FG Trade/E+ via Getty Images

A Divergence

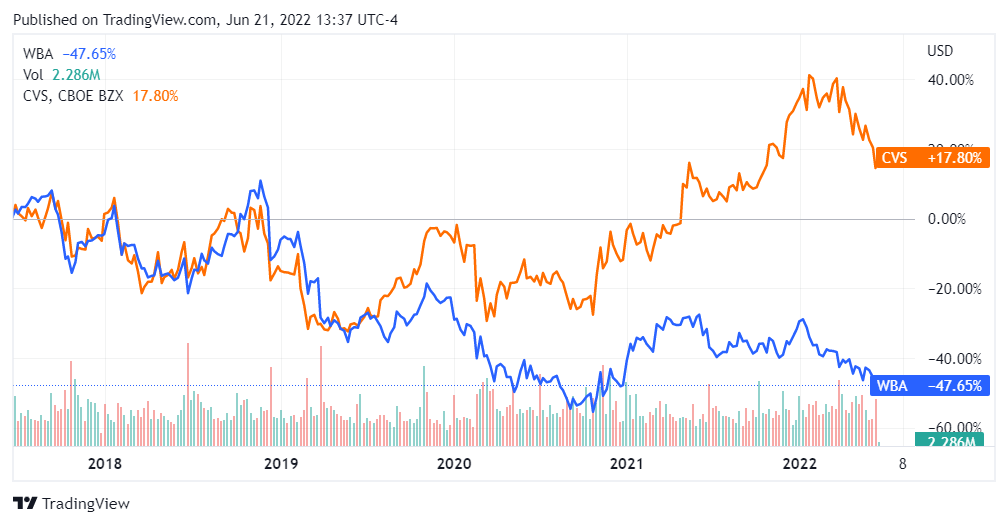

Walgreens (NASDAQ:WBA) and CVS (NYSE:CVS) obviously have overlapping, albeit not identical, businesses. In the graph below, we can see a certain correlation since 2018 in terms of the (percentage-based) movement of each stock; but, we can also see that correlation breaking down in mid-2019, growing into the performance spread that exists today.

Figure 1: WBA and CVS Relative Performance Trailing 5-Years (Seeking Alpha)

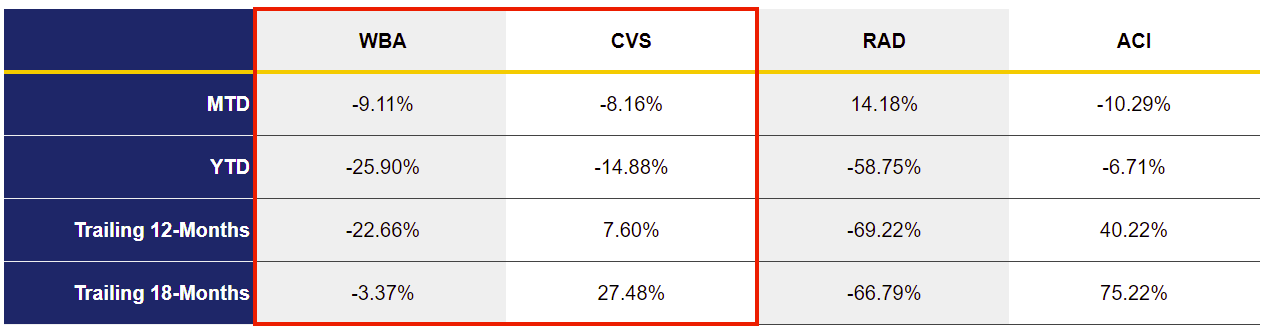

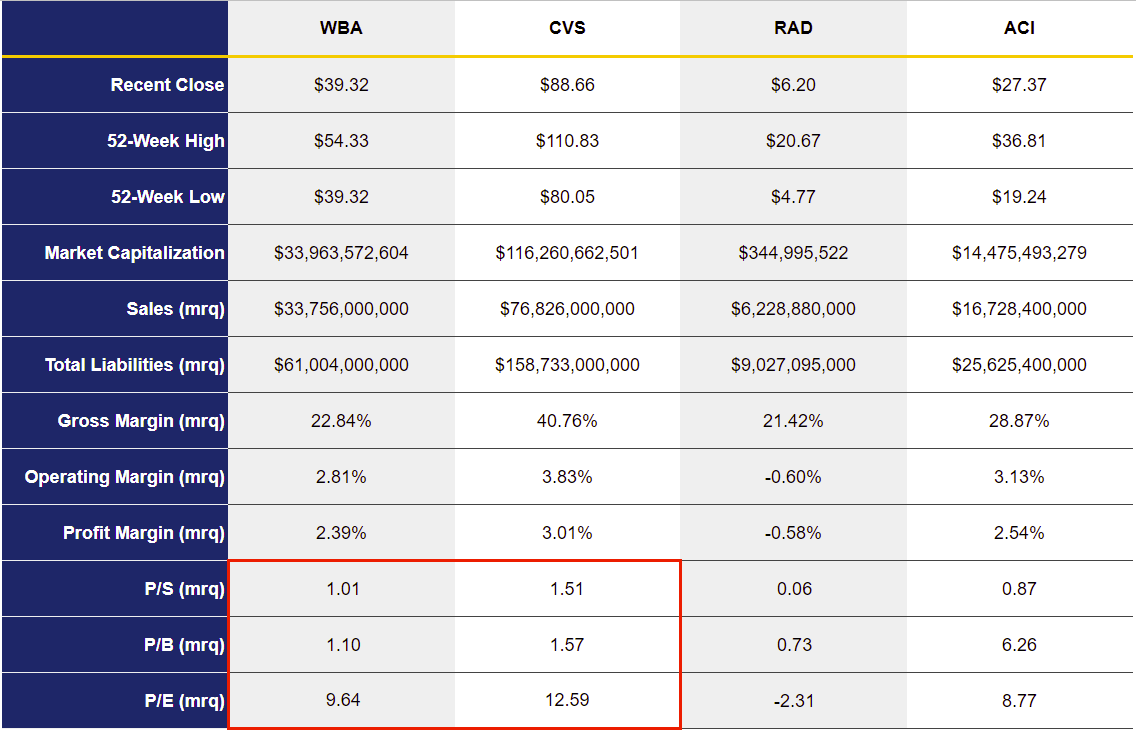

This divergence is further evidenced by the specific period performance metrics for both stocks, as well as their (recent) valuations.

Figure 2: WBA, CVS, and Selected Competitor Performance (Yves Sukhu)

Figure 3: WBA, CVS, and Selected Competitor Comparison (Yves Sukhu)

Notes:

-

Data in Figures 2 and 3 as of market close June 20, 2022.

-

P/S, P/B, and P/E valuation metrics in Figure 3 are based on recent close price as compared against revenue, book value, and earnings data for each firm’s most recent quarter.

I suggest there are reasons to think the divergence in the performance of the two stocks will collapse in the future, and hence I present them in this report as a potential pair trade.

Walgreens Vs. CVS: 3 Arguments

I think WBA and CVS are both fantastic companies; and, up until recently, I was long both firms. In my case, I chose to lock in some gains on CVS when its price was trading around ~$110. In retrospect, that turned out to be a good decision.

I offer 3 main arguments as to why I think WBA’s stock price may be headed higher and CVS may be headed lower.

1. Expectations. On this first point, my idea is rather simple. The current forecast for WBA, particularly for Q3 FY ‘22, is rather bearish whereas estimates for CVS are on the bullish side. As I will explain, I think WBA is in a good position to surprise the market, and hopefully spark a rally in the stock in the near-term.

2. Strategy. From my point-of-view, and as I’ve argued in the past, I think WBA’s strategic focus on a primary care model within the multi-trillion dollar chronic care market is simpler as compared to CVS’ vertically integrated healthcare benefits-to-pharmacy-to-patient-care model. I suggest the former offers far less risk and therefore has a greater chance of long-term success.

3. Underestimated. As I watched WBA stock get “beat up” over the last couple weeks, more so than CVS, I couldn’t help but wonder if the market underestimates Roz Brewer’s leadership at WBA. If so, I suggest investors will eventually “catch up” and reward the stock appropriately.

As is implied, I think that WBA’s stock is likely to rise in the near-term (i.e. this year) and CVS is more likely to fall over the long term.

First Argument: On Expectations

On this first point I suggest both WBA and CVS are likely to do well when they report results from their current quarters. But I think WBA has a good chance of beating expectations because (1) current estimates for the firm are so bearish and (2) the business may be performing better than the market thinks.

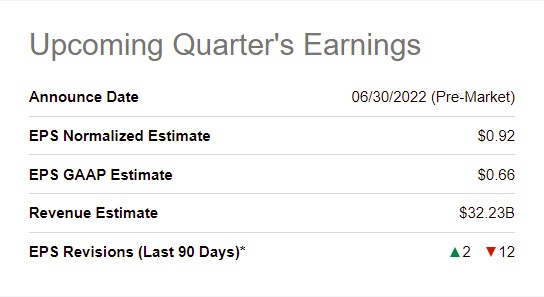

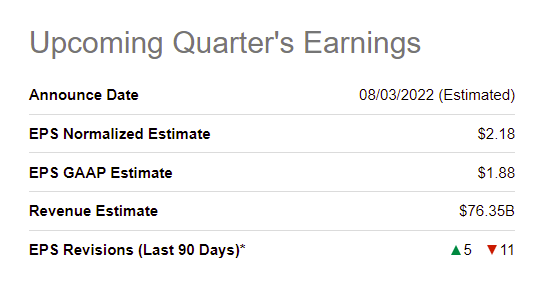

WBA will report Q3 FY ‘22 earnings on June 30. In comparison with Q3 FY ‘21 revenues of ~$34B and adjusted EPS of $1.51, net sales and earnings are expected to fall.

Figure 4: WBA Upcoming Quarter’s Earnings (Seeking Alpha)

Obviously, adjusted EPS is expected to fall significantly versus the prior period, at nearly ~(40%).

The forecast for CVS, on the other hand, is more bullish with expected growth in net sales and “only” a ~(10%) drop in adjusted EPS, with these estimates compared against Q1 FY ‘21 revenues of ~$73B and adjusted EPS of $2.42.

Figure 5: WBA Upcoming Quarter’s Earnings (Seeking Alpha)

With the anticipated ~($2B) and ~(40%) drops in net sales and adjusted EPS respectively, consider the following with respect to WBA:

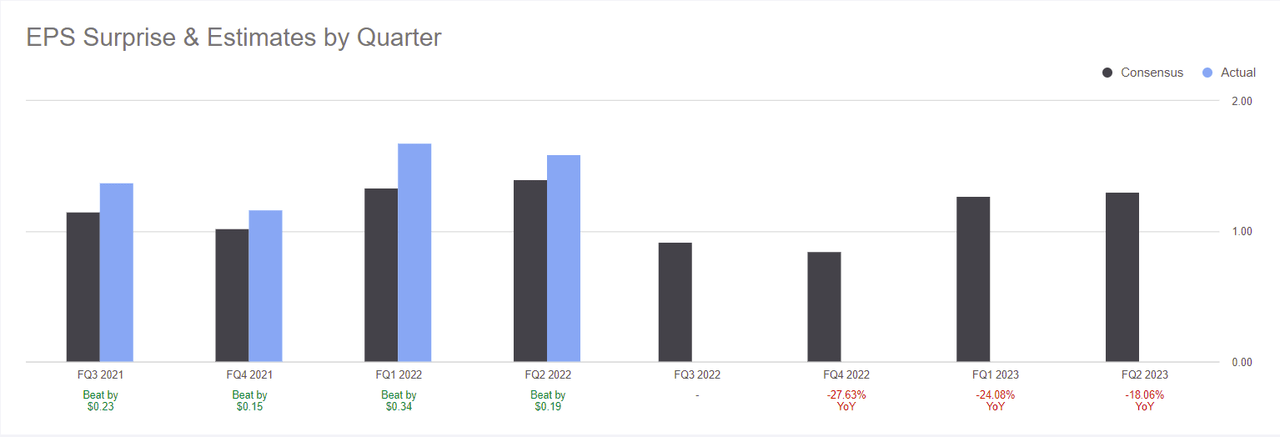

1. WBA has beaten EPS expectations the last 4 quarters.

Figure 6: WBA EPS Surprise & Estimates by Quarter (Seeking Alpha)

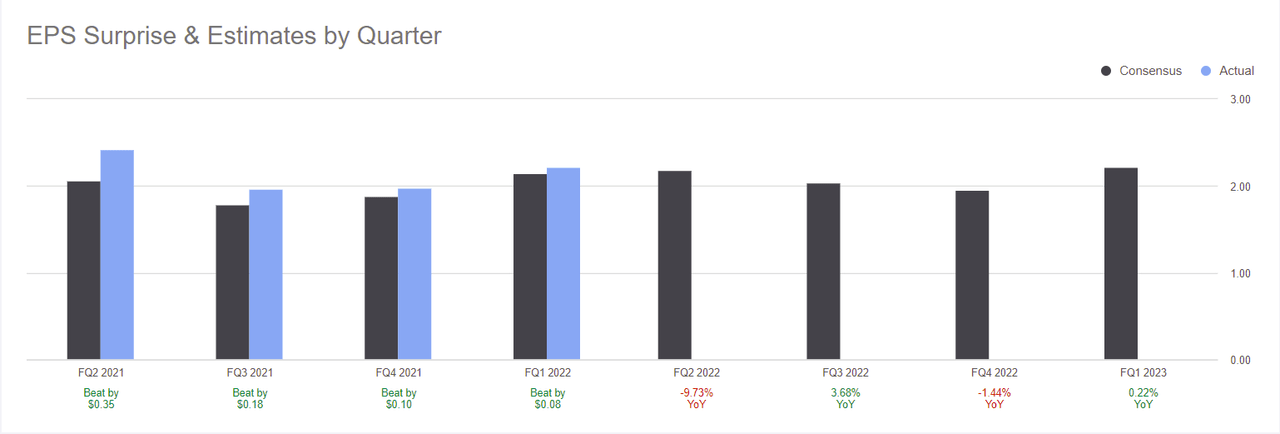

CVS has beaten EPS expectations over each of its last 4 quarters as well, but by smaller margins.

Figure 7: CVS EPS Surprise & Estimates by Quarter (Seeking Alpha)

My point is that with such a steep EPS decline forecast for WBA, it seems like a fair gamble to think they might surprise given their performance over the prior 4 quarterly periods.

2. The current inflationary environment could actually help boost WBA sales. CVS offered some useful context on this point in their Q1 FY ‘22 Earnings Transcript, noting “…[inflation] is a dynamic that can actually help frankly with our membership programs and also make our store brands more attractive relative to other products.” Logically, the same should hold true for WBA; and therefore both firms may benefit “sales-wise” from the same effect. But, remember, we’re talking, in this section of the report, about who might produce a (bigger) surprise. And, on that point, I think WBA is in a better position to springboard off of whatever tailwinds the current inflationary environment might produce. Notably, CVS management also explained in their Q1 FY ‘22 Earnings Transcript that they were not seeing negative inflationary effects on the pharmacy business as drug pricing is generally governed by multi-year contracts; and we would expect the same from WBA. Indeed, WBA offered in their Q2 FY ‘22 Earnings Transcript that “…[they] have basically offset all the inflationary impacts, and that includes a massive increase in the cost of international ocean freight.”

3. WBA’s US Retail and Boots UK operating segments produced strong performances in Q2 FY ‘22, and may be able to continue that trend heading into Q3. I discussed these segments in my last article on WBA. US Retail and UK Boots retail comparable sales were up 14.7% and 22.0%, respectively, in Q2 FY ‘22 year-over-year (“YoY”), with “…[Q2] US retail comps..the highest in 20 years”. Comparable sales for the first-half period also improved with increases of 12.8% and 19.2% for the US retail and UK Boots retail operations, respectively. While UK Boots foot traffic was noted to still be ~(15%) below pre-pandemic levels, WBA expects a full foot traffic recovery exiting 2022 and a full sales recovery heading into 2023. In other words, there’s a good chance WBA sales in Q3 FY ‘22 will be better-than-expected, especially if inflationary-effects wind up helping both WBA and CVS, as discussed in the prior bullet.

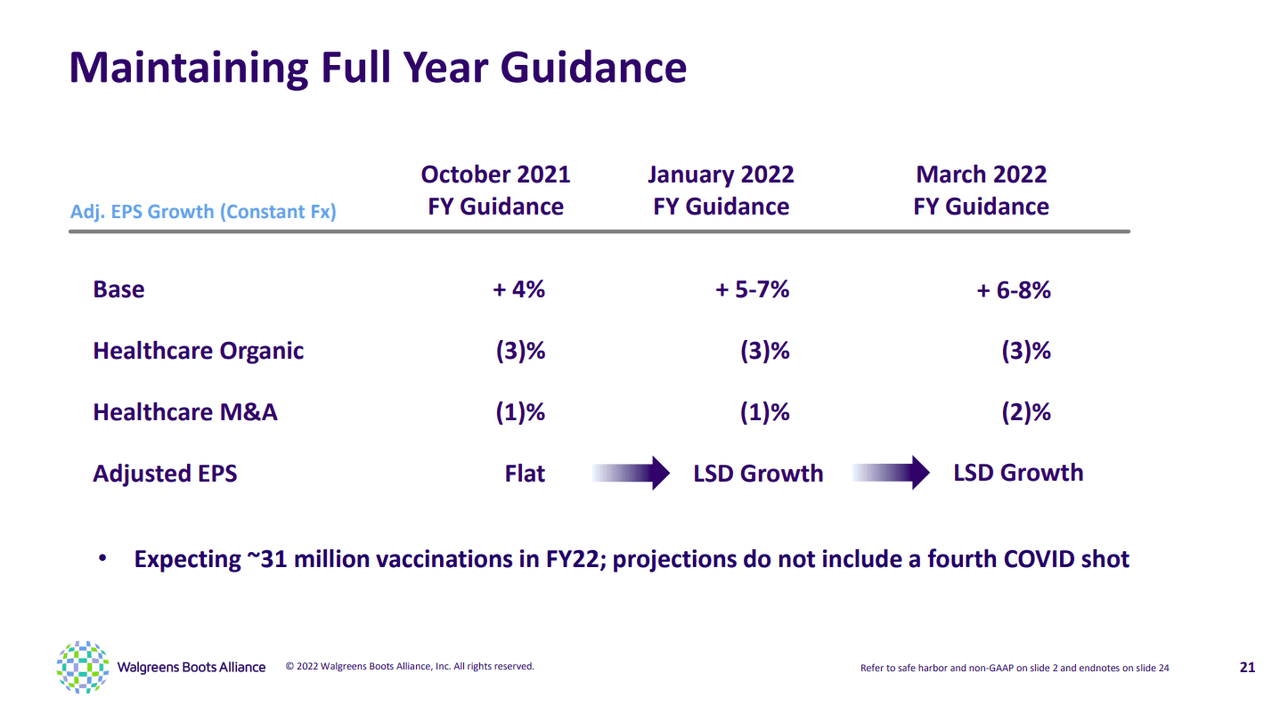

4. WBA management’s updated guidance for FY ‘22 did not include projections for a fourth COVID-19 booster shot. Like it or not, COVID-19 is still with us. It is entirely possible that WBA and CVS may see an unanticipated increase in COVID-19 vaccinations during the latter-half of the calendar year as more people seek out their second booster shot, and more children become vaccinated under the new guidelines set by the federal government. If so, it stands to reason that both companies are likely to realize a COVID-19 fueled sales boost, and accompanying scripts growth. However, bear in mind that WBA guidance following Q2 FY ‘22 earnings did not include a fourth COVID shot, whereas CVS guidance following Q1 FY ‘22 earnings did include projections for a fourth COVID shot.

Figure 8: Walgreens FY ‘22 Guidance March 2022 (Walgreens Q2 FY ’22 Earnings Presentation)

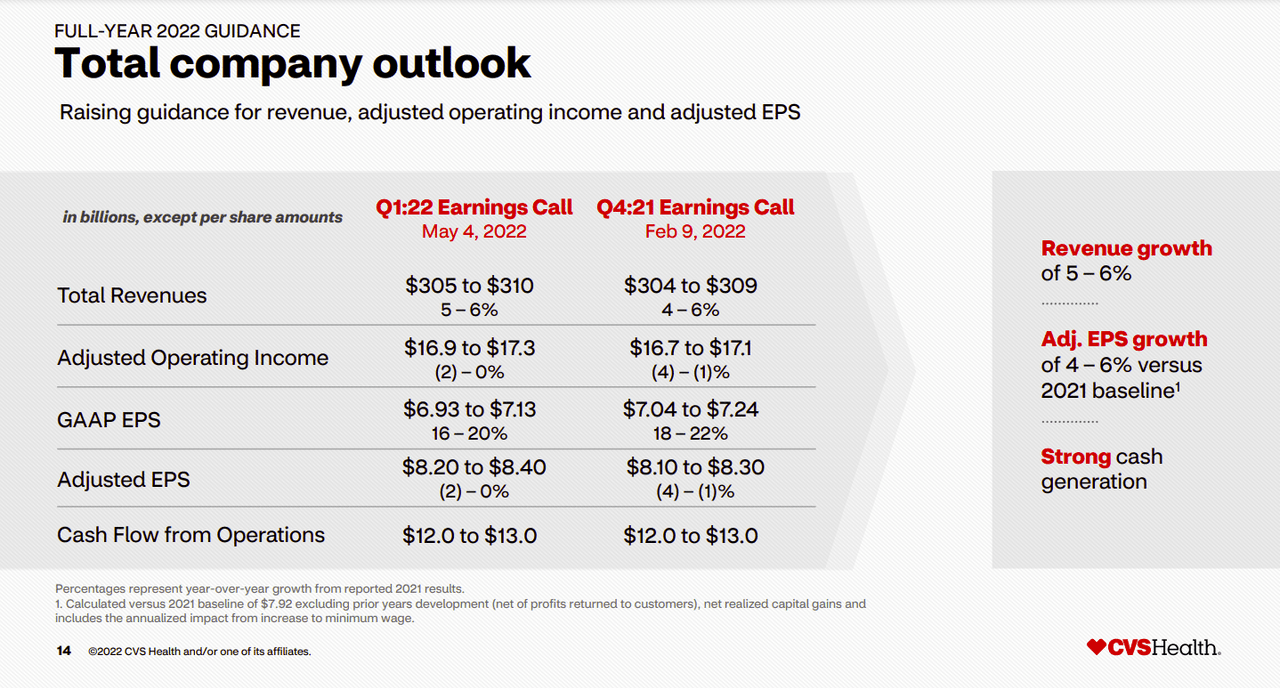

Figure 9: CVS FY ‘22 Guidance May 2022 (CVS Q1 FY ’22 Earnings Presentation)

Again, this provides us with another reason to think WBA may be in a position to surprise the market in a few days time.

Naturally, any tailwinds in the market (e.g. COVID-19 vaccination, positive inflationary effects, etc.) will benefit both firms. But WBA may be able to produce a bigger “surprise” for investors. Since the market has “baked-in” greater expectations for CVS as compared to WBA, it stands to reason the latter’s stock should benefit more from a sales and earnings beat, both of which I think are possible based on the reasoning in this section.

Second Argument: On Strategy

I will be the first to admit that my second argument may not find significant support among readers. After all, how can anyone (i.e. me) argue that CVS’ strategy is flawed when the company is posting results such as these from Q1 FY ‘22:

-

Revenue of $76,826M with net sales up 11.2% YoY.

-

Non-GAAP operating income of $4,483M, up 6.6% YoY.

-

Non-GAAP EPS of $2.22, up 8.8% YoY.

-

Cash flow from operations of $3,563, up 23.2% YoY.

Moreover, as we see in Figure 9, CVS management has raised guidance for FY ‘22.

To be clear, it is not so much that I think CVS has a broken strategy as much as I think they have a rather risky, complicated strategy. From my point-of-view, they are trying to be “all things to all people” with respect to healthcare. They want to be your benefits administrator; they want to be your pharmacy; they want to be your primary care destination; they want to be your wellness center. There is undoubtedly a logic to it; particularly from the standpoint of driving consumer healthcare costs down. But, the model invariably features a lot of moving parts that the company has to consistently manage well. That, of course, creates quite a bit of risk. Also, while CVS has done a good job bringing down their debt load post the Aetna acquisition, they still have a healthy amount of debt to contend with (~$76B). Naturally, this could act as an inhibitor with respect to their strategic model. Perhaps we saw some signs of CVS management hedging on their ability to execute against their broader strategy during the Q1 FY ‘22 earnings call. For example, CVS CEO Karen Lynch, when asked about the possibility of a large acquisition in the primary care space, remarked “…we are continuing to look for a broader range of primary care capabilities. It’s an interesting market. We are trying to make sure that we are prudent, both strategically and financially, but it is part of our strategy and we’re – more conversation to come.” If primary care is indeed an integral part of CVS’ overall strategy, the comment may strike as a bit opaque. CVS CFO Shawn Guertin provided some additional perspective on the question stating “…I want to be careful because different people will define large different ways. I think we’ve been pretty clear. We’re not talking about a jumbo acquisition here. We’re talking about a capability-based acquisition of some size, but not necessarily anything jumbo.” Certainly, CVS management must act against their strategy with financial prudence so I resonate with both of the previous comments. But, the commentary might, at least, make one wonder if CVS’ vertically-integrated model might be a bit more than they can effectively “chew”. So far, their performance would suggest they are operating against their strategy just fine. However, I speculate that, over the long term, investors could see larger and larger cracks in their plan. Naturally, in that case, the market is likely to assign a lower relative valuation than they presently enjoy.

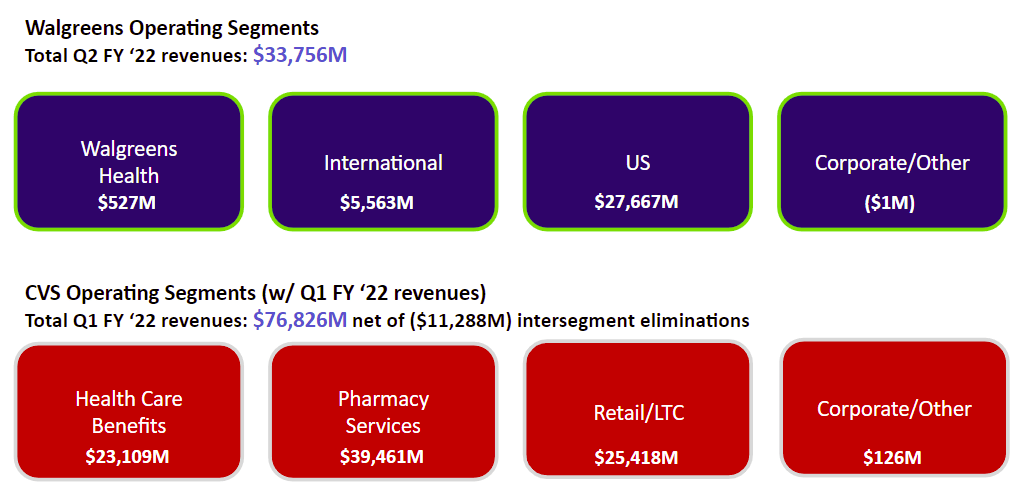

On the other hand, as I’ve stressed in the past, I find WBA’s measured aim to tackle the multi-trillion dollar chronic care market via their co-located Village MD (primary care)-pharmacy locations as offering less risk to investors. Further, their overall goal of driving scripts growth is entirely consistent with their historical strategy. This is to say, their focus on primary care is a simpler path (in my humble opinion) to drive scripts growth versus, say, also entering the benefits space which is arguably a far more complex undertaking. WBA finished Q2 FY ‘22 with more than 100 operational VillageMD locations, and is targeting a $10B run-rate for Walgreens Health by FY ‘25.

Figure 10: WBA and CVS Operating Segments and Corresponding Quarterly Revenues (Yves Sukhu)

Playing my argument out, I see, longer-term, CVS losing its relative valuation premium over WBA as the latter’s healthcare strategy continues ramping up and as the former’s strategy (potentially) falters.

Third Argument: On Being Underestimated

Bluntly, I wonder if the valuation premium assigned to CVS relative to WBA might be in part due to the market’s underestimation of WBA CEO Roz Brewer. Of course, I can’t pretend to be able to read the collective mind of investors, so I could be “way off base” in posing that possibility. But, if I am right, then the market’s short-sightedness creates an opportunity. I do think any underestimation (if it exists) would eventually self-correct; and, I argue that it lends additional support to the idea of a (near-term) price rally in WBA.

A Comment and a Couple Risks

With respect to what I outlined in this report,

1. I do not mean to suggest in the introduction, and specifically relative to Figure 1, that I think there is a technical reason for WBA shares to appreciate and CVS shares to decline based on the fact that they moved somewhat in “lock-step” with each other in the past. Figure 1 only presents 5 years of data, and it would not be possible to draw any kind of meaningful conclusion from such a limited amount of information. Nonetheless, I think it is still worth noting that the movements of the respective stocks showed some degree of correlation in the past. It could be suggestive, but not conclusive, of a technical relationship, albeit perhaps a weak one.

2. I am long WBA and therefore can’t rule out a certain amount of bias when writing this report.

3. Obviously, my 3 main arguments in this analysis rely on conjecture backed up — as best I could — by past performance, market dynamics, management commentary, etc. Accordingly, I am not identifying specific, identifiable events that would catalyze WBA shares to move up and CVS shares to move down. Nonetheless, I think my arguments are reasonable based on the reasoning as discussed.

In Summary

To reiterate, I think both WBA and CVS are fantastic companies; and I would be eager to find my way back into CVS at the right price despite my concerns over their strategic model. Going somewhat against the grain, I propose that FY ‘22 may turn out to be stronger for WBA than presently expected and could result in near-term appreciation in shares. Longer-term, I see the risks in CVS’ strategic model becoming more “visible” in terms of their financial performance, leading to a decline in share price.

Be the first to comment