intraprese/E+ via Getty Images

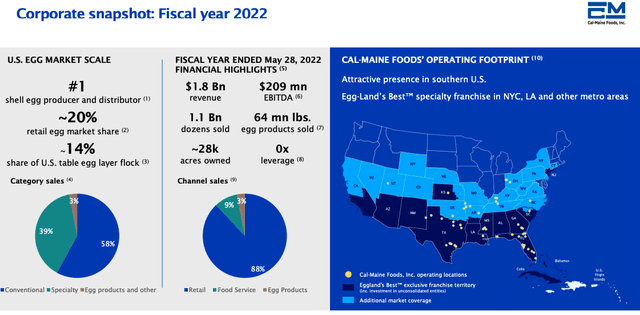

Cal-Maine Foods, Inc. (NASDAQ:CALM) is considered to be the largest producer and distributor of eggs in the USA, selling over one billion dozen shell eggs yearly. It has been posting upward-trending top and bottom line performance for ten years, has no debt, and has beaten EPS expectations for the last two quarters. Over the last year, investors have been rewarded with 58.27% returns.

One year stock trend (SeekingAlpha.com)

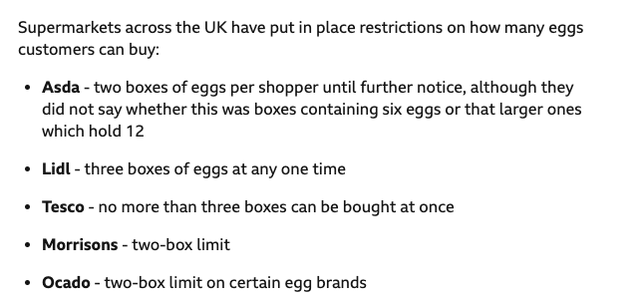

This year has been exceptional due to price inflation and the avian flu’s impact on reducing supply. There is the belief that the company has peaked, and once egg pricing normalises, the stock will decline. However, there is a growing egg shortage, as already seen in the UK; the company is investing in an expansion project set to go live in early 2023. Although we should be cautious of the temporary state of record high pricing for eggs, the growing production costs and the loom of a recession impacting demand, I believe the environment will remain favourable for CALM for the next few quarters and therefore recommend a hold rating for the stock that is still under its one-year analyst target value of $60.67.

Overview

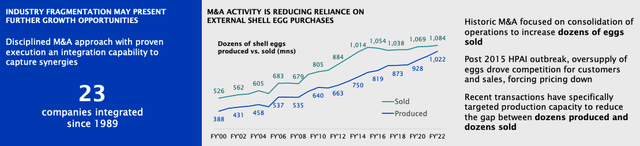

Calm is a shell egg and egg product business that aims to be low-cost and located near its customers. Fred Adams founded it in 1957 in Mississippi, and the family still hold a controlling interest in the company. It IPO’d in 1996 and has grown significantly through its twenty-three countrywide acquisitions benefiting from the opportunities within a fragmented industry.

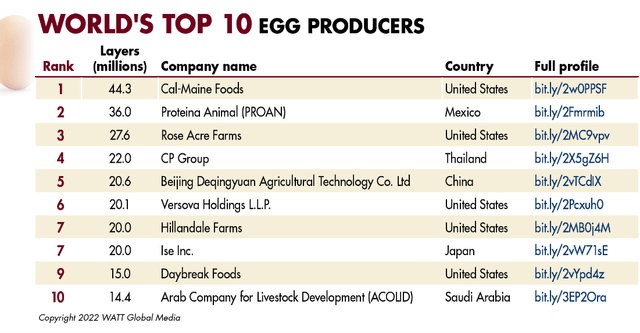

World’s top ten egg producers (Wattagnet.com)

They have acquired four companies in the last five years. The most recent addition was in 2021, Red River Valley Egg Farm in Texas.

Company growth (Investor Presentation 2022)

Their three most prominent customers are Walmart Sam’s Club, HEB and Publix, which account for 42% of their total sales.

Corporate Snapshot (Investor Presentation 2022)

The company has allocated $105 million in capital this year to expand its egg production capabilities. One effort currently under construction is a two-layered house for 400,000 cage-free hens and 210,000 pullets to be completed by January 2023.

Egg pricing fluctuates heavily based on supply and demand and is impacted by many factors, such as feed consumption, disease, and environmental factors. The worldwide supply of grain has been negatively affected for months by the Ukraine-Russia conflict. Avian flu breaks out, which began in February and has taken the lives of more than 50 million birds, which is a record-breaking number in the US. The flu has impacted the EU for almost two years now, and the US summer did not immediately halt the issue as it has done in the past.

Egg purchasing restrictions (BBC.co.uk)

This industry is forecasted to grow at a 7.5% CAGR from now until 2032. Part of the growth will be using eggshells in cosmetics, personal care and pharmaceuticals. This tells me that demand will remain strong for a while, and the supply shortage may play a significant role in the pricing remaining high.

Financials and Valuation

The financial from CALM has positive indicators that show the company’s strong and upward-trending performance. CALM has been growing its revenue and income for the last ten years and has beat earning expectations over the previous two quarters. The company will release its following quarter report later this month.

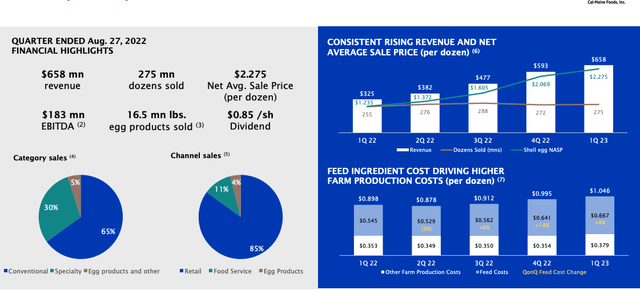

Financial Overview (Investor Presentation 2022)

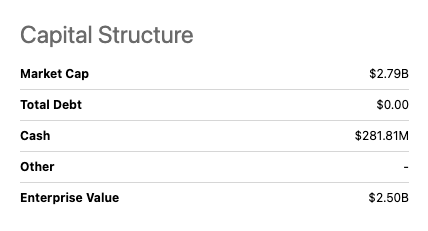

If we look at the balance sheet, the company has no debt. There has been less consistency regarding cash flow, which has fluctuated between positive and negative results from year to year.

Capital Structure (SeekingAlpha.com)

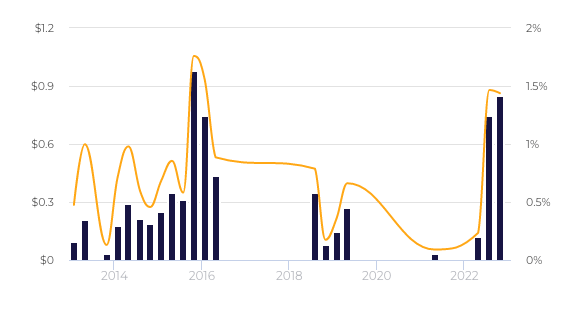

Although the company has a dividend program, this has not been consistent. At the moment the company has sufficient earnings to pay out its dividend share. It pays a dividend of $1.73 per share and the annual dividend yield is 3.03%.

Dividend trend to date (Wallstreetzen.com)

We are seeing a dividend-paying company with high profits and growth. However, the company’s growth rate is due to favourable conditions and is unlikely to be sustainable in the long run.

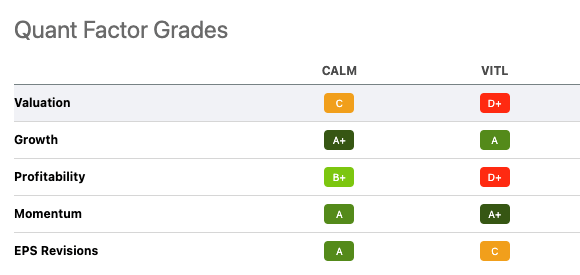

Let’s compare CALM to the other publicly traded egg company, Vital Farms (VITL), a company that IPO’d in 2020 and is known for its sustainable business practises and is seen as the largest producer of pasture-raised eggs. Based on Seeking Alpha’s Quant rating, CALM ranks firmly on growth, profitability and momentum due to the favourable market conditions. CALM has a price-to-earnings ratio of 10.06, which is above Zack’s Ranks agricultural industry average rating of 6.98. However, its valuation is a lot more positive than VITL. Analysts have mixed reviews. Zack’s Rank gives the stock a Hold rating of 3, while Wallstreet recommends a Strong Buy. The strong fundamentals are there, but there is uncertainty about maintaining the plumped-up growth rate in the future.

Quant Rating (SeekingAlpha.com)

Risks

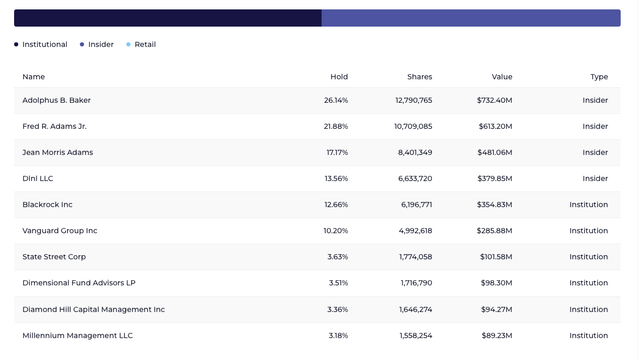

Egg pricing and supply are sensitive to many different external factors. This year, we have seen production costs increase due to the Ukraine-Russia conflict’s impact on the world grain supply and energy costs. Environmental factors and disease can also create unforeseen operational challenges. Another factor investors should be cautious of is the founder’s family’s strong ownership position in the firm. Decisions made by family members do not always align with individual shareholders’ best interests.

Ownership of the company (Wallstreetzen.com)

Final thoughts

We are looking at a company that has delivered eggcellent results and will continue to do so in the short run. It has stellar profitability, no debt and is investing in increasing its capacity, well above its peers. There are still many opportunities for future acquisitions in this largely fragmented industry dominated by CALM. However, the question remains as to how long the industry will see these surged egg prices and the implication to the company once things return to ‘normal’. Due to the current shortage of eggs on a global platform, the company still has room to grow and recommends a hold status as we wait for the release of its next quarter results this month.

Be the first to comment