Tamas-V

It’s been about six and a half months since I wrote a cautious piece about Canadian National Railway Company (NYSE:CNI), and in that time the shares have returned -4.4% against a loss of ~15.4% for the S&P 500. The company has just announced earnings, so I thought I’d review the name again. After all, an investment is less risky when the stock is trading at $117, relative to when it’s trading at $123. I’ll decide whether or not it makes sense to buy based on the freshly announced earnings, and the valuations.

Finally, and this should come as no real shock to those who follow me regularly, last January I recommended selling the January 2023 puts with a strike of $90 for $2.05, and I’m absolutely aching to talk about, and brag about, how that trade’s worked out so far.

We’re all quite busy, so we don’t have much time to read articles. We particularly don’t have much time for long winded articles put out by long winded, self congratulating blowhards. For that reason, I’ll offer my thoughts to you in a tidy “thesis statement” paragraph. I’ll be buying some Canadian National this morning. The shares are trading at very reasonable levels in spite of the fact that the company has just posted very decent results. In fact, it seems that the company is on track (forgive the pun) to deliver results even greater than the record breaking 2019. Finally, although I’m going to remain short the puts I wrote earlier, I think it makes much more sense to buy stock at the moment. I think the long term returns an investor receives from dividends will be greater than put option premia over time.

When “Losers” Win: Summarizing My Prior Work on Canadian National

It may come as a deep shock to all of you, but the fact is that I try to avoid redundancy when I can. For that reason, I’m not going to simply repeat the entirety of what I wrote previously, but I think it’s worth reminding investors of the most relevant and interesting finding that I came away with from my prior work.

I tracked the price performance of Canadian National, Kansas City Southern, and Canadian Pacific Railways as the merger drama unfolded between these three parties. After looking at the market’s reactions to various “zigs and zags” of the drama, I offered the tentative conclusion that “losing” the merger talk was actually a far better outcome than “winning.” This suggests to me that, when it comes to Class 1 railroads at least, “bigger” may not always be “better.”

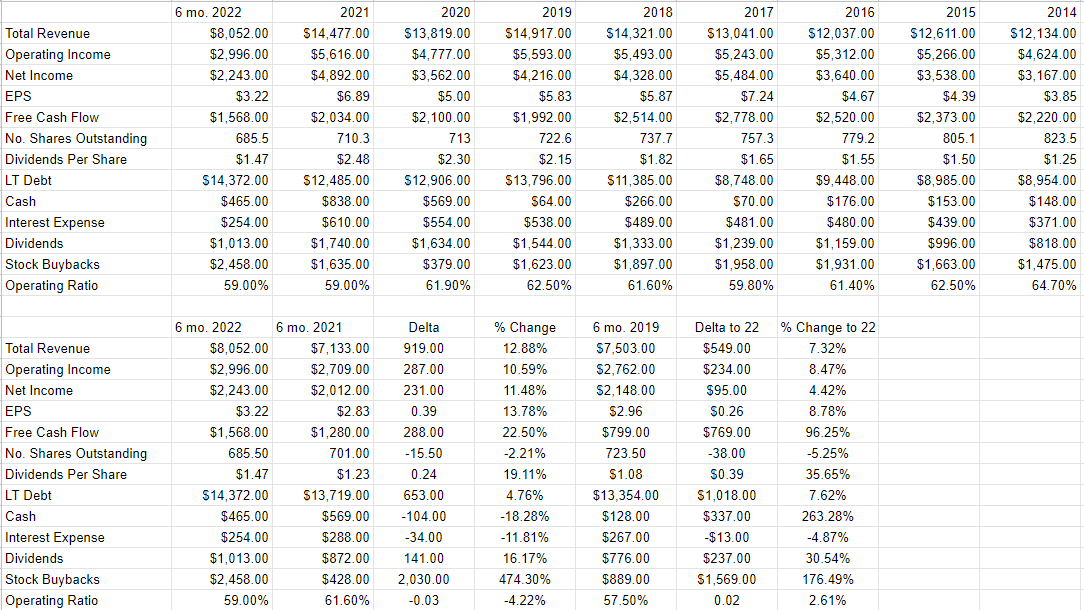

CNI Financial Snapshot

The company has just posted financial results, so they deserve comment. It shouldn’t be surprising, given that “Canadian” is in the name of the company, but the following figures are in Canadian dollars. For the first six months of this year, financial results are generally much better than they were during the same period in 2021. Specifically, revenue and net income were up by about 13%, and 11.5% respectively. At the same time, free cash flow improved by 22.5%. Management rewarded owners by increasing the dividend by just over 19% relative to the same period a year ago.

It’s not all sunshine and animated bluebirds over at Canadian National, though. Long term debt has increased by ~$653 million, while cash is down about $104 million. I don’t think there’s much risk of default here, but I’m of the view that higher levels of debt increase the risk of an enterprise.

Things look less impressive when we compare the most recent half year to the same period in 2019. Revenue is up only about 7.3% relative to 2019, and net income is up by only about 4.4%. That said, 2019 was itself a record year, so there’s no getting around the fact that Canadian National has just posted very solid results. The relatively low payout ratio of about 45% suggests to me that the dividend is reasonably well covered, and thus I’d be very happy to buy this juggernaut at the right price.

Canadian National Financials (Canadian National investor relations)

The Stock

Remember earlier in the article when I wrote that I try to avoid redundancy. I need to clarify that position somewhat. Just because I try to avoid it doesn’t mean I always succeed. I’m about to tread over very old ground that you know well if you subject yourself to my stuff regularly. I think the stock is distinct from the business in many ways. A business buys a number of inputs like fuel, railroad ties, adds value to them, and then sells transportation services for a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company. It seems that the crowd changes its views about the company relatively frequently which is one of the factors that drives share prices up and down. Added to that is the volatility induced by the crowd’s views about stocks in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride. Although it’s tedious to see your favourite investment get buffeted because the asset class of “stock” goes in and out of favor, within this tedium lies opportunity. If we can spot discrepancies between the price the crowd dropped the shares to, and likely future results, we’ll do well over time. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

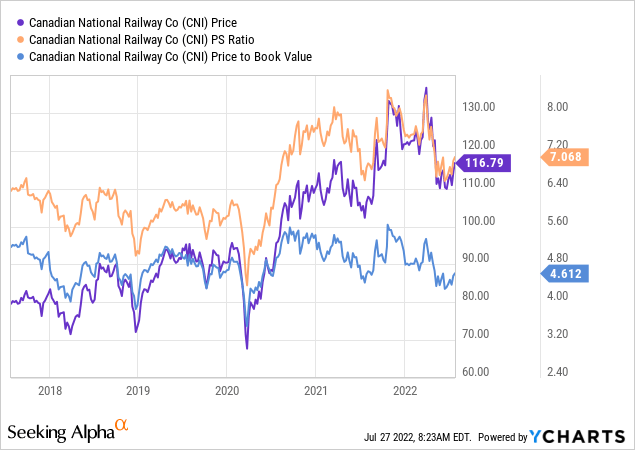

As my regulars know, when judging the cheapness (or not) of a stock, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Because I think “cheaper wins”, I want to see a company trading at a discount to both the overall market, and the company’s own history. In case you’ve forgotten, I fretted about Canadian National back in January because the stock was trading at a price to sales and price to book of 7.727 and 5.137 times respectively. The stock is now about 8.5% and 10% respectively per the following:

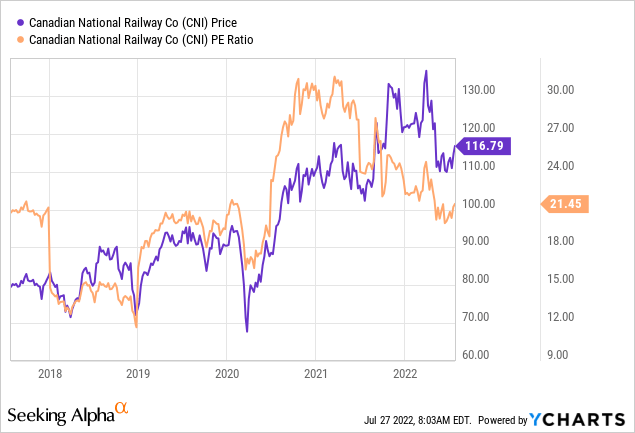

At the same time, the shares are trading near multi-year low valuations on a PE basis, per the following:

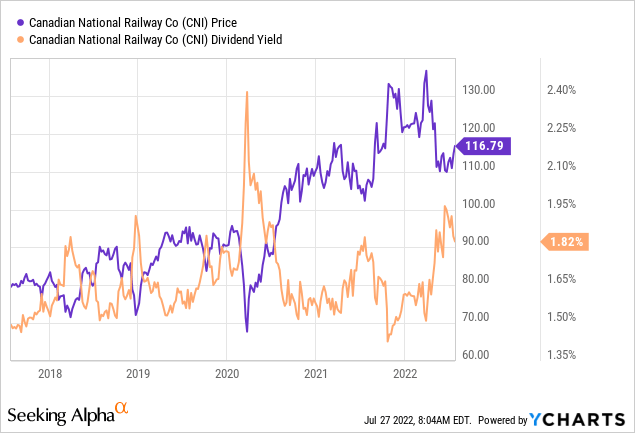

At the same time that the shares are relatively cheap, the dividend yield is near a multi-year high. Thus, it seems that investors who buy at the moment are paying less than average, and getting more than average. This is never a bad outcome in my view.

I think the combination of stronger business performance, sustainable dividend, and relatively low valuations is compelling. I did well buying CSX recently, and I think the entire rail complex may be on an upswing. For that reason, I’ll be buying some Canadian National at current prices.

Options Update

As I wrote earlier, I wrote five January 2023 puts with a strike of $90 for $2.05 each. The shares have obviously dropped in price since, but a great deal of time value has whittled away, so these are currently bid at $.05, so I think that trade’s worked out well.

My regular readers know that I like to sell deep out of the money puts on relatively overpriced stocks because these create what I’ve characterised as a “win-win” trade. If the shares remain overpriced, the investor pockets the premia. If the shares fall, the investor collects the premia, and has the opportunity to buy a great business at a great price. Since I think the shares are reasonably priced at the moment, I think the best path forward is to simply buy the stock. I’d rather lock in a reasonably good price and collect the dividends rather than limit my upside with short put options. I still really like selling puts, but on a relative basis they’re less attractive than stocks at the moment in my view.

Conclusion

I think Canadian National is en route to post a record year. Revenue and net income are much higher than they were this time last year, and they’re still respectably higher than they were during the record setting 2019. In spite of this, the shares are quite inexpensive. As a result, investors are collecting a near multi-year high dividend yield. I’m going to let my puts expire, or not, and today I’ll be buying shares. The company has an unassailable moat in my view, and I’ll be able to sleep at night going long at current levels.

Be the first to comment