JacobH

Just under two weeks ago, I wrote a piece about Cameco Corporation (NYSE:CCJ) in which I upgraded the stock from a Sell to a Buy. The change in rating was based on several factors that included improving industry fundamentals, the restart of McArthur River Mine, changes in the long-term contract portfolio, and the completion of a cap raise that I suspected would be used to buyout the remainder of Cigar Lake Mine.

But like most of the market, I was rather surprised when I heard Cameco had agreed to purchase the Westinghouse Electric Company from Brookfield’s private equity arm, Brookfield Business Partners (BBU). Upon first hearing the news, I had misgivings about the proposed transaction; questioning the deal’s rationale. But after thinking about it for a few days, I decided to hold on to the stock and I have even added to my position. In this article, I will explain why.

The Deal

The $7.9bn deal will see Cameco team up with Brookfield Renewable Partners (BEP), another company under the Brookfield umbrella but one focused on operating clean energy producers. Westinghouse makes the technical equipment used in roughly half the world’s 436 nuclear reactors. Most of its revenue is recurring and about 85% of its clients have long-term contracts.

Brookfield Renewable will purchase 51% of Westinghouse for $2.3b while Cameco gets the remaining 49% for $2.2b. Westinghouse, which has a total Enterprise Value of $7.9b, will also come with $3.4b of existing debt on its balance sheet.

Brookfield Business Partners originally bought Westinghouse four years ago at an EV valuation of $4.6b after its former owner, Toshiba, put Westinghouse into bankruptcy in 2017. Unsurprisingly, the purchase was structured as an LBO whereby BBU fronted $1b and financed the rest through the issuance of $3b in long-term debt. That debt will largely be passed along to the new owners while BBU clears a very healthy profit on its exit.

Cameco, on the other hand, finds itself having to go back to the well. In order to pay for Westinghouse while maintaining some semblance of a respectable balance sheet, the miner had to enter into a $650m bought deal. The offering will see it issue shares at a price of $21.95 per share, a steep discount from the $26-$28 range in which the shares have been trading over the past month. Needless to say, news of the issuance caused the stock price to plummet.

Negative Aspects of the Deal

Granted, not all of the investors who were selling the stock on October 12th were doing so because of dissatisfaction with the price of the share offering; many were probably selling because they didn’t like the deal. And I can understand their point of view.

In an interview done this week, Tim Gitzel, Cameco’s CEO, played up the opportunities for revenue diversification and vertical integration that the deal will bring about. He discussed how the deal will allow Cameco to be involved in the full nuclear supply chain.

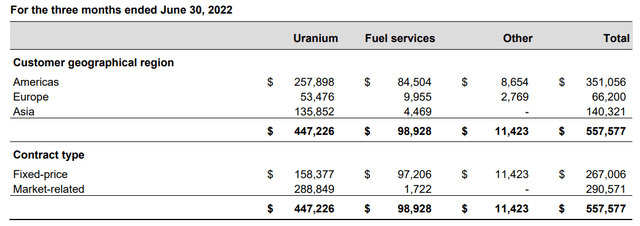

That point is undoubtably true, as any move outside of uranium mining or fuel services will diversify the company’s revenue. That’s because Cameco is presently a very narrowly-focused company that concentrates on uranium extraction as well as some midstream activities such as conversion and manufacturing. The exhibit below shows that 82% of the company’s Q2 revenue came from uranium mining and most of the rest came from Fuel Services.

Exposure to the underlying commodity is one of the main reasons why many investors buy stock in Cameco. The Sprott Physical Uranium Trust (OTCPK:SRUUF) may be better at providing exposure to spot uranium prices, but Cameco’s long-dated contract portfolio is an excellent way for potential uranium investors to gain exposure to uranium’s forward market. And while that won’t completely change under the proposed deal, the addition of Westinghouse may, to certain an extent, lessen Cameco stock’s correlation to uranium futures prices.

In addition to that, vertical integration is a song that I have heard many a CEO sing before. In fact, the vertical integration argument can be used to justify the purchase of any business that produces a physical good by any upstream resource company that supplies it with raw materials. Using the vertical integration logic, one can build a case for graphite and lumber companies getting into the pencil business because the commodities they produce are integral to the production of pencils.

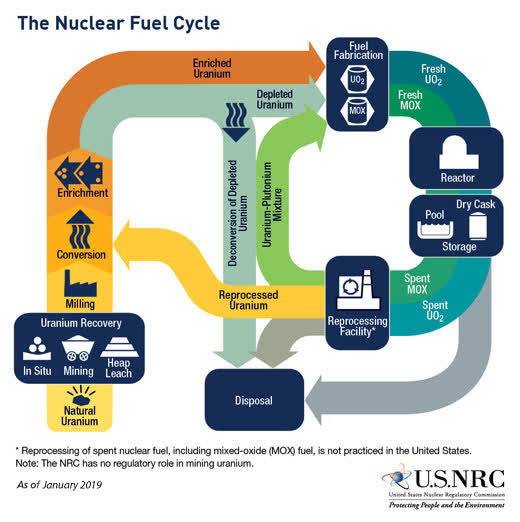

Most investors intuitively grasp that at some point along the value chain, a raw material will have undergone search fundamental changes that it will require a very different skillset to process any further. And that skillset is usually found in a different company that is run very differently from how a raw material producer is run. The uranium and nuclear industries are no exceptions as uranium looks very different at the end of the Nuclear Fuel Cycle than it did at the beginning. This is doubly the case if one considers the end product of uranium to be the energy that it produces.

nrc.gov

There’s no question that Cameco’s management knows how to run a uranium mine effectively. However, the question is whether or not that same management team would be as effective in managing a company that sells and installs hardware for nuclear reactors. I have my doubts.

Positive Aspects of the Deal

The good news, however, is that given Cameco’s minority interest in the company, it’s unlikely that management will play too great of a role in Westinghouse’s day-to-day operations. Brookfield Renewable Partners is no novice in the power generation space and looks to be exceedingly capable of taking the lead. This means that once the deal is consummated and the dust settles, Cameco’s management will be free to get back to focusing on mining and fuel processing. But that then begs the question, why even do the deal in the first place?

A lot of media coverage discussing the deal has tended to focus on nuclear energy’s environmental benefits. But those same media reports also usually mention, in very vague terms, another major global trend; that being energy security and how it relates to the nuclear industry. This is key as it will have an outsized impact on Westinghouse’s growth in the years to come.

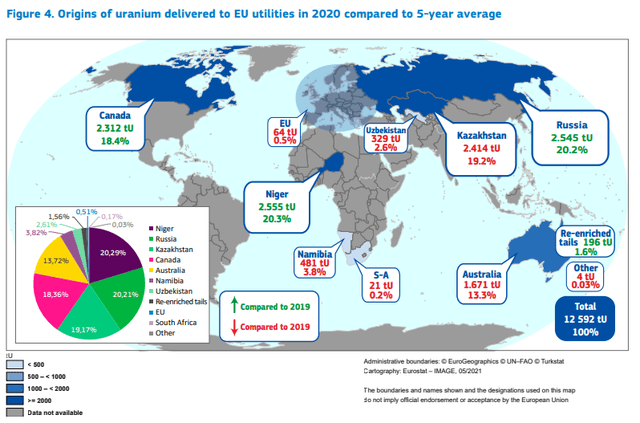

One of Westinghouse’s primary competitors is Rosatom, a Russian state-controlled company that also sells nuclear technology all over the world. In the past, the company built 42 of its water-water energetic reactors (known as VVER) in 8 Asian and European countries, including Finland, Slovakia, and the Czech Republic. They continue to rely on Rosatom for the supply of nuclear fuel as well as other services. A report by the European Euratom Supply Agency shows that Europe is dependent on Russia for 20.2% of its uranium.

European Uranium Imports (euratom-supply.ec.europa.eu)

And those supplies haven’t stopped, in spite of the numerous rounds of sanctions placed on the country by the European Union since the start of the war in Ukraine. Many utilities in the EU have expressed a willingness to change suppliers, but doing so is not a simple process.

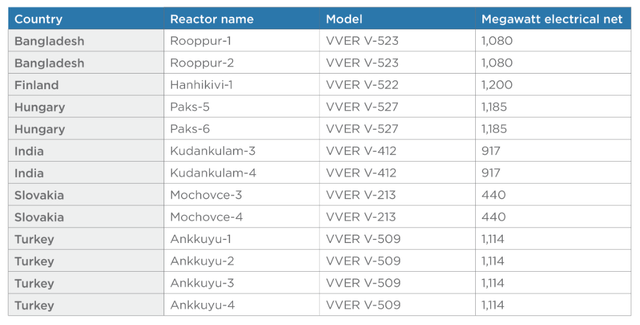

Some European countries even have agreements with Rosatom to build new reactors. The company currently has plans or is in the process of building reactors in 6 countries outside of Russia or its traditional allies such of Belarus, Iran, and China. The list can be seen in the exhibit below.

The onset of the war will not put an end to all of these projects, but European governments such as Slovakia may reconsider development plans. In May, Finland announced that it would not proceed with the building of a Russian VVER reactor. Westinghouse may further benefit by efforts to replace Rostom as a supplier to existing installations. The company is seeking to provide replacement fuel for plants in the Czech Republic, Slovakia, Bulgaria and Finland.

The European Parliament clearly backs a full-embargo on Russian nuclear fuel and in April issued a statement saying as much. In the U.S., there is broad bipartisan support for a Russian uranium embargo but the country faces many of the same problems as the Europeans in implementing such a policy.

That is the biggest positive feature of this deal. Cameco is buying into an industry in which the U.S. and European governments are doing everything they can to limit competition. There is no mention of antitrust concerns because the elimination of Rosatom’s participation in the market is viewed as a national security imperative. And given the very wide moat around the nuclear technology industry, it is highly unlikely that new competitors will emerge out of the mists. Granted, Westinghouse and Rosatom are not the only two companies operating in the space but they are the leaders.

Takeaway

Given that the nuclear power plant development cycle can take over a decade, what occurs now will have a significant long-term impact on the industry. Governmental efforts to lock-out Rosatom are providing Westinghouse with the opportunity to become an exceptionally dominant player within the space. Cameco seems to have recognized this dynamic and the purchase of its Westinghouse stake should allow it to benefit from this long-term trend.

Risk

The risk to this thesis is a reentry of Russia, and by extension Rosatom, into the international community. If that were to occur, and Rosatom began aggressively competing with Westinghouse again, the value of the company would suffer.

Be the first to comment