peshkov

Investment Thesis

C3.ai (NYSE:AI) is one of those businesses that came public at the height of the bubble.

And the bull case can be simply surmised as this, buy the dip.

However, when we peel back the rhetoric and stop price anchoring that last month these shares were higher than $20 per share, there’s really very little value left in the bull case.

Furthermore, I understand that the stock is already down more than 65% in the past year, and therefore it should be undervalued. However, I simply don’t find value in this name.

I believe that investors would do well to avoid this name.

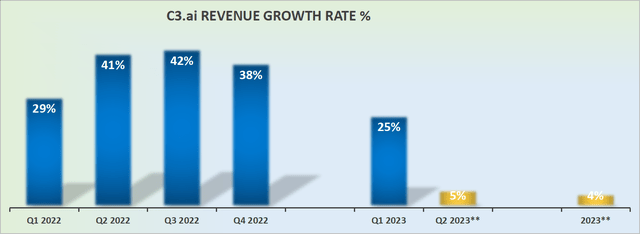

Revenue Growth Rates vs Current RPO

C3.ai has seen its revenue growth rates substantially fizzle out. While on the surface, the good news appears to be that its current remaining performance obligations have increased by 20% y/y in Q1 2023.

Typically having a significant amount of current remaining performance obligations (”cRPO”) means that there’s enough booked pipeline of work to see its revenue growth rates pick back up.

Indeed, during its fiscal Q1 2023 earnings call, C3.ai’s management said with reference to its slowing business,

The measures that we have implemented include a restructured, more productive enterprise sales function, an enhancement of our strategic partnering model, several new product offerings, a new consumption-based pricing model and an acceleration of our path to profitability.

If you’ve been investing for a while you’ll remember that back in 2020 usage-based revenue streams were all the rage.

Companies such as Fastly (FSLY) and Twilio (TWLO) were highly rewarded as business models that rapidly grew their revenues as their customers were unexpectedly landing a surprisingly large bill. And that worked quite well for a while until it didn’t.

Accordingly, this is what C3.ai’s SEC filing states,

The Company excludes amounts related to performance obligations and usage-based royalties that are billed and recognized as they are delivered or billed and recognized in the same period. This primarily consists of monthly usage-based runtime and hosting charges in the duration of some revenue contracts.

Hence, I argue that the number that investors should focus on in C3.ai’s case is its revenue guidance and not its current RPO figures.

What’s Next for C3.ai?

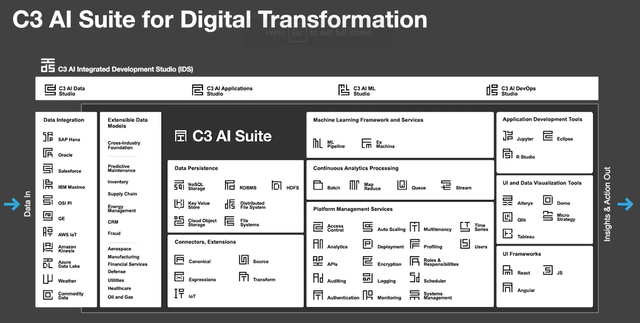

C3.ai is an AI application platform. It deploys predictive analytics at scale. The business model is a low code or no code prebuilt platform that can be deployed across industries, from energy to defense to utilities, C3.ai operates across the spectrum in the design and operation of enterprises to solve AI problems, with the goal of delivering very high ROIs to its customers.

C3.ai is used across industries as a productive tool with a wide range of use cases from inventory optimization, demand forecasting, predictive maintenance, and production scheduling, to name a few verticals that C3.ai is suited for.

Despite being recently IPOed C3.ai already holds a number of blue chip companies such as Shell (SHEL) and Baker Hughes (BKR) as its customers, as well as holding a blank check for its work with the government defense industry.

What’s more, C3.ai contends that in time healthcare will be its biggest business.

C3 website

As you can see above, C3.ai is recognized by Forrester as a leader in its market.

So the technology is clearly superior and recognized as such. What about its profitability?

Path to Profitability Still Some Time Away

Adjusting for one-off commissions, during fiscal Q1 2023 its adjusted free cash flow was negative $24 million. That means that on the back of growing its revenues to $65 million its adjusted free cash flow margin was negative 37%.

Now consider the following, of the $65 million reported as revenues in fiscal Q1 2023 $57 million was stock-based compensation.

Put another way, with so much stock-based compensation I can’t see this business turning a clean profit for a while.

AI Stock Valuation — Difficult to Estimate Fair Value

Presently, analysts following C3.ai are making what I believe to be too aggressive revenue growth assumptions as to how C3.ai’s next fiscal year will shape up to be. Analysts believe that C3.ai will grow its revenues next year by slightly over 20% CAGR.

And herein lies the problem. This doesn’t line up with the underlying situation. Indeed, C3.ai readily admits that its own customers are ”expecting a recession”.

So what we are left here with is a company that’s priced at approximately 6x this year’s revenues.

The Bottom Line

There are so many different points of dissatisfaction for investors appraising C3.ai. Indeed, asides from the impressive rhetoric by billionaire founder Thomas Siebel there’s little worthwhile for investors to pay 5x this year’s revenues.

There’s a business with rapidly decelerating growth rates, where its revenues are nearly all going out the door as stock-based compensation.

In sum, I believe that there’s very little upside left for new shareholders to the name.

Be the first to comment