Back To The Future With Papa Dow rarrarorro/iStock via Getty Images

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

The Warm Embrace Of The Familiar

It is common knowledge that the U.S. is about to enter a recession. This, it is said, is induced by the Federal Reserve being too slow to raise rates, allowing inflation to get out of control because of excess money supply causing too much demand, then ramping rates quickly in order to try to get the cat back in the bag. Since everybody agrees that this is the case, it must be true. Right?

Well, maybe. It’s possible that there is some other explanation for the inflation – say, energy and fuel costs out of control due to overly ambitious plans to move supply across to renewable sources, further amp’d up by supply shortages arising from the Russian invasion of Ukraine, coupled with food costs out of control due to supply chains being smashed by Covid-19 lockdowns, then the resultant rebuild hampered by rising grain prices following the self-same invasion. And it’s possible that the Fed’s description of inflation as transitory does in fact come true, albeit over a longer timeframe than was envisaged.

If you believe that, at some point, international pressure is brought to bear upon the Russian invasion of Ukraine – not due to any humanitarian concerns but due instead to realpolitik, i.e., the degree of consumer/voter pressure on incumbent Western governments about inflation and their retirement accounts – and you think that will result in a freeing-up of supply of fuel and grain which should ease input prices ergo lower inflation – then perhaps recession isn’t inevitable after all. In addition, the notion that there is excess demand causing inflation… can that also be true if there is a recession bearing down upon us?

It’s almost as if… when even the kid at the bus stop can tell you what’s going on with the market… maybe the orthodox view isn’t the whole story. (You want our view on what’s going on? This is our view).

But let’s say the kid at the bus stop is correct. Let’s say doom be visited upon us all and recession is about to hit. If you said to that same kid, well kid, where should I put my money? We’re pretty sure he would tell you, in the Dow. Put it in the Dow. That’s where it’s safest in times of trouble. Hm, you might say. Sounds good. And these days I can buy the Dow in an ETF form, right – I don’t need to mess about with futures or any of that scary stuff. DIA, that’s the one! And if I’m feeling a little sporty that day – toss in a little UDOW too. Easy! Thanks, kid!

Well, now, here we do agree with the kid at the bus stop. But not because the Dow is safe from risk. Allow us to explain.

What’s In A Name?

The Dow’s top holdings include United Health, Goldman Sachs, Home Depot, Microsoft, McDonalds… Corporate America 101. Now on the one hand you would say that if U.S. GDP is in reverse, these companies will suffer and their stocks follow suit. But you might counter that by saying, well, Microsoft won’t get hit as hard as some yahoo (with a small ‘y’)-type names like, you know, anything Cathy Wood has been talking about these last couple years. So, sure, I’ll buy me some Dow protection.

We Think This Is A Good Call But For The Wrong Reasons

We believe the Dow is a very sensible instrument to be buying right now. But not because we think the American Dream is over, destroyed by a tsunami of wokeness and foreigners. Quite the opposite. There is no more resilient economy on this planet than the U.S., and so even if there is a brief recession – let’s not forget, ‘recession’ is usually defined as just a consecutive couple quarters of GDP declines, it’s not The Big One, Lights Out, It’s All Over Folks Let’s Go Farm Collective Yams For The Rest Of Our Days – we would expect Corporate America to come roaring back in quick style, as it usually does. And that is why we think the Dow is a compelling buy.

The News Doesn’t Drive Stock Prices

What happens on TV may well influence what any one individual retail investor does that day. But that one investor doesn’t move the market. Big Money moves the market, and Big Money knows what is going to be in the news before it hits the screen. This is why markets appear to anticipate the news, not react to it. (We expanded on this in a recent Seeking Alpha blog post, which you can read here).

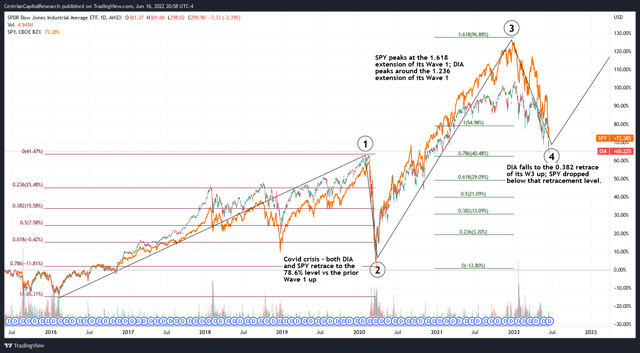

The Dow has in our view anticipated a recession already; we believe its next big move is up, not down. Here’s how the index – in its proxy ETF form, DIA – has moved since the 2016 lows.

DIA Chart (TradingView, Cestrian Analysis)

A wave 1 up peaking right before the Covid-19 impact; then a textbook 0.786 retrace to the Wave 2 lows in Q1 2020. A Wave 3 up peaking in January this year, followed by a Wave 4 down which has thus far troughed at right around a textbook 0.382 retrace of that Wave 3 up. If this pattern holds, and we think it will, then whilst we could of course see some short term further weakness we think the fund can make new all-time highs within the next 12-18 months.

Yes we know that sounds crazy, but again – stocks run ahead of the news, not behind the news. All that bad stuff on TV right now? Big Money knew all that months back. So the next moves in the world which in our view are most likely, inflation falling back not moving up, the Russia-Ukraine invasion moving closer not further away to a ceasefire and some kind of territorial giveaway to Russia – those moves are better known and understood at Big Money LLP than they are by the kid at the bus stop. So when we see a stock chart appearing to find support like that and making like it can reverse? We respect the chart more than we do the kid at the bus stop. (Although he does produce funnier stock memes than our chart software can).

So, want to buy the Dow? We think that can work out.

But want to buy the Dow for downside protection? There we beg to differ. Since 2016, in its down-moves (from the pre Covid-19 high to the mid Covid-19 low, and from the recent all-time high to the current low), DIA has retraced at to exactly the same degree (i.e., percentage change) as the S&P500 in SPY ETF form. But in the big move up, from the Covid-19 lows to the recent all-time highs, DIA moved up significantly less than SPY. So in buying the Dow, you appear to be buying less upside but the same downside as SPY.

Dow vs. S&P Chart (TradingView, Cestrian Analysis)

That’s true over the six-year period shown in the chart. But that’s when Big Tech was truly on fire and represented not only high growth but also high margins and category leadership. If in doubt since 2016, putting your money in Microsoft (MSFT), or Apple (AAPL), or Google (GOOG) (GOOGL), and so on was the thing to do.

What if that’s not the case going forward? What if there is a great sector rotation ahead of us out of growth tech, and into some other sleepier sector?

We have news. That already happened.

Why Rotation Can Drive Indices Upwards

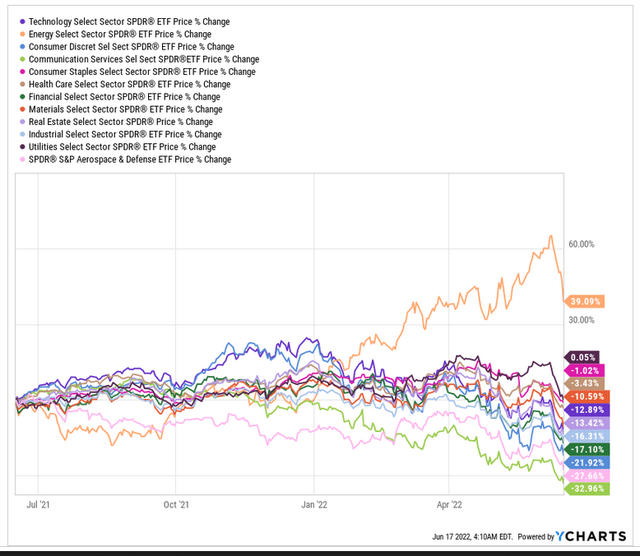

SPDR Sector ETF Performance, L12M (YCharts.com)

Oops. This chart is the reason so many people are hurting right now. Because the lesson from history is, diversify. Right? And if growth is on fire, as it was in 2020 and 2021, you probably wanted to be diversifying into defense, telecom, utilities, energy, healthcare, etc. Of course, you did. And if you did, in fact, diversify, then as tech weakened you were probably congratulating yourself saying, well, I am hurting in my growth names but I will be just fine overall because of how smart I have been in buying all these other sectors.

Oops, again.

Unless you moved hard into energy a year back, and most did not, whatever they tell you right now, well, you’re likely having a tougher year than you expected. Didn’t matter if you bought utilities, airlines, defense, industrials, whatever kind of diversification you picked, you were wrong unless you went full on crazy-bull energy or full-on crazy bear the indices and/or tech.

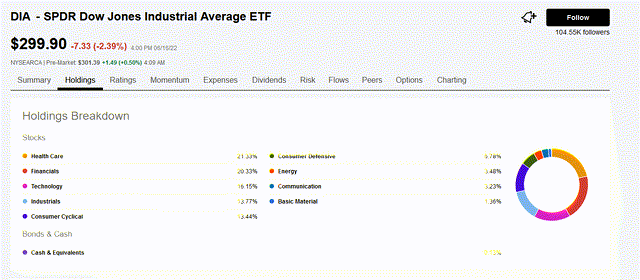

That’s what happened already. What next? Well, subject to the usual ‘nobody knows’ rider, we believe that sector rotation is upon us once more. In our Growth Investor Pro service on Seeking Alpha this is a theme we have been developing for some time now, and right now our view is that energy is likely to be a source of funds in the coming months. We discuss that in more detail here and indeed in a Growth Investor Pro Newsletter that will be released to our Newsletter members shortly. If we’re correct, then liquidation of profits in the energy sector by institutions moving that capital into the most beaten-up sectors you see above? That can help the indices move back up once more. Because energy – the only sector that’s up in the last twelve months – represents just 3.5% of the Dow:

DIA Sector Breakdown (Seeking Alpha)

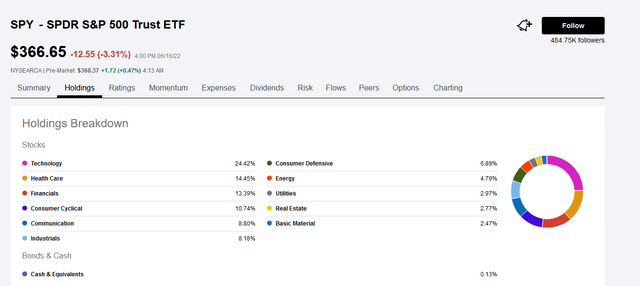

– just 4.8% of the S&P:

S&P Sector Breakdown (Seeking Alpha)

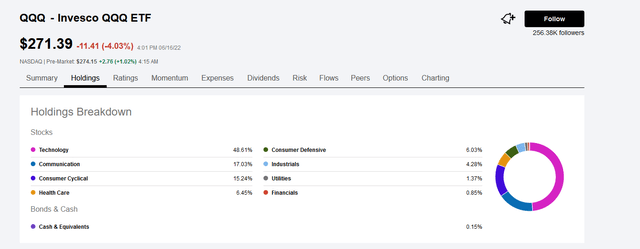

– and it barely features in the Nasdaq-100:

Nasdaq-100 Sector Breakdown (Seeking Alpha)

So if indeed capital comes out of the energy sector and into the other sectors, that can have a beneficial impact on all the indices, including the Dow, which has a surprisingly low allocation to energy when you think about it.

So, DIA we think is a Buy, with the opportunity to place a stop-loss in the $290 zip code (that’s a little below that 0.382 retrace of the Wave 3, and it’s a little below the prior Wave 1 high too, so it’s a sensible place to stop out if markets continue to go south). Despite everything you see out the window, it’s possible that the Dow can move to new highs within a couple years; and there will be opportunities to take profits on the way up if that’s the case.

Cestrian Capital Research, Inc – 17 June 2022.

Be the first to comment