z1b

Everything has dropped in 2022.

Stocks (SPY), Bonds (IEF), real estate investment trusts (“REITs”) (VNQ), Bitcoin (BTC-USD), and even Gold (GLD).

But there are some things that deserved to drop, while others didn’t.

To take an example: the S&P 500 (SP500) was priced at a historically high multiple leading up to the recent selloff, and its returns over the past few years were far above average. Clearly, these returns weren’t sustainable.

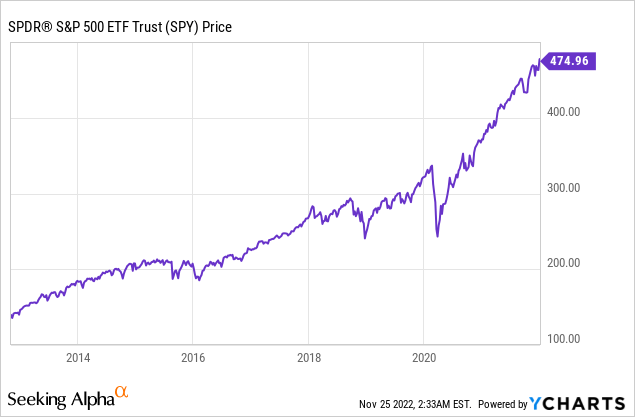

Just take a look at the chart below:

The large gains of the recent years were largely the result of multiple expansion, which can only go on for so long. Multiples expanded because interest rates were near zero, and all investors seemed to care about was growth. Current profits did not matter since interest rates were near 0% and rapidly growing tech companies like Zoom (ZM) and Peloton (PTON) could access near-infinite equity at a very low cost.

But then inflation took off, and interest rates began to rise.

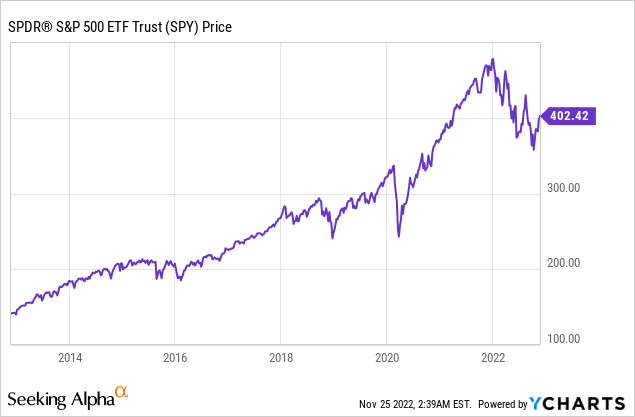

The S&P 500 Index quickly dropped by 15% as earnings multiples began to contract. I would say that the selloff is well-justified, because even now valuation multiples remain high relative to interest rates and the S&P 500 is still well ahead of its pre-pandemic levels:

But then there are some other asset classes that sold off just as much or even more for no good reason.

The best example of that is REITs.

REITs are publicly listed real estate investment vehicles. They allow investors to invest in real estate just as how they would invest in any other industry – through the purchase of stock.

During most time periods, REITs have been very rewarding investments, generating ~12% annual returns on average, and they have even outperformed the S&P500 in the long run.

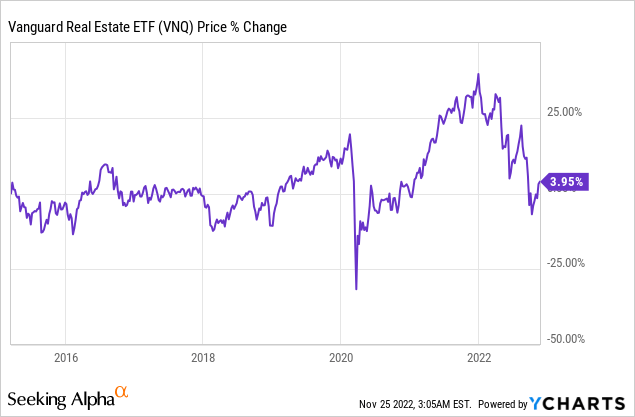

But over the past many years, REITs have been out-of-favor and it has caused their valuation multiples to contract.

As a result, their share prices are essentially flat since 2015!

This is pretty mind-boggling when you consider that REITs have enjoyed very significant cash flow growth since 2015 and their balance sheets have also gotten a lot stronger.

The value of their properties has more than doubled in some cases, and yet their share prices are flat, as if their real estate had not appreciated at all.

As a result, REIT valuations are now deeply discounted with some trading at just half of their net asset value. Those are our favorite investment opportunities because of three key reasons:

- Downside protection: They offer significant margin of safety due to the low valuations, strong balance sheets, and growing rents. REITs are resilient to inflation and most of them earn cash flow from long-term contracts which also protects them from recessions.

- High Yield: REITs pay a higher yield than most stocks and because they are now discounted, their yields are even greater than usual. It is not uncommon to find high-quality REITs that pay a 6-8% dividend yield.

- Significant upside potential: REITs have historically always recovered from every market sell-off. We think that this time again, the market has overreacted, and REITs will eventually recover and this will lead to significant upside for investors who buy today. There are many REITs that offer 50%+ upside just to get back to where they were earlier this year and in many cases, even those valuations were discounted.

But not all REITs are created equal.

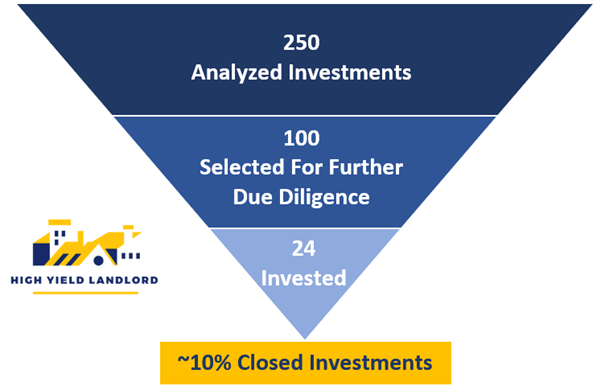

At High Yield Landlord, we are very selective and only invest in one REIT out of ten on average. We cherry-pick the REITs that offer the best combination of yield, growth, and safety:

High Yield Landlord

Below, we highlight two REITs that are getting irresistible. We are accumulating them for our Core Portfolio at the moment:

NewLake Capital Partners, Inc. (OTCQX:NLCP)

NLCP is one of just a few REITs that specializes in cannabis cultivation facilities. It went public last year, and since then it has grown rapidly, making large acquisitions at high rates of return.

NewLake Capital Partners

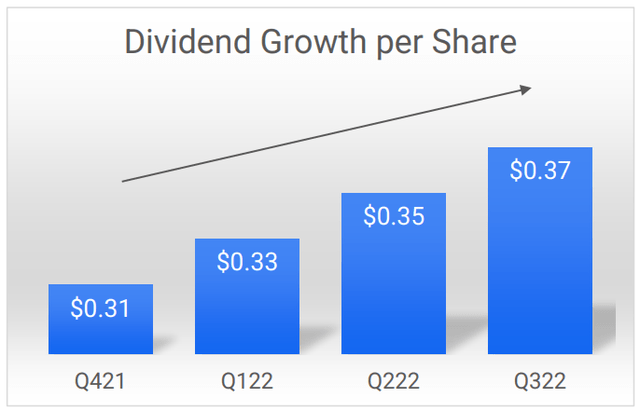

This has resulted in steady dividend growth, as you can see in the chart below. NLCP has managed to hike its dividend in every quarter since going public:

Typically, you would expect such a rapidly growing REIT to trade at a high multiple and a low dividend yield.

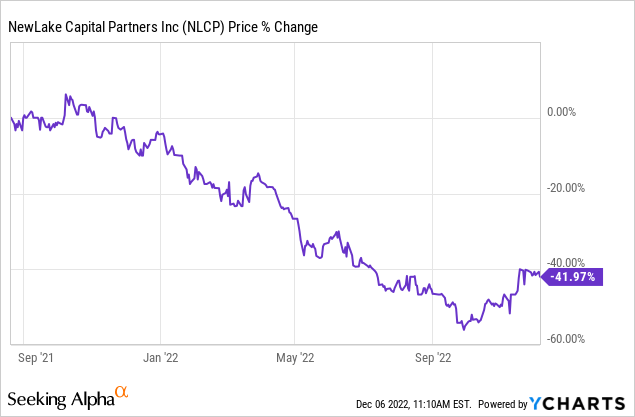

But against all odds, NLCP has dropped steadily ever since it went public. Its share price got cut almost in half even as it grew its dividend by 20%:

We believe that NLCP dropped by so much because the entire cannabis sector fell out of favor. The major cannabis stocks like Trulieve (OTCQX:TCNNF), Green Thumb (OTCQX:GTBIF), Curaleaf Holdings (OTCPK:CURLF), Cresco Labs (OTCQX:CRLBF), Verano (OTCQX:VRNOF), and Columbia Care (OTCQX:CCHWF) are all down significantly and we suspect that NCLP was simply put in the same cannabis basket and it dropped in association with them.

As a result, it has now become very opportunistic.

Currently, the company is priced at just 9x funds from operations (“FFO”) and it pays an 8.3% dividend yield, which leaves enough retained cash flow for the company to also reinvest in growth.

NLCP also recently announced a share buyback program and the management made the following comment (emphasis added):

“While there continue to be attractive investment opportunities across the cannabis real estate sector, we think there is also compelling value in our stock. The authorization of a $10 million share repurchase program underscores our confidence in the quality of our portfolio, robust pipeline and growth opportunity of the cannabis industry for many years to come,” stated Anthony Coniglio, NewLake’s President and Chief Executive Officer.

We also like NLCP’s closest peer, Innovative Industrial Properties (IIPR), but we slightly prefer NLCP because of its smaller size and lower leverage, which should position it for faster external growth going forward.

We believe that the company’s fair value is near $30, which was its IPO price last year. Just to get there, the company would need to nearly double in value, and while you wait, you earn an 8.3% dividend yield and the company is also set to grow its cash flow by 5-10% per year.

It’s hard to beat that!

EPR Properties (EPR)

EPR Properties is one of the few REITs that specializes in entertainment-related properties such as movie theaters, golf complexes, and waterparks.

EPR Properties EPR Properties

It is avoided by most investors because about 30% of its portfolio is invested in movie theaters (as measured by NAV).

Many people fear that AMC Entertainment Holdings, Inc. (AMC), Cinemark Holdings, Inc. (CNK), and others are headed into bankruptcy because they took on too much debt during the pandemic, and box office sales still haven’t fully recovered and possibly never will. Meanwhile, Netflix (NFLX) and other streaming platforms made significant gains during the pandemic and continue to grow.

This recently pushed Cineworld Group plc (OTCPK:CNNWQ), the parent company of Regal, to file for bankruptcy protection.

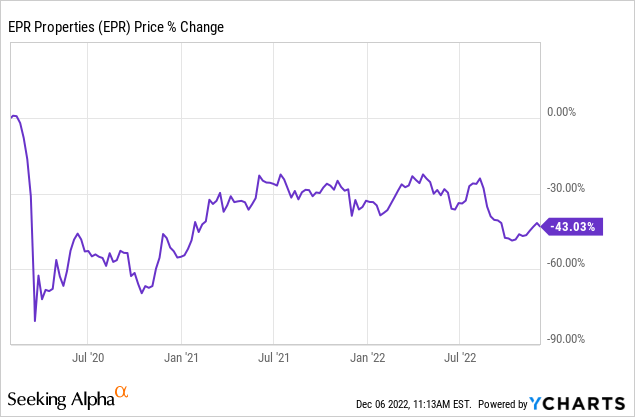

EPR was already heavily discounted prior to this announcement, and it only dropped further as a result of it:

We think that this is an opportunity.

Yes, EPR owns 52 Regal properties, and Cineworld’s bankruptcy is causing some uncertainty. But we think that the market is overreacting here because:

- EPR is the landlord, not the operator, and the rent keeps getting paid.

- These properties are mostly profitable and enjoy positive rent coverage.

- They are absolutely essential to Regal’s business.

- They are among the most productive theaters in their markets and could be released to competitors.

- In many cases, these properties would be more valuable empty than occupied because other uses could generate more NOI.

Even then, the market has priced EPR as if it would lose a very significant portion of this value forever. It remains unclear for now whether Cineworld will abandon any of its properties with EPR, and what the lease terms will be for those it retains. Even if it managed to negotiate somewhat lower rents, EPR would likely only accept such a deal if it got something else in exchange, such as longer leases and/or higher rent escalations.

Ultimately, it is not such a big deal as the market makes it seem to be, and we remain bullish on the long-term prospects of the movie theaters, as we have explained in a separate article.

The box office is nicely recovering from the pandemic. Streaming services aren’t killing theaters because they serve a different need. Movie producers like Disney (DIS) are realizing that streaming isn’t the best option to monetize new blockbusters. And Amazon (AMZN) just announced that it was going to invest $1 billion to produce 12-15 movies exclusively each year for theaters. That would be roughly on par with major film studios like Paramount (PARA):

EPR Properties

While the Regal bankruptcy will continue to loom over the stock, we believe far too much pessimism is priced in. At an AFFO multiple of 8.6x, EPR is simply dirt cheap and priced for negative growth. But management asserts that EPR owns some of the most productive and highly trafficked theater properties in the nation. Thus, we would expect the resolution of the Cineworld bankruptcy to be far more favorable to EPR than the market seems to think.

If we do end up seeing a better-than-expected resolution, then EPR probably has 50% upside from here. While you wait, you earn an 8.1% dividend yield.

Bottom Line

REITs are deeply undervalued right now and we are aggressively accumulating them at High Yield Landlord. NLCP and EPR are just two among 23 other REITs that we currently hold in our Core Portfolio.

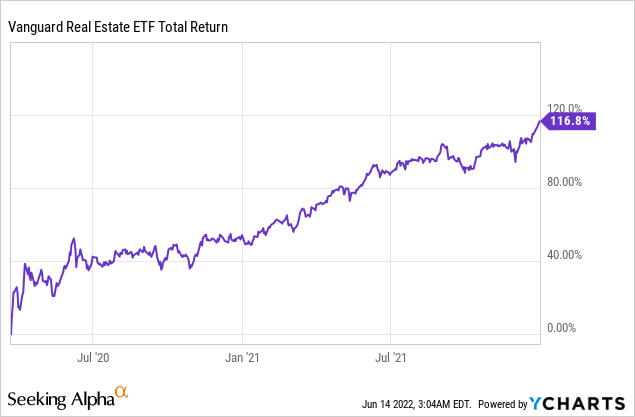

In the aftermath of the pandemic, our portfolio value doubled in just one year as REITs recovered:

YCHARTS

Today, we are given another opportunity to earn similar large returns in the coming years as REITs recover.

Be the first to comment