconomic environment improves. I believe ALGN’s Invisalign product will resume rapid growth in the coming years as it takes a share away from traditional wired braces. I also expect ALGN’s Systems and Services business to return to growth, led by its iTero scanners sales and amplified by the services revenues accompanying it. There’s a lot to like about ALGN’s business but overall, at a 29 trailing P/E, ALGN’s stock is just too expensive for my taste, but if you disagree, please let me know in the comments section below.

Thank you for reading!

Be the first to comment