Spencer Platt/Getty Images News

Investment Thesis

The Invesco QQQ ETF (NASDAQ:QQQ) is expensive compared to the SPDR S&P 500 ETF (SPY) when considering its estimated sales and earnings growth. Investors looking to buy QQQ to capitalize on the dip following mixed earnings reports from the mega caps can get about the same capital appreciation potential and better diversification with SPY for a valuation of 4.44 points less on forward earnings. Given the implied negativity for the remainder of the year, I don’t recommend buying QQQ today, but I will highlight an alternative growth ETF for those inclined to take on the additional risk.

QQQ Overview And Performance

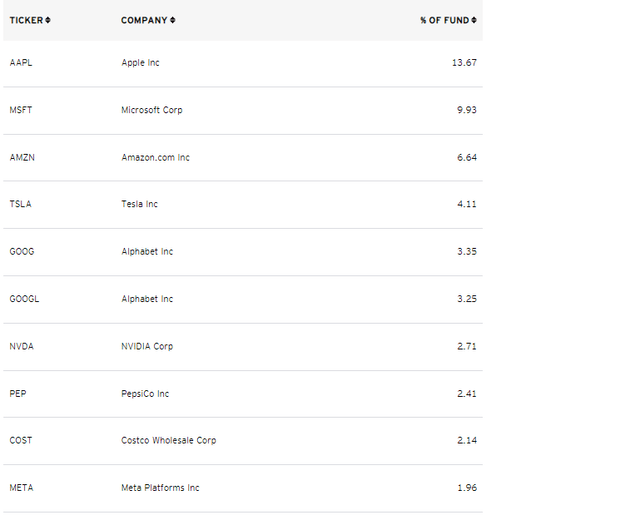

Most readers are familiar with the Nasdaq-100, which QQQ has tracked since March 1999. QQQ holds the 100 largest non-financial companies listed on the Nasdaq exchange. It’s heavily concentrated in Technology stocks like Apple (AAPL) and Microsoft (MSFT), and its top 25 holdings account for over 70% of the portfolio, with the top ten listed below.

Technology stocks account for 50% of the ETF and include Apple, Microsoft, and NVIDIA (NVDA). Amazon (AMZN) and Tesla (TSLA) make up the bulk of QQQ’s Consumer Discretionary exposure (16%), and Alphabet (GOOGL, GOOG) and Meta Platforms (META) account for 8.5% of the portfolio’s 15.5% Communication Services exposure. Finally, there is no representation among Financials, Real Estate, Energy, and Materials securities. It’s a very focused portfolio, but it’s done an excellent job capturing the last decade’s growth. Consider QQQ’s total returns since the longest-running bull market began after the Great Financial Crisis ended.

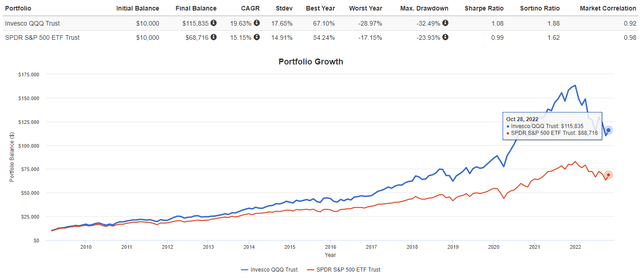

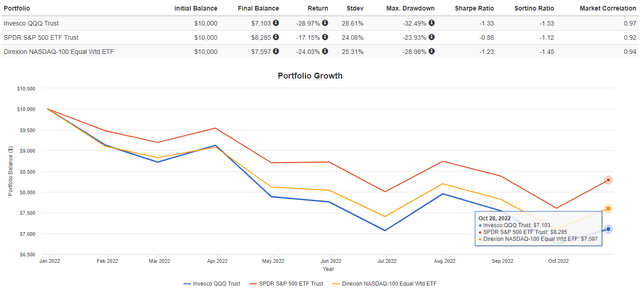

As expected, there was a slight outperformance in the early 2010s, followed by extreme gains after Q1 2020. QQQ gained 111% between April 2020 and December 2021 compared to 89% for SPY and 92% for the Direxion NASDAQ-100 Equal Weighted ETF (QQQE). QQQE’s returns highlight how a few overweight stocks hugely impacted QQQ. However, there’s been a 4% underperformance YTD, and it’s prudent to consider alternative-weighted ETFs like QQQE.

QQQ Analysis

QQQ’s Fundamentals Are Lacking Vs. SPY, QQQE

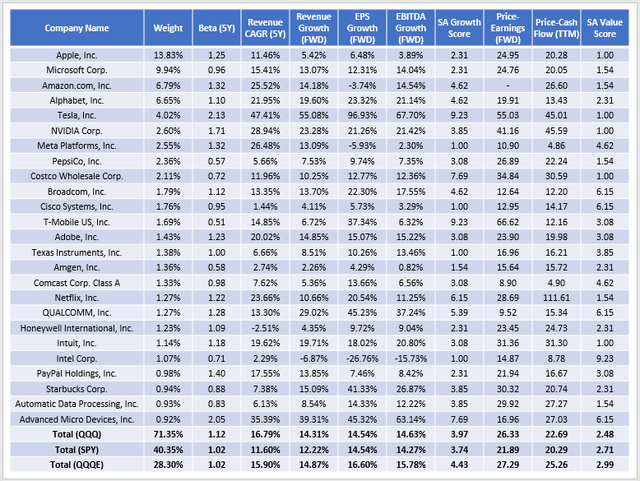

The primary reason why investors should not buy QQQ today is that SPY and QQQE each look better from a fundamentals perspective, albeit for different reasons. I’ve highlighted relevant growth and valuation metrics for QQQ’s top 25 holdings below. For those looking for a singular metric, I’ve normalized Seeking Alpha’s Value and Growth grades on a scale of 1-10. These ratings indicate QQQ has a better growth score than SPY, but QQQE scores better on both growth and value, making it a potentially attractive option for those wanting to diversify away from the mega caps.

Seeking Alpha’s Quant Scores are consistent with what the individual metrics tell us. QQQ has 14-15% estimated sales, earnings, and EBITDA growth, slightly better than SPY. The key negative is that it trades at 26.33x forward earnings, 4.44 points more than SPY. In January, QQQ traded 6.13 points higher but at least had a 6.82% advantage on estimated earnings growth. In May, the premium fell to 4.70 points, but earnings growth was still 3.45% better. Now that there’s no earnings growth advantage and QQQ trades at a similar premium than in May, buying it at these prices makes little sense. Growth investors should choose SPY instead.

By looking at the individual holdings, we can understand why this is. Amazon now has a negative 3.73% estimated earnings growth rate over the next year, with the e-commerce giant briefly losing its trillion-dollar market cap status on Friday. Apple and Amazon also have below-average earnings growth rates of 6.48% and 12.31%, with only a modestly lower valuation of 25x forward earnings. Apple remains solid, but it’s not cheap, and a 13.83% Index weighting alongside a 1.25 five-year beta gives me pause. Apple’s weighting in SPY is a more reasonable 6.83%.

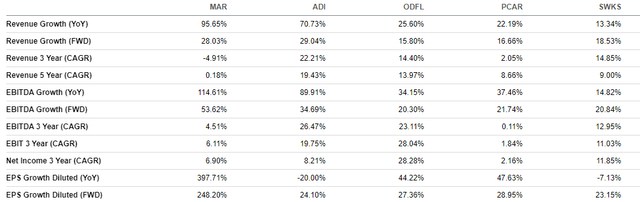

QQQE is the better choice for investors not averse to risk because of its stronger 16.60% estimated earnings growth rate. There are many good growth opportunities left in the Index, and QQQE’s equal-weighting scheme provides more exposure. I’ve highlighted five in the table below: Marriott International (MAR), Analog Devices (ADI), Old Dominion Freight Line (ODFL), PACCAR (PCAR), and Skyworks Solutions (SWKS).

All five companies trade less than 25x forward earnings and have 20% or better earnings growth rates. In addition, they all have above-average Seeking Alpha Revision Scores, leading me to my second reason to avoid QQQ.

Analysts Are Bearish On QQQ

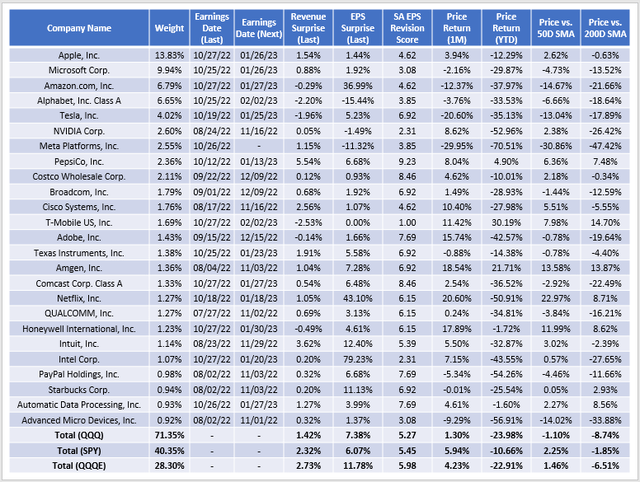

The following table represents a condensed summary of the latest earnings season for QQQ’s top 25 holdings. Most of these top names have reported Q3 earnings, and the results weren’t impressive. Even Apple, whose stock price has been rock solid over the last 50 and 200 trading days, only reported sales and earnings that beat analyst expectations by about 1.50%.

The weighted-average last sales and earnings surprises for QQQ are 1.42% and 7.38%, respectively. Excluding those yet to report, those figures reduce to 1.03% and 6.46%. Yardeni Research confirms the downward trend for the broader S&P 500 Index, showing an aggregate earnings surprise of just 2.9%, with half of the companies reporting as of October 28. The enthusiasm isn’t there on Wall Street.

However, QQQ’s 5.27 EPS Revision Score is more concerning, down from 5.98 in January. Apple, Microsoft, Amazon, and Alphabet, whose weights total 37.21%, all have negative scores. Apple did its best to manage expectations on its Thursday conference call of decelerating sales in Q4 and the foreign exchange impacts of a strong U.S. dollar. One analyst described Microsoft’s latest report as “ripping the band-aid off a disaster PC market” and citing FX as a headwind despite an overall bullish long-term outlook on the company. Amazon’s fall was the size of one Meta Platforms, or 20%, after its next quarter guidance caused analysts to lower their sales estimates by about 6%. Finally, Alphabet remains trading below 20x forward earnings after it missed earnings expectations by 15.44%. In January, analysts estimated one-year future earnings growth of 32.24%, but that figure is now at 23.32%. Poor results lead to lower expectations and lower prices, and it’s too risky to be putting all your eggs in a basket as small as QQQ.

A reasonable solution is QQQE. No, it hasn’t performed nearly as well as QQQ in the last few years, but that’s partially the point. A mean reversion of sorts is happening now, and QQQE makes sense for the fundamental reasons I listed earlier. In addition, QQQE’s EPS Revision Score is 5.98 compared to 5.27 and 5.45 for QQQ and SPY. Its constituents’ latest earnings surprise nets out to an impressive 11.78%, with a sales surprise nearly double QQQ. While QQQE is still too risky for me, as I’m aiming for a portfolio beta between 0.90 and 0.95 until sentiment improves, it should capture much growth in a rebound. It should be better protected than QQQ in the short term on the back of a better earnings season.

Investment Recommendation

QQQ is not ideal now due to poor results and guidance from several of its mega-cap holdings. Investors can gain an identical earnings growth rate with SPY for a forward earnings valuation that’s 4.44 points cheaper or choose QQQE, which offers superior growth and better diversification due to its equal-weighting scheme. Thank you for reading, and I look forward to your comments below.

Be the first to comment