da-kuk/E+ via Getty Images

It’s been about 45 months since I wrote my bullish article on Patrick Industries Inc. (NASDAQ:PATK), and , although the shares showed signs of life in early 2021, they have basically flatlined against a gain of ~60% for the S&P 500. Something with the name “Patrick” attached massively underperformed. Huh. Shocker.

Anyway, I thought I’d review the name yet again as I’m compelled by the 2.3% dividend here. The shares have dropped 37% over the past year, and I find that compelling also. So, dear readers, it’s time to review yet another financial history, and a stock. I want to pay particular attention to the sustainability of the fledgling dividend. I also want to check to see how cheap the stock is relative to both its own past and the overall market.

I know you’re a busy group, dear readers. You’re juggling a few dozen companies at the moment, and you’re trying to figure out which supermodel’s phone call to return. I too am busy as evidenced by the fact that I’ve got about a year of “The Young and the Restless” to catch up on. So, in an effort to save you time, I’m going to offer you the gist of my argument in this, the “thesis statement” paragraph. I think Patrick Industries is a great buy at the current price. The company has just had an excellent year, and the shares are priced very, very cheaply in my view. I think they are so cheap that even if earnings drop significantly from here, the investment is still compelling, given the low valuations. In addition, I think the dividend is reasonably well covered. Finally, I think the options market is offering some decent premia at the moment, so I’ll be selling the August puts with a strike of $45. If the shares don’t happen to drop over 20% in price over the next 4½ months, I’ll pocket the rich premia. If the shares do fall, I’ll buy even more of this company at a price that lines up with a 3% dividend. That’s it. At the beginning of this paragraph, I set out to offer you the entirety of my thinking in as pithy a manner as possible. I don’t want to blow my own horn too hard, but I think I’ve succeeded.

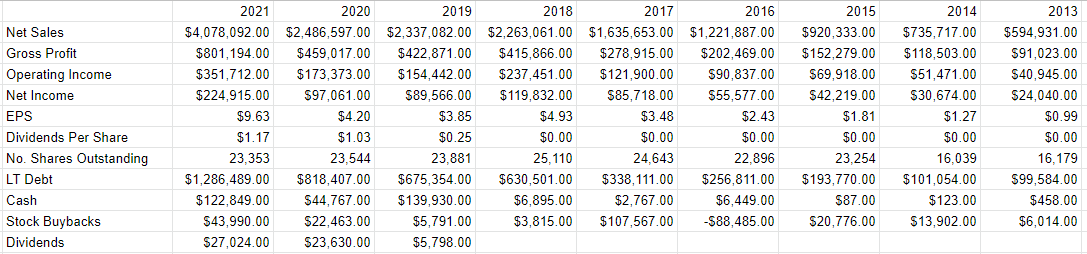

Financial Snapshot

I think it’s fair to say that 2021 was a very good year for the company. Specifically, the top and bottom lines were up by 64%, and 132%, respectively. The company rewarded investors with a 96% uptick in buyback activity, and a 14% increase in dividend payments. At this point, the suspicious among you may be skeptical of comparisons to 2020, as you may remember that the year 2020 was singular, and thus any comparisons made to only that period should be taken with a very liberal helping of salt. That is a fair point, my skeptical friend. The year 2020 was indeed awful, and thus any comparisons to that year has the potential to make a company look unreasonably good. Knowing that, let’s expand our horizons and make a comparison to 2019, shall we? When we do that, 2021 stands out yet again as a relative standout year. Revenue was 75% higher, and net income was 151% higher than it was in 2019.

It’s not all animated bluebirds and cookies fresh from the oven over at Patrick Industries, though. In particular, the company added about $468 million to the long-term debt outstanding. The fact that cash expanded by $78 million at the same time cushions the blow somewhat, but the fact is that the capital structure has deteriorated somewhat in my view. When I see debt increases my first thought is of the dividend. “Is the added debt sufficiently troublesome as to potentially impact the dividend?” is the specific question that pops into my head, and it’s one that I’m about to try to answer for our collective enjoyment.

Dividend Sustainability

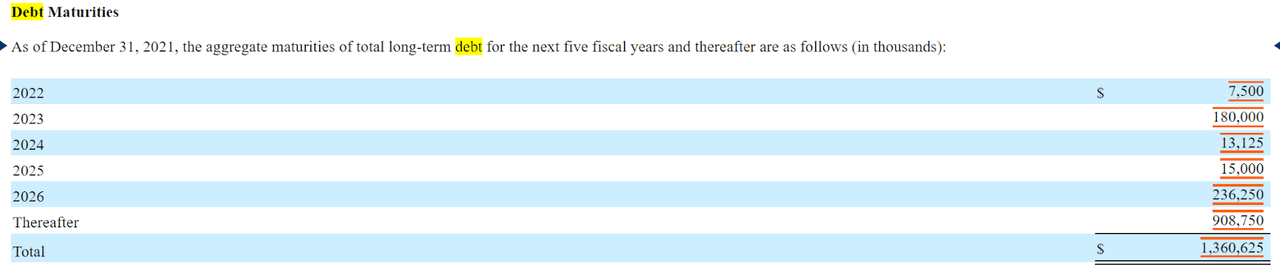

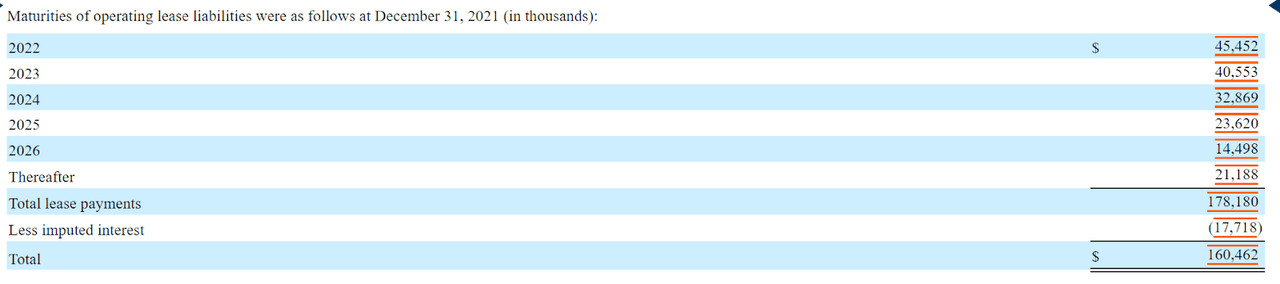

Welcome to the “dividend sustainability” portion of the article, dear readers. The fact is that I’m as interested in financial history as the next finance nerd, but all of you are much more interested in a company’s financial future in general and dividend sustainability in particular for pretty obvious reasons. In case the importance of dividend sustainability isn’t particularly obvious to you, I’ll pass along why I think it is. First, the cash flows received from dividends help smooth the ride from a bumpy stock. They constitute a pretty important component of total returns. Second, the dividend is obviously supportive of stock price. Although I’m as much of a fan of accrual accounting as any semi-sane person can be, when it comes to tracking the sustainability of a given dividend, I look at cash. I specifically want to compare the size and timing of future cash obligations to the current and likely future sources of cash. Let’s start with the obligations. I’ve taken the liberty of plucking a copy of the size and timing of both future debt payments and future lease obligations the latest 10-K. I’ve done this so you won’t be obliged to go through this document yourself. You’re welcome.

Apart from large outflows in 2023 and 2026, we see from the below that lease expenses represent the lion’s share of contractual obligations over the coming years. For example, this year the company will spend about $45.5 million on leases, while repaying about $7.5 million in debt.

Patrick Industries Debt Repayment Schedule (Patrick Industries 2021 10-K)

Patrick Industries Lease Obligation Schedule (Patrick Industries 2021 10-K)

Against these obligations the company has about $123 million in cash and equivalents. Additionally, they’ve generated an average of $202 million in cash from operations over the past three years, while spending an average of about $330 million on CFI activities. The CFI figure was goosed by acquisitions, though, which aren’t “ongoing” issues obviously. If we strip out the cash spent on acquisitions, the company spends about $40.5 million on average in “typical” CFI activities. Given the above, I’d suggest that the annual dividend of approximately $27 million is very well covered. Thus, I’m comfortable buying at current levels, assuming the market hasn’t gotten ahead of itself on the valuation front.

Patrick Industries Financials (Patrick Industries investor relations)

The Stock

Some of you who follow me regularly know what time it is. It’s the point in the article where I turn into a real “downer”, because it’s here that I remind everyone not to get too excited about Patrick’s dividend or its latest financial results. The company can make a great deal of money, but the investment can still be a terrible one if the shares are too richly priced. This is because Patrick is a business that takes a bunch of inputs, adds value to them, and then sells them for a profit. That’s all a business is in the final analysis. The stock, on the other hand, is a proxy whose changing prices reflect more about the mood of the crowd than anything to do with the business. In my view, the stock price changes are much more about long run, future expectations, and the whims of the crowd than anything to do with the business. This is why I look at stocks as things apart from the underlying business.

I love to belabour points, so please allow me to indulge in this tendency. I’ll demonstrate the importance of looking at the stock as a thing distinct from the business by using Patrick Industries itself as an example. The company released annual results on February 25th. If you bought this stock that day, you’re down about 20% since then. In fact, most of the gains of the past few years have been wiped out since. If you waited a month before buying, and picked up some shares on March 25th, you’re down about 9% since. Obviously, not much changed at the firm over this short span of time to warrant an 11% variance in returns. The differences in return came down entirely to the price paid. The investors who bought virtually identical shares more cheaply did less badly than those who bought the shares at a higher price. This is why I try to avoid overpaying for stocks.

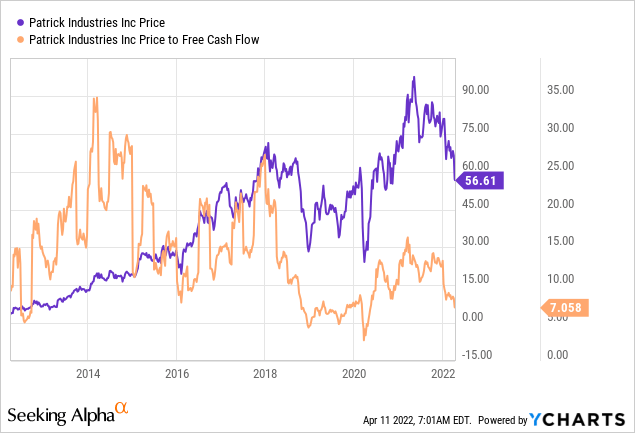

My regulars know that I measure the cheapness (or not) of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I look at the ratio of price to some measure of economic value like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, I became downright giddy when the stock hit a price to free cash flow value of 13.2, which was very near a multi-year low. The shares are now ~47% cheaper per the following:

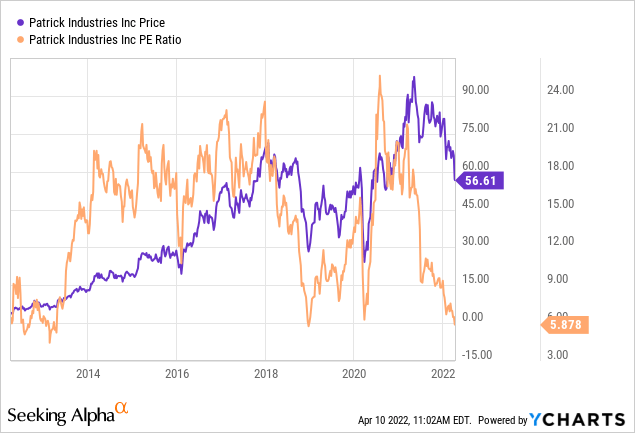

In addition to price to free cash flow per share, we see that the PE multiple is near multi year lows as well.

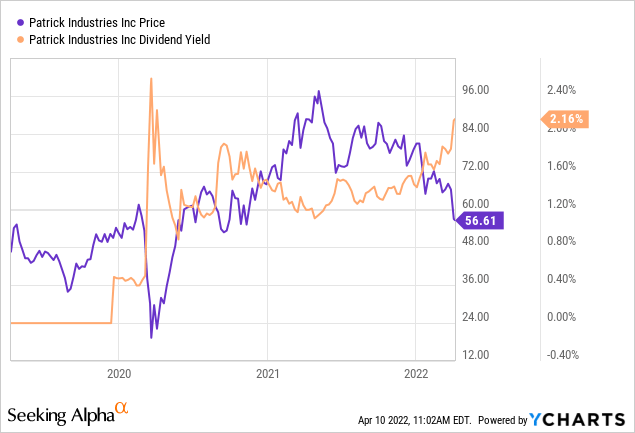

At the same time that investors are paying relatively little for $1 of cash flow, and earnings, they are receiving a dividend yield that’s on the high side by historical standards. I’ll admit that the dividend here is hardly “historic”, being only ~3 years old in its current manifestation, but it is something in my view.

I think the combination of investors getting a higher yield from a sustainable business, and paying less for that dividend is quite positive.

In addition to simple ratios, I want to try to understand what the market is currently “assuming” about the future of this company. In order to do this, I turn to the work of Professor Stephen Penman and his book “Accounting for Value.” In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in the said formula. Applying this approach to Patrick Industries at the moment suggests the market is assuming that this company will be bankrupt within eight years. This is very nicely pessimistic in my view. Given the valuation, and the sustainability of the dividends, I’m comfortable buying.

But Wait, There’s More…

My regulars know that I like to sell put options on great companies, because I consider these to be “win-win” trades. If the shares remain above the strike price, I’ll simply pocket the premium, which is never a hardship. If the shares fall in price, I’ll be obliged to buy, but will do so at a price that’s even more attractive than the current market price.

In particular, I’m going to be selling some of the August puts with a strike of $45. These are currently bid at $1.75, which I consider to be a decent yield. If the shares remain above $45 over the next 4½ months, I’ll simply add to the premium. If the shares fall about 21% over that time, I’ll be obliged to buy, but will do so at the equivalent of a 3% dividend yield, and a price to free cash flow of ~5.3 times. I’m comfortable with either outcome, and thus, “win-win.”

If you managed to wade through my section on the stock, where I brought the mood down by writing about how a great company can be a terrible investment at the wrong price, prepare for more of the same, because it’s “mood killing time” yet again. I need to remind some investors that there’s risk with every investment, including short puts. I consider risks with these instruments to fall into two broad categories: the economic and the emotional.

Starting with the economic risks, I’d say that the short puts I advocate are a small subset of the total number of put options out there. I’m only ever willing to sell puts on companies I’d be willing to buy, and at prices I’d be willing to pay. So, don’t take what I write about short puts being “win-win” as an excuse to go out there selling every put you can get your virtual hands on. Only ever sell puts on companies you want to own at (strike) prices you’d be willing to pay.

The two other risks associated with my short puts strategy are both emotional in nature. The first involves the emotional pain some people feel from missing out on upside. To use this trade as an example, let’s assume that the market really likes what’s happening at Patrick Industries and the shares climb to $80 over the next five months. Obviously, my puts will expire worthless, which is a great outcome in some ways. I will not catch any of the upside in the stock price, though. So, short put returns are capped by the premium received. This is emotionally painful for some. Given that I’ve got pretty low expectations generally, I’m comfortable with this one.

Secondly, it can be emotionally painful when the shares crash below your strike price. This has happened to me many times over the years. While it has always worked out well over time, it is emotionally painful in the short term. The fact is that it’s not fun when the stock crashes well below the strike price. So, I can make a reasonable argument that Patrick Industries would be a bargain at a net price of $43.25, but if they drop to $30, for instance, that will take an emotional toll, at least in the short run. I think people who sell puts should be aware of these emotional risks before selling.

That said, I’m still of the view that selling these puts with this strike price actually enhance returns by generating some premia, and they reduce risk by (potentially) locking in an even cheaper price, and higher dividend yield. So, you may consider me to be odd to end a section on risk by writing about the risk reducing potential of short puts. If this is the first time you’ve noticed “odd” from me, you’re quite obviously not paying attention.

Conclusion

I think Patrick Industries has had an excellent year, and I think the dividend is reasonably well covered. I think there’s room for an increase in the coming years. In spite of all that, the shares are trading very near multi year lows. In my view, even if the “E” in the PE ratio declines from here, the valuation is still reasonable given the relatively low “P.” In addition to picking up some shares at current prices, I’ll be boosting my returns by selling some of the puts described in this article as they are a “win-win” trade in my view. If you’re comfortable with put options, I’d recommend this or a similar trade. If you’re not, I’d recommend buying the shares anyway as they are trading at very attractive prices in my opinion.

Be the first to comment