Juan Jose Napuri/iStock via Getty Images

2021 was a year to forget for investors in the Gold Miners Index (GDX), with the index sliding more than 11% for the year. Despite solid operational results, Calibre Mining (OTCQX:CXBMF) was not a sanctuary from the selling pressure, declining 44% last year, and it’s started off 2022 in negative territory as well. However, the solid beat on Q4/FY21 results should help put a floor under the stock. I continue to see Calibre as one of the better growth stories, with the Fiore acquisition being a great move, but I plan to remain on the sidelines until I see how the stock trades post-deal-closing.

Calibre Mining Website

Calibre Mining released its preliminary Q4 and FY2021 results last week, reporting quarterly production of ~49,200 ounces of gold, a 15% increase from the year-ago period. This pushed the company’s year-to-date production to ~182,800 ounces, with the company smashing its guidance mid-point of 175,000 ounces and coming in more than 1% above the top-end of guidance at 180,000 ounces. Given the continued headwinds related to COVID-19, this was a solid result, helped by a steady ramp-up in production from Pavon Norte. Let’s take a closer look at the results below:

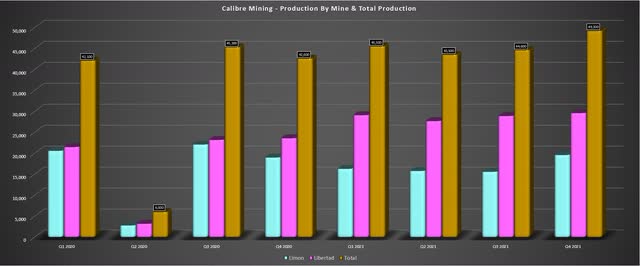

Company Filings, Author’s Chart

As shown in the chart above, Q4 marked a record quarter for Calibre, with the production of ~49,200 ounces, beating its prior record of 45,500 ounces in Q1 2021. The strong performance was driven by solid operation results at Limon and Libertad, with ~19,600 ounces produced at Limon and a record ~29,600 ounces at Libertad. Assuming an average realized gold price of ~$1,790/oz for the quarter, this should translate to record revenue of more than $88 million, an exceptional finish to a very solid year for the company.

Company Website

Digging into the results a little closer, Limon processed ~123,300 tonnes in the period at 5.59 grams per tonne gold, with a ~90% recovery rate. This helped the Nicaraguan asset report its best quarter of the year by a wide margin, with production at ~67,300 ounces for FY2021. The ~67,300-ounce production figure represented a 4% increase from FY2020 levels. However, it’s important to note that Limon was up against easy year-over-year comps due to a voluntary shutdown related to COVID-19.

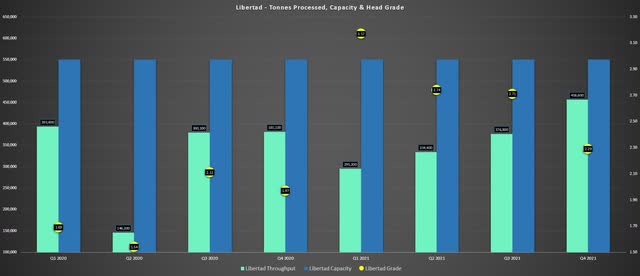

Company Filings, Author’s Chart

Moving over to Libertad, the results were nothing short of exceptional, with ore trucked from Pavon Norte continuing to be a major contributor towards the higher production. As shown above, Libertad production came in at ~29,600 ounces, up 25% year-over-year, driven by increased throughput at higher grades. During Q4, Libertad processed a record ~456,600 tonnes at 2.29 grams per tonne gold, a 20% increase in tonnes processed, and a 16% increase in grades. The improved grades are partially attributed to Pavon Norte, where Calibre began trucking ore early last year.

Production Growth

In the prepared remarks, Calibre noted that it delivered an average of 935 tonnes per day from Pavon Norte to the Libertad Mill in Q4, which explains the much higher throughput vs. Q4 2020, when the company had yet to commence deliveries. However, it’s important to note that while Libertad has seen significant growth year-over-year, this asset still has the potential to increase production further, with excess 94,000 tonnes of processing capacity per quarter left at the mill (total capacity shown in blue). This is based on total capacity, which is closer to 550,0000 tonnes vs. ~456,000 tonnes processed in Q4.

Company Presentation

The plan is to exploit this idle capacity with even higher-grade ore from Eastern Borosi (400 kilometers northeast of the mill), in line with its current Hub & Spoke model. Assuming a conservative average processed grade of 5.0 grams per tonne gold and 800 tonnes per day being delivered to the mill, this would boost Libertad production by ~43,500 ounces per annum, giving the asset the potential to produce ~160,000 ounces per annum, up from ~115,000 ounces produced in FY2021.

In a higher-grade scenario with similar deliveries (6.5 grams per tonne gold / 800 tonnes per day), Libertad’s production could increase to ~170,000+ ounces per annum, and there would still be a little bit of excess capacity left. So, while FY2021 was a solid year for Calibre with strong production from FY2020 levels (34% production growth), I see much more growth on the horizon in Nicaragua, with the potential for Calibre to become a ~235,000-ounce producer in FY2024 (170,000-180,000 ounces at Libertad, 60,000-70,000 ounces at Limon). This would represent ~29% growth from current levels, or an ~8.7% compound annual production growth rate.

2022 Outlook

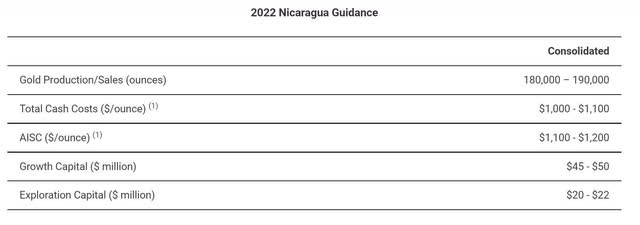

While the FY2021 results were solid, inflationary pressures continue to weigh on costs for producers, and Calibre has not been immune to these headwinds. This is evidenced by the company’s FY2022 outlook, which is for production of 180,000 to 190,000 ounces (185,000-ounce mid-point) at all-in sustaining costs of $1,150/oz. Growth capital and exploration are expected to come in at similar levels to FY2021 at ~$67 million combined, but the all-in sustaining cost guidance is much higher than FY2021 levels.

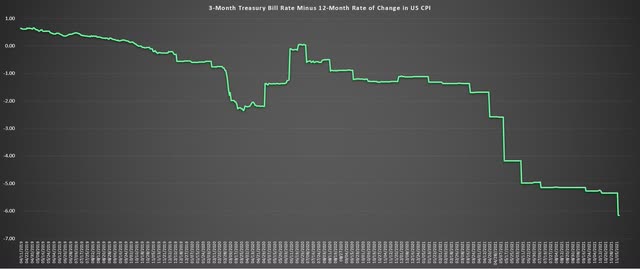

Company News Release

As shown above, despite ~5% production growth vs. FY2021 guidance (~175,000 ounces), the all-in sustaining cost guidance sits at $1,100/oz to $1,200/oz, up from $1,040/oz to $1,140/oz, and this is despite what should be a slight reduction in COVID-19 costs. Normally, we would expect costs to be declining or flat, given a slightly higher production profile. It’s important to note that this is not company-specific and can be attributed to increased labor, consumables, and fuel costs. With diesel prices continuing to remain elevated, this could pressure margins on a year-over-year basis for Calibre unless the gold price decides to finally cooperate, as it has historically, against a backdrop of deeply negative real rates.

YCharts.com, Author’s Chart

To summarize, while Calibre is likely to come in below $1,125/oz in FY2021, given the guidance beat, I would not be surprised to see costs at its Nicaraguan business come in above $1,160/oz in FY2022, translating to another consecutive year of cost increases. The good news is that, unlike other producers, Calibre has a solid organic growth opportunity, which should help to improve costs by FY2024 assuming it can increase production to 230,000+ ounces. Notably, this growth opportunity is very low capex, with modest capex to develop Eastern Borosi, and the mill already built and simply waiting to receive more material at Libertad.

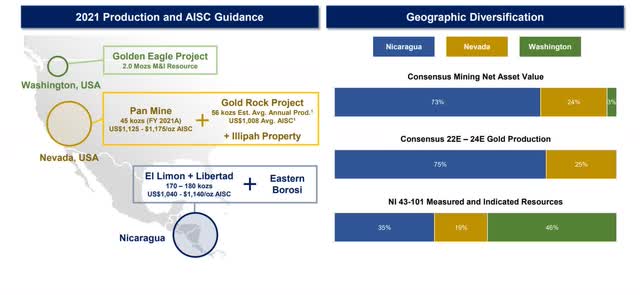

On a consolidated basis, Calibre’s production should increase to closer to ~235,000 ounces in FY2022, with the Pan Mine contributing more than 50,000 ounces following the Fiore acquisition. However, Pan’s costs appear to be higher than the Nicaraguan business, which could push Calibre’s consolidated costs (Nicaragua + Nevada) closer to $1,175/oz. I don’t see this as a huge deal, given that Calibre should be able to claw back some of its lost margins as production increases in Nicaragua and if it can bring the slightly lower-cost Gold Rock Project online. However, at least in FY2022, Calibre will be a higher-cost producer than the industry average (~$1,075/oz estimates).

Finally, it’s worth noting that Calibre recently combined with Fiore, scooping up the Nevada producer at a very attractive valuation of ~0.70x P/NAV. This is a great deal for Calibre, given that it reduces the risk of having all its eggs in a less attractive jurisdiction, Nicaragua. In addition, the company maintains its organic growth profile, with Fiore also bringing organic growth to the table with its PEA stage Gold Rock Project. Combining the #1 ranked mining jurisdiction globally (Nevada) with an unattractive jurisdiction (Nicaragua) improves Calibre from a Tier-3 jurisdiction producer to a Tier-2 jurisdiction producer, making this a brilliant deal by the Calibre team, even if there aren’t operational synergies with the assets being on different continents.

Company Presentation

So, Is The Stock A Buy?

With organic growth in Nevada and Nicaragua and less risk due to the diversified production profile with a clear upgrade following the Fiore deal, Calibre ranks very high on growth. Meanwhile, the team has a track record of under-promising and over-delivering, and both of its growth projects are relatively straightforward and can be developed with zero share dilution.

Having said that, stocks often trade erratically following M&A deals, even when the deal improves the investment thesis, as we saw with Northern Star (OTCPK:NESRF) and Saracen, and Kirkland Lake Gold (KL) / Detour Gold. So, while I see Calibre as a name to keep on one’s watchlist and the valuation is very attractive, I plan to remain on the sidelines until I see how the stock trades once the deal closes.

Be the first to comment