Jonathan Kitchen

The relatively newly spun-off The Aaron’s Company, Inc. (NYSE:AAN) started trading in late November 2020, and since then, the shares are down about 44%. That, and the fact that I find the “lease” and “lease to own” markets intriguing has me intrigued. I like buying bargains, and a price drop of this magnitude is, by definition, interesting. I’m going to work out whether or not it makes sense to buy at current prices by looking at the short financial history here, and by looking at the stock as a thing distinct from the underlying business. In particular, I want to consider whether the dividend is sustainable and whether the yield is worth the risk here.

My writing can be tiresome for many. I get that, and for that reason, I want to try to limit exposure to people as best I can. You’re welcome. One of the ways I do this is by sometimes aggressively editing my stuff (hard to believe, but I do). Another way is by writing a thesis statement where I give you the “gist” of my thinking in a short paragraph, so you won’t be obliged to wade through the entire article. I will be buying a small stake in Aaron’s this morning for a variety of reasons. I think the business is reasonably sustainable, though volatile. I’ll be adding to the position (or not) depending on how things shake out over the next few quarters. I’m particularly compelled by the relatively high dividend yield, which goes a long way toward evening out returns from the stock. Finally, the shares are trading at a deep discount to the overall market, in spite of recent profit softness. I think the company has the potential to grow from here, and the attractive dividend yield gives me time to wait for that growth.

Financial Snapshot

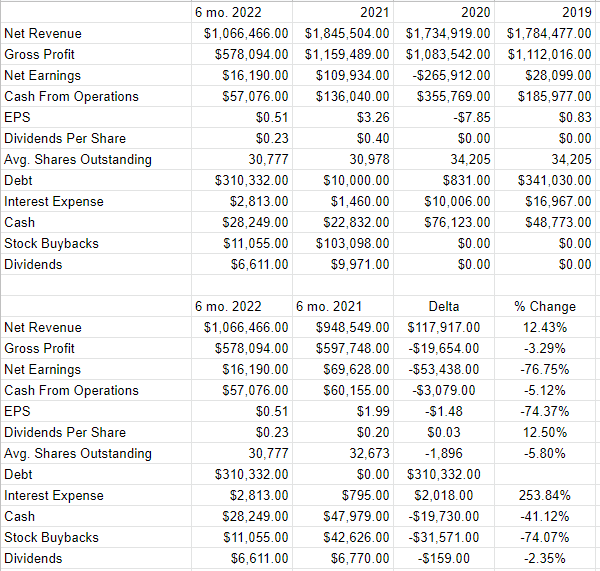

There’s obviously very little financial history here, but I’ll comment on it, because that’s just the kind of person I am. To refresh your collective memories in case you forgot, the announcement of the spin-off happened in July 2020, so Aaron’s doesn’t have the longest trading history. Also, on April 1st, the company closed its $230 million acquisition of BrandsMart USA.

Digging into the financials, we see that the first six months of this year are a mixed bag when compared to the same period in 2021, in my view. Specifically, revenue was about 12.5% higher, though net income was off by $53.5 million, or 76% compared to the same period last year. The chief culprit was a $153 million uptick in cost of sales. Additionally, debt has exploded higher, to $310 million, largely caused by the BrandsMart acquisition. This obviously increases the risk, but all signs are that the merger is going reasonably well. Specifically, in the second quarter alone, BrandsMart delivered $181 million in revenue.

Of primary concern for me is the dividend, for two reasons. First, it’s supportive of price, meaning that at some point people will buy the shares of a sustainable dividend, which puts a floor under the stock. Second, the dividends that investors receive are far, far more predictable than the returns from the capricious stock market. Given that the company has $28.3 million in cash, earned $57 million in cash from operations for the first six months of the year, while spending only $6.6 million, I’m fairly comfortable about the dividend. Thus, I’d be willing to buy the stock of what I think is a sustainable dividend payer at the right price.

Aaron’s Financials (Aaron’s investor relations)

The Stock

If you’re one of my regular victims, you know that I think the stock is distinct from the business in many ways. I’m about to elaborate on that idea yet again, so, strap yourselves in, I guess. Anyway, it’s not too controversial to point out that a business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company. It seems that the crowd changes its views about the company relatively frequently, which is what drives the share price up and down. Additionally, the stock may move up and down dramatically because some fashionable analyst or money manager says something in the financial press. They may then change their mind after a quick conversation with someone from another part of their firm. Added to this are all the risks that have nothing at all to do with the specific company or stock. There’s the so-called “systemic” volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favorite investment get buffeted in the short term, within this tedium lies opportunity. If we can spot discrepancies between the crowd’s price and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

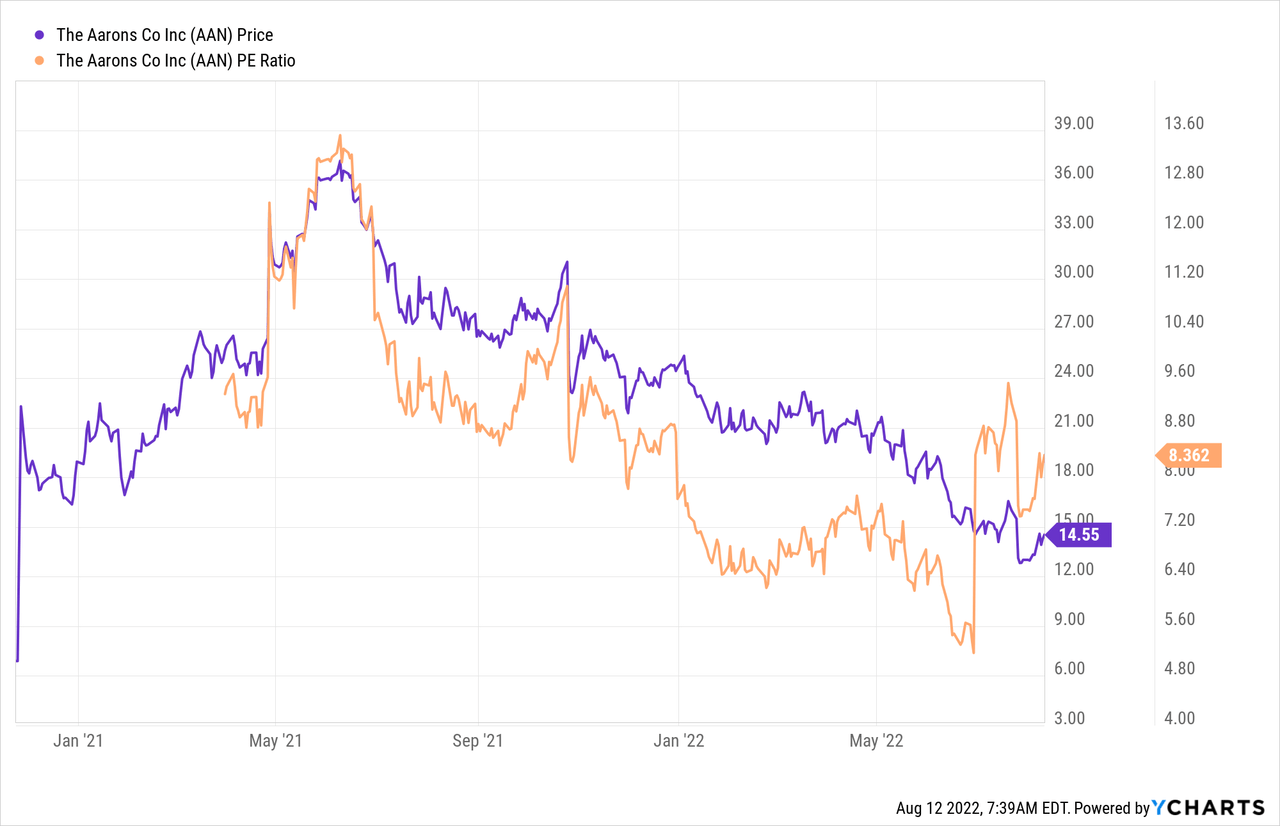

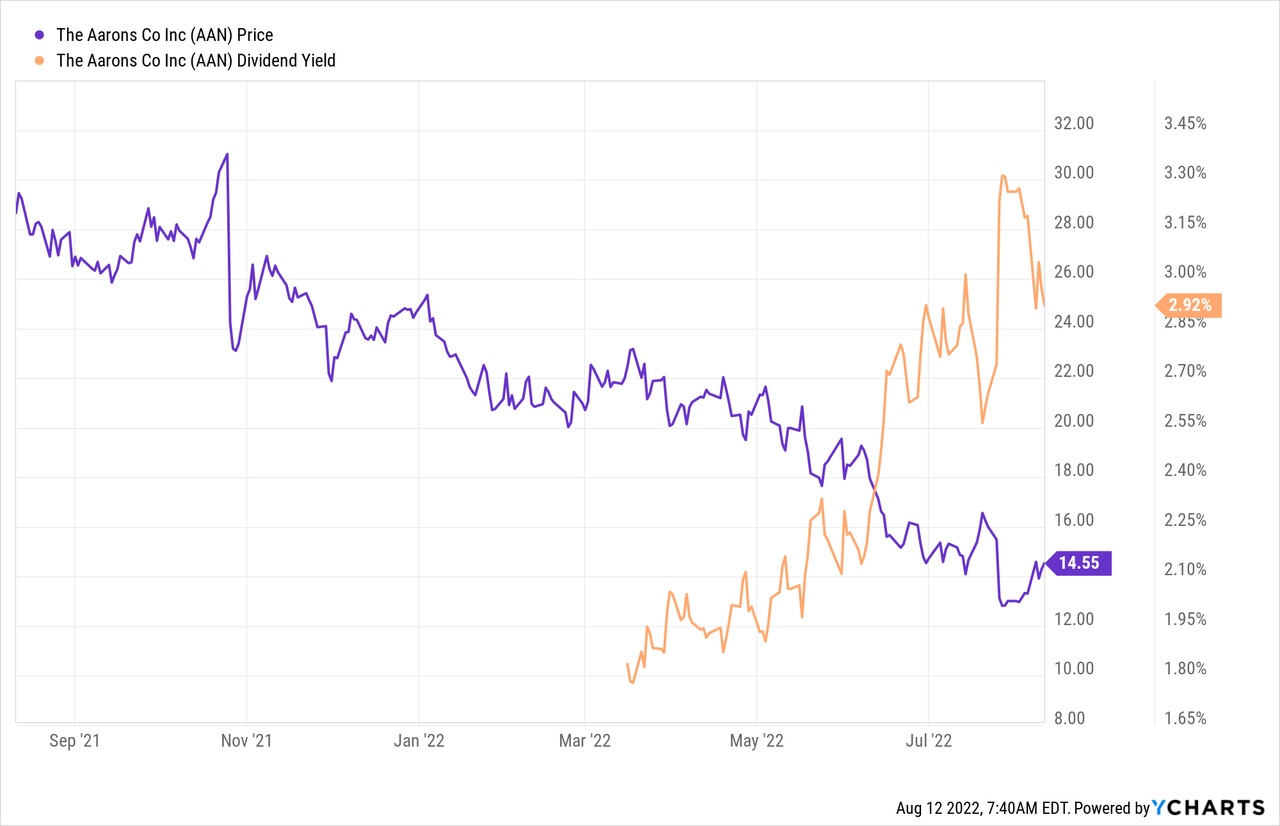

If you read my stuff regularly, you know that I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. I want to see a company trading at a discount to both the overall market, and the company’s own history. With that as a preamble, please have a look at the following. The shares are neither cheap nor expensive relative to their own past, but they’re objectively cheaper than the overall market:

In addition, the shares are yielding on the high side relative to most other points during their very short history.

In addition to looking at simple ratios, I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Some people have complained that Penman is a bit dense for them. Another great introduction to this idea of using the stock price itself as a rich source of information to work out expectations is “Expectations Investing” by Mauboussin and Rappaport. The duo has recently written an update, and it is excellent in my estimation.

Anyway, applying this approach to Aaron’s at the moment suggests the market is assuming that this company will grow at a rate of ~3%, which I consider to be reasonable enough. Given all of the above, I’ll be taking a small stake this morning and will add to it if the shares remain attractively priced.

Everything’s Relative

Over the past few articles, I’ve made a big deal about the fact that in the domain of investing, everything’s relative. If you buy X, you’re by definition eschewing Y, so “X” had better be a superior choice to “Y.” I mention this to highlight how much better a choice Aaron’s is to the overall market. For instance, at the moment, the S&P 500 is sporting a dividend yield of 1.7%, and a PE of 21.25 respectively. So the yield on Aaron’s stock is 70% greater, and the PE on the S&P 500 is about 236% greater than that of Aaron’s. So, investors in this stock are paying much less, and getting much more. In my view, that is a combination that works out well over time.

Conclusion

In my portfolio, I have some companies that I buy for growth, and I have some that I buy for boring, steady income. Aaron’s will be an example of the latter. I don’t need this stock to grow very much because I’m compelled by the relatively high yield at the moment. Temperamentally, I prefer dividends, option premia and the like because these are more predictable than the returns from stocks. People buy fashionable stocks in hopes of riding them even higher, but that’s troublesome in my view because what the market giveth, the market can very easily taketh awayeth. There are many reasons to believe that the market is heading for a correction (as there always are), but there are no reasons to believe that this dividend will be cut anytime soon. For that reason, I’ll be taking a small position in this standalone enterprise over the next day or so.

Be the first to comment