JohnnyGreig

All figures are in CAD unless otherwise noted.

Introduction

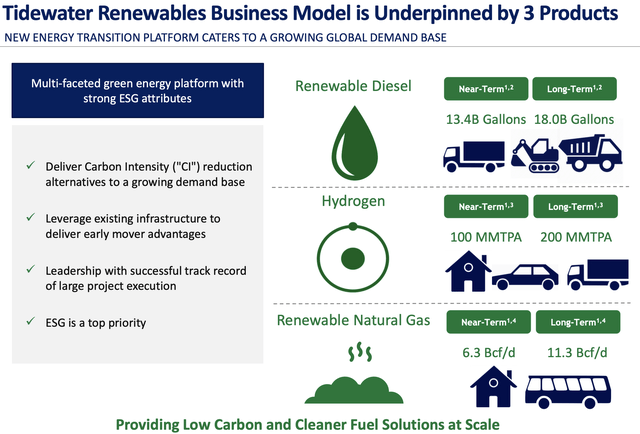

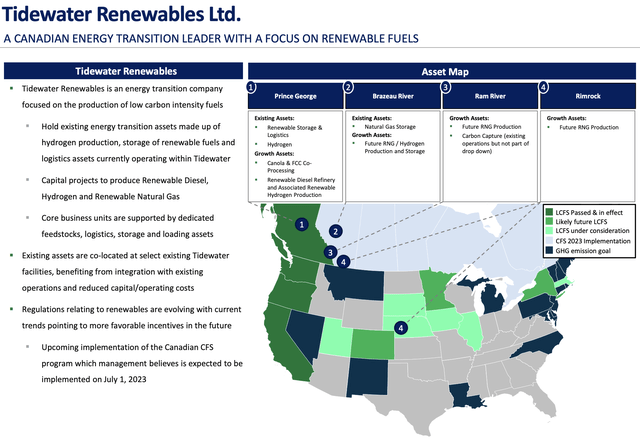

Tidewater Renewables (OTCPK:TDWRF) trades under the symbol LCFS on the TSX. LCFS is based in Calgary, AB and is a “multi-faceted, energy transition company and is focused on the production of low carbon fuels, including renewable diesel, sustainable aviation fuel, renewable hydrogen, and renewable natural gas, as well as carbon capture through future initiatives. LCFS was created in response to the growing demand for renewable fuels in North America and to capitalize on its potential to efficiently turn a wide variety of renewable feedstocks (such as tallow, used cooking oil, distillers corn oil, soybean oil, canola oil and other biomasses) into low carbon fuels.”

LCFS was formed in July 2021 by majority shareholder Tidewater Midstream and Infrastructure Ltd. (OTCPK:TWMIF) as a wholly owned subsidiary. Tidewater Midstream and Infrastructure Ltd. trades under TWM on the TSX. LCFS was formed to provide TWM a vehicle for pursuing funding growth to focus on the production of innovative low carbon fuels. In August 2021, TWM closed its IPO of LCFS offering 10 Million shares at $15/share for $150 Million. TWM maintains 69% ownership in LCFS. LCFS is utilizing the existing infrastructure and engineering expertise regarding the development of the LCFS’s portfolio of greenfield and brownfield capital projects as well as the expansion of the Corporation’s product offerings. This was discussed further in a previous article Tidewater Midstream And Infrastructure: A Rare Opportunity For Exceptional Returns In The Midstream And Renewables Space.

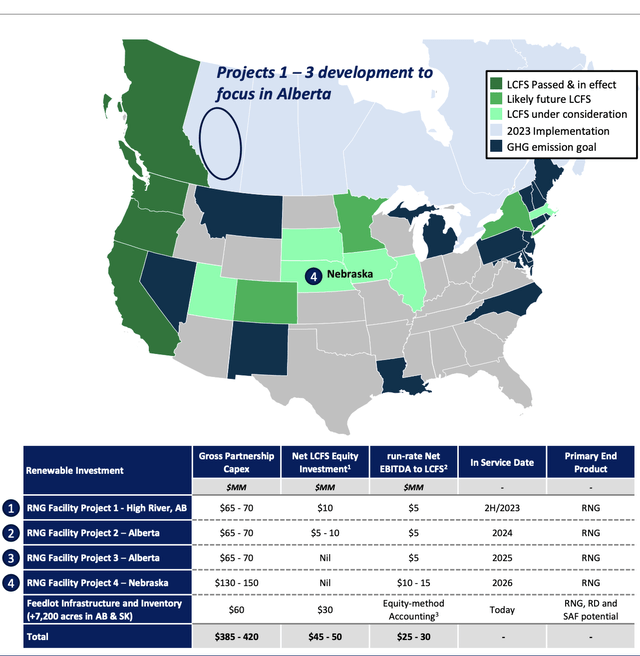

July 2022 Investor Presentation (Tidewater Renewables )

Outlook

EBITDA

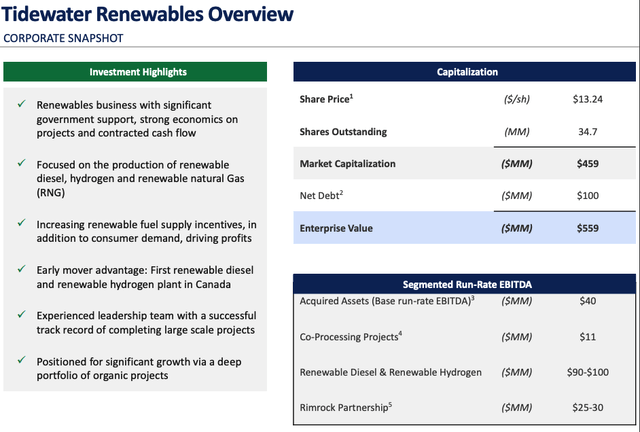

LCFS has not been in business long enough to produce fiscal YEFS. LCFS’s current run-rate EBITDA is $40MM and expects to generate 2022 and 2023 run-rate EBITDA of $50-55MM and $140-150 million respectively.

Tidewater Renewables Ltd. July 2022 Investor Presentation (Tidewater Renewables Ltd. )

July 2022 Investor Presentation (Tidewater Renewables)

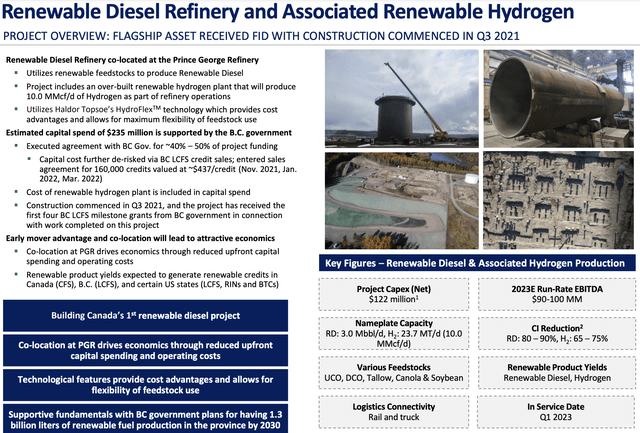

Renewable Diesel and Hydrogen

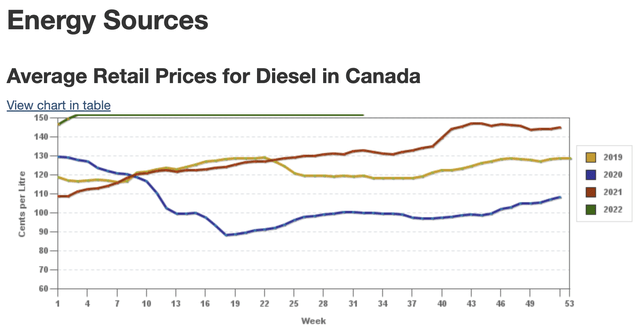

The majority of LCFS’s current cash flow comes from their renewable diesel and hydrogen which comes from their plant in Prince George, BC. It has an estimated capital spend of $235MM to become fully operational but 40-50% is supported by the Government of British Columbia mostly in the form of grants. Run-EBITDA has been revised upwards as a result of historically high diesel prices and a strengthening BC Low Carbon Fuel Standards (BC LCFS) market as they have forward sold credits at upwards of $478/credit. LCFS benefits from a first mover advantage as a result of being the first renewable diesel plant in Canada.

EBITDA is expected to reach $90-$100MM by 2023 FYE. Run-rate EBITDA has not accounted for Canadian Clean Fuel Standards (‘CFS’) in their run-rate EBITDA but LCFS expect to obtain as well. During the second quarter of 2022, the Corporation reached a tremendous milestone of 3,000 bbl/d.

July 2022 Investor Presentation (Tidewater Renewables) Average Retail Prices for Diesel in Canada (Natural Resources Canada)

Canola and FCC Co-Processing

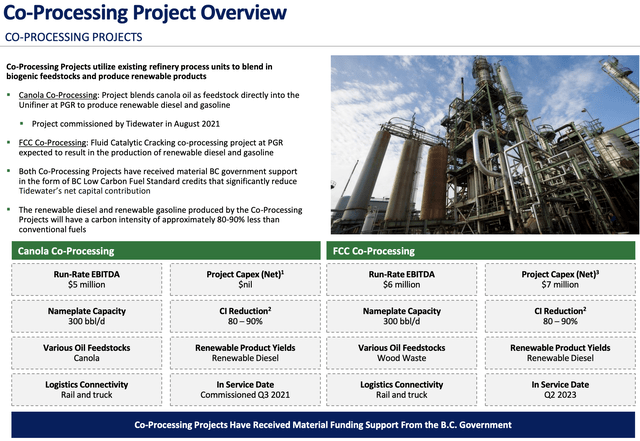

Canola and Fluid Catalytic Cracking (FCC) co-processing have an expected run-rate EBITDA of $11MM and LCFS plans to bring them online earlier than originally planned to take advantage of high gas prices and low feedstock prices in Canada. LCFS hedged 50% of 2023 feedstock and 30% of 2024 feedstock. Canola co-processing blends canola oil as feedstock directly into the Unifiner in Prince George to produce renewable diesel and gasoline. FCC co-processing project in Prince George is expected to result in the production of renewable diesel and gasoline. Both co-processing projects have received material BC government support in the form of (BC LCFS) that significantly reduce LCFS’s net capital contribution.

July 2022 Investor Presentation (Tidewater Renewables)

Renewable Hydrogen

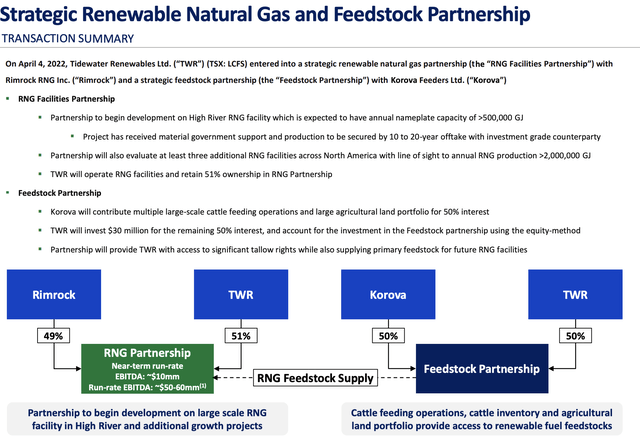

On April 2022 LCFS entered into a strategic renewable natural gas and feedstock partnership with Rimrock RNG Inc., and Rimrock Cattle Company Ltd. (RCC). RCC is one of the largest cattle feeding operations in North America. The Partnership will secure feedstock supply for LCFS and its renewable diesel business units, while also accelerating the diversification of their low carbon intensity fuels product offering. The partnership will provide a material addition to production capabilities and is expected to be secured by 10 to 20-year off-take agreements with investment grade counter parties.

Tidewater Renewables will invest $30MM in exchange for a 50% ownership of RCC, including its associated cattle feeding operations and cattle inventory. The $30MM investment will be paid for in four equal quarterly installments with the first installment beginning in April 2022. RCC has existing feedlot infrastructure in operation and is expected to generate EBITDA of $10-20MM annually.

Tidewater Renewables and Rimrock plan to begin construction on their first Alberta-based RNG facility at High River, AB. The High River Facility is expected to have a gross capital cost of $65-70MM and has received material government grant support. LCFS’s net equity investment is expected to be approximately $10MM, and LCFS will retain a 51% ownership in the RNG Facilities Partnership. The High River Facility is expected to generate gross annual EBITDA of approximately $10MM (approximately $5MM net to LCFS). Tidewater Renewables and Rimrock are also evaluating three additional RNG facilities located in Alberta and Nebraska. LCFS is pursuing 10-20 year investment grade off-take agreements and has received multiple related term sheets.

July 2022 Investor Presentation (Tidewater Renewables)

Provincial and Federal Low Carbon Fuel Standards

On October 25, 2021, The Government of British Columbia released its CleanBC Roadmap to 2030, which is part of B.C.’s plan to help it achieve its legislated targets for reducing its greenhouse gas emissions, including a targeted 40% reduction below 2007 levels by 2030. Regulation is known as BC Low Carbon Fuel Standard (BC LCFS). In July 2023 it is expected that the Canadian federal government will implement Canada-wide clean fuel standard which aims to reduce CI emissions 13% below 2016 levels. Regulation is known as Clean Fuel Standard (‘CFS’).

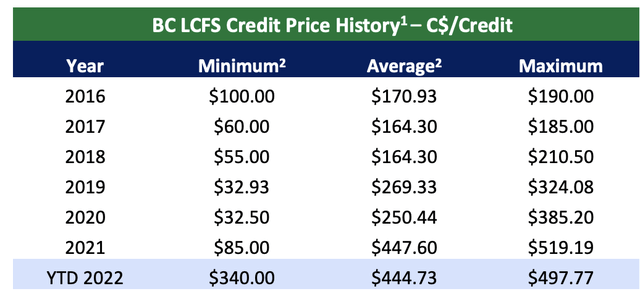

BC LCFS may be earned by BC Part 3 Fuel Suppliers by either supplying a fuel with a CI below the prescribed CI limit or taking actions that would have a reasonable possibility of reducing GHG emissions through the use of Part 3 fuels sooner than would occur without the agreed-upon action (i.e. the construction of the Renewable Diesel & Renewable Hydrogen Complex). LCFS can choose to capture the value of the expected BC LCFS Credits by selling the forecasted renewable fuel to a consumer with the BC LCFS Credits embedded in the purchase price or through monetizing the credits separately in the open market. As we can see below these credits have reached historical highs since they were implemented by the BC Liberal government in 2016. LCFS will likely be the largest producer of credits in Canada for the next few years as a result of their first mover advantage.

Tidewater Renewables Ltd. July 2022 Investor Presentation (Tidewater Renewables Ltd. )

Valuation

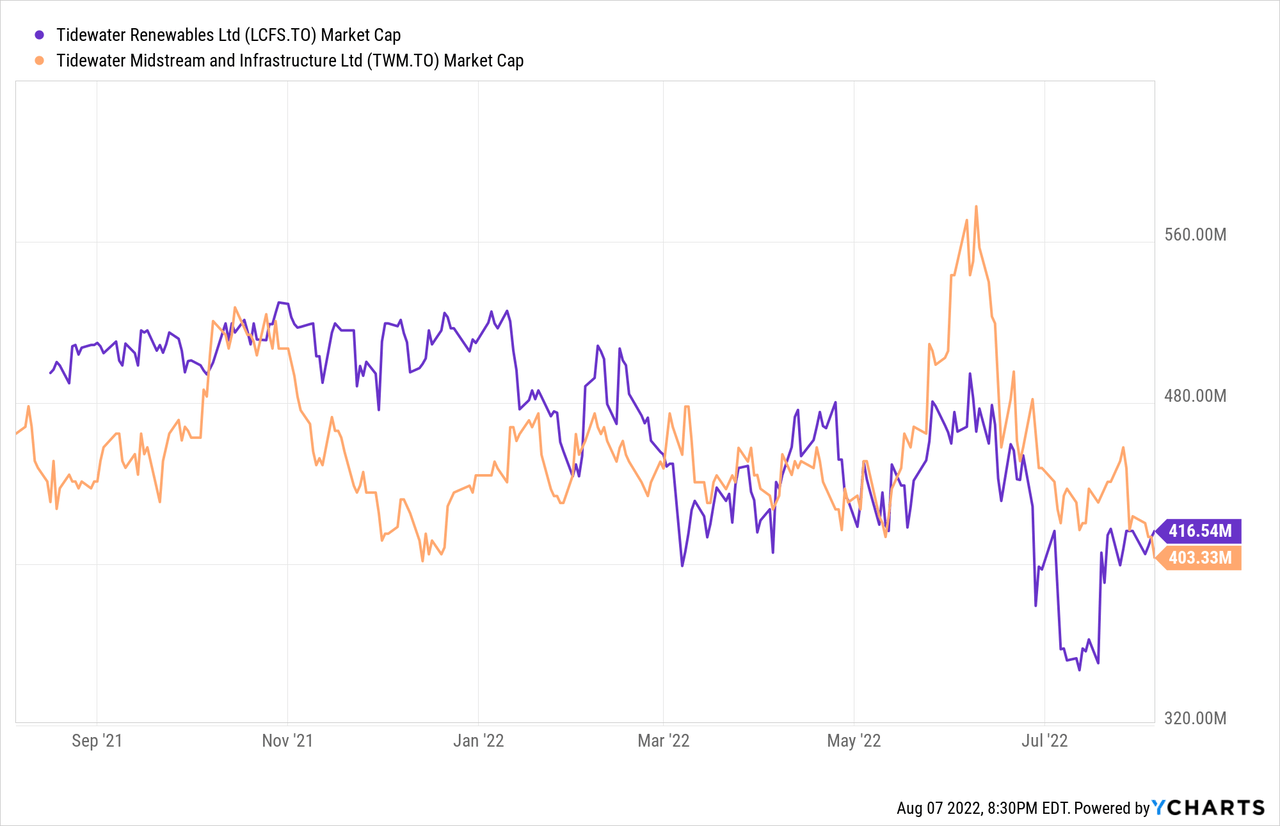

The world really began to awake to renewable energy in 2020 as it has been speculated the pandemic had a direct link. Valuations went up across the board and just having the word “renewables” in your name could give you a $500MM market capitalization which was the case with LCFS when it made its IPO in 2021. What is astounding is that LCFS has had a higher market capitalization than its parent company TWM.

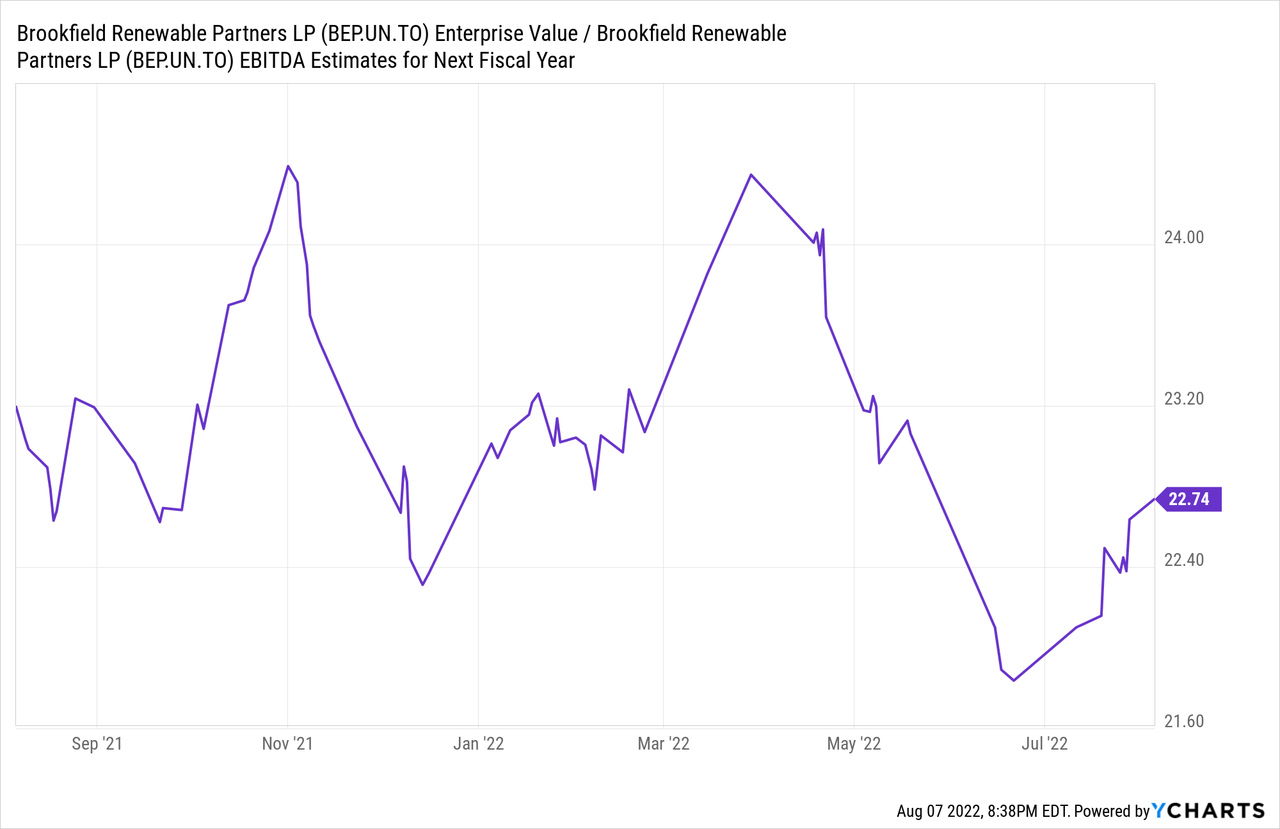

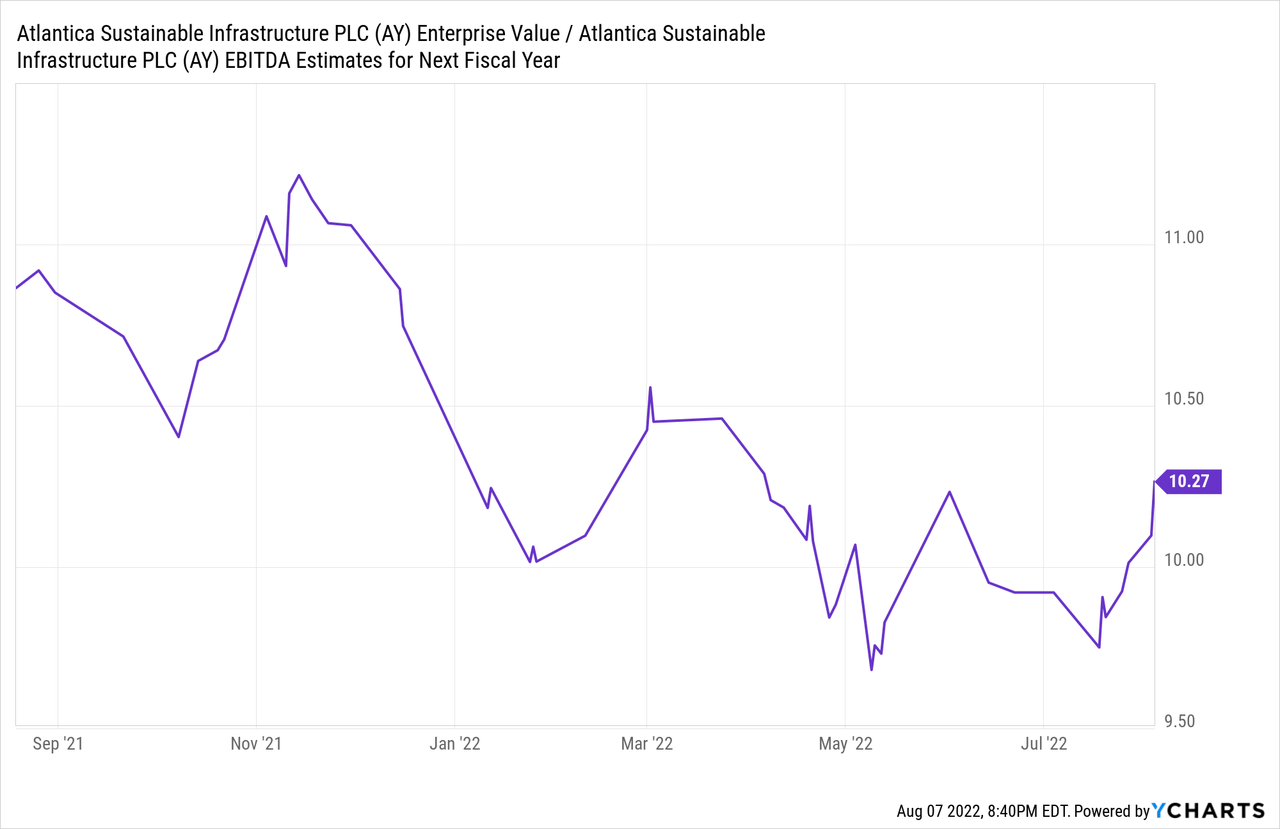

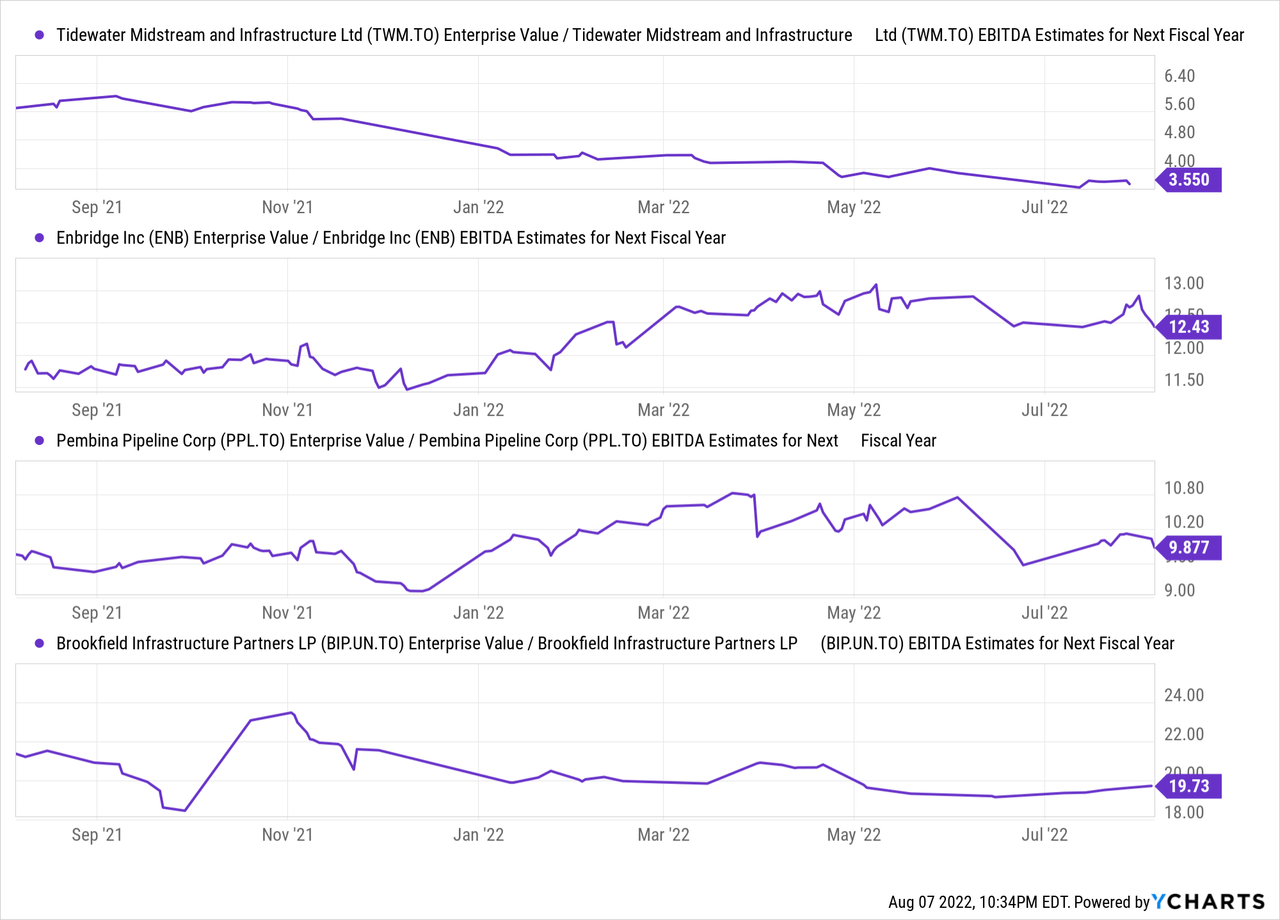

Renewable stocks have cooled down to more reasonable valuations in recent weeks. Assuming even a conservative $55MM run-rate EBITDA for LCFS would put their valuation at 9x EBITDA which is still cheaper than Canadian counterparts, most notably Brookfield Renewable Partners (BEPC).

Tidewater Midstream and Infrastructure

In January 2022 I wrote an article on the parent company TWM where I was extremely bullish.

“I believe this is one of the most undervalued opportunities on the market today with at least 59% upside. The market is not properly accounting for the company’s renewable segment which has tremendous upside. Company trades at a cheap 5x EV/EBITDA valuation.”

“TWM’s key assets include the Prince George Refinery which has an off-take agreement with Cenovus Energy (CVE), the Pipestone Gas Plant which has 80% of its volumes under take-or-pay contracts, and the Brazeau River Complex and Fractionation Facility which allows producers access to three natural gas egress solutions. There is also the Ram River Gas Plant, which is a rail-connected processing facility, and natural gas storage assets, which are contracted to six investment grade counter-parties. PGR is a 12,000 bbl/day light oil refinery that mostly produces low sulphur diesel and gasoline to supply the greater Prince George area. The Prince George area is generally in short supply of refined products and the refinery’s location within the region makes it a critical piece of infrastructure with significant logistical advantages to address demand in Northern B.C.”

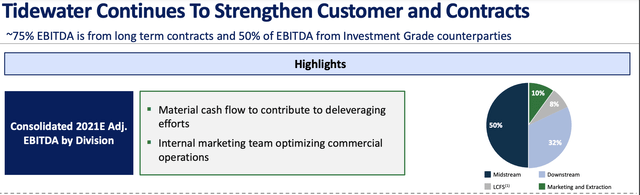

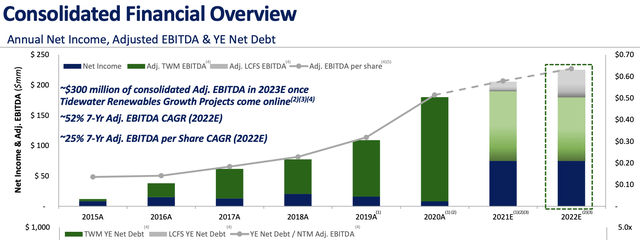

Only 8% of consolidated EBITDA comes from LCFS which doesn’t exactly make this a pure ESG play as the remaining 92% comes from Midstream, downstream and Marketing. Management expects this figure to grow to as high as 16% for fiscal 2022. As the EBITDA run-rate is expected to be $181MM for LCFS and TWM did $210MM in consolidated EBITDA for fiscal 2021, LCFS’s share of that would be 60% of 2021 EBITDA. Therefore, LCFS should become a much greater portion of TWM’s profitability in later years which arguably could eventually make TWM an ESG investment and increase its valuation.

Investor Presentation January 2022 (TIDEWATER MIDSTREAM & INFRASTRUCTURE LTD) Investor Presentation January 2022 (Tidewater Midstream and Infrastructure Ltd.)

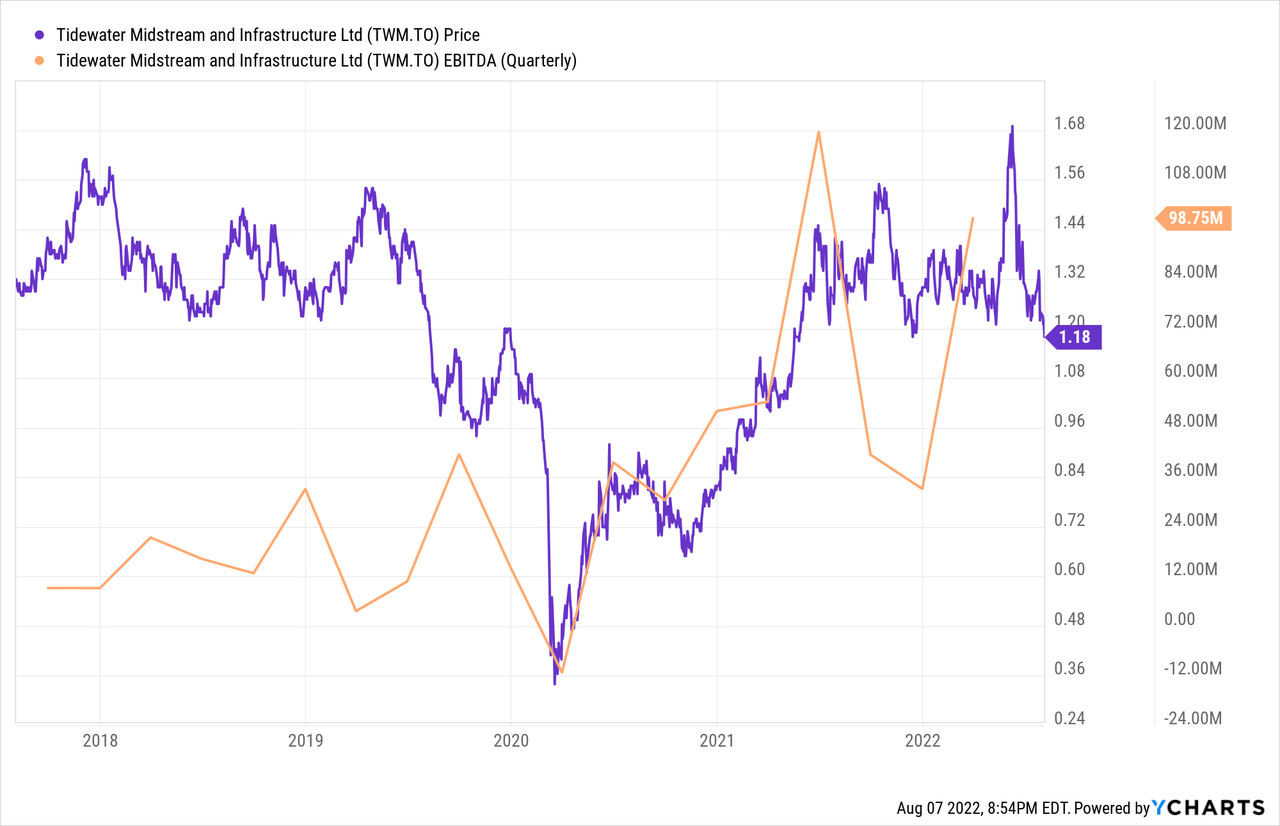

In Q1 2022, TWM delivered its twelfth consecutive quarter of consolidated adjusted EBITDA and distributable cash flow growth as a result of higher commodity prices and as you can see trades at very little more than a “penny” stock at just $1.18/share. TWM also sports a favorable 3% dividend and with their strong EBITDA growth should expect increases to the quarterly $0.01/share common dividend. LCFS does not currently pay a dividend which makes them less of an “income” play. TWM trades at a very reasonable valuation in comparison to Canadian midstream competitors, at a measly 4x EBITDA.

Not only that but by buying shares of TWM you are buying the EBITDA of LCFS at a significant discount. You may recall that I previously made the below observation in January 2022:

First of all a run-rate of $160M is too low, as TWM’s assets are easily on pace to exceed that for 2021 fiscal YE. In fact TWM’s assets being valued at $1.03/share would be a steal at 7x DCF or a 14% free cash flow yield using 9-month annualized figures (you can’t actually buy just TWM’s assets without LCFS). What is more astounding is by buying TWM shares you get their assets and an extra $463MM in Market Capitalization for only $92MM (27 cents a share). Again not saying LCFS is worth $463MM in market capitalization, but it would almost seem as though you get access to LCFS’s growth for next to nothing just by buying shares of TWM.

Concluding remarks

I am very bullish on the outlook for LCFS, its profits should more than triple by 2026 and does not need to take on significant debt as it can utilize government grants. How many companies have that luxury?

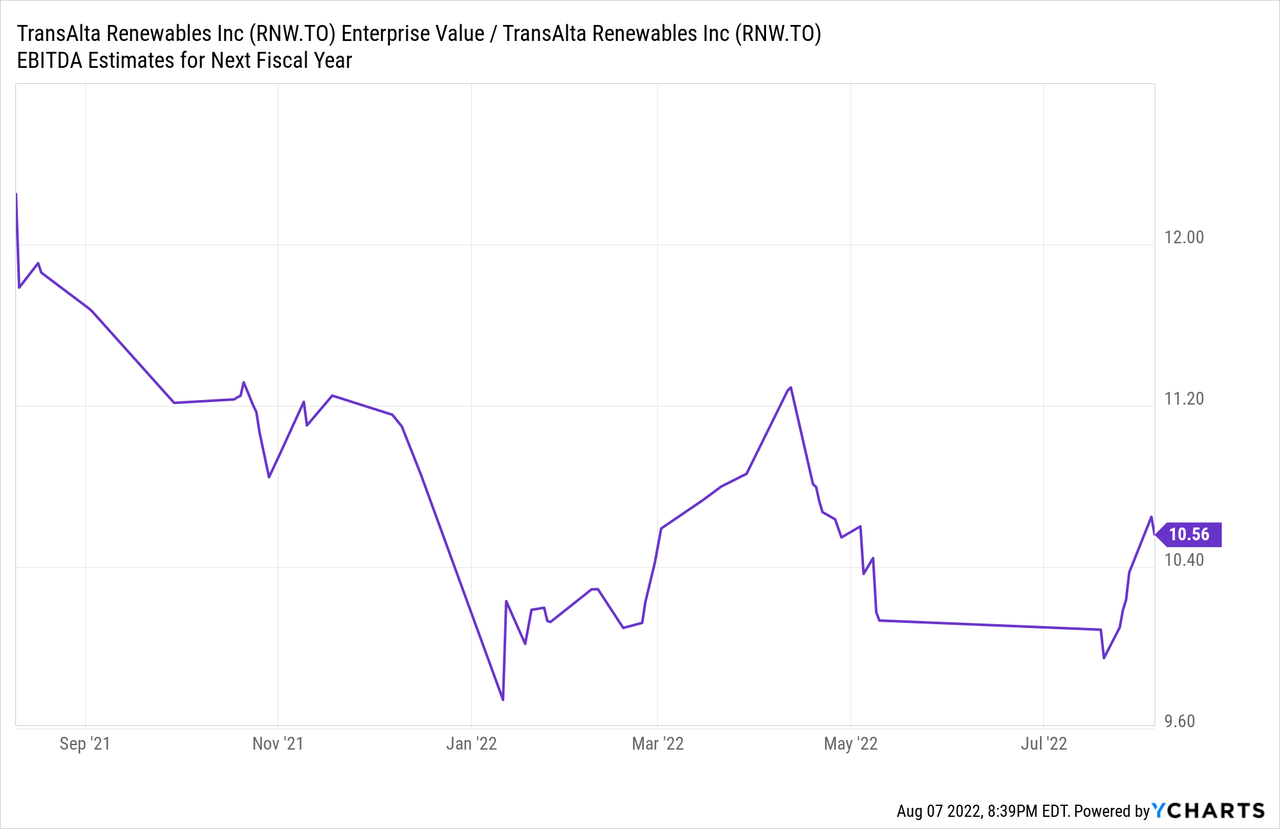

I am not a fan of buying it at 9x EBITDA with being in its infancy stages as more established renewables plays like TransAlta Renewables (OTCPK:TRSWF) only trade at 10x EBITDA and has a much longer track record and a safe 6% dividend yield as discussed in my previous article TransAlta: The Best Way To Play The Renewables Segment.

LCFS does represent tremendous value if bought through TWM and as a result of greater than expected profitability shown by LCFS I maintain my $2.07/share price target for TWM which is discussed in my previous article. This would imply 75% upside from the current price of $1.18/share.

Be the first to comment