Olemedia

In early June, C3.ai, Inc. (NYSE:AI) reported another strong quarter with revenue coming in ahead of expectations, continued gross margin strength, and impressive customer adds.

However, guidance for FY23 was disappointing, with revenue growth expected to be 22-25% YOY, coming in ~7% below expectations and implying a pretty significant deceleration from the 38% YOY revenue growth seen last year. In addition, non-GAAP operating loss is not expected to improve in FY23 and when looking under the hood, much of this “profitability” is in the form of stock-based compensation add-backs.

The company is reporting FQ1 earnings at the end of the month (expected on August 31), and while I do believe they will likely beat and raise the quarter, I remain a little hesitant for now.

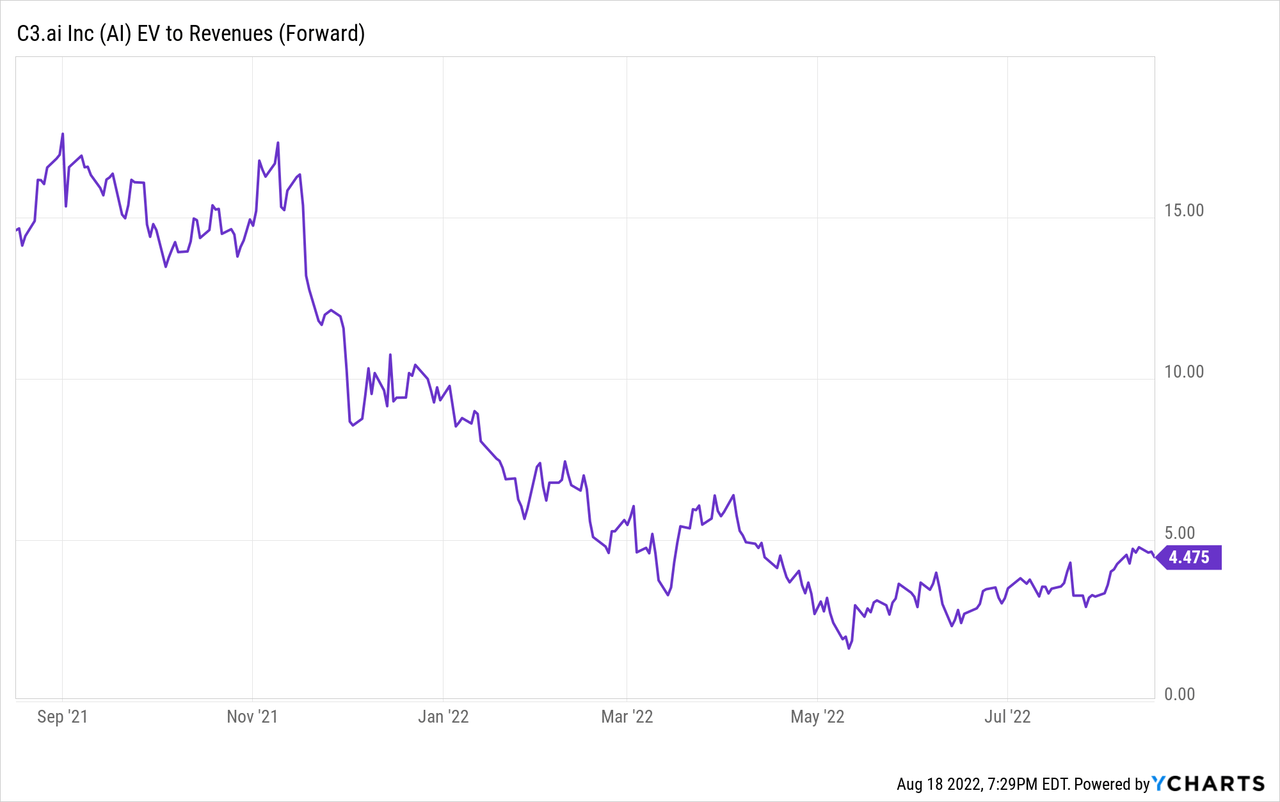

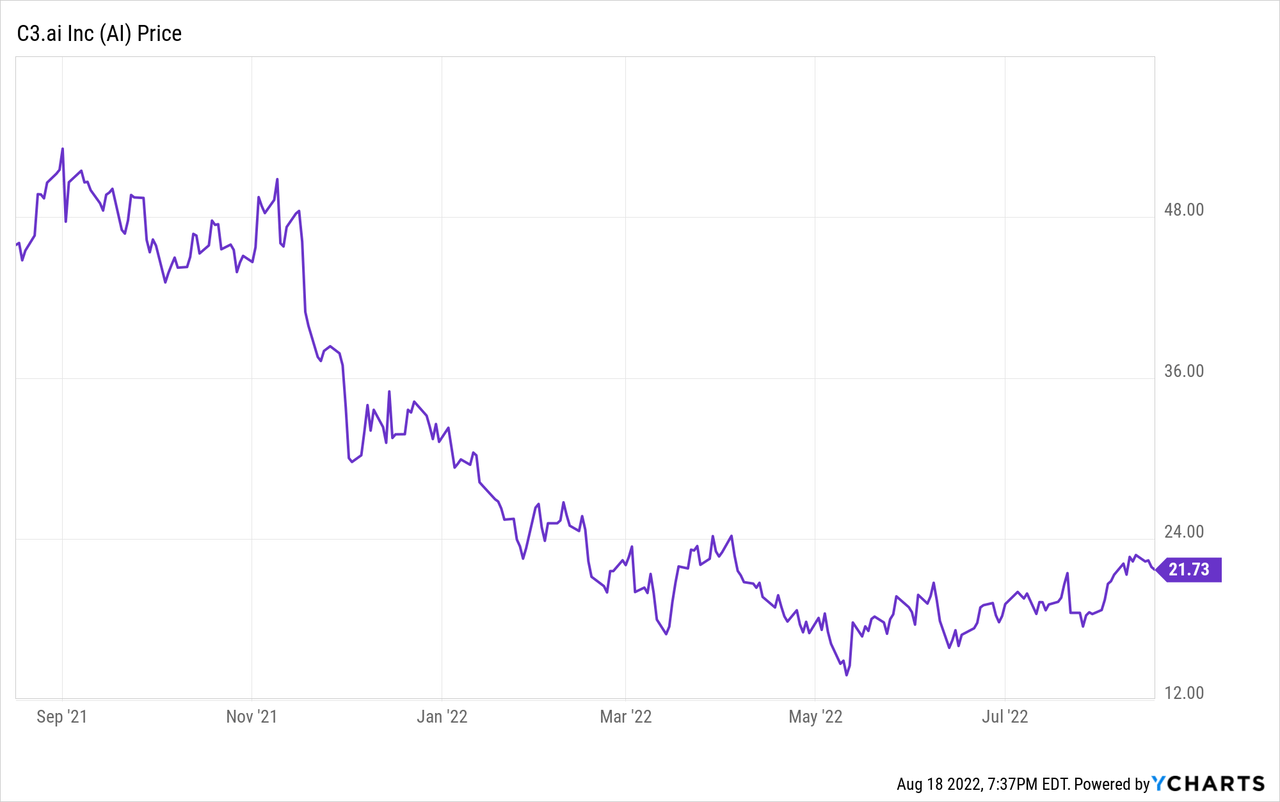

First, the stock has rebounded quite nicely over the past few months, up around 20%, despite the underwhelming FY23 guidance. While this outperformance has come to my surprise, investors likely looked at the “cheap” valuation for a company growing revenue 25%+ YOY.

Second, while long-term profitability will likely continue to improve as the company scales, non-GAAP operating loss is expected to be about the same in FY23, despite revenue growing 22-25%. This means that the incremental revenue additions during FY23 are not profitable. In addition, their non-GAAP operating loss benefits from the company adding back the significant amount of stock-based compensation, which nearly hit 50% of revenue in FY22.

Finally, while valuation has pulled back, the stock currently trades around 4.2x FY23 revenue. Yes, revenue guidance is likely conservative for the year, but for a company with revenue growth significantly decelerating and profitability a few years away, it becomes difficult to justify a much higher multiple.

While I am bearish near-term, I believe long-term investors would find any pullback in the stock an attractive opportunity to accumulate.

Financial Review and Guidance

During the company’s FQ4 in early June, they reported another quarter of beating expectations, with revenue growing 38% YOY to $72.3 million and coming in $1 million expectations. Encouragingly, subscription revenue grew 31% YOY and now represents just under 80% of total revenue.

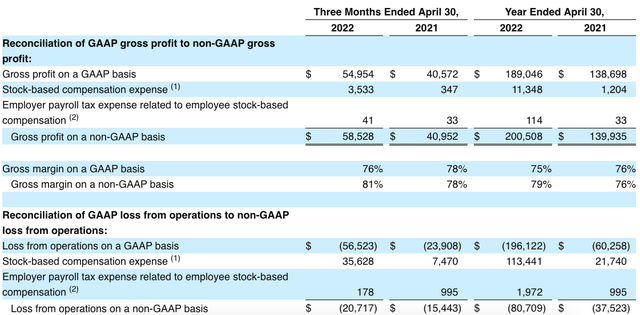

Not surprisingly, gross margins remained strong at 81%, and I have high confidence the 80%+ gross margin trend continues long-term. This will help with the company’s long-term path towards bottom-line profitability improvement.

What continues to weigh on my sentiment is the company’s lack of non-GAAP operating profit. Yes, revenue growth, customer growth, and RPO remain very strong and demand is likely resilient during a more challenging macro environment, but the company continues to hemorrhage money.

During the most recent quarter, non-GAAP operating loss was $21 million, which includes $36 million of stock-based compensation expense being added back. For the full-year, non-GAAP operating loss was $81 million, with $113 million of stock-based compensation being added back.

The only reason non-GAAP operating metric is inching closer to breakeven is because the company adds back a massive amount of stock-based compensation. Just in their most recent fiscal year, the company had stock-based compensation represent almost 50% of their revenue, all of which was added back to “profitability.”

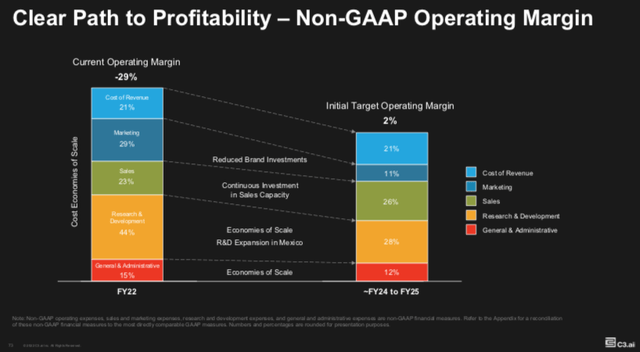

The chart above shows how the company is expecting to generate a target operating margin of 2% in FY24/FY25. However, one must question how much of this non-GAAP operating profit is actual profit, compared to non-GAAP add-backs.

I do believe there is a lot of scale the company can achieve and this will naturally help with profitability, but investors should look under the hood to figure out what the true profitability of the company is.

Nevertheless, the company does have nearly $1 billion of cash on their balance sheet to help fund their growth for the next several years. So, while I am not worried about the company’s ability to invest in growth, I am cautious around their underlying profitability.

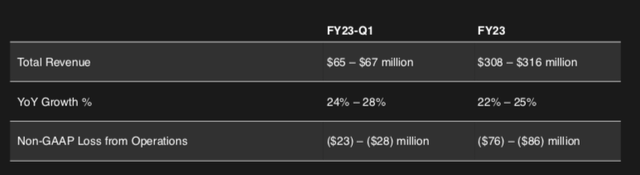

In addition, the company provided FY23 guidance that was disappointing. Revenue growth is expected to decelerate to 22-25% YOY for the full year and while the company may beat and raise expectations each quarter, this still implies a pretty big deceleration from the 38% YOY growth seen last year. FY23 revenue guidance also came in 7% below expectations, so even if they end up beating their current guidance, they might achieve consensus’ original expectations for the year.

Additionally, non-GAAP operating loss for the year is expected to be $76-86 million, it appears the underlying profitability may take more time to play out.

I do believe that expectations have been significantly lowered since the company provided their underwhelming guidance and with their upcoming earnings coming at the end of the month, investors will see just how conservative guidance is.

Valuation

Year to date, the stock remains down over 30%. However, and to my surprise, the stock is actually up almost 20% since reporting FQ4 earnings. After the FQ4 report, I thought the stock would be in the penalty box as revenue deceleration and ongoing non-GAAP losses would weigh on sentiment. I was wrong with that assumption as investors instead looked at the “cheap” valuation as justification to buy this beaten-down stock.

Currently, the stock has a market cap around $2.3 billion and with nearly $1 billion of net cash, enterprise value stands at $1.3 billion. Using the company’s likely conservative FY23 revenue guidance of $308-316 million, this implies an FY23 revenue multiple around 4.2x.

While the multiple has pulled back a lot from their historical levels, revenue growth has significantly decelerated and investor sentiment around high-valuation stocks has cooled off. With fears of a potential recession around the corner, investors are rotating into more defensive names, specifically those with sustainable levels of profitability.

Even if revenue growth were to beat expectations each quarter, it will be challenging to return to 30% YOY growth. Granted 25% revenue growth is still very healthy, the lack of profitability makes it difficult to justify a valuation much higher than 4-5x forward revenue.

For now, I continue to remain on the sidelines for C3.ai, as the revenue growth and profitability combination should not justify further multiple expansion. With the company reporting FQ1 results at the end of the month, I believe we could see some volatile trading sessions. While I lean a little bearish on the stock heading into the quarter given the challenging macro environment and the stock’s 20% rebound over the past few months, I believe long-term investors will find any pullback a good opportunity to accumulate.

Be the first to comment