NicoElNino

Investors who bought Cambium Networks (NASDAQ:CMBM) in the summer beat the S&P 500. After it posted second-quarter results, the stock gained 18%.

After posting third-quarter results, revenue and earnings exceeded consensus estimates. Although the supplier of a fixed wireless infrastructure provider is still down for the year, will CMBM stock trend higher from here?

Cambium Third Quarter 2022 Results

Cambium posted revenue of $81.2 million, up by 7% from last year. It reported a net income of 34 cents a share non-GAAP. In the reconciliation of net income to adjusted EBITDA, the company booked just $2.848 million in share-based compensation. Amortization of capitalized software costs, acquired intangibles, and restructuring expenses accounted for around one million dollars.

The company exceeded its revenue and profitability significantly. Gross margin improved because component supplies for enterprise products improved. For example, Cambium saw a record revenue for Wi-Fi switching and SaaS solutions. A favorable product mix and lower spending helped it beat its outlook issued in the second quarter.

Investors should expect Cambium’s recovery to continue from here. Demand for the company’s point-to-point for defense applications will rise. In addition, switching revenue for Wi-Fi 6, Wi-Fi 6E, and switching revenue will enjoy record demand from here. Shareholders will find comfort in Cambium’s strong backlog fulfillment.

New Products

Network firms require a product refresh to fuel their continued growth. In Q3, Cambium benefited from project wins in Europe, Middle East, and Africa region. For example, a service provider in Northern Africa committed to Cambium’s new 28 GHz cnWave 5G fixed platform. After winning two large managed service provider deals in France, investors should expect more wins for Cambium’s ONE Network.

The industry is planning for the availability of the new 6 GHz spectrum. Once online, Cambium positioned its next-generation multi-gigabit ePMP 4600 to expand its addressable market. Already, nearly 10 customers are running proof-of-concept projects to validate Cambium’s technology.

Opportunities

Cambium has strong product positioning that markets were slow to recognize. CMBM stock corrected for the discount by rallying from the $18 – $20 range to as high as over $24 after the Q3 report. Investors could take advantage of the post-earnings profit taking by accumulating shares on the dip. In 2023, the company will grow as customers complete their validation for the next-generation networks.

In the fourth quarter, gross margins will dip slightly due to a less favorable product mix. Chances are low that the Q4 report will offer an upside surprise revenue and earnings beat. Fortunately, Cambium will increase product prices to adjust for higher inflation.

Cambium’s 6 GHz market is a large market opportunity. Customers will share their performance numbers and strong return on investments. Thanks to its affordable product pricing, investors should expect the company to benefit from a competitive edge, strong moat, and revenue acceleration through the end of 2023.

Cambium’s gross margin in the low 50% range will continue. It has a long-term operating model that assumes a gross margin of 51% to 52%. Even as the economy worsens, customers need to invest in their infrastructure to stay ahead. This will result in Cambium emerging as a strong mid-tier enterprise provider.

On the conference call, President and Chief Executive Officer Atul Bhatnagar said that Cambium is winning deals for three reasons. It has simplicity in its products, it offers plenty of automation for scaled enterprise networks, and its products are affordable. Customers may justify their purchases because of the lower total cost of ownership.

Risk

In Q2, Cambium’s net inventory rose to $50.6 million, up by $21.9 million from last year. The company is preparing for increased market share. If the industry does not grow as fast as expected, having too much finished goods on the balance sheet is a risk. Furthermore, the supply chain is an ongoing risk. The company may not respond fast enough to changing demand dynamics.

Cambium has a product backlog. As inflation rises, customers still get those goods at contracted prices. Still, the company is increasing prices for orders placed on or after Nov. 26, 2022. This will sustain its profit margins from here.

Stock Grade and Your Takeaway

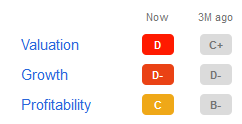

After the stock bottomed from the teens in May, Cambium’s valuation grade worsened from a C+ to a D.

CMBM grade (SA Premium)

The stock has a fair profitability grade and an unfavorable growth score. Investors could take advantage of the market’s next steep sell-off. Should CMBM stock fall with the markets, long-term investors could initiate a starter position in the low $20s.

Be the first to comment