blackred/iStock via Getty Images

Thesis

Though Cal-Maine Foods, Inc. (NASDAQ:CALM) is a great company with excellent financial success, zero debt, a solid product, and knowledge of the market, they seem to be overvalued at the current price. Their dividend has diminished over the years, and their continuous earning misses, share dilution, and underwhelming discounted cash flow (“DCF”) analysis all lead to signs of overvaluation. Though a great stock pick at the right price, I will be waiting until it drops to the low $30s, along with other catalysts, before its right for me.

Company

CALM is the largest producer and distributer of shell eggs and egg products in the United States. Founded in 1957 and headquartered in Ridgeland, Mississippi, they seek to demonstrate a culture of sustainability to create value for shareholders. They are a simple operation to understand, with a single segment through production, grading, packaging, marketing, and distribution of shell eggs. Products include cage-free, organic, free-range, pasture-raised, and brown eggs along with frozen, liquid, and powdered egg solutions.

Their growth strategy involves providing the markets requirements for specialty eggs and growing facilities and acquisitions as well. They have twenty-three business acquisitions tallied as of May 30, 2021, after the purchase of Red River Valley Egg Farm, LLC, along with new capital projects including a $105 million dollar facility in Okeechobee, Florida, and conversions of older facilities, to expand cage-free egg production capabilities. Their facilities include “in-line” systems that mechanically gather, clean, grade and package the eggs.

They state to be closely monitoring the detection of avian flu in February of 2022 and are working to mitigate the supply constraints through maintaining biosecurity programs and working closely with government officials after fighting this battle before during the HPAI outbreak in 2015. The price of their egg products is volatile and formulated by several market factors. Feed inputs are volatile as well and consist of primarily corn and soybean meal which are affected by the Russia-Ukraine war’s effect on the worldwide supply of grain. They have created a leading Animal Welfare Program to align with regulatory, veterinary, and certifying bodies values.

Furthermore, they are a member of Egglands Best (EB) and produce, market, distribute and sell Land o’ Lakes branded eggs along with eggs under 4-Grain brand. They are customer top-heavy, with the top three representing roughly half of sales, with Walmart and Sam’s Club the largest customers.

Financials

On the income statement, through ten years, they exhibit revenue growth and net income growth. However, they have been steadily increasing shares, diluting shareholders. Per the balance sheet, they exhibit minimal debt. Their cash flow is very volatile with years experiencing significant negatives and positive returns. They have missed earnings 3 of the last 4 quarters and their dividend has been extremely sporadic. Valuation, growth, profitability, and momentum grades look great sector relative, and we also see them performing well compared to peers. Regarding financials, there are good indicators, and non-preferred ones.

Industry Outlook

There are a million and one research studies and resources towards the shell egg market. Whether it be broken down into product based, regional, growth percentage, the studies only outcome should answer one question: Does the industry look good or bad over the long run? Consensus says it will be good. Organic, free range, cage free, powdered, liquid, you name it, CALM is well equipped for whatever the market demands in ten years. But the base product, egg, is what truly matters. Egg, and its products, are one of the most energy dense foods, containing exceptional levels of essential macros, protein and fats, and nutrients, while simultaneously being affordable and transportable. Overall, they are in a lifelong industry and the research supports this.

Valuation

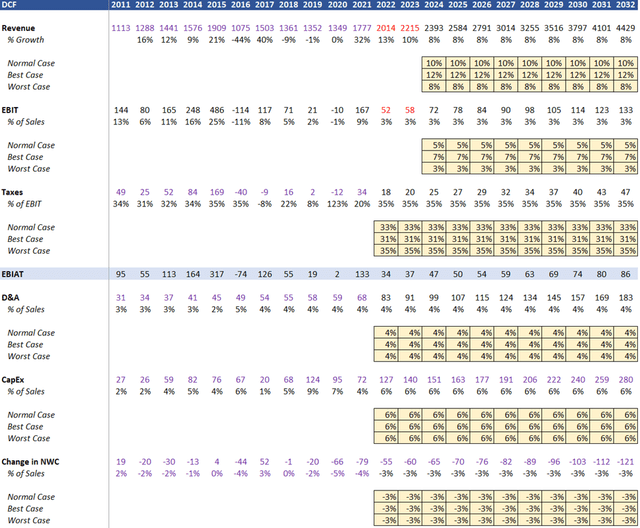

A fair value of $37 per share was calculated by a Ten-Year, Unlevered DCF analysis using CAPM and WACC as a discount. Revenue and EBIT projections were used from average results of sixteen analysts for years 2022 and 2023 from Financial Modeling Prep. Personal projections were used thereafter with the following, rather optimistic, assumptions:

Revenue:

- Normal Case Scenario: 10% YOY

- Best Case Scenario: 12% YOY

- Worst Case Scenario: 8% YOY

EBIT

- Normal Case Scenario: 5% YOY

- Best Case Scenario: 7% YOY

- Worst Case Scenario: 3% YOY

Taxes

- Normal Case Scenario: 33% YOY

- Best Case Scenario: 31% YOY

- Worst Case Scenario: 35% YOY

D&A: 4% YOY

CapEx: 6% YOY

Change in NWC: -3% YOY

WACC: 10%

Terminal Growth Rate: 2.5%

Judgment Day: 2032

Fair Value (Author)

Conclusion

Overall, I want to be crazy about CALM, but I think they are overvalued. They are indeed a great, debtless, company, with excellent profitably, and are financially competitive compared to peers. However, an inconsistent dividend, underwhelming earnings, share dilution, and an unsatisfactory DCF valuation, leads me looking beyond. A catalyst here that would change my view is if it dropped in price, announced share buybacks, and consistently grew their dividend. This is a defensive play after all, so I’d like to be compromised for lack of growth.

Furthermore, they seem to be very sensitive to health crises like Avian flu and COVID-19 and global issues like the Russia-Ukraine War anyway. There are some great nuggets here, but I won’t be putting any of my eggs in this basket as of right now. “Hold” is a relative term. I see no reason to jump ship and start unloading if one has acquired at a lower price, but I see no reason for new investors to rush into this anytime soon.

Be the first to comment