William_Potter/iStock via Getty Images

Co-produced with Treading Softly

Most investors have no experience with run-away inflation and its impact on the market. The last time the U.S. saw significant inflation ramping up was the 1970s. We’ve seen hyperinflation in other countries where rapidly the value of their currency disappears as money is mass printed. We can think of Germany after the World Wars, for example, where a wheelbarrow of cash was required to buy a simple piece of bread.

Thankfully, we have routes in which to invest in real assets that tend to maintain their value and historically work as excellent inflation hedges.

So how does this apply to investing? I have a few simple rules:

- Buy companies tied to real assets

- Buy companies that benefit from rising interest rates

These rules help me stay ahead of inflation and see my income grow as inflation rages on. Real estate benefits from inflation directly, while floating rate investments benefit from the Federal Reserve’s response to inflation. We can do this via REITs, which are tied directly to real assets, and Business Development Companies, which issue debt to help grow middle-market firms.

Today, I want to look at two fantastic opportunities.

Let’s dive in.

Pick #1: RQI – Yield 6%

It is a “perfect storm” for REITs to outperform the market. Inflation is high, which is driving rental rates through the roof. Guess who collects rent? This comes after REITs have enjoyed a luxurious two years of historically low-interest rates. REITs have been crazy busy refinancing their old debt at lower interest rates, typically everything that matured before 2024.

For REITs, rental income is their most significant source of revenue, and with few exceptions, interest is their highest expense. In short, REITs are seeing their revenue growth accelerate while their highest expense has crashed. Higher revenue plus lower expenses is a wonderful thing for shareholders. Just do me a favor and don’t tell Congress, someone might label it a “windfall”.

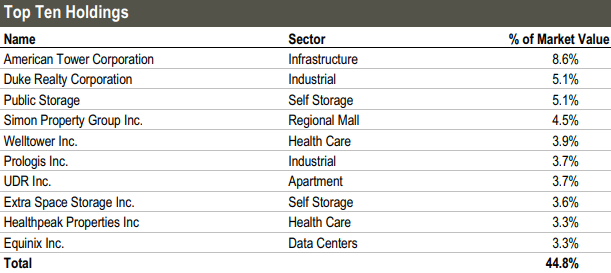

Cohen & Steers Quality Income Realty Fund (RQI) is a CEF that will benefit from these strong tailwinds driving REIT profits to record heights. RQI invests in blue-chip REITs:

RQI Factsheet

These holdings represent a very diverse array of property types, all of which will benefit from inflation, while REITs benefit from lower interest rates at the corporate level.

The reason we don’t hold these REITs in the HDO portfolio is that the yields are too low to meet our goals. This is where a CEF can come in and produce a higher yield and provide exposure to high-quality companies.

RQI is trading at a 6% discount to NAV, meaning that it is actually cheaper to buy RQI than it would be to buy all the individual companies directly. With NAV already at the highest level in over a decade, and likely to go higher, there is a very good chance that RQI raises its dividend like sister fund RNP did last year, or that there is a sizable special dividend at year-end.

2022 is going to be a great year for REITs, and RQI is a great way to take advantage of it!

Pick #2: ORCC – Yield 8.1%

Owl Rock Capital Corporation (ORCC) is a BDC (business development company) that invests in “upper middle market” businesses. As the third-largest publicly traded BDC, ORCC has the ability to invest in privately-owned companies that have regional dominance in their industries. These are companies that are looking to expand by acquiring smaller peers or might be acquisition targets for large publicly traded companies looking to expand quickly.

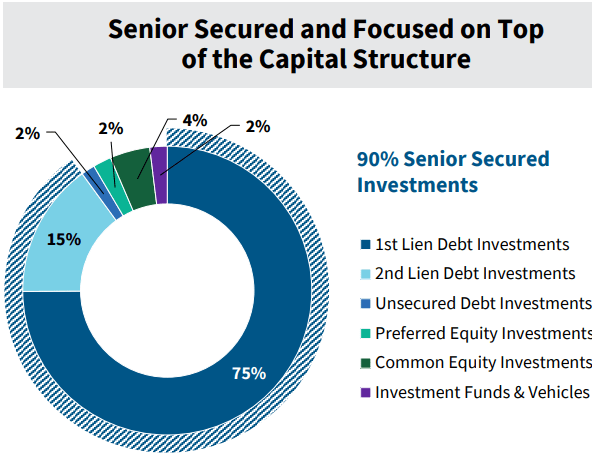

ORCC has a conservative portfolio that is heavily weighted towards senior secured loans. (Source: ORCC March 2022 Investor Presentation)

March 2022 Investor Presentation

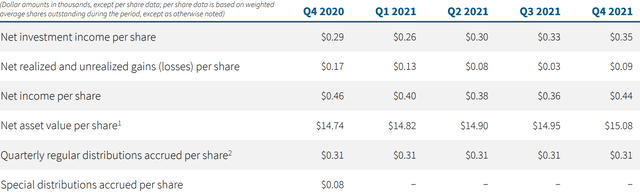

The focus for ORCC in 2021 was to increase leverage to its target range (0.90x-1.25x) in order to ensure its dividend is fully covered. That mission was accomplished as ORCC’s leverage climbed from 0.87x to 1.13x, right in the middle of their target range. This drove NII (Net Investment Income) higher. NII went from $0.29/share in Q4 2020 to $0.35/share in Q4 2021.

March 2022 Investor Presentation

Dividend coverage has been achieved, with a comfortable cushion. Additionally, book value ended at $15.08. ORCC produced both income growth and book value growth.

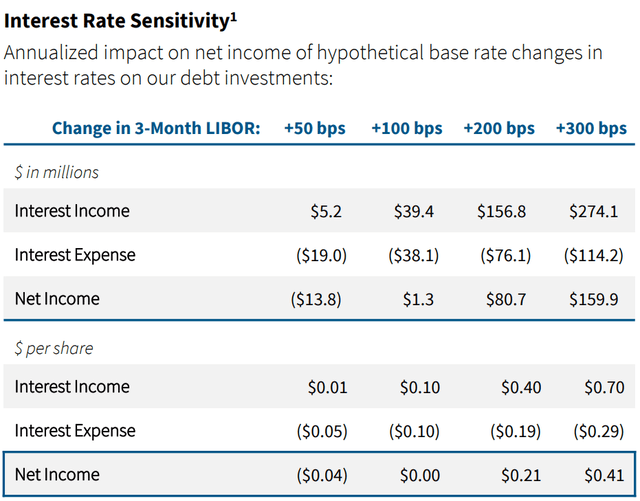

The best part is that ORCC significantly benefits from rising interest rates. Like most BDCs, ORCC lends out money using floating rates, while a significant portion of ORCC’s debt is fixed. The more rates rise, the more ORCC’s net-investment income rises.

March 2022 Investor Presentation

This is a perfect example of how we want to position ourselves for interest rate fluctuations. If interest rates stay low, ORCC is making a lot of money, easily covering its generous dividend. If interest rates rise, ORCC is making even more money and is likely to raise its dividend. Heads we win, tails we win again. Since this chart was made, the 3-month LIBOR has gone up about 75 bps.

ORCC has the scale (as it is the 3rd largest publicly traded BDC), an investment-grade credit rating, and the quality to trade at a premium to book value. The one thing ORCC really needs is time in the market to earn investors’ trust. We are impressed with how ORCC handled the COVID crisis, and are more than happy to collect our +8% yield while we wait for the market to realize what we already figured out: ORCC is a premium BDC. The BDC sector will be one of the hottest sectors in 2022 and set to deliver stellar returns. Buy ORCC while it is still cheap and lock in this super high yield!

Conclusion

I like being paid early and often. To do that, I keep my hard-earned money tied to sources of income that are dependable in a wide variety of conditions. By investing in RQI and ORCC, I have exposure to real assets or loans secured by the assets of companies within the United States.

By keeping my money earning more money, I can relax and reduce my stress – two things key to preserving your health. When it comes to retirement, I want to ensure my financial health is not an issue I have to worry about. I want the same for you as well. Just like your personal health, your financial health needs to be cared for and monitored, but you don’t want to be stressed and worried endlessly about it.

You want your financial health and personal health to enable you to enjoy all that retirement has to offer. Find that hidden beach, enjoy a new drink, create new friendships, or rekindle old ones. Take time to enjoy the breeze, the flowers, and the warmth of the sun on your skin. After all those years of working hard, you should be allowed time to enjoy the simple things. Being the landlord and creditor allows you to do that while being a debtor puts you back in the workforce.

Don’t be the one paying rent and interest, be the one collecting rent and interest. Then rent and interest rates going up due to inflation is your gain!

Be the first to comment