Sundry Photography

Camden Property Trust (NYSE:CPT) is one of the largest multifamily real estate investment trusts (“REIT”) in the U.S. In April of 2022, they were added to the S&P 500.

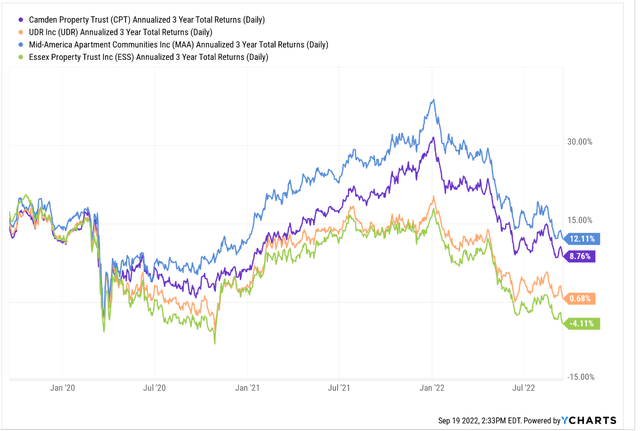

With a market cap of about +$14B, they are similar in size to UDR, Inc (UDR), Mid-America Apartment Communities, Inc (MAA), and Essex Property Trust, Inc (ESS), who each have a cap between +$15B – $20B.

Over the past three years, they have outperformed both UDR and ESS, returning nearly 9% during this period, with the performance gap becoming particularly wide in the middle of 2021 due to their greater exposure levels to the Sunbelt region of the U.S., an area that has benefitted from elevated inbound migration from northern locations. MAA has also benefitted from their exposure to the region, even more so than CPT, as evidenced by the performance gap of 335 basis points (“bps”) between the two REITs.

YCharts – 3-YR Total Returns of CPT Compared To Peers

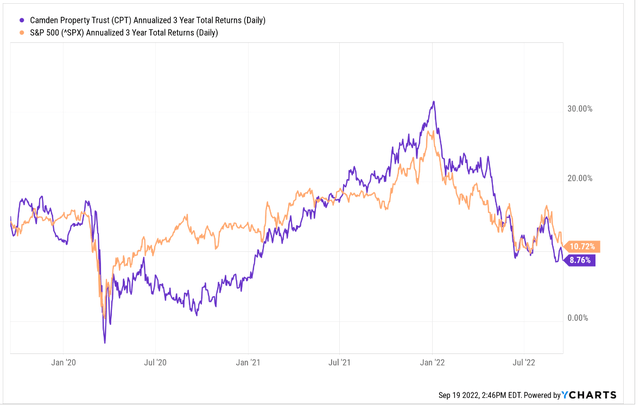

Compared to the broader S&P 500, CPT is trailing in total returns, though they did enjoy about a year’s worth of outperformance.

YCharts – 3-YR Total Returns of CPT Compared To S&P 500

At present, shares are down nearly 30% YTD. This is in-line with their multifamily peers, but it’s significantly worse than the broader index, which is down about 19%. Similar with the sector at large, the stock is also trading at the bottom of end of their 52-week range.

For existing shareholders, CPT does offer a durable dividend payout, which is currently yielding nearly 3%, but upside potential in the shares is limited in the near-medium term.

At approximately 20x forward funds from operations (“FFO”), shares appear to be fairly valued in relation to their multifamily counterparts. Though opportunities for growth exist, a moderation in rental rates against challenging comparatives will likely result in a less than stellar Q3 earnings release. This will in-turn keep shares rangebound over subsequent periods. While a hold for existing shareholders, new investors may be better off leaving CPT on the watchlist.

A Diversified Portfolio With Exposure To The Attractive Sunbelt Region

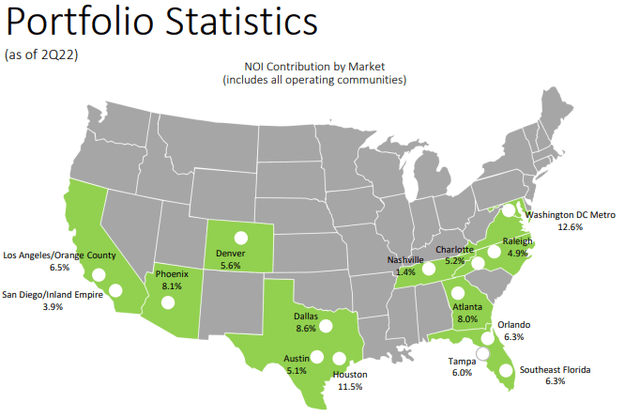

CPT’s portfolio includes 58k apartment homes in 15 major markets across the country. While the D.C. Metro, itself, does account for about 13% of the company’s net operating income (“NOI”), they have a more significant presence in the states of Florida and Texas, with the two contributing to nearly 50% of NOI. Over the past year and a half, this exposure has provided lucrative benefits due to the strong inbound migration from other non-Sunbelt states.

September 2022 Investor Presentation – Map Of Geographic Concentration

The portfolio also is adequately diversified, with a mixture of both Class A and B buildings in Urban and Suburban neighborhoods. Overall, their properties are weighted more heavily towards Mid-Rise Class B properties in Suburban neighborhoods. This provides renters with a relatively affordable alternative to other forms of housing, such as single units or the more luxurious multifamily accommodations offered by some of their competitors.

While the average household income of their tenants is lower than others, such as UDR, whose tenant base has average incomes in the $150k range, earnings are still in the six-figures within CPT’s market. In addition, the rent-to-income ratio is just over 20%, which is comparable to the sector average and is not indicative of a rent burdened tenant class. This is reflected in a low net turnover rate, which came in at 46% for Q2, and a low percentage of move-outs to purchase homes, just 15.1% versus 17.7% during the same period last year. And this is despite double-digit rental-rate growth in recent periods.

Opportunities For Growth In Several Key Markets

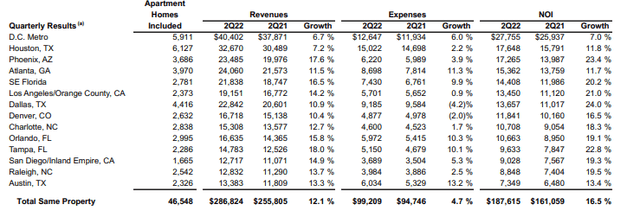

In the current quarter, total same-property rental revenues were up 12.1%, with all but two markets posting double-digit growth rates. One of the strongest performing markets was Phoenix, AZ, where revenues and NOI were up 17.6% and 23.4%, respectively, while expenses grew at a lower rate than the total same-property average of 4.7%.

Q2FY22 Investor Supplement – Summary Of Q2FY22 Same-Property Operating Performance

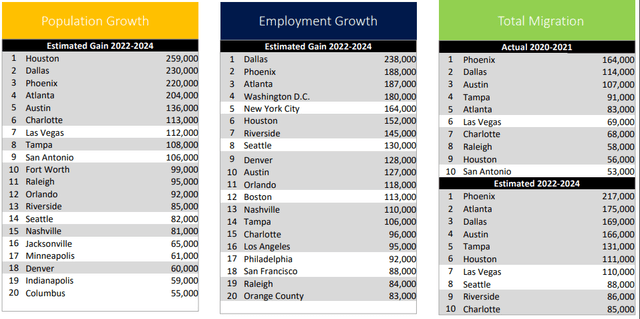

The strength in Phoenix is notable because of the data pertaining to its inbound migration. From 2020-2021, the area experience net arrivals of over 150K people and an additional 217K are expected to migrate in from 2022-2024. With the Phoenix market accounting for nearly 10% of same-property NOI, CPT is likely to realize continuing strength in cash flows in the years to come from this region itself.

September 2022 Investor Presentation – Estimated Market Growth Through 2024

Two laggards during the quarter were the D.C. Metro and the Houston markets, which each exhibited revenue growth of about 7%. While this is certainly worse than their other markets, it’s still strong from a historical perspective. Furthermore, in the Houston market, future upside potential exists in the form of population growth, which at 259k, is more than all of CPT’s other markets.

As a vital hub for the energy sector, Houston also would benefit from employment gains within the large oil companies, such as Exxon (XOM) and Chevron (CVX). Though both companies have displayed restraint on investment, production will gradually need to increase to meet expected demand. This would bring in high-paying jobs and a workforce whose options for affordable housing would be severely limited.

Favorable Revisions To Guidance Despite Expected Moderation In Rate Growth

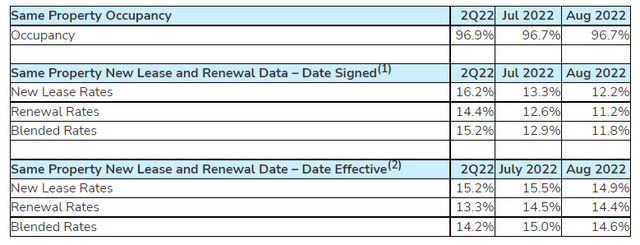

Even though multifamily units are relatively more affordable than the alternatives, rental rates are still growing at double-digit rates, with blended rates up 15.2% through the end of Q2. Growth, however, did moderate after quarter end. In addition, occupancy levels appear to be at a peak, which does add pressure to continue producing double-digit blended rate growth to support current valuations.

September 2022 Operating Update

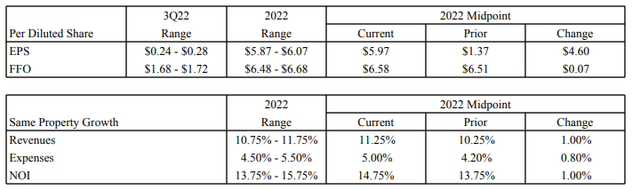

Nevertheless, management did revise their full-year guidance higher following results that came in better than expected. Both NOI and FFO, for example, are now expected be up about 1% at the midpoint on an anticipated 12.5% increase in rental rates on new leases and an 8.5% increase on renewals. With figures still coming in higher than that through August, especially on renewals, it’s possible that CPT’s future results will surprise to the upside. But a beat, by itself, may not be enough to significantly move the share price.

Q2FY22 Investor Supplement – 2022 Full-Year Guidance

Fairly Insulated From Higher Interest Rates, Aside From The Impacts On Transactional Market

Though higher interest rates have yet to materially affect CPT’s financials, they have substantially slowed the transaction market. In the current quarter, for example, the company held back on dispositions due to the lack of clarity in the market on appropriate pricing. By their estimates, they figure values have declined between 10-15%, with the older, value-add properties, feeling the brunt of the price declines.

On the earnings call, management did mention that they expected more clarity after Labor Day. But that does not appear to have materialized, given across-the-board market volatility. If anything, the environment has become even more unclear since Q2.

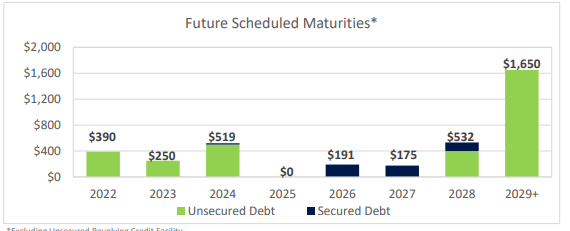

While the transactional slowdown is a concern for their future growth prospects, it’s not an issue for their balance sheet, which has an investment-grade credit rating from all three credit agencies and a debt composition that is over 90% fixed, thereby greatly reducing their exposure risk to changing interest rates.

In addition, the company has an attractive debt ladder, with the vast sum of debt maturing after 2028. For the more near-term obligations, CPT has ample funds on hand, with over +$1B available on their revolving credit facility.

September 2022 Investor Presentation – Debt Maturity Schedule

For income investors, the payout of 3% isn’t the most attractive, but it’s safe, with a payout ratio of just under 60% of FFO and about 70% of adjusted FFO. Still, compared to what one may obtain from current yields on a risk-free high yield savings account, the payout does appear to be lacking.

CPT Will Remain Rangebound On Moderating Rents And Insufficient Catalysts

CPT is one of the largest multifamily REITs and a newly added component of the S&P 500. Over the last year and a half, they logged their best growth in their nearly 30-year history, growing NOI and FFO by 19.6% and 47%, respectively. This growth has been aided in part by financially secure tenants working in industries with strong employment growth and large wage increases. At approximately 20% of income, rental obligations are not an excessive burden, despite average monthly rental rates that are approaching $2K per home.

In-bound migration of more than 700k Americans into their markets from other states has also created a boom in demand for CPT’s properties, especially considering the relative affordability of their multifamily units compared to both single units and outright ownership. A deficit in apartment supply in relation to demand should also provide a continued runway for growth in subsequent periods.

While the fundamental outlook is positive, it’s not overly differentiated from similar REITs in the sector, who are trading at similar multiples. CPT does have an edge over two peers, ESS and UDR, due to their greater exposure to Sunbelt states. But MAA has an even stronger presence in the region.

In addition, rental-rate growth, though still up double-digits, appears to be moderating, and occupancy looks to be at a peak, further limiting the growth opportunities. An uncertain acquisition environment, amplified by rising interest rates, adds an additional barrier to future earnings growth.

A strong, investment-grade balance sheet with manageable debt obligations provides assurance of CPT’s ability to weather any setbacks in the broader macroeconomic environment. Existing shareholders can also take comfort in the receipt of reliable dividend payouts. Share price upside, however, is limited, given moderating rents and insufficient catalysts. For new, prospective investors, CPT is best left on the watchlist, at least through their Q3 earnings release.

Be the first to comment