Mario Tama

Introduction

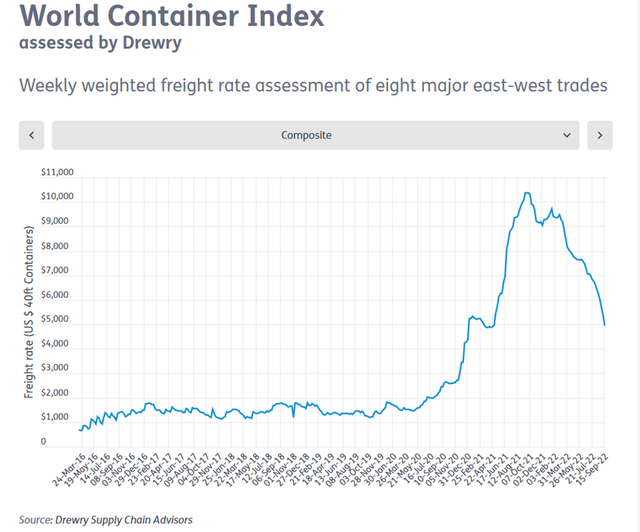

I’ve covered A.P. Møller – Mærsk A/S (OTCPK:AMKBY)(OTCPK:AMKAF) several times throughout the last couple of years, and I’ve been both right and wrong in how I viewed the stock would move. First of all, I was terribly wrong when it came to how long the container freight price glut could last, and the consequence for the stock price, causing a massive upwards surge. Maersk’s own management team has expected the freight rates to come down several times during the Covid-19 period, but they have remained elevated throughout, also as China has kept region-wide shutdowns as a tool to combat infection rates, impacting freight operations, as seven of the ten busiest container ports in the world are located in China. The result is that Maersk has been lining their pockets with gold beyond the wildest imagination, to the benefit of not only shareholders, but also Maersk’s long-term strategic outlook. To my astonishment, this effect continues to last to some extent, bolstering Maersk’s coffers to the point where it’s been possible to become very active in the acquisition market.

Infogram Container Rates 2022 (Infogram.com)

Secondly however, I eventually got the direction right, as the stock is down 31.2% since my latest bearish stance on the stock, while the S&P 500 is down 11.9% in the same period. In fairness, during that same period, shareholders have received a substantial dividend, meaning if that is factored in, the stock is only down 22.9% for the period. As the freight rates gave way, container company stock prices also had to eventually, with the current macro-outlook not making it better.

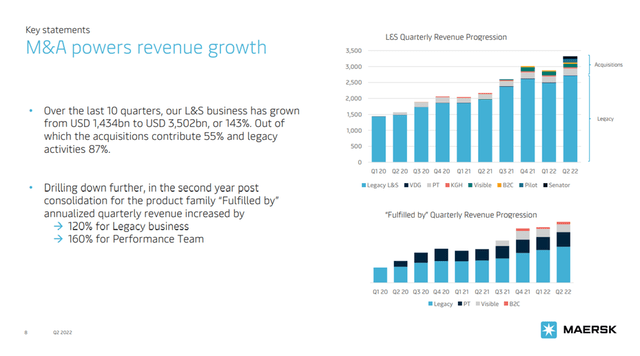

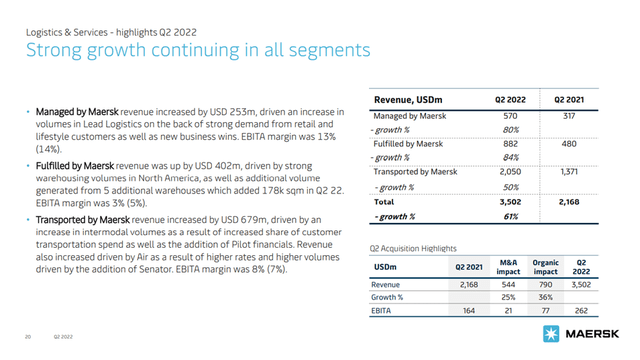

Maersk has been on an acquisition bonanza, strengthening its Logistics & Services (L&S) division, the focal point of becoming an integrated supply chain end-to-end solutions provider, showing six consecutive quarters of 30%+ revenue growth for L&S. Interestingly, 71% of L&S’s Q2-2022 revenue growth came from the group’s container freight customers, showing the value proposition across the Maersk group.

Given the strong development within the group’s L&S division, and the fact that freight rates will most likely continue to line Maersk’s pockets for an extended period, this company is not just about the ocean division going forward, as L&S is starting to contribute with an EBITDA in excess of $1 billion when normalized to a full twelve-month period. I believe that warrants looking at Maersk with fresh eyes, even if L&S is still a very small little brother compared to the other divisions of Maersk.

The Spawn Of Logistics & Services

Let’s rewind the clock, to September 2016, when Maersk sent out an announcement concerning an update on the ongoing strategic review of its existing business, a review that was initiated that same summer. Back then, still involved in oil & gas, management communicated the need to separate itself from its former business units that had been major earnings contributors for the group for decades; a financial year that ended with a loss of $1.9 billion for the full year due to an impairment charge of $2.9 billion. As such, the underlying business was profitable, but not thanks to the major driver of revenue, the container freight division, instead, the two meaningful contributors to profitability that year was Maersk Oil and Maersk Drilling with $497 million and $743 million respectively. In fact, Maersk had for the past four years straight, secured gross profit of $9.5 billion or above, but clocked only $2.4 billion for 2016, as such, it was a company in a state of crisis.

Still, management had the foresight to make a bold move to shape the Maersk group of the future. Maersk Oil was later acquired by Total (TTE) for $7.45 billion, a deal which was announced in 2017 and consisted of some cash but also a substantial amount of shares in Total. In November 2021, it was announced that Maersk Drilling, at this point a stand-alone public company owned by the family holding company, would merge with Noble Corporation (NE).

In June of 2016, the board of directors tasked management with reviewing the business, and on September 22nd, 2016, the following was announced, which was later anchored in the annual report.

Transport & Logistics consists of Maersk Line, APM Terminals, Damco, Svitzer and Maersk Container Industry based on a one company structure with multiple brands. The vision for Transport & Logistics is to become the global integrator of container logistics by connecting and simplifying the global supply chain. There are three cornerstones to realise the vision:

• Providing simple solutions to customers’ complex supply chain needs

• Elevating the customer experience through digital innovation

• Offering the industry’s most competitive container transport network to every market in the world.

Managing and operating the business activities in Transport & Logistics in a more integrated manner can unlock profitable growth and synergies through stronger collaboration and disciplined capital allocation.

The profitable growth will be realised from better customer experience across the brands in Transport & Logistics. By covering the entire value chain, supported by digitisation, Transport & Logistics can offer customers reliable logistics services and integrated offerings via tailor-made solutions and expanded products.

Maersk Group, Annual Report, p. 9, ‘Strategy section’

To begin with, as can be seen above, the current L&S went under the division name of Transport & Logistics. The main difference being that Maersk Ocean and APM Terminals was part of the original umbrella of Transport & Logistics. That changed however, as 2018 marked the first year where L&S was established and reported on a stand-alone basis.

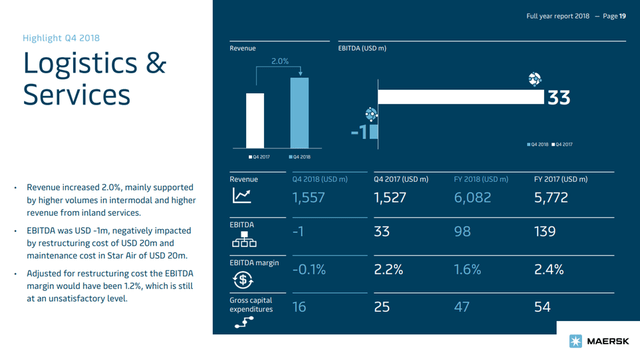

FY2018 Investor Presentation (Maersk Investor)

FY2018 for L&S resulted in revenue of $6 billion and an EBITDA margin of 1.6% corresponding to $98 million. Not exactly the hallmark of something that only a few years later would exhibit an expected rolling twelve-month EBITDA in excess of $1 billion.

Here is the performance for the following years for L&S.

- FY2019 revenue of $6.3 billion, EBITDA margin of 3.4% corresponding to $216 million in EBITDA

- FY2020 revenue of $6.9 billion, EBITDA margin of 6.5% corresponding to $454 million in EBITDA

- FY2021 revenue of $9.8 billion, EBITDA margin of 9.2% corresponding to $907 million in EBITDA

- 1H2022 revenue of $6.3 billion, EBITDA margin of 10.4% corresponding to $656 million in EBITDA

In recent years, the EBIT margin has been between 6 – 7.5% with management expecting a consistent performance of >6% in EBIT margin and an organic revenue growth above 10%. The word organic is key here, because L&S didn’t grow to its current size by pure organic growth, instead, management poured billions into acquisitions to broaden both service offerings, while also entering a whole new arena of capability not previously available to Maersk.

The Many Acquisitions Supporting L&S

The current invested capital for L&S comes in at $5.9 billion as of Q2-2022, compared to $1.8 billion a year ago at Q2-2021. Going back an additional year, and the invested capital for L&S listed after closing Q2-2020, was $1.3 billion. A lot has happened in very little time. Just for comparison, Maersk Ocean has an invested capital of $33.4 billion as per Q2-2022, illustrating the difference in size.

Initially, L&S didn’t make much of a fuss, as it wasn’t supported substantially by new capital due to a need for the group as a whole to deleverage. From 2017 to end of 2018, the group reduced its net interest-bearing debt from $14.8 billion to $8.7 billion, not least because of proceeds from the energy separation. However, as the group shored up its business, reduced debt and absorbed the recent large acquisition of Hamburg Süd into its container division, management stated becoming crisper on the actual strategy for L&S.

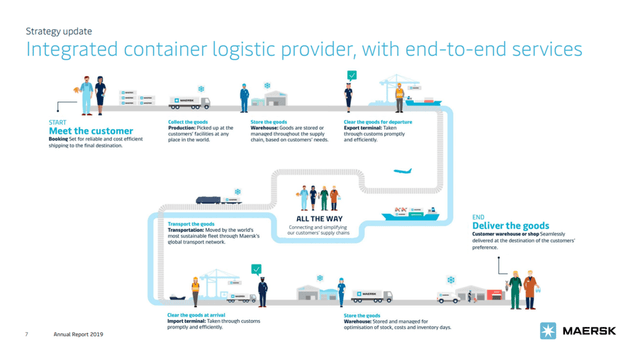

FY2019 Investor Presentation (Maersk Investor)

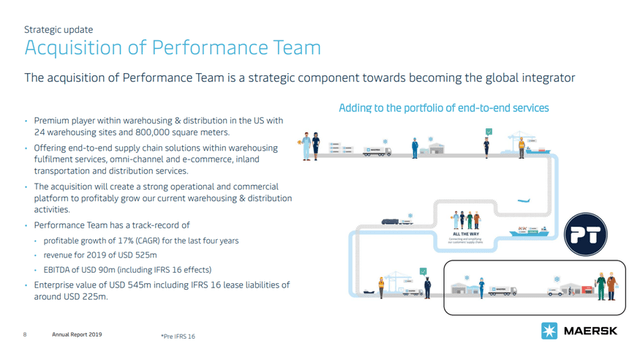

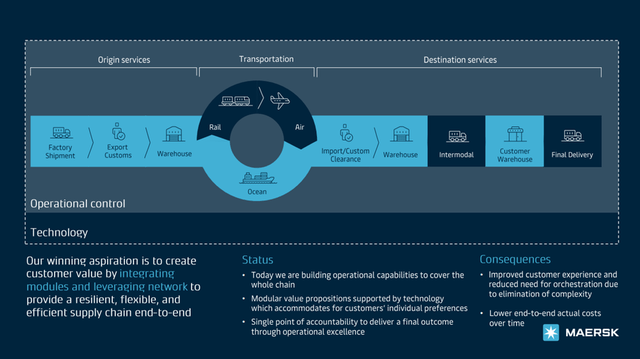

As is evident from the outlay above, Maersk wanted to service the entire value chain, linking up with customers all the way, aiming to create value at all touch points. However, Maersk didn’t have all these offerings on the shelf already, and therefore landed its first significant acquisition during 2019 with Performance Team, a US-based warehousing and distribution company, strengthening Maersk’s’ capabilities as an integrated container logistics company, offering end-to-end supply chain solutions to its customers. The price tag, $545 million.

Acquisition Of Performance Team (Maersk Investor)

As can be seen, this deal aimed at strengthening the later stages of the global transportation value chain.

The next big jump in L&S’ revenue took place during 2021, which is also the year of the most recent investor day. The investor day took place in May of 2021 where management gave an update on the strategic outlook for L&S, as well as the other divisions of the group. Being the largest container freight operator in the world, there is limited growth possibilities for Maersk in this arena, meaning management is putting their attention elsewhere, to L&S.

The global supply chain up until today, has been structured around a mindset of efficiency in a static environment, where each and every link could be relied upon with little interruption. It’s become lean to the point where the chain easily breaks in situations of disruption, as we have seen plentiful of during Covid-19. Perhaps by chance, but Maersk is hitting the sweet spot here, by aiming to possess the full overview of the transport chain, to offer the needed flexibility and resilience across, for the benefit of customers.

Maersk Supply Chain End-To-End Strategy & Status (Maersk Investor Day Presentation)

The upset in the global supply and demand balance, has caused customers to focus more on long-term value i.e., reliability, as opposed to traditional procurement with cost optimization in focus. Customers are looking towards increasingly differentiated solutions in order to meet their respective supply chain needs, and this is where Maersk’s new strategy comes into play.

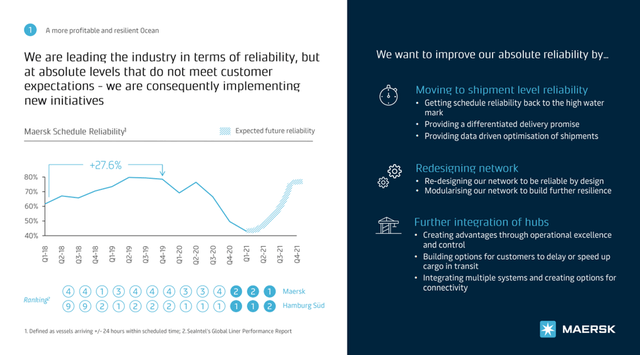

Maersk Industry Leader (Maersk Investor Day Presentation)

Maersk views absolute reliability as the biggest value lever for customers and the foundation for the integration of supply chains, and as such, it’s in this view we should observe their acquisition strategy.

Maersk M&A Roadmap (Maersk Investor Day Presentation)

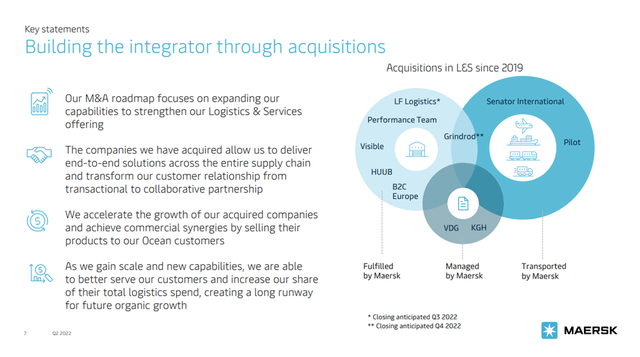

Management considers L&S as the growth engine of the future, addressing unmet needs amongst customers, as also evident by the growing revenue and EBIT margin throughout this period. Up until the investor day in May, Maersk had completed three acquisitions.

- In February 2019, Maersk acquired Vandegrift, a US based customs and trade compliance expert business, for an undisclosed price.

- The aforementioned acquisition of Performance Team for $545 million.

- In September 2020, Maersk acquired KGH Customs Services, an EU based customs expert business, for $281 million.

The acquisition bonanza continues:

- In August 2021, Maersk announced the acquisition of Visible Supply Chain Management as well as B2C Europe Holding for $838 million and $86 million respectively. Visible SCM, a US based E-commerce fulfilment company, with B2C Europe being focused on parcel delivery services.

- In September 2021, Maersk announced the acquisition of HUUB, a Portugal based cloud logistics start-up, specializing in technology solutions for B2C warehousing. Price is undisclosed, but minor.

- In November 2021, Maersk announced the acquisition of Senator International, a German based freight forward focused on especially air freight. In addition, Maersk purchases two B777F’s to bolster air freight capacity. Acquisition cost of $644 million.

- In December 2021, Maersk announced the acquisition of LF Logistics, a Hong Kong based contract logistics company with premium capabilities within omnichannel fulfilment services. Acquisition cost of $3.6 billion.

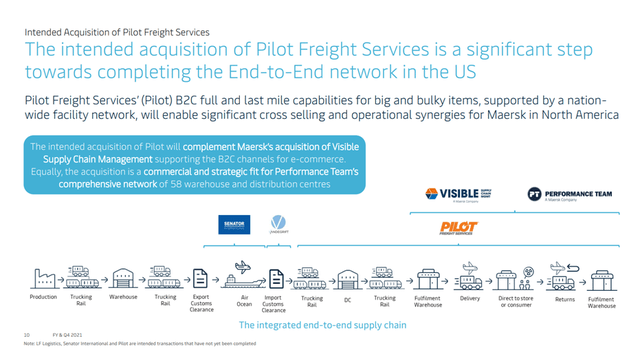

- in February 2022, Maersk announced the acquisition of Pilot Freight Services, a US based international and domestic supply chain provider with cross-border operations into Canada and Mexico. Acquisition cost of $1.68 billion.

Management labeled the latest acquisition, as a big step towards completing the end-to-end network in the US. The slide below, gives a visual illustration of where Maersk had bolstered its end-to-end offerings via the many recent acquisitions.

Maersk Acquisition Illustration (Maersk Investor, FY2021 Presentation)

The company also provides another illustration, where L&S is broken down into three sub-parts, fulfilled by Maersk, managed by Maersk and transported by Maersk – here, it’s shown how the acquisitions tie into the overall L&S offering.

Maersk Integrator Strategy (Maersk Investor, Q2-2022 Presentation)

All this activity, financed by the massive free cash flows from its legacy container operations, is quickly powering L&S into a substantial business.

Maersk Logistics & Services Revenue Development (Maersk Investor, Q2-2022 Presentation)

Here again, broken down into the individual segments.

Maersk Logistics & Services Revenue Breakdown (Maersk Investor, Q2-2022 Presentation)

Where Does This Leave Maersk’s Outlook?

Let’s not get carried away, as of first half of 2022, Maersk Ocean stood for 80.5% of total revenue and 91.4% of total EBITDA, while L&S secured 15.5% of total revenue and only 3.4% of total EBITDA, so there is a long way for L&S to become the business that makes the needle move for Maersk.

However, Management has been putting the free cash flow to good use, almost eliminating debt, shoring up the balance sheet immensely. Additionally, they have built the foundation for a Maersk that is supported by a less volatile business in the form of L&S, that will bolster the earnings over the coming years as Maersk Ocean will probably have to accept a future where rates come down.

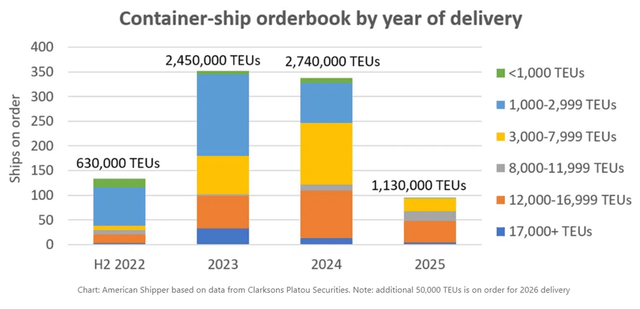

Container Ship Orderbook Outlook (www.freightwaves.com)

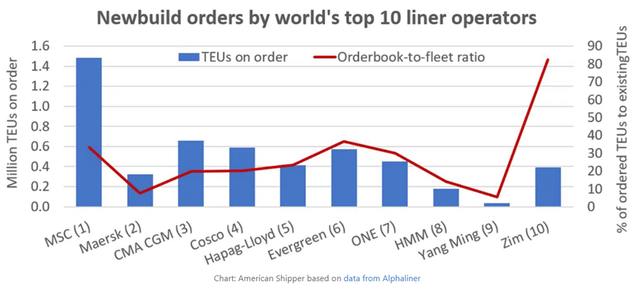

No one knows where the new equilibrium for container freight rates will be, but history appears to be repeating itself, as a time of boom in global container freight, always leads to companies ordering new builds like there is no tomorrow – with 2022 already being the fifth largest year on record when it comes to the growing demand for new builds, and we still have several months to go before closing 2022. Naturally, the large players can retire existing ships within their fleets, but there is also the risk that supply will once again start exceeding demand, causing a downwards pressure, only time will tell. As a consequence of the growing order book, Maersk was also unseated as the largest player, measured on capacity, earlier in 2022. From my vantage point, Maersk is focusing on efficiency in its ocean division, instead of strapping itself with new builds, a direction I’m much more supportive of.

Newbuild Orders By Company (www.freightwaves.com)

For now, however, I think Maersk will continue to secure strong profits and equally strong free cash flows, that management will continue to pour into the growing part of the business, the L&S division, where I believe more acquisitions are to come, growing the scope as well as revenue and profits for L&S. I’m pleased to see some of the volatility being countered in Maersk, and it will be interesting to see how far management can take this.

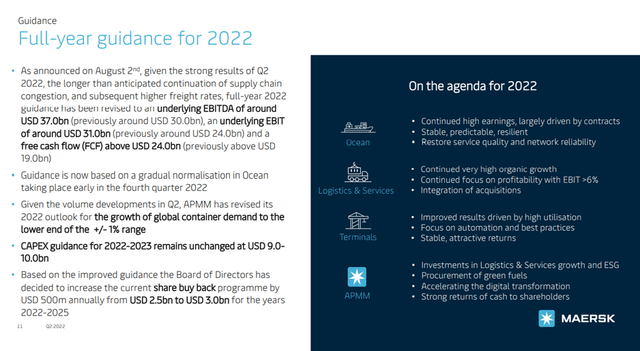

Maersk FY2022 Guidance (Maersk Investor, Q2-2022 Presentation)

The full guidance has been updated, as was expected by the market, but Maersk is also reporting that they are starting to witness the growing cost pressure, something that may reduce margins in L&S. However, looking to the long-term, this still appears to be a relevant and strong strategic move by management.

Wrapping Up

Within this article, I’ve taken a closer look at Maersk’s growing division, Logistics & Services. A division aimed at offering tailored supply chain solutions to customers, at an exact time where global supply chains require resilience and where customers are willing to pay for such resilience, as opposed to the traditional hardcore procurement cost savings focus. Having earned a ton of money on the container freight rate surge in recent years, management has allocated a substantial part of that into L&S, as opposed to doing what shippers always do in great times – order a lot of new builds. As such, even as freight rates inevitably come down to find a new equilibrium, Maersk will likely have a growing business providing earnings besides its legacy container freight. I believe management has done well in this situation, as it removes some of the volatility associated with container freight rates, a marketplace characterized by strong competition and little differentiation. Lastly, Maersk also has a much stronger balance sheet than just a couple of years ago, and in total a more meaningful outlook.

Be the first to comment