Artystarty/iStock via Getty Images

Calix (NYSE:CALX) had a great run higher over the past two years as it increased from the single digits to its current price of just under $58. The company increased revenue from $424 million in 2019 to $736 million in the past 12 months. That’s a 74% revenue increase. On the earnings side, Calix went from multiple years of being unprofitable to being consistently profitable since 2020.

While the company experienced significant success in recent years, the stock reached an overbought and overvalued condition. Therefore, I think it is likely that the stock is at risk for a sell-off on profit taking as we head into the end of 2022.

Calix provides cloud services and software that supports broadband service providers. The tools that Calix offers are analytics which helps enable broadband service providers to increase subscribers, customer loyalty, and revenue. These offerings are important to broadband service providers as it helps them improve their businesses, making them more attractive to customers. That makes Calix’s offerings attractive and likely to grow.

Valuation May Limit the Upside

Calix is currently trading with a forward PE of 67 and a PEG ratio of 3.4. This is significantly higher than the S&P 500’s (SPY) forward PE of 18.3 and PEG of 1.44. Calix is also trading higher than the Software Application industry’s forward PE of 42, but is approximately on par with the industry’s PEG of 3.5.

Frankly, the Software Application industry is trading at a high valuation as compared to the broader market. Personally, I would prefer to see the forward PE and PEG ratio near or below the S&P 500’s average. I would even accept Calix’s PE and PEG to be slightly above the S&P 500’s valuation due to the company’s above-average growth. The growth companies that I cover typically trade with a PEG between 1 and 2 and have stocks that tend to perform well from this level. So, I would prefer to wait for a better valuation to present itself.

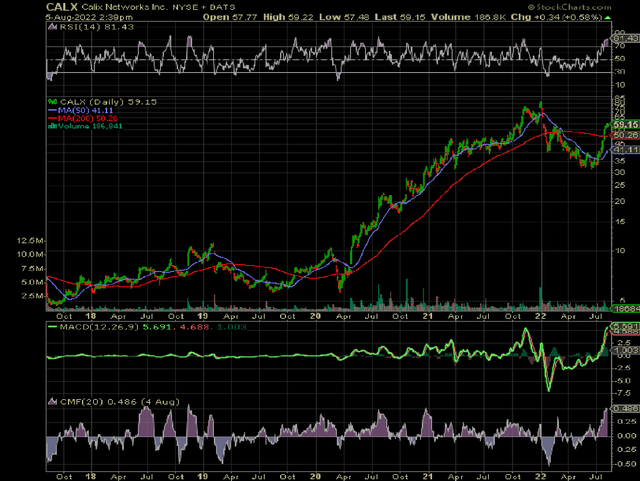

Technical Perspective – Overbought

As you can see on the daily chart above, the price peaked at the end of 2021 along with the broader market’s sell-off. While the price did recover since then, I don’t think that it will take out the last high any time soon. The reason for this is because the macro economic conditions are likely to deteriorate as the Federal Reserve continues to increase interest rates. The Federal Reserve recently increased rates by 0.75% in July and are hinting at another increase of 0.50% in September.

These series of interest rate increases which are targeted to help lower inflation, typically lead to a slowdown in lending which runs the risk of resulting in a recession. With that said, I think there will be another leg down for the broader market and most stocks including Calix. The housing market is already slowing down with a 5.4% sales decline in June 2022 for existing home sales and a 17% sales decline for new homes.

Getting back to the chart, the RSI is currently overbought at 81. The MACD increased to about the level where the stock previously sold off. The money flow [CMF] also increased to a level where it typically begins to decline. So, overall the indicators are pointing to a possible pullback for the stock. That makes sense as investors and traders could be taking profits at these levels.

The Good News

I’m bullish on Calix for the long-term. However, I think it would be wise for investors to wait for a more attractive entry point. The company does have strong expected revenue growth of 14% and expected earnings growth of about 30% for 2023 (consensus). This can catalyze the stock from a more attractive valuation and technical level.

Calix is experiencing strong demand for its offerings as evident in the 20% year-over-year revenue increase for Q2 2022. Calix is seeing some of its customers improving the subscriber experience to encourage customer retention. The business model for Calix’s customers is known as broadband-as-a-service instead of merely providing internet service. Additional services from broadband providers may include domain registration, web hosting, email, and browser/software packages. The company has enough visibility to project a 25% revenue increase for Q3 2022.

Calix is expected to average 20% earnings growth annually over the next 3 to 5 years. One of the factors that is driving the company’s success is the shift from a licensing model to a subscription model.

The company’s AXOS product, which aims to increase service speeds, eliminate service disruptions, and to streamline operations, is now offered in subscription form. The subscription model provides steady, predictable revenue for Calix. Calix is seeing growth across the board from its broadband service provider customers which is driving strong growth.

Another positive is that Calix reduced its revenue concentration risk over the past two to three years. The company previously had one customer comprising 19% of total revenue. Currently, the largest customer, Lumen (LUMN), comprises less than 10% of Calix’s total revenue. Calix does have a risk if significant business is lost from a large customer. However, now the risk has been lessened as revenue is spread more broadly with a lower concentration revenue coming from one customer.

Strong Balance Sheet/Cash Flow

As Calix increased profitability over the past few years, the balance sheet and cash flow strengthened. Calix has $51.5 million in cash & equivalents with just $14.4 million in total debt. Back in 2019, Calix had $51 million in debt.

The balance sheet also has 3.5x more current assets than current liabilities and 4.5x more total assets than total liabilities for stockholders’ equity of $617 million.

Operating cash flow improved from $4.7 million in 2019 to $56.8 million in 2021. Calix had $37.8 million in operating cash flow and $19.5 million in leverage free cash flow over the past 12 months. The strong balance sheet and cash flow puts the company in a great position to effectively handle short and long-term debt obligations and provides Calix with plenty of flexibility to expand the business, to do stock repurchases, etc.

Calix’s Long-Term Outlook

Overall, Calix has a bright future with the potential for multiple years of strong above-average growth. While the company is focusing on expanding its business in North America in the near term, Calix does operate globally. I see the global market as a longer-term potential driver of growth. There will always be a need for maximizing broadband service throughout the world and Calix provides the products to accomplish that.

The current reality for Calix is that the stock is valued too high and it is trading at an overbought level. This puts the stock at risk for a pullback on profit taking. For that reason, I wouldn’t buy the stock at this point. I would feel more comfortable waiting for a more attractive entry point.

Be the first to comment