peshkov/iStock via Getty Images

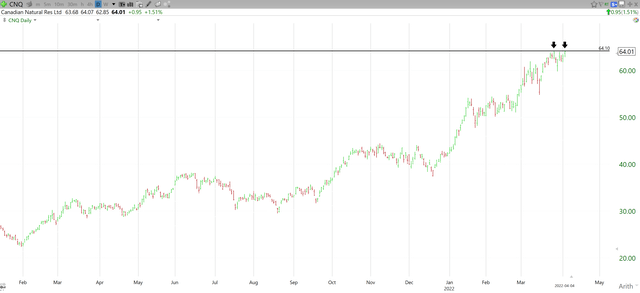

It seems like the oil & gas picture gets better and better every day lately. At least if you are invested in the great Canadian producers like Canadian Natural Resources (NYSE:CNQ). As we just got word on the average oil price for March coming in at over $100, and estimates out of the EIA calling for an even higher average in Q2, investors are paying attention. Mix that with record cash flows, record dividend increases, and a buyback plan that could see 10% of the outstanding shares get gobbled back up in one year, and you have yourself a bull case. Canadian Natural is at all-time highs and going higher.

Where Does Canadian Natural Go From Here?

Higher. If you saw the news the last couple of days, WTI averaged just under $110 in March. Who saw that coming? We saw Canadian Naturals stock rise 15% and climb to all-time highs in the same period. Once we dive into the free cash flow story and how it’s being distributed, you will wish you had some Canadian Natural in your account.

The big question is how long does this last? Well, in mid-March the EIA put out that they expected WTI to average $113 in March and $112 for the second quarter of 2022. Well, the second quarter is officially underway. I don’t even want to try and predict how it shakes down, but the macro issues are still at large. You would expect a flurry of new rigs showing up all over North America so these “greedy” oil companies can rake in the profits. Well, rig counts are essentially flat over the last month. Mix that in with all the geopolitical issues going on in the world, and you get a simple supply/demand problem that drastically benefits producers like Canadian Natural.

That said, we are expecting to see some production growth out of Canadian Natural in 2022. We are expecting to see ~60,000 BOE/d. Which at the end of the day isn’t going to have much of an impact at all on the price of oil. This will take CapEx to $4.345 billion, with $700 million of that tagged for strategic growth. As for what we can expect for free cash flow, the estimates are all over the place. That’s thanks to the oil price. I’ve seen numbers as high as $25 billion. While I think $14-18 billion is more realistic, the change is still drastic. We are only one quarter into 2022 and a lot can happen between now and then, but if we do see $100 oil stick around all year, we could easily see $20 billion in free cash flow. That’s great news for shareholders concerning dividends and buybacks.

How’s The Dividend?

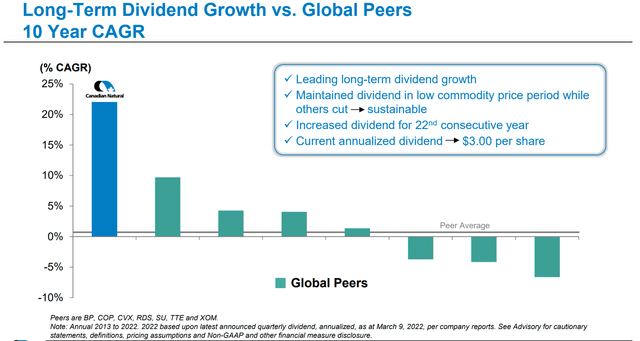

Growing, at record rates. The bad news is that the share price is as well, so the actual yield isn’t anything crazy. But it’s healthy!! We saw a 28% increase come through on March 2nd. This took the quarterly dividend to $0.75 and we should see a roughly 4% yield at the end of the day. Not too bad. What’s more impressive is that this is the 22nd straight year with a dividend increase. If you have been around the industry for the last 15 years, you’ll know how volatile it has been. That speaks to management’s commitment to returning cash to shareholders.

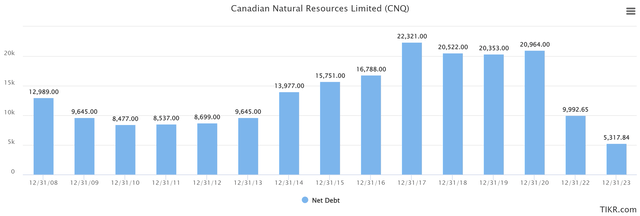

It’s been easier said than done. Looking above you will see the company’s Net Debt over the years. For 2021, the reported $14 billion. The lowest amount since 2014, and a ~$7 billion haircut from 2020. This dragged the debt below the $15 billion threshold which is great news for shareholders. Obviously, this is only possible with the kind of oil prices we are seeing. But, they aren’t done yet. This now means 50% of free cash flow is going towards debt repayment and the other 50% will go to share repurchases. They are not currently focused heavily on acquisitions, but that could change should an opportunity present itself. There will be no shortage of funds to go around.

As far as what to expect in repurchases in 2022, it’s hard to say exactly. In 2021 we saw $1.6 billion committed towards it. Combined with the dividend it came to $3.8 billion. If we see free cash flow of $14 billion, that would mean shareholders are going to expect to see potentially $7 billion come their way. While Canadian Natural cannot come out and say that’s what’s going to happen now, the potential is crazy, and this is only the beginning.

What Does The Price Say?

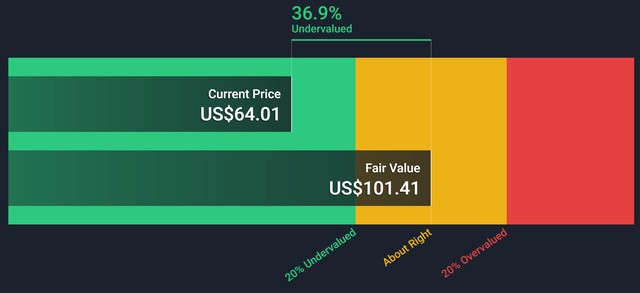

Yet another couple of months have passed, and the story hasn’t changed. Even though the stock is up $11-ish since I last wrote on it in early February, the fair value has jumped up over $15. Why is this happening? Well, it comes down to the cash flows increasing with oil averaging what it did in March. Canadian Natural is at all-time highs and there is still lots of room to go from here.

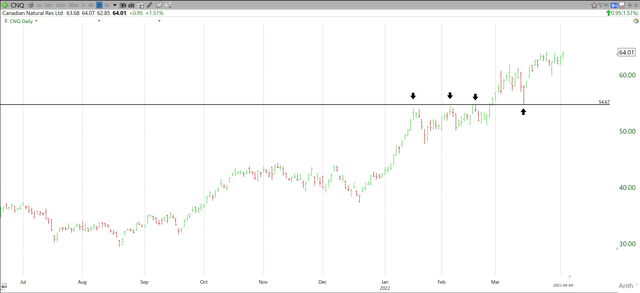

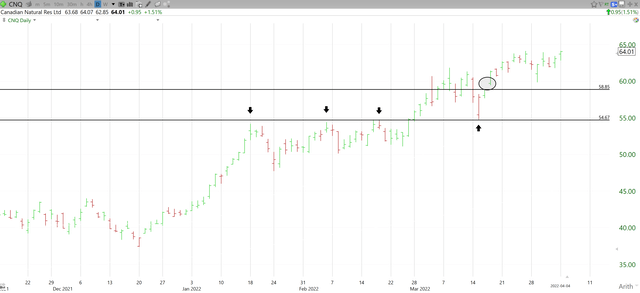

The move to new all-time highs has played out almost perfectly. I had a target of $54.67 which was the mark to beat. Looking below, we can see we had a triple top rejection. Which is pretty bearish. But a powerful couple of late February days later, and we were once again at new highs. Then, the best possible scenario played out. We rallied for a few more days, before finally falling 10.5% in two days, to what level… $54.78. The stop held in, and we were at new highs again within 4 days. So where do we go from here? Let me dive into it.

On any type of pullback we see, I would be looking for $58.85. Looking below we can see why. There was a gap left here, and I would like to see it get filled sooner than later. Many technical traders will use gaps as targets or stops and this getting filled could once again increase further optimism in Canadian Natural. This is about 8% of current levels. I would place a stop just below here on a good majority of the position and keep the other stop at $54.67. As we continue to blast into uncertainty, protecting capital becomes the number one game.

As we make another run at a new all-time high, the current mark to beat remains $64.10. Where do we go from there? $70? $80? I think both are potentially in play. $70 is only another ~10% from here and the company would still be undervalued heavily there based on cash flows. I do think we could see another pullback here especially if we can’t get a push to new highs this week. But what I can assure you of, is that this party isn’t over. There is way too much money being made by these companies for the re-rate to not continue.

Wrap-Up

As you can see, there is a lot to like about what is happening in the energy space right now. Especially with regard to companies like Canadian Natural. No, it’s not too late to get in. I would recommend waiting for a dip, but we are set to see some pretty incredible shareholder rewards coming down the pipe over the next couple of years. With there being minimal risk at this point given the companies aren’t increasing production and CapEx at crazy rates, you can sit back and collect the money. I still recommend using stops as the geopolitical picture can change in a second, but the macro, long-term picture still reads very bullish on oil & gas.

Be the first to comment