shaunl

It’s never fun to admit you were wrong. One case in which I was clearly wrong was when I last wrote an article about C.H. Robinson Worldwide (NASDAQ:CHRW). Previously, when I wrote about the firm, I ended up rating it a ‘hold’, indicating that I felt it offered limited upside relative to the broader market. Since then, fundamental performance for the company has been strong. And while shares of the business have risen, the valuation of its stock has declined. I am still cautious about current market conditions, especially considering recent economic data, leading me to keep my ‘hold’ rating on the firm for now. But clearly, my assessment of the business earlier this year came too early.

Things are going well

Back in late January of this year, I wrote an article that took a neutral stance on C.H. Robinson Worldwide. In that article, I acknowledged that the company’s performance had been very strong in the prior months. This was due in large part to global trade pressures that were making its services more valuable. I did say that shares looked cheap on a forward basis, but that investors should be wise to assume that the trade picture would not last forever. I also said that when the situation on trade normalized, that shares would not look cheap at all. This ultimately led me to rate the business a ‘hold’. But since then, shares have generated a return for investors of 15.3%. That compares to the 1.1% decline experienced by the S&P 500 over the same timeframe.

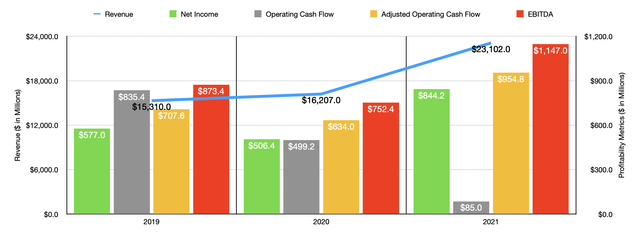

Since the publication of my article, the company has flourished, with fundamental performance drastically outperforming the broader market. To see what I mean, we should first touch on how the company finished its 2021 fiscal year. When I last wrote about it, we only had data covering through the third quarter of the year. For the year as a whole, revenue came in at $23.10 billion. That translated to a year-over-year increase of 42.5% compared to the $16.21 billion generated in 2020. Profitability for the company also improved, with net income rising from $506.4 million to $844.2 million. Operating cash flow fell from $499.2 million to just $95 million. But if we adjust for changes in working capital, it would have risen from $634 million to $954.8 million. Over that same window of time, EBITDA rose from $819 million to $1.15 billion.

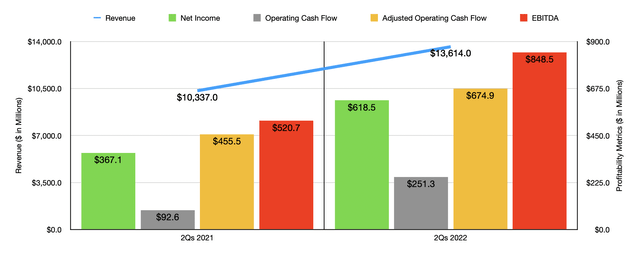

This increase was not a one-time thing. In fact, performance so far in 2022 is looking really robust. Sales in the first half of the year came in strong at $13.61 billion. This represents an increase of 31.7% over the $10.34 billion generated in the first half of its 2021 fiscal year. Transportation sales grew by 32.6%, while sourcing sales increased by a more modest 15.8%. Management attributed this upside to a couple of factors. Thanks to strong demand for its services, the company was able to raise prices in all of its service lines, especially when it came to ocean and truckload services. Volume for ocean and truckload services also increased, but management did not say by how much. To understand this, we have to look at the specific operating segments of the enterprise. The NAST segment, for instance, saw truckload volumes grow by 3% year over year, even as the less-than-truckload volumes dropped by 3%. Under the Global Forwarding segment, ocean line volume grew by 4.5%, while air volume increased a more modest 1.5%. The greatest volume increase, however, was under the customs category. Growth here was 8% year-over-year.

This strength on its topline naturally led to increased profitability for the company. Net income came in during the first half of the year at $618.5 million. This compares favorably to the $367.1 million in profits generated in the first half of 2021. Operating cash flow rose from $92.6 million to $251.3 million. If we adjust for changes in working capital, it would have risen from $455.5 million to $674.9 million. Meanwhile, EBITDA for the company also expanded, climbing from $520.7 million to $848.5 million. Unfortunately, no guidance was given when it came to the 2022 fiscal year as a whole. But if we assume that first-half results are indicative of second-half results, we should anticipate net income of $1.42 billion, adjusted operating cash flow of $1.42 billion, and EBITDA of $1.87 billion.

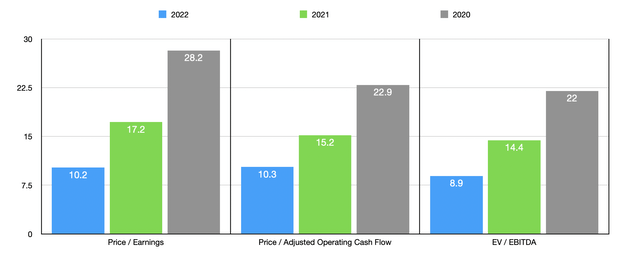

Using this data, we can see that the company is trading at a forward price-to-earnings multiple of 10.2. This is down from the 17.2 multiple that we get using 2021 results. What’s more, it’s also cheaper than the prior 16.3 reading that I estimated for 2022 in my last article. The price to adjusted operating cash flow multiple should come in at 10.3. This stacks up against the 15.2 reading we get using last year’s results, and it is cheaper than the 13.7 reading I calculated in my prior piece. Meanwhile, the EV to EBITDA multiple should be 8.9. When it comes to the 2021 figures, this multiple increases to 14.4. By comparison, in my last article, I calculated it at 11.5. It is worth noting, however, that while shares to the company do look cheap on a forward basis, a return to even 2020 levels would make it look a bit lofty. This can be seen in the table above. As part of my analysis, I also compared the company to five similar firms. On a price-to-earnings basis, these companies ranged from a low of 8.4 to a high of 23.2. Using the price to operating cash flow approach, we saw ranges from 5.6 to 15.1. In both cases, only one of the five firms was cheaper than C.H. Robinson Worldwide. Meanwhile, using the EV to EBITDA approach, the range is from 5 to 13.2. And in this case, only two of the five firms were cheaper than our prospect.

| Company | Price/Earnings | Price/Operating Cash Flow | EV/EBITDA |

| C.H. Robinson Worldwide | 10.2 | 10.3 | 8.9 |

| Expeditors International of Washington (EXPD) | 13.0 | 12.0 | 8.5 |

| ZTO Express (ZTO) | 23.2 | 15.1 | 13.2 |

| GXO Logistics (GXO) | 17.7 | 11.3 | 12.9 |

| Hub Group (HUBG) | 8.4 | 5.6 | 5.0 |

| Forward Air Corporation (FWRD) | 14.8 | 10.7 | 10.1 |

Takeaway

The data provided suggests to me that I was too early and making my ‘hold’ call on C.H. Robinson Worldwide. Although it may seem odd that I am admitting this while retaining that call, I do believe that the picture has changed from an economic perspective. At some point, demand for transportation should drop. And when it does, the company might experience a decline in profitability to some degree. A return to 2020 levels, for instance, would probably warrant some downside for the stock. But for people who remain committed to this space and who believe that pricing for transportation will remain elevated, C.H. Robinson Worldwide is definitely more attractive from a valuation perspective than similar firms. So for these types of investors, it might make sense. But for me, it is still a pass for now.

Be the first to comment