peterschreiber.media/iStock via Getty Images

Recently, the market has been incredibly volatile. During times like this, investors who are concerned about the near-term future might be focusing on some safer investment opportunities, while those who believe that the storm can be weathered easily might want something a bit more aggressive in their portfolios. Regardless of your view of the market, one company that is an interesting prospect to examine is BWX Technologies (NYSE:BWXT). This firm, which focuses on the production of nuclear components and that also provides engineering and in-plant services for nuclear power utility customers and the government, has been holding up quite well in recent months and certainly warrants some consideration. Fundamentally, the business continues to perform quite well and that trend looks set to continue for the foreseeable future. But even with strong performance, upside from here is likely limited. To be clear, I don’t think that the company is a bad prospect by any means. For those who want a solid company at a decent price, this may be a great prospect to consider. But for those wanting stronger returns, and who don’t mind accepting the volatility that comes with seeking those returns, there are better plays on the market right now.

Great performance

Back in May of this year, I revisited BWX Technologies after the company had posted some strong share price appreciation. In that article, I applauded the company for the performance that it achieved. I was particularly impressed with the increase in revenue, but I did say that profitability looked to be under pressure. Despite this, I felt that the enterprise was still a healthy business and that the long-term trajectory of the company was positive. But for the most part, I felt as though much of the value that existed when I initially wrote about the company previously had now been captured. This led me to downgrade the company from a ‘buy’ to a ‘hold’, the latter reflecting my belief that it should generate returns that more or less follow the broader market for the foreseeable future. Since then, the company has surprised in a positive way. While the S&P 500 is down by 6.9%, shares of BWX Technologies have generated a profit for investors of 2.2%.

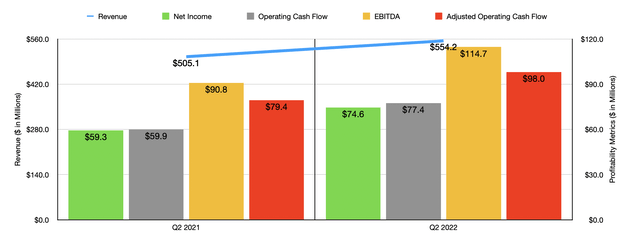

This return disparity occurred because of strong performance on both the top and bottom lines for the business. To see what I mean, we need only look at data covering the second quarter of the firm’s 2022 fiscal year. This is the only quarter for which data is now available that was not available when I last wrote about it. Sales during that quarter came in at $554.2 million. That represents an increase of 9.7% compared to the $505.1 million the company generated the same time one year earlier. In absolute dollar terms, the largest contributor to this increase in sales year over year was the Government Operations segment of the enterprise. Sales there jumped by 7.7% from $405.5 million to $436.5 million. This was driven, in turn, by additional volume in the manufacture of nuclear components for the US government programs the company services and it was also due in part to the timing of the procurement of certain long lead materials relative to when those materials would have been recognized one year earlier. On a percentage basis, however, the real increase came from the Commercial Operations segment of the company, with revenue shooting up by 16.4% from $101.8 million to $118.5 million. This, management said, was driven by higher levels of in-plant inspection, maintenance, and modification services, as well as by increased revenue associated with its nuclear fuel handling and medical radioisotopes product lines.

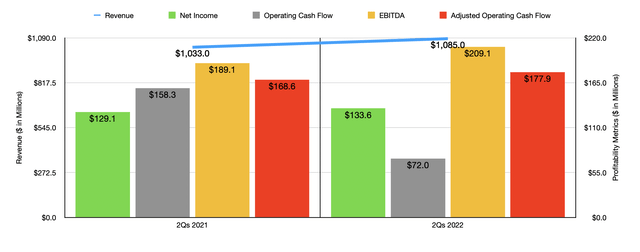

In my prior article, my big concern for the company had been related to the profitability of it. However, the company more than made up for this in the second quarter. Net income during that quarter came in at $74.6 million. That dwarfs the $59.2 million in profits generated the same time one year earlier. Operating cash flow grew from $59.9 million to $77.4 million. If we were to adjust for changes in working capital, it would have risen from $79.4 million to $98 million. Meanwhile, EBITDA for the company also improved, rising from $90.8 million to $114.7 million. As my second chart in this article shows, this strong performance in the second quarter was instrumental in pushing most of the profitability measures for the company up above what they were last year if we look at the first six months of each year as a whole.

Moving forward, management does have high expectations for the company. Now they anticipate revenue climbing by between 6.5% and 8% year over year. That’s up from the prior range of between 3% and 4%. This increase in guidance brought with it an increase in expectations when it comes to the company’s bottom line as well. Earnings per share are now forecasted to be between $3.08 and $3.23. That’s half a cent higher than the prior expected figure provided if we use the midpoint as our number. Meanwhile, EBITDA is now forecasted to rise by between 5% and 6.5%. That stacks up against the 3% to 4% increase previously offered up. The only profitability metric that is not expected to improve is operating cash flow. This still remains unchanged at between $260 million and $290 million.

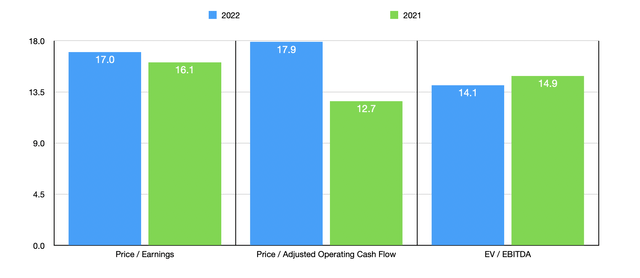

Using these figures, we can easily value the company. On a price-to-earnings basis, the company is trading at a forward multiple of 17. That compares to the 16.1 reading that we get using data from 2021. The price to operating cash flow multiple is now expected to be 17.9. That’s a significant deterioration compared to the 12.7 reading that we would get using data from 2021. Meanwhile, the EV to EBITDA multiple should drop slightly from 14.9 to 14.1. As part of my analysis, I also compared the company to five similar businesses. On a price-to-earnings basis, these companies ranged from a low of 17.3 to a high of 51. In this case, BWX Technologies Is the cheapest of the group. Using the price to operating cash flow approach, the range is between 9.7 and 69.5, with only one of the five companies being cheaper than our prospect. And when it comes to the EV to EBITDA approach, the range is between 9.9 and 17.3. In this scenario, four of the five companies are cheaper than our target.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| BWX Technologies | 17.0 | 17.9 | 14.1 |

| Parsons Corp (PSN) | 51.0 | 23.9 | 17.3 |

| Raytheon Technologies (RTX) | 28.5 | 18.8 | 14.4 |

| Elbit Systems (ESLT) | 17.5 | 69.5 | 9.9 |

| Curtiss-Wright Corp (CW) | 22.3 | 23.3 | 13.7 |

| Textron (TXT) | 17.3 | 9.7 | 10.3 |

Takeaway

All the data provided right now suggests to me that BWX Technologies is doing a great job for itself and that trend is unlikely to be anything other than positive in the long run. Some of the profitability metrics this year are still slated to come in weak. But on the whole, the company does not look all that bad. Shares are definitely not undervalued at this time, but I can imagine a scenario where they would be considered more or less fairly valued. Because of this, I have decided to keep my ‘hold’ rating on the firm for now.

Be the first to comment