JHVEPhoto/iStock Editorial via Getty Images

Dear readers/Followers,

Canadian banks are a great investment – and CIBC, or Canadian Imperial Bank of Commerce (NYSE:CM) is definitely among them – if you can manage to buy the bank at the right sort of price. My own investments tend, historically, more toward Scotiabank (BNS) and Toronto-Dominion (TD) – but lately, I’ve also been pushing capital to work in this bank, and intend to continue to do so.

In this market, I’ve shifted significant capital and allocated fresh capital toward finance companies. Not just banks, but insurance shops, credit management, credit risk shops, and financial consulting companies. The reason? These companies and businesses usually see significant upsides from interest rate shifts when they go north – and they tend to be more stable than people expect (with the exception of the financial crisis).

Revisiting CIBC

When looking at CIBC, we have to remember that it’s part of the nations “top 5” banks, and one that’s been improving its operations for several years and is now reaping, slowly, the rewards of such work.

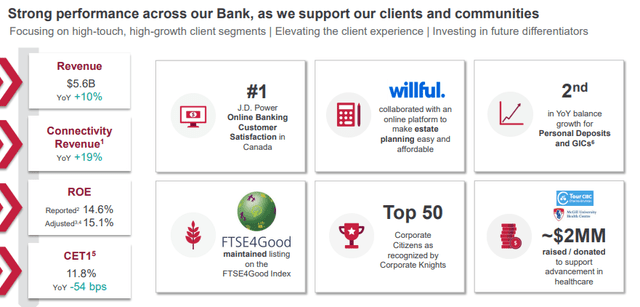

What i mean by this is that CIBC, at a high level, performed very well.

Despite a slight drop in adjusted EPS, the company’s overall reported earnings were up, the RoE was stable, revenue was up double digits, and operating leverage turned negative on an adjusted level. The company has a CET-1 above the required level, and we’re starting to see some of the positives as interest rate margins turn around to the bank’s favor.

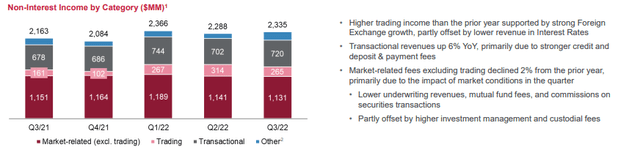

NII was up 14% in one quarter alone, and trading revenue was up 19%, showcasing strong flows across both fee-driven and interest-rate driven segments. The bank’s positioning form a rising environment is superb, and NII is set to rise by over $350M for every 100 bps of interest rate bump we see. Much of the company’s deposits are a positive as well, and CIBC expects a year-2 benefit of approximately $786M, driven by long rates.

Rising interest rates also don’t mean that fee-based businesses are down – they’re actually up.

There are of course negatives for the bank as a result of the current environment as well. Costs are up – around 9% YoY, from increases in operating costs, investments, and comp – but not enough to really de-rail the company’s growth targets.

The company’s various segments are performing very well. Personal & Business banking is seeing massive NII growth of close to 20% due to a favorable mix, loan balances are up 12%, deposits are up 9%, and credit loss provisions remain at a very low overall level. Canadian Commercial & Wealth banking is seeing even better results, with volume growth and loan balances showing NII of 32% increase, loan and deposits up 21% and 14% respectively, and fee-based income up 3%. High-net-worth individuals are still using CIBC, and the trends here are looking good.

The US-based business is also delivering decent results, with a 12% increase in NII, loan balances up 16%, and deposits up 6%. At the same time, the bank is seeing higher management fees and market depreciation, delivering a decline in AUM.

As the last segment, capital markets are still growing supported by strong trading, corporate banking, and other trends. CIBC is as stable as things get in Canadian banking, despite what you’re seeing in the company’s share price. CIBC has a solid balance sheet, very good top-line momentum and results, and good management proven over time.

The signs coming out of CIBC when looking at the high level, and the company’s various lending and deposit portfolios are not worrying to me. CIBC is a bank that’s 56% exposed to secured RE lending, with only a very slight 10% exposure to commercial real estate, almost no automotive, cars, or personal, and 37% government lending. The majority of the bank’s portfolio is tied to mortgages at 45% or below LTV values, meaning very high-quality loans.

This is also visible in the company’s overall credit quality, which is seeing impaired loan ratios down despite the environment, coming in at less than 0.35% for the quarter.

This quarter was another solid quarter for the business. CIBC remains A+ rated, remains at a 5%+ dividend that’s more than covered by a less than 50% adjusted EPS payout ratio, and with current forecasts solid, if not expecting massive growth or more than 3%, as some banks are.

However, if you think about it and consider that most Canadian banks at this time are trading below their 5-year or 10-year P/E average, you could conceivably construct a portfolio with top Canadian banks yielding 5-6% with a conservative upside in the double-digits, based on very conservative forward valuation estimates. This is not to be underestimated.

I still believe it fair to say that CIBC has performed well during difficult conditions, and I view it as likely that the company’s results and trends, going forward, will improve on the background of increased interest rates. We’ve already received initial confirmation of such trends in double-digit net interest income growth during this quarter.

Banks such as CIBC and financials overall are among the more appealing investments available in such an environment. That’s why I’ve been pushing money to work not only in CIBC but in Scotiabank, Allianz (OTCPK:ALIZY), Munich Re (OTCPK:MURGY), Zurich Insurance (OTCQX:ZURVY), Lincoln National (LNC), Manulife (MFC), Hannover Re (OTCPK:HVRRY) and others. I believe the combined high yield upside with interest rate increases will deliver the double-digit growth that I am looking for.

Let’s look at the valuation and see how this currently looks when we see 3-5 year forward.

CIBC – The valuation

The case for Canadian banks is relatively simple, which is a stance I’ve taken in many of my previous articles on them, and which is fairly easily backed by looking at their 20-year valuation ranges and prices.

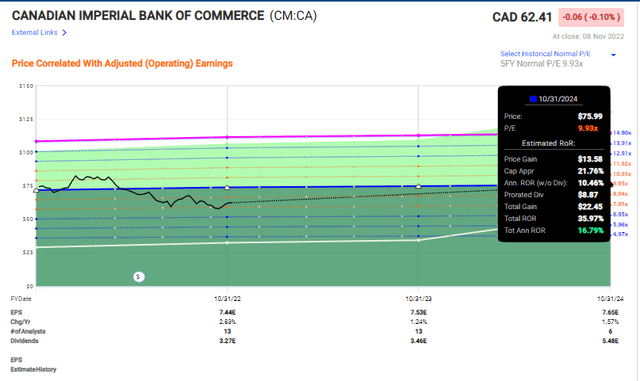

They all trade at a P/E discount average of around 9-11x, and they typically are good buys with good returns at these levels over time – and not good investments when the valuation moves higher and higher.

If you buy the company at valuations of 11.5x or above, your returns will stick around 3-8% annually – modest, but at times market-beating. But if you buy the company below 10x on the other hand, that “BUY” can turn into some serious market-beating RoR, while being safe with a BBB+ to A-rated major bank in one of the safest nations on earth.

CIBC doesn’t have the highest upside of banks today. That honor goes to BNS – which is also why I invest more in BNS than I do in CM. But CM’s upside is to an even lower conservative multiple – just below 10x – and it’s still over 16% annually.

Many of my readers want safety coupled with high yield – it’s the most common request I get. “I want a good yield, over 5%, but I don’t want to take any risks”.

Well, I argue this is some of the closest you can get to that desire. You’re getting a 5% yield back by A+ credit, or by 37%+ government loans and credits. Banks with this sort of mix and exposure, it doesn’t get much “better” than that if you buy them cheap.

Furthermore, CM has a high tendency to actually beat earnings estimates by more than 10%, 38% of the time for the past 13 years. This gives you the potential not of 16% but of over 20% annual RoR if things go that way again.

I repeat – the potential returns are impressive here. This is the thing about valuation investing.

Investing in safe companies with an IG rating can result in an RoR of almost 140% in less than 7 years if you invest at the right valuation. That’s more or less what I’ve been doing since I started investing many years ago.

That’s exactly the position CM currently is in, and why I’m saying and taking a strong “BUY” stance here.

Pick the undervalued companies – hold them till overvaluation, then either continue to hold or rotate them into new, undervalued quality businesses. Rinse and repeat as necessary and as possible considering your capital and income. It’s simple, and there’s really not that much, as I see it, the long-term risk involved.

As long as you can “BUY” CIBC below 10x P/E, I view it as a safe overall bet with a double-digit potential long-term upside.

The analyst PT for CM here is $75/share for the Canadian ticker, which still implies a significant upside of 20% here. That’s also a bit too rich for me, and i would somewhat adjust this closer to $70/share for the long term, which still gives us a very decent overall upside. Anything below a 10x P/E is a “BUY” for me on CM.

The coupled yield and long-term reversal upside means that I’m positive on this bank, and I do expect CM to outperform over the next few years, delivering safety and good yield to its investors.

This leads me to my current thesis.

Thesis

My thesis for CIBC is:

- A solid, fundamental Canadian bank with excellent upside at no more than $70/share, preferably below this. CIBC is one of the more conservative portfolios and exposures on the market with over 36% government credit/loans and a 50%+ secured RE mortgage portfolio, I view this as one of the better investments in the sector that can be made.

- Given the company’s latest valuation trends and decline, my thesis is now changed.

- At the current price, it’s a “BUY” to me. I now view the risk of a downturn as smaller than before, and the upside as more significant.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment