Bill Pugliano/Getty Images News

Co-produced with “Hidden Opportunities.”

One fine morning, you go to the grocery store and see that your favorite potato chips are 50% off. Do you panic and rush home to list the chips you already have for sale on Craigslist? Scooping up two bags for one price is a no-brainer, right?

But the same afternoon, you come home, log into your investment account, and see that your stocks are down 50% year-over-year. Now that is scary, and the average investor panics and makes poor decisions such as selling to go into cash. Why not buy more when they are cheaper?

“This is the one thing I can never understand. To refer to a personal taste of mine, I’m going to buy hamburgers for the rest of my life. When hamburgers go down in price, we sing the “Hallelujah Chorus” in the Buffett household. When hamburgers go up, we weep. For most people, it’s the same way with everything in life they will be buying – except stocks. When stocks go down and you can get more for your money, people don’t like them anymore.” – Warren Buffett

Successful investors like Warren Buffett have recognized the market sentiment being disconnected from the typical consumer mindset. For an average consumer, falling prices activate greed, but for the average investor, falling stock prices trigger fear instead.

Let me ask you this: Do you own more stocks today than you did 5 years ago? 10 years ago? 20 years ago? Do you plan on owning more stocks or fewer stocks 5 years from now?

For most of us, the answer is we want to own more. You are reading Seeking Alpha because you are looking for ideas of stocks to buy. In other words, you are a consumer who is looking to be a net buyer of stocks, not a store that is looking to sell stocks!

One reason I follow The Income Method is that I never want to be a seller of stocks. I invest for income and then use a portion of that income to buy more shares in the companies I like. Every year, I want to own more shares than I owned last year.

The stock market is my favorite store, and a fire sale is happening. I am buying big dividends at cheap prices. There is plenty out there for you, too. Two picks with yields of up to 8.5% to get you started.

Pick #1: MFC – Yield 5.8%

The insurance business has been Mr. Buffett’s favorite for years. There is a simple reason for it. This industry is highly future-proof and will remain essential 100 years from now.

Manulife Financial Corporation (MFC) is not only Canada’s largest insurance company but also the 11th largest global insurance company by net non-banking assets. Its operations can be broken down as shown below:

-

Asia – insurance products and insurance-based wealth accumulation products are massively popular in developing nations like India and China. MFC is expanding its presence in China with its recently disclosed attempts to obtain complete control of its joint venture. With a growing presence in two of the largest populated nations in the world, the market potential for MFC is massive.

-

Canada – MFC is Canada’s largest insurance firm, providing insurance products, insurance-based wealth accumulation products, banking services, and variable annuity business to its domestic market.

-

U.S. – providing life insurance products, insurance-based wealth accumulation products, and has an in-force long-term care insurance business and in-force annuity business.

-

Global Wealth and Asset Management – providing investment advice and innovative solutions to retail, retirement, and institutional clients worldwide under the Manulife Investment Management brand.

-

Corporate and Other – investment performance on assets backing capital, net of amounts allocated to operating segments; financing costs; costs incurred by the corporate office related to shareholder activities, Property and Casualty, Reinsurance business; and run-off reinsurance business lines.

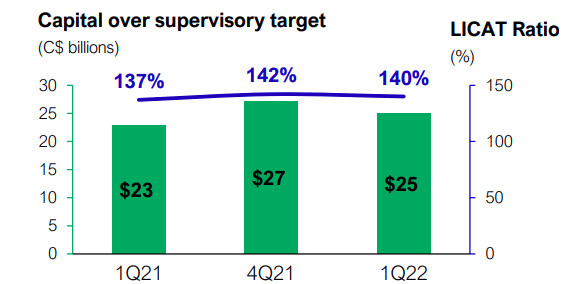

To sum up, MFC makes money through Insurance Premiums, Investment Income, Capital gain/loss, and Wealth Management Fees. Regulations for insurance companies have become stricter since the Global Financial Crisis (‘GFC’). The LICAT is a metric that measures the capital adequacy of an insurer and is one of several indicators used by the Office of the Superintendent of Financial Institutions (‘OSFI’) to assess an insurer’s financial condition. The Canadian regulatory authority has set 90% as the minimum requirement. MFC has significant flexibility with its capital, as its reported metric was 141% at the end of Q1 2022. (Source: May 2022 Investor Presentation)

May 2022 Investor Presentation

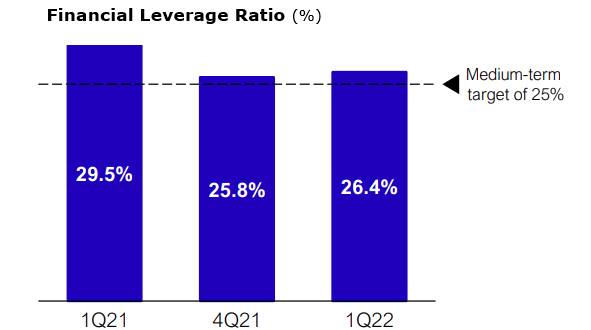

MFC’s dividends come at a respectably low payout ratio of 34%. At the end of Q1 2022, the company reported a 26.4% leverage ratio, a significant YoY improvement. MFC’s balance sheet carries an A- rating from Fitch, indicating that the company is in a comfortable position to weather challenging economic conditions.

May 2022 Investor Presentation

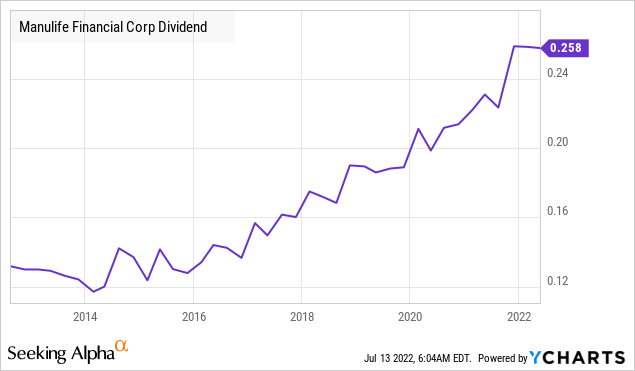

MFC’s current C$0.33/share quarterly dividend yield calculates to a 5.8% annualized yield. The company has consistently raised dividends since the reduction during the GFC.

It is important to note that MFC declares and pays dividends in Canadian Dollars. The amount received by U.S. investors will vary based on the USD – CAD conversion rates.

MFC’s current yield is significantly above the company’s long-term average. The company’s solid fundamentals and market position present a long-term income opportunity.

Readers may be quick to point out MFC’s struggles during the GFC and subsequent dividend cut; however, it is crucial to drive your investment vehicle looking at the windshield rather than the rear-view mirror. Today, MFC maintains a solid balance sheet and is better positioned to weather challenging economic conditions, and this is a significant investment consideration. Use this fear to buy this 5.8% yield with adequate room for raises, to sit back and wait for the market parameters to improve.

Pick #2: DFP – Yield 8.5%

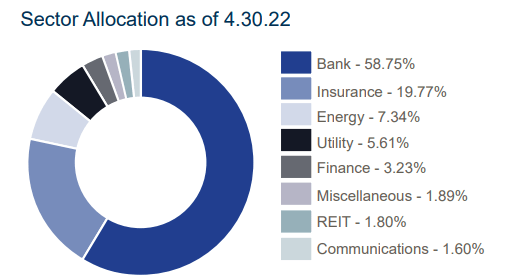

Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) is a CEF (Closed-End Fund) with a heavy emphasis on current income from preferred securities of banking and insurance companies. These industries represent almost ~80% of the fund’s holdings. (Source: DFP Fact Sheet)

DFP Fact Sheet

Not only are these Mr. Buffett’s favorite sectors, but the Oracle of Omaha has consistently accumulated large stakes in preferred units when the economy faces uncertainties. He likes the added layer of security and the ability to get paid to wait for the market conditions to improve, and we will follow in his footsteps.

DFP pays monthly distributions of $0.1505/share, which translates to an 8.5% annualized yield. In the calendar year 2021, approximately 85.0% of distributions made by the fund were eligible for treatment as qualified dividend income (‘QDI’). As of April 2022, 68% of DFP’s holdings generate QDI for investors.

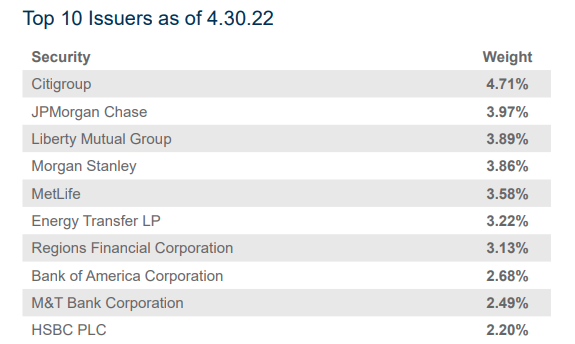

DFP’s top positions are some of the biggest U.S. banking names. Big Banks have passed the rigorous Fed stress test and indicated their ability to continue lending should the U.S. economy hit a severe recession. This makes it a defensive sector and DFP is the income method of profiting from irrational market sentiments.

DFP Fact Sheet

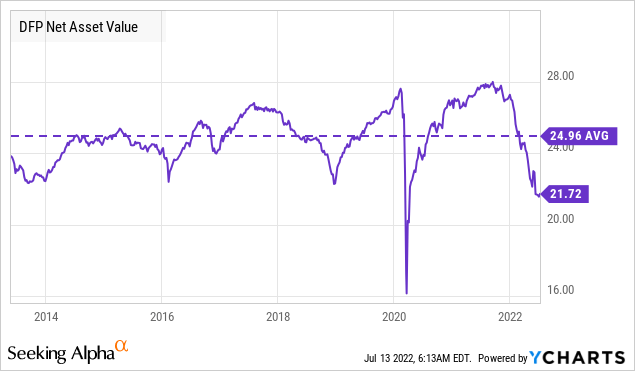

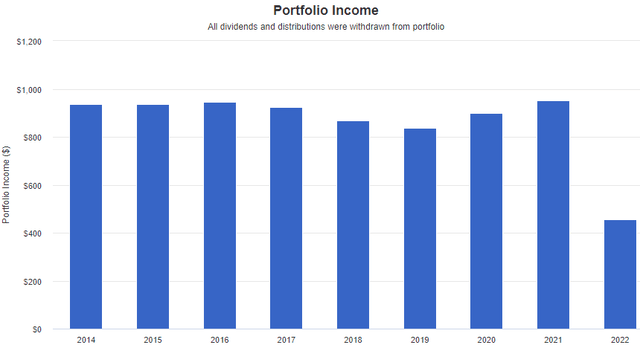

Since its inception in May 2013, DFP has distributed $17.05/share, including special dividends. Over the past decade of quantitative easing, rising rates, and near-zero rates, this CEF has continued to reward shareholders with an average 9.1% annual yield. (Source: Portfolio Visualizer)

The fact that DFP has maintained its NAV (Net Asset Value) since inception strongly indicates that the Fund is sustainably earning its payouts.

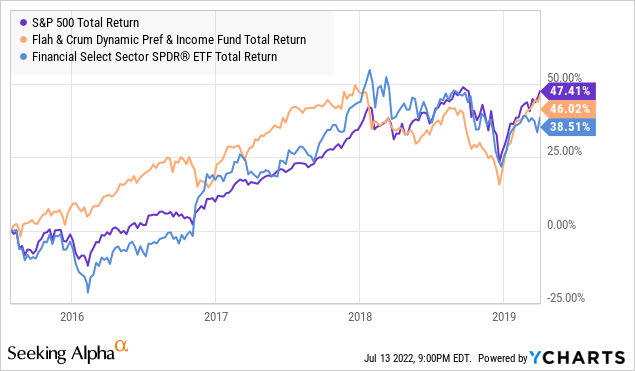

During the past cycle of rate hikes between 2015 and 2019, DFP outperformed the S&P Financial Services Sector and almost matched the S&P 500. This is because preferred units are relatively less sensitive to interest rates than equity, making DFP an ideal investment in the current environment.

Today, you can buy this 8.5% yield at an attractive 3% discount to NAV. Boost your income during this bear market with this defensive CEF and get paid through market turbulence.

Conclusion

Bear markets should be exciting for dividend investors. I have lost count of the number of people who have come to me and said – “if only I bought xyz in June 2020”, “If only I could go back in time to 2008 and buy abc”.

Hindsight is always 20/20; I get it. But if you are fearful of the economy, and let the news teach you to be an investor, then you will be speaking about this missed opportunity in 2025, then again in 2030, and so on for the rest of your life. I will follow in my teachers’ footsteps and buy quality amidst widespread fear.

“I’ve been a net buyer of stocks every year since I was 11” – Warren Buffett

My goal is to transform my portfolio into a cash-producing machine. I will always be a net buyer of dividend stocks, every single year. Bear markets are the season for a fire sale in the dividend superstore. Use this volatility to buy cheap dividends, two picks with yields of up to 8.5% to fire up your cash-producing machine today.

Be the first to comment