hapabapa

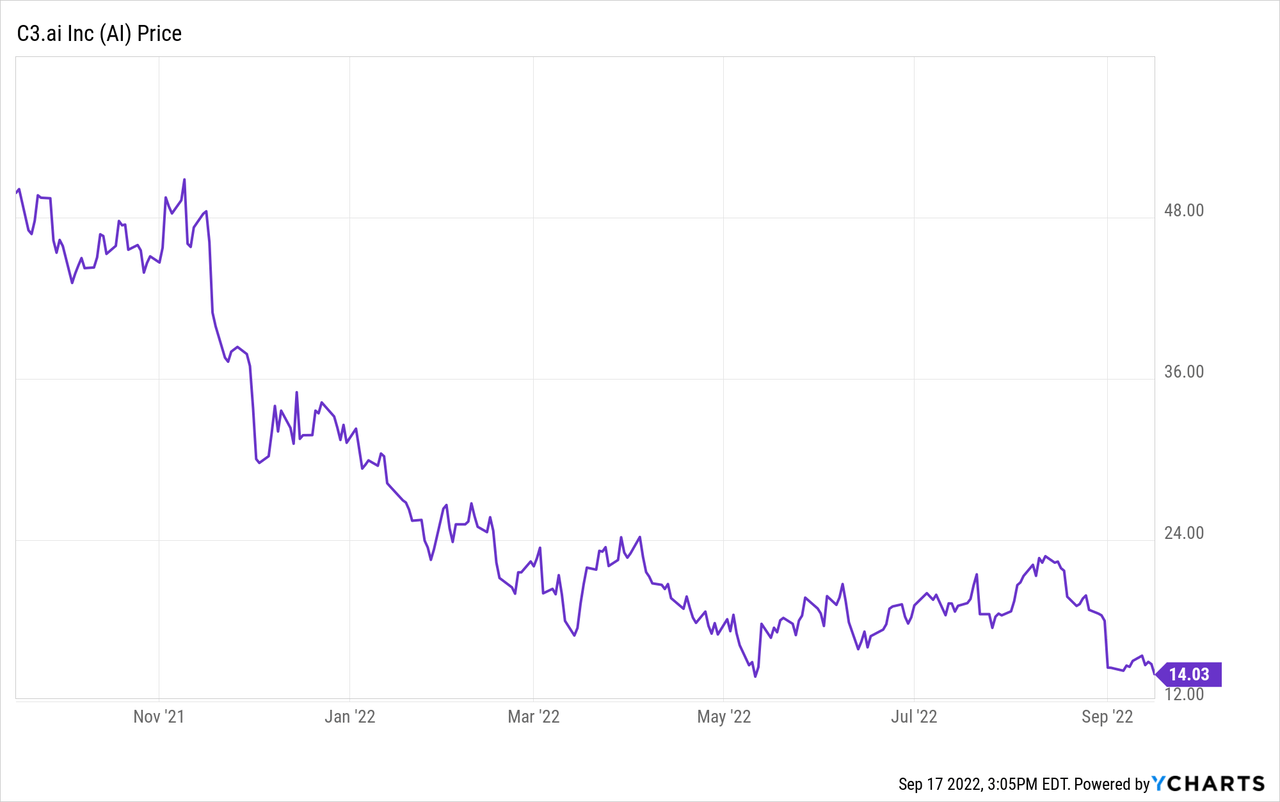

Potentially, no stock has fallen from grace from a prior status of “Wall Street darling” to absolute reject as quickly as C3.ai (NYSE:AI) has. This AI applications platform has suffered from a sharp deceleration in growth rates, constricted by the tightening macroeconomy and deprioritization of transformational IT projects in the interest of preserving corporate budgets.

Amid the noise, however, C3.ai has continued to innovate, to grow its customer base, and to increase its profile in the AI space. It continues to be ranked among the highest AI platforms by influential tech reviewer Forrester.

Year to date, C3.ai has shed nearly 60% of its value, and it’s a fantastic time for investors to re-assess the bull case for this stock.

The bull case for C3.ai

In light of C3.ai’s continued stock plummeting, and in recognition of two very specific actions the company is taking to correct its course (cutting spend to hit pro forma profitability by FY24 and changing its revenue model to consumption-based deals), I’m upgrading my viewpoint on C3.ai to very bullish.

As a reminder for investors who are newer to this name, here is what I view to be the key bull case drivers for C3.ai:

- C3.ai is still exhibiting strong growth. Even though C3.ai is no longer growing revenue north of >50% y/y, its ~25% y/y growth rates still stand strong amid a tightening macroeconomy. The company is also scaling from a customer base perspective and is now at over 220 customers (versus just ~50 at its IPO).

- Industry diversification. AI is a “horizontal” technology, meaning it can be equally applied and benefited from by companies in any industry. Historically, C3.ai has concentrated in heavy manufacturing and oil, due to its relationship with Baker Hughes. More recently, however, the company has expanded applications in production to cover customers in financial services, healthcare, and other expansion industries for C3.ai.

- Star leadership. C3.ai’s CEO, Tom Siebel, is a well-known software industry veteran, best known for selling his startup Siebel Systems to Oracle for $5.8 billion.

- Powerful technology. C3.ai is one of the best-recognized names in enterprise AI transformation, which is an area that will only continue to receive more corporate investment as businesses look to modernize and automate their operations.

Targeted business changes

C3.ai is in deep pivot mode as it looks to address the challenges that it faced over the past year.

The first action that the company is taking is to change its revenue model to consumption-based for all of its new deals. Instead of charging customers by the month, the company is now shifting to charging by vCPU usage.

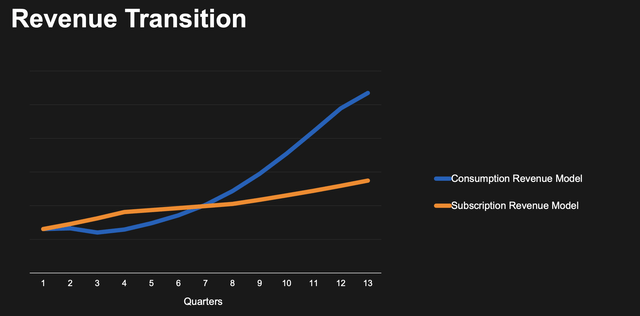

Now, needless to say, this business model will make C3.ai take a hit upfront. Customers tend to start their deployments off smaller, and over time as the technology delivers proven value, businesses move more and more of their processes onto it. Over the long run, however, C3.ai expects that large customers (and the company’s customer base predominantly weights toward large blue-chip firms) will end up generating more revenue after roughly two years.

C3.ai business model shift (C3.ai Q1 earnings deck)

We note as well that some of the most successful and fastest-growing cloud services also operate on a consumption-based model, including Datadog (DDOG), Snowflake (SNOW), Splunk (SPLK), and even Amazon AWS (AWS) and Google Cloud Platform. Considering that GCP is one of C3.ai’s key go-to-market partners alongside Baker Hughes (BHI), the alignment in the revenue model also makes much more sense. Note as well that 56% of the company’s customers run C3.ai on the AWS cloud.

Here’s some further commentary from CEO, Tom Siebel, highlighting the benefits of the change, taken from his prepared remarks on the Q1 earnings call:

Our sales cycles included lengthy negotiation of what were typically 36 month contractual contracts, including developer license fees, application license fees, data science license fees, professional services and run time fees, with the total initial commitment ranging from $1 million to $35 million or more. Now these customer commitments typically expanded over time in $1 million, $5 million or even $50 million increments as our customers achieve success. And we’ve been able to command these types of customer commitments in the past decade because of the substantial customer value that our products and services generated sometimes on the order of billions of dollars a year in economic benefit.

This pricing model has allowed us to attain 228 customers, realize a 38% revenue growth rate in fiscal year ’22 and achieved a compound annual growth rate of 40% for revenue from fiscal year ’19 through fiscal year ’22. The downside has been more lumpiness than we would like to see in bookings, lengthy sale cycles and higher levels of uncertainty associated with individual deal closure in period. While this elephant hunting subscription sales model has served us well in establishing C3 AI as a leader in enterprise AI, it is clear but is not well suited to the deliberate decision and approval processes inherent in the current economic environment […]

The cost of entry is low, the business to move forward is easy, the protracted acquisition deliberation process is avoided. While the initial revenue ramp will be slower from each new customer, considering the substantial increase in the number of new customers, we expect to see a substantial increase in revenue and revenue growth rates after three to four quarters. We believe this will be further accelerated by increased effectiveness of our joint partner selling model and especially by our new agreement with Google Cloud to go sell and fund 50% of the cost of over 100 Tier 1 new customer engagements, making it quite easy for new customers to adopt C3 AI applications.”

Given the reduced barriers to entry in a pay-as-you-go model, C3.ai’s shift will also help the company increase its customer diversification, which has been a major pain point for investors (the company added only 5 net-new customers in Q1.)

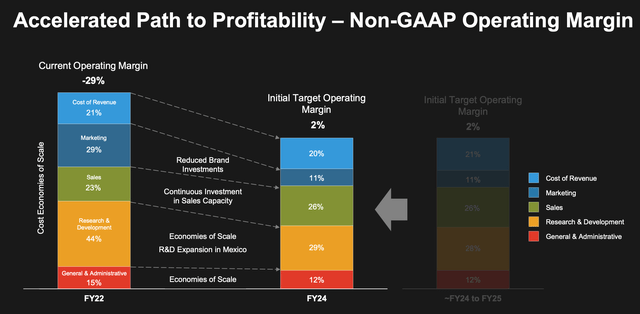

The other shift that the company is making is to substantially reduce discretionary spend, especially trimming marketing expenses. The company noticed a -29% pro forma operating margin in FY22; it expects to hit a positive 2% pro forma operating margin by next fiscal year FY24, particularly by reducing marketing spend, R&D costs, and G&A costs over the next year.

C3.ai path to profitability (C3.ai Q1 earnings deck)

Recall as well that C3.ai’s pro forma gross margins are in excess of 80%, giving the company plenty of operating leverage to scale as it eventually reaps the benefits of its consumption-based contracts over time.

Valuation and key takeaways

Right now, the market is not giving C3.ai the benefit of the doubt. At current share prices near $14, C3.ai has a market cap of just $1.52 billion. The majority of this value is sitting in cash: after netting off the $938.2 million of cash on the company’s latest balance sheet (with zero debt), C3.ai’s resulting enterprise value is just $584 million.

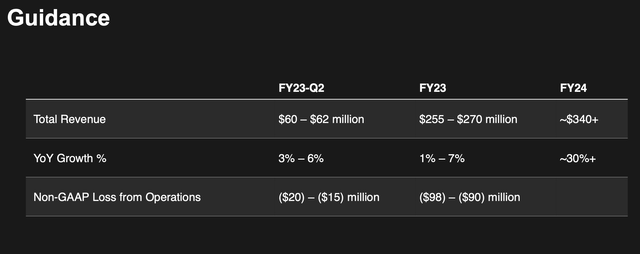

C3.ai guidance (C3.ai Q1 earnings deck)

Against the company’s FY23 (year ending in April 2023) revenue outlook of $255-$270 million (1-7% y/y growth, with growth initially hit by the consumption model change and then re-accelerating in FY24), C3.ai trades at just 2.2x EV/FY23 revenue.

It comes down to this: if you believe in C3.ai’s ability to execute through FY23 in cutting expenses and signing on large customers who will eventually consume large amounts of compute power on the C3.ai platform, FY24 is looking much brighter for this company. I’m willing to take this risk at such a low price today.

Be the first to comment