Rich Fury

Introduction

It seems as if macroeconomic conditions are weakening every day, and as a result of such a sentiment, SoFi Technologies, Inc. (NASDAQ:SOFI) (“Sofi”) stock has suffered heavily in the past few months. The continued stock price decline comes even after an earnings surprise in the last quarter, Q2 2022, as investors continue to believe the risks in Sofi due to macroeconomic conditions far outweigh the future potential.

I think otherwise. In fact, I believe Sofi’s Q3 2022 earnings report will be another surprise. Personal loan demand has been higher than ever continuing off of years-long demand for easily accessible loans, especially in times of economic hardships where some consumers need additional loans. Further, sharp rises in interest rates are pushing people with variable loans such as credit cards to consolidate with personal loans. Therefore, because Sofi is a financial service platform servicing both consumer financial services and loans, I believe Sofi is in a position to benefit from this underlying trend, prompting my buy rating.

Personal Loan Demand

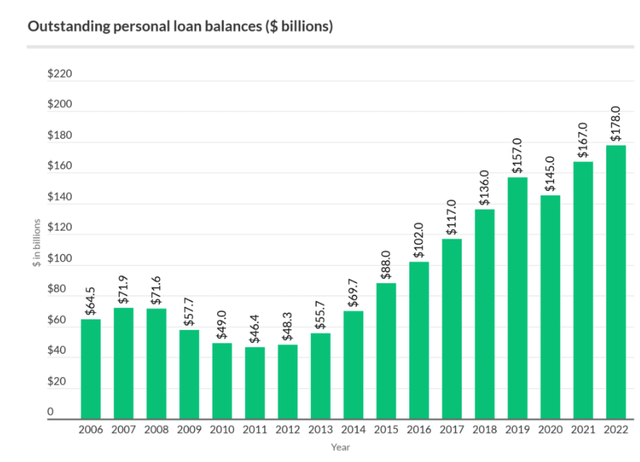

With the rise of fintech companies such as Sofi, personal loan demand has been rising since 2012. Companies like Sofi made it easier and more accessible for normal consumers to take out unsecured and secured personal loans from the comfort of their homes in often mere minutes. Thus, as the chart below shows, personal loan demand has been enjoying and continues to enjoy a strong secular trend. In 2022, the total personal loan debt increased by 24% year-over-year to $178 billion from $144 billion.

[Source]

Further, looking at data from the New York Federal Reserve, the “other” category consisting of personal loans has increased by 10% year-over-year, which was the fastest compared to all other forms of loans.

Despite weakening economic conditions and outlook, Americans are continuing to take out more personal loans. One of the strong reasons for this phenomenon is that personal loan rates are fixed. Thus, if consumers with credit card debt, often variable rates, are looking to consolidate in times of steeply rising rates, personal loans will be one of the accessible forms of new loans. Further, for other various reasons to take out a loan, whether it is for financial relief in times of inflation or for home remodeling, a personal loan has been popular due to its easily accessible nature through companies like Sofi. Therefore, the personal loan market’s favorable trend is expected to continue.

How Sofi Benefits

The rise and growth of the personal loan market are significantly favorable for Sofi. Sofi is a financial platform that lures millions of consumers through its loss leaders such as high-yield checking and savings account, credit cards, brokerage services, and many more financial services. Then, with an established customer base, the company offers loan products when customers are seeking one. Because Sofi already has numerous data points on its customers through previous relationships, the company will be able to provide loans faster and at more competitive rates giving consumers more reason to stay within Sofi’s platform. For consumers, they do not have to hassle with using multiple financial services companies for daily needs. Thus, given this platform advantage, Sofi will be one of the biggest beneficiaries of strong personal loan demand.

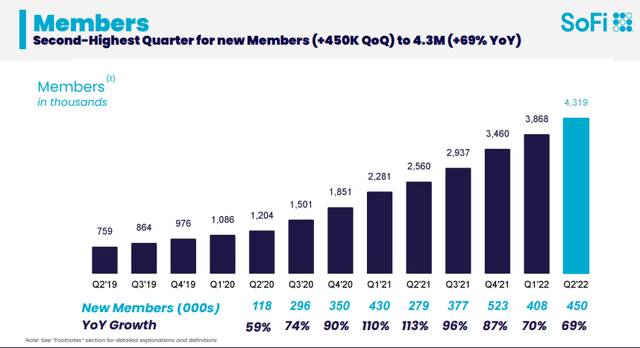

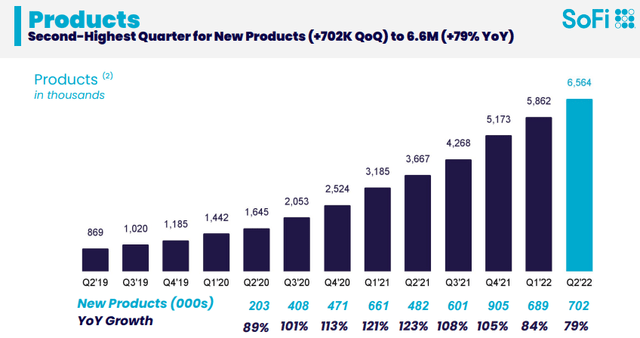

Looking at Sofi’s Q2 2022 earnings report, I believe it is logical to argue that Sofi may outperform expectations in the upcoming earnings report on top of a strong personal loan trend. First, as the charts below show, Sofi’s member and product growth has been consistently increasing at a rapid pace, increasing the potential future customers and making services more accessible, personalized, and widely available through product expansion.

[Source]

Finally, even in the previous quarter, Sofi has outperformed on top of strong personal loan demand with its loan originations growing 91% year-over-year. I believe this data proves Sofi’s strength in the market. Sofi was able to significantly outpace the market’s annual personal loan growth of 24% year-over-year. Therefore, given Sofi’s strengthening platform and continuously growing personal loan market, I believe Sofi will be able to surprise investors in the upcoming earnings report on November 1st.

Risks

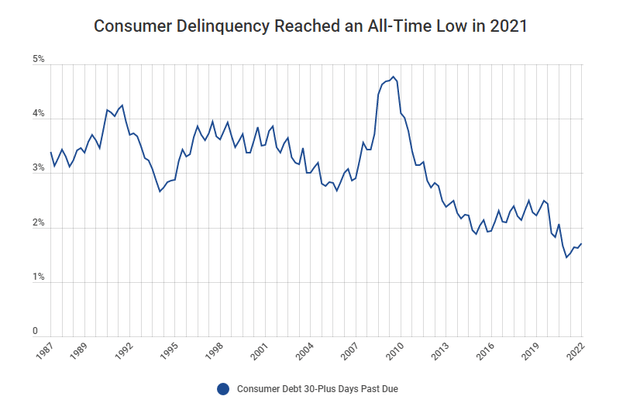

Some investors may point out that personal loans have higher average delinquency rates than other forms of loans, making an investment in Sofi dangerous in times of difficult economic times. While this argument may be true in the future, data suggests that these fears are overblown. According to Experian, delinquency rates are still at historically low levels. As the picture below shows, given the continuous low delinquency rate, I believe fearing the potential delinquency rate is overblown.

[Source]

Further, considering Sofi’s core customers, average market delinquency rates may not affect Sofi as much as investors are fearing. The average income of Sofi loan product customers is over $100,000 per year, which is about $30,000 higher than the real median household income, according to St. Louis FED. Thus, given the relatively stronger Sofi customers’ income and continuously low delinquency rates, the fears of massive default on Sofi’s personal loan products may be overblown.

Financials

Many investors view Sofi as extremely risky especially in the current macroeconomic environment because the company is not yet profitable. However, given the strong balance sheet, fast-improving financials, and expected net cash-positive operation in 2023.

First, Sofi has an extremely strong balance sheet. The company has about $700 million in cash or about 16% of the total market capitalization in cash with a total liability-to-asset ratio of about 56.5%. Further, the company’s losses have been improving significantly. Sofi reported a loss of 26 cents per share in 2021Q2, which has improved to $12 cents per share in 2022Q2. These levels in the coming few months in 2023, are expected to turn positive. Of Sofi’s three main businesses, lending, technology, and financial services, only financial services are unprofitable, which has been leading the company’s losses citing marketing and loss-leader products for growth. Through optimization and growth, the company is expecting this segment of the business to turn positive as well by the end of 2023. Therefore, given the strong financial health and expected improvements in the company’s operations, I do not think the company’s current losses will be a hindrance to Sofi’s future growth and vision.

Summary

I am expecting Sofi to surprise in the upcoming 2022Q3 earnings on November 1st. Personal loan, which has been strong for the past few years, continues to be strong as consumers seek debt consolidation and easily accessible debt, and because Sofi has proven that it is able to capitalize on this opportunity by increasing its personal loan debt originations faster than the market growth, I believe Sofi will surprise investors in the upcoming earnings report. Therefore, I believe Sofi is a buy.

Be the first to comment