PhillDanze/iStock Editorial via Getty Images

On Thursday, April 28th, technology giant Apple (NASDAQ:AAPL) will report its fiscal Q2 results after the bell. Everyone will be looking if the company can keep its impressive business strength going on the heels of the 5G iPhone upgrade cycle. However, this quarter’s report also gives investors an annual update on the company’s massive capital return plan. Today, I’ll provide my expectations for what I believe we’ll see in about three weeks.

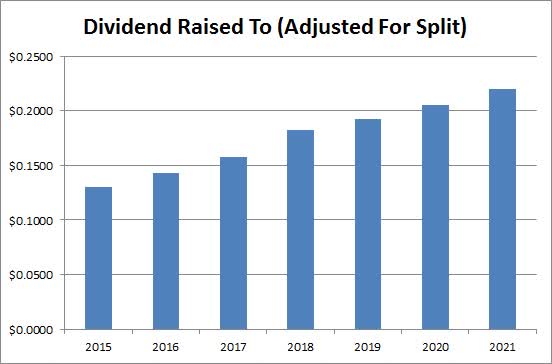

Let’s first start with the quarterly dividend. Apple has steadily grown the payout over time as the chart below shows. However, some investors have been disappointed over the years as the company could have done a lot more, and total cash payouts haven’t risen that much. More so in this case, the dividend raise has been related to the share count reduction, which I’ll get to in a bit. The numbers below represent the raised amount for that respective year, so for instance last year the payout was raised to $0.22 per quarter.

Apple Dividend History (Seeking Alpha)

Over this six-year period, the split-adjusted dividend rose from $0.13 a quarter to $0.22. That’s an average of a penny and a half each year, and the last three years have all seen increases in the mid-single digits, with 2021’s increase of 7.32% being the highest of those three. The annual yield sat at just 0.49% as of Monday’s close, which is down a bit from the 0.67% figure seen when I did my preview last year. This yield also looks much less impressive when you consider how much fixed income rates have risen over the past year.

When looking at a potential dividend raise, the first thing I look at is the company’s cash situation. As I discussed in my latest Apple earnings article, quarterly free cash flow for the ever-important holiday period soared by more than 25% to over $44 billion. The company is on pace to start delivering $100 billion in annual cash flow rather soon, and there was a net cash balance of about $80 billion at the end of the latest quarter. With dividend payments being a little less than $15 billion a year currently, there is still plenty of room for an increase in the quarterly payout.

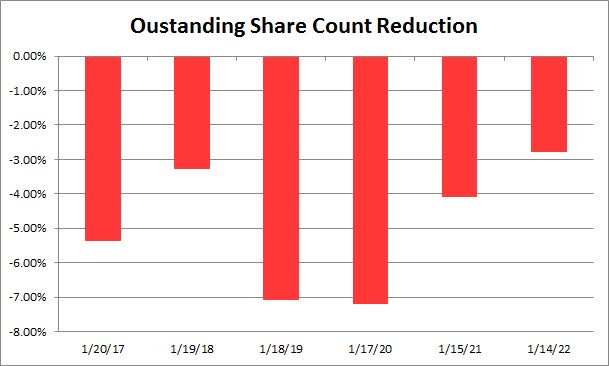

For Apple though, the more important item to look at for a potential raise is how the share count has trended. Over the years, management and the board have favored the buyback, so we haven’t seen any really dramatic dividend increases. In the chart below, you can see how Apple’s outstanding share count has come down for a rough 12- month period in recent years, based on the date given in the fiscal Q1 10-Q filings.

Apple Share Count Reduction (Apple Quarterly Filings)

The share count came down by less than 2.8% over the most recent twelve-month period. That wasn’t due to a lack of spending on the buyback, but because shares surged towards a $3 trillion valuation. A smaller decline in the share count would mean a lower dividend raise if the board is targeting a certain dollar value of overall cash payouts. On the flip side, investors might wonder if the high valuation of AAPL stock should mean less money going to the buyback and a little more to the dividend.

The business itself is doing quite well, with expectations calling for revenues and earnings per share to rise nicely in the coming years. Apple took advantage of the 5G upgrade cycle with the iPhone, and the services business continues to head towards being a $100 billion annual revenue generator. In addition to the current product lines, consumers are looking for Apple to potentially enter new markets in the coming years, such as AR/VR headsets, an electric car, more wearables, etc. By the fiscal year ending in September 2026, the street sees Apple topping half a trillion dollars in annual revenue.

As of Christmas 2021, Apple had $40.5 billion left on its total buyback authorization according to the 10-Q filing. If we assume a normal quarter like we’ve seen recently, about half of that will be used up for the March 2022 fiscal period, which would also mean the buyback has topped $500 billion since its start about a decade ago. Last year, we saw another $90 billion authorized from the board. With management spending a little more than $20 billion a quarter currently, I’m expecting that we’ll see at least another $75 billion announced in late April to get the company through the next 12 months.

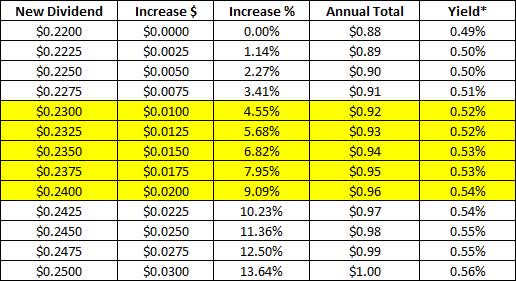

As my readers know, I provide a prediction table each year to show what a potential dividend raise could look like. That graphic can be seen below, with my personal prediction range in yellow. As we’ve seen in past years, I think we’ll see another slow and steady raise, probably in the mid-single digits. Since we’ve averaged a split-adjusted penny and a half raise per year over the past six years, I’m going to say that’s the likeliest outcome here as well. Perhaps investors could get a little more if the board wants the dividend increase to be more than the current US inflation rate.

2022 Dividend Raise Prediction Table (Author’s Estimate)

*As of Monday’s close.

In the end, we should be just a little more than three weeks away from Apple raising its quarterly dividend and announcing increase to its buyback program. As the technology giant continues to produce massive free cash flow over time, it is rewarding investors with the best capital return plan on earth. I understand that some may be disappointed with the low dividend yield, but the buyback has really helped the stock as well as earnings per share over the years. Throw in some decent expected revenue and income growth over time, and Apple will likely remain a favorite moving forward.

Be the first to comment